Landscape Overview

The blockchain hardware and infrastructure sector is a domain with extremely broad coverage. From the early PoW mining industry to hardware manufacturing such as chips, all can be included in this scope. In the current cycle, people typically use the term DePIN to describe this entire sector.

The dimension used to classify the entire sector is crucial for clarifying its current trajectory.

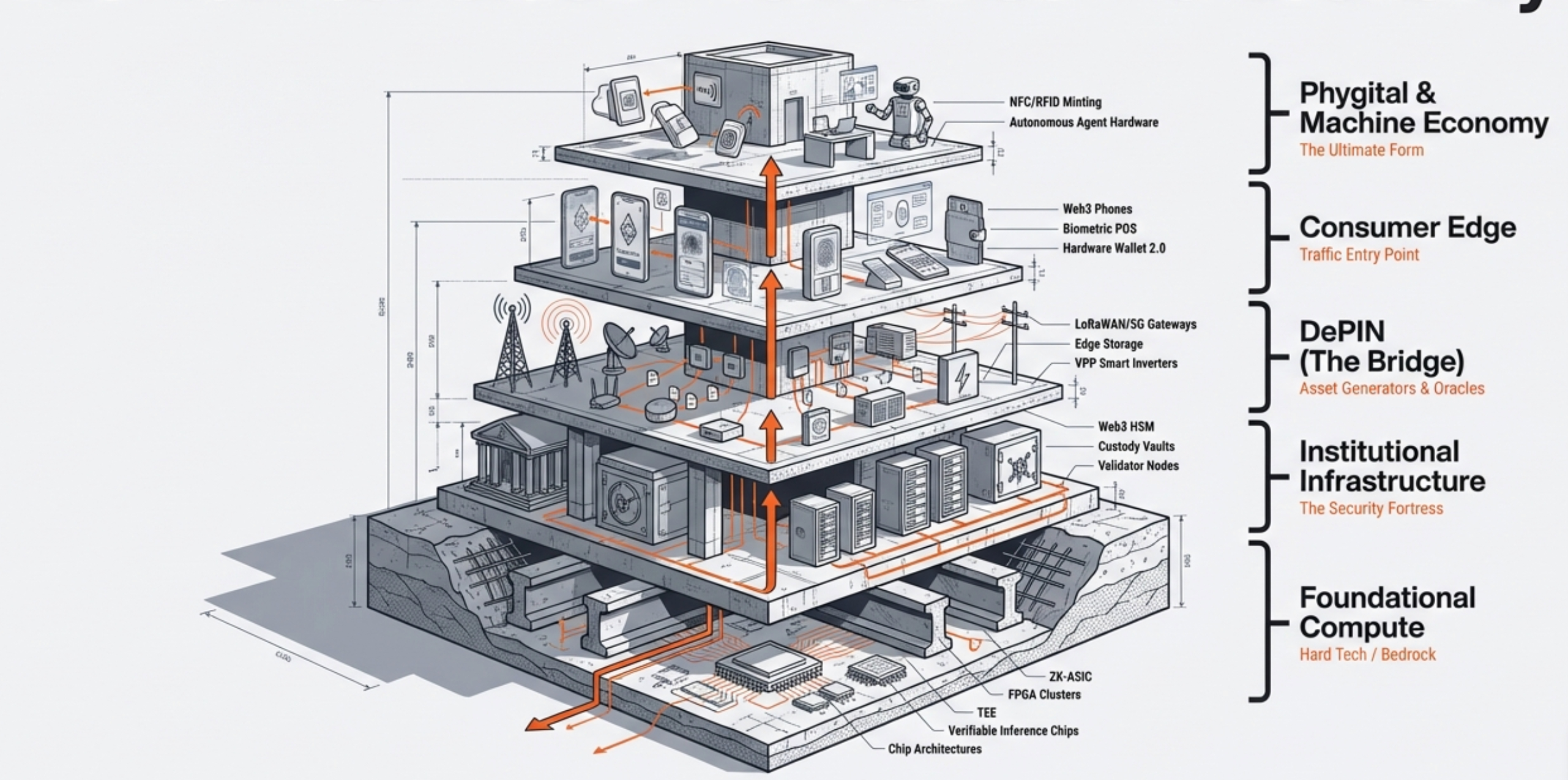

The Vertical Stack Perspective

- Foundational Compute & Security

- ZK Hardware Acceleration

- ZK-ASIC

- FPGA Clusters

- TEE & Secure Elements

- Trusted Execution Environment (TEE)

- Next-Gen Secure Element (SE)

- Decentralized AI Hardware

- Verifiable Inference Chips

- ZK Hardware Acceleration

- Institutional Infrastructure

- Next-Gen Key Management

- Web3 HSM

- Institutional Custody Vaults

- Consensus & Verification Nodes

- Validator Nodes

- Light Client Hardware

- Next-Gen Key Management

- Physical Infrastructure Network (DePIN)

- Decentralized Connectivity & Sensing

- LoRaWAN/5G Gateways

- Proof of Coverage Hardware

- Environmental Sensor

- Compute & Storage Mesh

- Edge Storage Servers

- GPU Rendering Nodes

- VPP & Energy Hardware

- Energy Wallets

- Smart Inverters

- Decentralized Connectivity & Sensing

- Consumer Edge & Payments

- Crypto-Native Mobile

- Web3 Smartphones

- TEE-Enabled Mobile Wallets

- Hybrid Payment Terminals

- Dual Mode POS

- Biometric Payment Hardware

- Hardware Wallet 2.0

- Smart Card Wallets

- Air-Gapped Devices

- Crypto-Native Mobile

- Phygital & Machine Economy

- Phygital Anchors

- NFC/RFID Minting Chips

- Physical Backed Token (PBT)

- Machine Identity & Agents

- EoT Modules

- Autonomous Agent Hardware

- Phygital Anchors

The simplest classification standard is the vertical perspective based on the industry chain and customer segmentation. In terms of industry links, Foundational Compute (Chip Layer) is the bedrock of the entire industry. Whether for institutional custody or DePIN, everything ultimately relies on performance breakthroughs in specialized chips (ASIC/FPGA/TEE). This reveals the "Hard Tech" attribute of this sector.

Above this foundation, Institutional Infrastructure forms the industry's "Security Fortress." Unlike traditional Web2 data centers, Web3 institutional-grade hardware demands not just high performance, but extreme key management and consensus security.

- Core Logic: With ETF approvals and the entry of traditional finance, general-purpose servers can no longer meet the compliance requirements for asset custody. Web3 HSMs (Hardware Security Modules) and Institutional Custody Vaults have become essential gateways connecting traditional finance to crypto assets.

- Key Shift: The value of hardware here shifts from pure "computation" to "signing" and "verification." Whether Validator Nodes or light client hardware, their essence is to provide an auditable, tamper-proof anchor of trust within a decentralized network.

Extending further outward, Physical Infrastructure Networks (DePIN) represent the "Breadth Expansion" of Web3 hardware. This is the critical interface where blockchain moves from the digital world into the physical world, and it is also the layer with the most complex variety of hardware types.

- Core Logic: DePIN hardware (such as LoRaWAN gateways, edge storage servers, smart inverters) are effectively "Asset Generators." Through Proof of Coverage or Verifiable Compute, they transform real-world physical resources (bandwidth, energy, computing power) into on-chain assets.

- Key Shift: Hardware here assumes the role of an "Oracle," guaranteeing the authenticity of physical data. Therefore, hardware in this sector is evolving from generic IoT devices to "Specialized Devices with Cryptographic Verification Capabilities" to prevent data falsification (such as GPS spoofing or fake traffic).

Once the infrastructure is robust, Consumer Edge & Payments serves as the "Traffic Entry Point" for the entire ecosystem. This is the key battlefield for making Web3 technology "invisible," aiming to solve the barrier to entry for massive user adoption.

- Core Logic: Web3 Smartphones and Hardware Wallet 2.0 are reshaping user interaction habits. By integrating TEE (Trusted Execution Environment) directly into mobile chips, the hardware itself becomes a biometric vault that eliminates the need for mnemonic phrases.

- Key Shift: Hybrid Payment Terminals bridge the "last mile" between fiat and cryptocurrency. The hardware's mission here is Experience Downgrade (lowering the cognitive threshold) and Security Upgrade (physical-level protection), allowing users to enjoy a silky-smooth experience akin to Apple Pay when using Web3 payments.

Finally, Phygital & Machine Economy represents the "Ultimate Form" of the sector. When hardware is no longer just a tool, but an economic agent with an independent identity, a new closed-loop economy is born.

- Core Logic: Through NFC/RFID Minting Chips and EoT (Economy of Things) Modules, every physical good (e.g., sneakers, luxury items) can be bound to a PBT (Physically Backed Token), achieving "Confirmation of Rights for All Things."

- Key Shift: A more profound transformation lies in Autonomous Agent Hardware. Future hardware will no longer require human intervention; charging piles can automatically collect payments from cars, and drones can automatically purchase data. Hardware as an account, device as a bank—this is the hardware foundation of the Machine Economy.

The Horizontal Functional Perspective

- Backend Computation for Efficiency

- ZK Hardware Acceleration

- ZK-ASIC

- FPGA Clusters

- Decentralized AI Compute

- Verifiable Inference Chips

- Edge Training Hardware

- Specialized Infrastructure

- High-Performance Validator Nodes

- Distributed Rendering/Storage Servers

- ZK Hardware Acceleration

- Backend Security and Compliance

- Cryptographic Infrastructure

- Web3 HSM (Hardware Security Module)

- TEE (Trusted Execution Environment)

- Custody & Compliance

- Institutional Custody Vaults

- MPC-Enabled Hardware

- Key Management Servers

- Cryptographic Infrastructure

- Frontend Connection

- Human Connection

- Web3 Smartphones

- Biometric Verification Hardware (e.g., Orbs)

- Consumer Hardware Wallets (Smart Cards/Air-Gapped)

- Dual Mode POS Terminals

- Object Connection

- NFC/RFID Minting Chips

- Physical Backed Token (PBT) Anchors

- Supply Chain Trackers

- Network Connection

- LoRaWAN/5G DePIN Gateways

- Proof of Coverage Devices

- Light Client IoT Embedded Nodes

- Machine Connection

- Economy of Things (EoT) Modules

- Autonomous Agent Identity Chips

- M2M Payment Controllers

- Energy Connection

- Energy Wallets (Smart Meters)

- VPP (Virtual Power Plant) Inverters

- Tokenized Charging Piles

- Human Connection

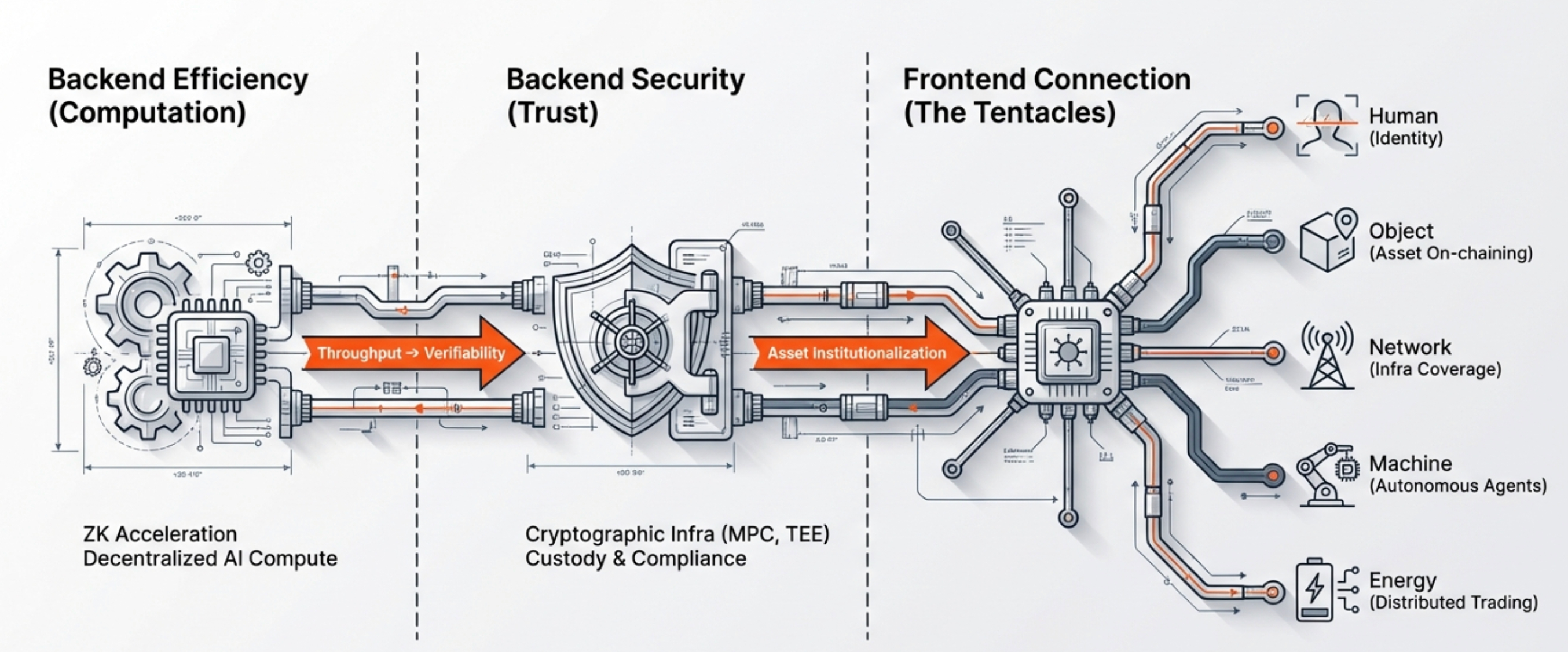

The second perspective for viewing the entire sector is a horizontal one based on functional attributes (Computation/Security/Connection) in the AI era, focusing on the frontend, backend, and connection objects: The Horizontal Functional Perspective. If the first perspective was a vertical division based on the industry chain, this perspective is a horizontal slice based on the technology stack.

Web3 hardware is no longer just mining machines; it is the carrier for "Verifiable Computing" and "Assetization of the Physical World" in the AI era.

The first part is Backend Computation for Efficiency, serving computational efficiency. In the context of AI and Web3 integration, the definition of computation has undergone a qualitative change: from purely pursuing Throughput to pursuing "Verifiability" and "Zero-Knowledge Proof (ZK) Generation Efficiency." The core logic is that with blockchain scaling needs (Layer 2) and the rise of privacy computing, general-purpose CPUs/GPUs are inefficient at handling complex cryptographic proofs. The emergence of ZK-ASICs and FPGA Clusters is precisely to reduce the cost of generating ZK proofs to a commercially viable level. Decentralized AI Compute pushes this logic to the extreme. To prevent black-box operations by centralized AI models, Verifiable Inference Chips have emerged. They not only execute calculations but also generate "proofs" of the computation process simultaneously, ensuring AI output has not been tampered with. This is the physical cornerstone of Web3's resistance against AI monopolies.

Next is Backend Security and Compliance, ensuring system trust. If the computation layer is the "engine," then the security layer is the "brakes" and "steering wheel." Under the trend of asset Institutionalization, security hardware upgrades from personal-grade protection to financial-grade infrastructure. The core of this layer lies in the industrialization of key management. Web3 HSMs (Hardware Security Modules) and MPC-Enabled Hardware are no longer simple storage devices but complex policy executors. Combined with TEE (Trusted Execution Environment), they ensure private keys remain in an "encrypted black box" during use, inaccessible even to hardware operators. Extending into compliance: Institutional Custody Vaults provide physical-layer solutions with multi-party computation, time locks, and geographic distribution to meet the compliance needs of ETFs and bank-grade clients.

Finally, the most prosperous layer is Frontend Connection. This is the "sensory tentacle" of Web3 hardware, breaking the boundary between the digital and physical worlds. We subdivide this layer into five dimensions (Human, Object, Network, Machine, Energy), which precisely summarizes all scenarios of DePIN and RWA (Real World Assets).

- Human Connection: Aims to solve "Identity and Access."

- Web3 Smartphones and Biometric Hardware (like Orbs) are establishing a passwordless digital identity layer (Proof of Personhood). Meanwhile, Dual Mode POS realizes seamless switching between fiat and Crypto at payment terminals, bringing Web3 payments truly into retail scenarios.

- Object Connection: Aims to solve "Asset On-chaining."

- Through NFC/RFID Minting Chips and Supply Chain Trackers, physical goods (like a bottle of wine or artwork) gain a non-replicable on-chain ID (PBT). Hardware here is the ultimate arbiter of "physical authenticity."

- Network Connection: Aims to solve "Decentralized Infrastructure."

- LoRaWAN/5G Gateways and Proof of Coverage Devices are effectively "mining routers." Users earn token rewards by contributing network coverage; hardware acts as both a network node and a value capture endpoint.

- Machine Connection: Aims to solve "Autonomous Agents."

- This is the most sci-fi layer. EoT Modules and Autonomous Agent Identity Chips endow machines with independent account systems. Future autonomous vehicles or drones will have their own hardware wallets, capable of autonomous M2M (Machine-to-Machine) payments and service exchange without human intervention.

- Energy Connection: Aims to solve "Distributed Energy Trading."

- Energy Wallets and VPP Inverters turn every home battery or charging pile into part of a Virtual Power Plant (VPP). Hardware not only records electricity usage but also manages automatic energy trading between grid peaks and valleys, realizing real-time monetization of energy assets.

According to our deductions for the future, the second dimension undoubtedly helps us better capture the correct direction.

The first part (Backend Computation) we have largely finished analyzing; it is challenging for us to enter due to relatively high costs and barriers. The second part (Backend Security) is the direction we have basically settled on: revolving around WaaS (Wallet-as-a-Service) and a series of security and audit services expanded around it. The third part, Frontend Connection, is the track with the greatest value and the broadest prospects in the future AI context. Within this, Human Connection in the payment track has been discussed extensively; Object Connection is usually combined more with RWA; and Network Connection is a relatively mature and fiercely competitive niche.

Therefore, the remaining two become our research focus. From the perspective of pure AI track hardware infrastructure, Energy and Robotics industries are undoubtedly the current strategic high ground. Researching these two tracks will not only help our secondary investment strategy and targets after transformation, but the final listed companies also provide references for our M&A business.

Energy Connection

Energy is undoubtedly the AI sub-sector that has continued to receive large bets over the past year, not only in the pure AI track but also in the AI x Crypto intersection.

The frenzy in the entire sector stems from the AI field. The energy component of the AI industry is no longer just a cost center; it has evolved into a core strategic asset that determines the speed of computing deployment, scale, and even geopolitical competitiveness.

The Background of Energy Crisis Under Exponential Compute Growth

In the classic computing era, Moore's Law ensured that transistor density doubled every 18-24 months, with performance improvements accompanied by optimized energy efficiency. However, the growth rate of computing demand in the deep learning era far exceeds Moore's Law. OpenAI research has pointed out that the computing power required to train state-of-the-art AI models doubles every 3.4 months.

According to Goldman Sachs forecasts:

| Forecast Metric | Key Data | Remarks |

|---|---|---|

| Global Data Center Power Growth by 2030 | +165% | Huge increase compared to 2023 |

| Data Center Capacity Demand by 2027 | 92 GW (Gigawatts) | An increase of about 50% from current levels |

| CAGR (2025-2028) | 17% | Could reach 20% in an optimistic scenario |

| US Total Electricity Demand Growth | 2.6% | Driven by data centers, reaching the highest growth rate since the 90s |

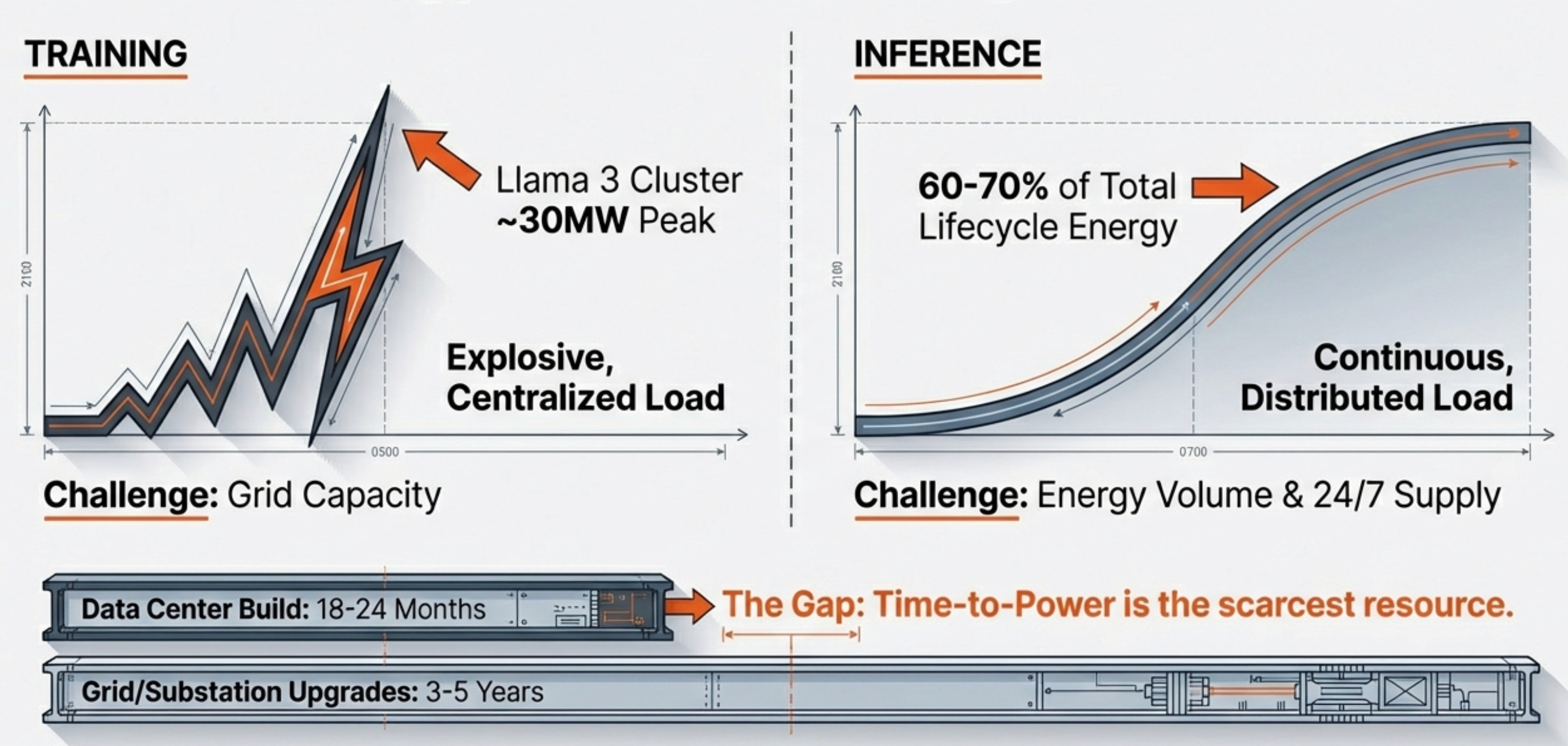

AI energy consumption must distinguish between the "Training" and "Inference" phases, as their impact on energy systems is completely distinct.

- Training Phase: Explosive, Centralized Load. Training a trillion-parameter model (like GPT-4 and its successors) requires running tens of thousands of GPUs continuously for weeks or months. This generates huge instantaneous power peaks. For example, Meta's Llama 3 training cluster used 24,000 H100 GPUs, with peak power consumption likely exceeding 30MW, equivalent to the electrical load of a small city. This phase challenges the grid's "Capacity."

- Inference Phase: Continuous, Distributed Load. Although the energy consumption of a single inference is far lower than training, due to the massive user base (billions of daily calls), inference accounts for 60%-70% of the total lifecycle energy consumption of AI. Google research shows that as AI is integrated into Search (Search Generative Experience), the energy consumption per search could increase by 10-30 times compared to traditional keyword searches. The inference phase challenges the grid's "Energy" (total volume) and 24/7 supply capability.

Currently, major shortages arise from two aspects:

- Time mismatch between data centers and power infrastructure: In Northern Virginia (Dominion Energy service area), the largest data center market in the US, the waiting time for new data center grid connections has reached several years. Grid operators need to upgrade substations and transmission lines to carry GW-level single-park loads. This process usually takes 3-5 years, while AI data center construction takes only 18-24 months, creating a severe time mismatch. "Time-to-Power"—the time required to obtain grid interconnection, transformers, and energization infrastructure—has become the most precious resource metric. Bitcoin miners have accumulated gigawatt-level (GW) grid connection capacity and robust power infrastructure, giving them control over scarce resources desperately needed by AI Hyperscalers.

- Shortage of basic components: Due to supply chain tensions, the delivery cycle for large high-voltage transformers has extended from 12 months in the past to 3-4 years, becoming a physical bottleneck limiting power expansion.

Technological Changes and Market Structure in Industry Links

Generation Layer

The continuity of AI loads (especially training tasks that cannot be interrupted) requires power supply availability of 99.999%. Traditional wind and solar energy, due to Intermittency, must be paired with expensive storage systems to serve as a primary power source. Therefore, "Clean Baseload Power" capable of stable output has become the scarcest resource at the top of the industry chain.

Nuclear Energy, with its high energy density, zero carbon emissions, and 24/7 operation, is seen as the ultimate solution for AI energy. Microsoft signed a 20-year PPA with Constellation Energy to restart Unit 1 of the Three Mile Island nuclear power plant by 2028. This is not only the first time in US history that a nuclear plant is being restarted for a single commercial customer, but it also marks a shift in the nuclear business model from "selling to the grid" to "direct supply to specific large customers."

Geothermal Energy is another clean energy source with baseload characteristics. Companies like Fervo Energy are using hydraulic fracturing technology from the oil and gas industry to develop Enhanced Geothermal Systems (EGS), making it possible to develop geothermal energy in non-traditional volcanic activity areas. Google's data center in Nevada has begun using geothermal power provided by Fervo Energy. Fervo's Cape Station project in Utah is expected to provide 400MW of all-weather clean power, with drilling efficiency and cost rapidly approaching the commercialization inflection point.

Natural Gas Power Generation will still play a key role in the next decade. To compensate for renewable energy fluctuations and the lag in nuclear construction, natural gas will provide necessary peak-shaving capabilities and baseload support. It is expected that by 2030, 60% of new US power demand will still be met by natural gas. Many data centers are deploying gas turbines with "Hydrogen-Ready" capabilities for future conversion to hydrogen fuel.

Transmission and Distribution Layer

According to our previous analysis, the power grid is currently the weakest link in the AI energy chain. To bypass grid bottlenecks, data center operators have begun adopting a "Behind-the-Meter" strategy, building data centers directly within the walls of power plants (such as nuclear plants or large wind/solar bases) and drawing power directly through dedicated transmission lines without passing through the public grid. For example, Amazon (AWS) acquired Talen Energy's Cumulus data center campus for $650 million; the campus is directly connected to the Susquehanna nuclear power plant and has 960MW of power supply potential.

Virtual Power Plants (VPP) and Energy Storage

Data centers are transforming from pure loads into flexible regulation resources for the grid. By deploying large-scale Battery Energy Storage Systems (BESS), data centers can cut off grid power when electricity prices are high or unstable, switching to battery power, or even feeding power back to the grid to provide ancillary services (like frequency regulation). Combined with AI algorithms to predict compute loads and price fluctuations, they automatically optimize charge/discharge strategies. This not only enhances their own energy resilience but also creates additional revenue streams. And the demand for economic incentive systems in Virtual Power Plants and Energy Storage is the link where Crypto can demonstrate its maximum advantage.

Facilities and Cooling Layer

NVIDIA is promoting an 800V High Voltage Direct Current (HVDC) architecture, which rectifies the grid's medium-voltage AC directly into 800V DC for transmission to cabinets, reducing multi-stage AC-DC-AC-DC conversion losses. Compared to 48V systems, 800V systems can reduce copper usage by 45% and improve end-to-end energy efficiency by about 5%. This change has driven huge demand for Silicon Carbide (SiC) and Gallium Nitride (GaN) power semiconductors capable of withstanding high voltage and high-frequency switching.

The physical limit of Air Cooling is typically 30-40kW per cabinet. Exceeding this threshold results in deafening fan noise and extremely low energy efficiency. AI has brought data centers into the "Liquid Cooling Era."

| Year | Chip Architecture (NVIDIA) | Typical TDP (Thermal Design Power) | Cabinet Power Density (NVL72/36) | Recommended Cooling |

|---|---|---|---|---|

| 2022 | Hopper (H100) | 700 W | 30 - 40 kW | Air / Hybrid |

| 2024/25 | Blackwell (B200) | 1,000 - 1,200 W | ~120 kW (NVL72) | Must be Liquid Cooled (Cold Plate) |

| 2026 | Rubin (R100) | > 1,500 W (Forecast) | > 150 kW | Liquid (Transition to Immersion) |

| 2027+ | Rubin Ultra / Vera | TBD | Likely 200 kW+ | System-level thermal management redesign required |

Shift from "Cost-Oriented" to "Asset-Oriented" and "Value Co-Creation"

Vertical Integration by Tech Giants: From "Buying Power" to "Making Power"

In the past, companies like Google and Microsoft mainly purchased Green Energy Certificates (RECs) through Virtual Power Purchase Agreements (VPPA) to offset carbon emissions, while actually relying on the public grid. Now, to ensure physical power supply, they are intervening deeply upstream:

- Joint Development Model: Tech companies provide upfront payments or low-interest loans to help energy developers (like Fervo, Kairos) cross the "Valley of Death" of technology commercialization.

- Asset Ownership: Directly holding equity in power generation assets. For example, Amazon not only buys nuclear power but also invests in R&D for nuclear technology. This vertical integration ensures they have priority power rights in case of grid collapse or power shortages.

Evolution of Power Purchase Agreements (PPA): 24/7 CFE

Traditional PPAs are settled annually (e.g., use 100 million kWh in a year, buy 100 million kWh of green certificates), leading to "greenwashing" suspicions—using solar by day and coal by night, but appearing 100% green on the books. Google and Microsoft have committed to achieving 24/7 Carbon-Free Energy (CFE) matching by 2030. This means every hour of electricity consumed must come from clean energy sources.

Commercialization of Waste Heat Recovery

With the spread of liquid cooling technology, the "waste heat" discharged by data centers has changed from difficult-to-use low-temperature hot air (~40°C) to high-quality hot water (60-70°C), which has commercial value. In Northern Europe, operators like Equinix sell waste heat to municipal heating companies. For example, the waste heat from Microsoft's data center in Helsinki, Finland, will meet 40% of the city's heating needs.

The Two-Way Rush of Energy and Crypto

In the past year, financing in the AI x Crypto DePIN sector has shown a clear trend driven by AI + Energy, with large investments concentrated in Decentralized Energy Networks and AI Compute/Data Layers.

| Rank | Project Name | Funding | Valuation/Market Cap | Date | Track | Key Investors/Event |

|---|---|---|---|---|---|---|

| 1 | Daylight | $75M | Undisclosed | 2025.10 | Energy | a16z Crypto, Framework. Including equity financing and debt financing for grid asset development. |

| 2 | Fuse Energy | $70M | $5B | 2025.12 | Energy | Balderton, Lowercarbon. UK-based vertically integrated power company, already achieving hundreds of millions in revenue. |

| 3 | Mawari | $45M | ~$200M+ | 2025.07 | Spatial Compute | Public Node Sale (DIO). Decentralized network focused on AR/VR content rendering, raising large funds through node sales. |

| 4 | DoubleZero | $28M | ~$400M | 2025.03 | Fiber/Connectivity | Multicoin, Dragonfly. Providing fiber-level connectivity layers for high-performance AI and blockchain. |

| 5 | Sanity United | $25M | ~$40M | 2026.01 | Green Logistics | GEM Token Fund. Investment commitment obtained, focusing on AI-driven green fleets and logistics networks. |

| 6 | Skyfire | $14.5M | Undisclosed | 2025.02 | AI Payments | Seed Round. Providing autonomous payment infrastructure for AI Agents, critical layer for "Machine Economy" DePIN. |

| 7 | Gradient Network | $10M | Undisclosed | 2025.06 | AI Compute | Pantera, Multicoin. Decentralized edge computing layer on Solana. |

| 8 | Plural Energy | $7.13M | Undisclosed | 2025.09 | RWA (Energy) | Paradigm. Leading seed round. Tokenizing energy assets like solar and batteries via blockchain, allowing retail investors to invest directly in grid assets. |

In addition to projects, specialized DePIN funds are also raising significant capital. ESCAPE VELOCITY raised $62 million to invest in "DePIN" crypto networks in fields like telescopes and solar energy. General Crypto funds prefer investing in software (DeFi, L2) because scaling costs are low. Escape Velocity raising $62 million specifically to invest in "telescopes, base stations, solar panels"—these heavy assets—indicates that LPs (Limited Partners, likely family offices or traditional institutions) are beginning to accept the narrative that "Crypto is not just air, but can generate cash flow through physical hardware." Additionally, Kyle Samani, who recently stepped down from a role at Multicoin (clarification needed on exact role change if any, based on context of 'stepping down/back'), also mentioned in a now-deleted tweet that DePIN is one of the few standout exceptions worth pursuing.

DAT Strategy of Energy Companies

In the Traditional Energy sector, while giants like ExxonMobil are mainly in the experimental stage of "mining with waste gas," some companies that started in traditional energy services or infrastructure, or own independent power assets, have explicitly established Digital Asset Treasuries (DAT).

- CleanSpark (NASDAQ: CLSK): Originally a Microgrid Energy Software and Control Technology Company serving military bases and commercial facilities. This is its "traditional energy/power technology" root. It transitioned to using its energy management advantages for Bitcoin mining and has long adhered to a "HODL" strategy (meaning holding the mined Bitcoin without selling).

- VivoPower International PLC (NASDAQ: VVPR): Announced the launch of a "Digital Asset Treasury (DAT) Strategy." Unlike most companies holding Bitcoin, VivoPower announced its strategic focus on XRP (Ripple), planning to use cash flow surpluses for stock buybacks and XRP accumulation.

- Greenidge Generation (NASDAQ: GREE): Owns and operates vertically integrated power plants (such as a natural gas plant in New York). It is essentially a power generation company with its own plant. It uses self-produced power for Bitcoin mining. Although its financial strategy adjusts with market fluctuations (sometimes selling Bitcoin to pay operating costs), its core model is directly converting "power generation capacity" into "crypto asset reserves."

Monetization of Power Assets by Mining Companies

Bitcoin miners possess a unique strategic advantage: they already control the power. In past cycles, miners secured gigawatt-level capacity in deregulated markets like ERCOT (Texas) or PJM, along with existing substations, transformers, and land rights.

Miners are leveraging their power assets for arbitrage, not just based on price, but on the "availability" of power. There are two main transformation models:

- AI/HPC Colocation/Hosting — "Landlord Model": Miners provide the physical shell, cooling, security, and power infrastructure. Customers (like CoreWeave, Microsoft) own and manage the GPU servers.

- AI Cloud Services (GPU-as-a-Service) — "Vertical Integration Model": Miners directly purchase GPUs (like NVIDIA H100/H200), build cloud platforms, and rent compute instances to AI developers.

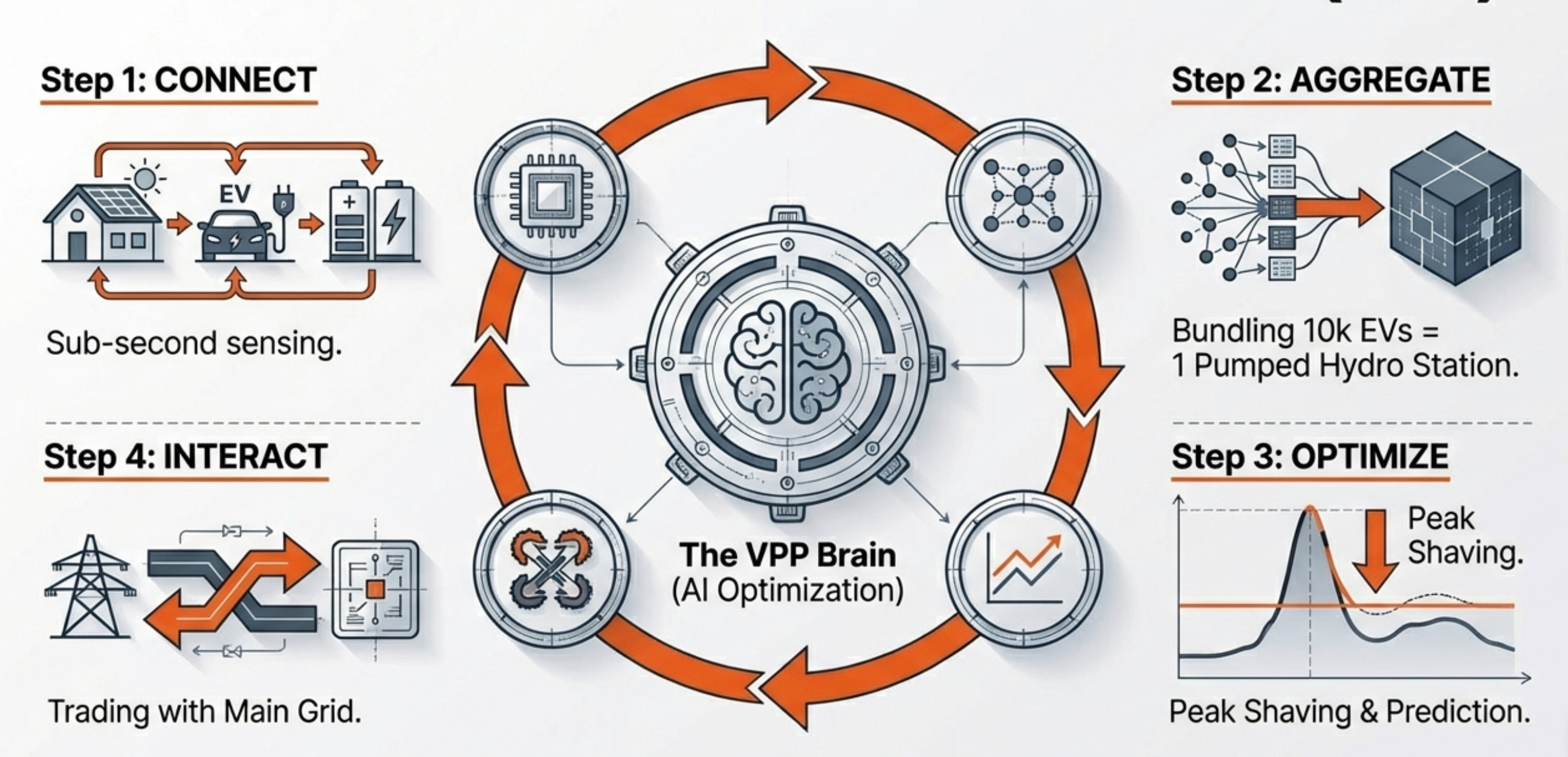

VPP Tackling Pain Points

The traditional power system is a one-way linear system: power flows from large power plants to the transmission grid, then through the distribution grid to passive end-users.

A Virtual Power Plant (VPP) is not a physically existing power plant but an intelligent energy management system. It doesn't necessarily own power generation equipment itself, but through digital technology, it aggregates dispersed energy resources, schedules them uniformly, and plays the same role as a traditional power plant.

The operating logic of a VPP can be summarized in four steps: Connect, Aggregate, Optimize, Interact.

Step 1: Connect (Sensing)

Through smart sensors and communication terminals installed on various devices, VPPs can sense and connect various dispersed power resources in real-time. These resources are mainly divided into three categories:

- Distributed Generation (Source): e.g., Rooftop solar, small wind turbines.

- Energy Storage (Storage): e.g., Home storage batteries, electric vehicle (EV) batteries.

- Controllable Loads (Load): e.g., Factory machines, mall air conditioning, office lighting, EV charging piles.

Step 2: Aggregate (Sand into Tower)

A single home storage battery or one EV charger has a negligible impact on the macro grid. But the VPP system "bundles" thousands of such tiny units together, forming a massive, controllable energy pool.

- Example: Aggregating batteries from 10,000 EVs is equivalent to a large pumped-storage hydro station.

Step 3: Optimize (Brain Decision)

This is the core of VPP. Cloud platforms use AI algorithms to calculate optimal scheduling strategies based on weather forecasts, price fluctuations, grid instructions, etc.

- Scenario: When grid load is too high, the system automatically instructs mall ACs to lower temperature by 1 degree (imperceptible to users) and commands batteries to discharge; when load is low, it commands charging.

Step 4: Interact (Trading & Dispatch)

The VPP interacts with the main grid as a single entity representing these dispersed users:

- Peak Shaving & Valley Filling: Exporting power to the grid during peaks, consuming during valleys.

- Ancillary Services: Helping the grid maintain frequency and voltage stability.

- Power Trading: Buying low and selling high in the spot market to make a profit.

In terms of reliability and continuous output capability, traditional power plants have significant advantages.Traditional plants have physical connections: hard metal. As long as the generator spins, power is generated. Large generators also have huge rotational inertia (Physical Inertia), allowing them to withstand shocks when the grid is hit—this is the "anchor" of the grid. Virtual Power Plants: Rely on Communication Networks. They are systems built on top of the Internet. If base stations lose power, network latency spikes, or cloud algorithms crash, the VPP instantly "disconnects."

Response speed and precision are VPP's PMF (Product-Market Fit). If the grid is suddenly short of power, a thermal plant needs to add coal, boil water, and speed up turbines, taking minutes or longer to ramp up to specified power. And adjustment precision is poor, making it hard to be "just right." Virtual Power Plants (especially storage-type): Like a swarm of jet skis. The core of VPP dispatch is often batteries (storage, EVs), relying on power electronics. From receiving a command to full power output takes only milliseconds (ms).

With more and more wind and solar (intermittent, weather-dependent), the grid becomes increasingly fragile and needs something to balance fluctuations rapidly. If you expect a VPP to replace a thermal plant for 24-hour generation, that is "unrealistic due to technical limitations." If you expect it to perform regulation, emergency rescue, and peak shaving, its performance is superior to traditional plants and extremely cost-effective.

When discussing DePIN, one cannot bypass those traditional giants that have already established massive distributed energy networks. Although they don't issue tokens, their business logic is highly isomorphic to DePIN at the physical level. The "Web2.5" hybrid model will exist for a long time. Pure decentralization is hard to achieve overnight in critical infrastructure like energy. The future belongs to "Web2.5".

| Dimension | Traditional Virtual Power Plant (VPP) | Energy DePIN |

|---|---|---|

| Control | Centralized (Commanded by operator) | Decentralized (Scheduled by smart contracts & protocol rules) |

| Access Mechanism | Permissioned (Tedious approval & certification) | Permissionless (Connects as long as protocol standards are met) |

| Incentives | Fiat (Bill credits, cash, long cycles) | Tokens (Real-time stream payments, asset appreciation expectation) |

| Data Ownership | Private (Owned by platform, e.g., Sunrun/Tesla) | Public & Transparent (On-chain storage, data sovereignty to user) |

| Financing Model | Corporate Balance Sheet Financing | Community Crowdfunding & Token Financing |

Case Study #1: Daylight

A typical "Energy-Native" team, rather than a purely technical or crypto-native team. this DNA determines that Daylight has a natural advantage in dealing with complex grid regulations, power trading, and project financing. Daylight chose a strategy of not being an enemy of the traditional grid, but an ally. Many early crypto energy projects tried to completely bypass the grid to build microgrids, but this is extremely difficult to achieve at the regulatory and physical levels.

| Core Member | Role | Background & Expertise Deep Dive |

|---|---|---|

| Jason Badeaux | Co-founder & CEO | Capital Architect. Jason is not a typical Silicon Valley geek, but a banker well-versed in energy finance. He worked as an investment banking analyst at Piper Sandler, focusing long-term on investment and M&A in the energy sector. Before founding Daylight, he deeply understood the pain points of traditional energy project financing: high customer acquisition costs (Soft Costs) and inefficient capital turnover. His core contribution lies in designing Daylight's unique "Equity-Debt Separation" financing structure, using traditional credit facilities to support physical asset expansion while reserving equity financing for technology development. |

| Udit Patel | Co-founder & CTO | Grid Technology Expert. Udit has practical experience working at the New York Independent System Operator (NYISO). The grid is a highly regulated field with an extremely high technical threshold; any device connecting to the grid must meet strict standards (such as UL certification, interoperability standards). Udit's background ensures that Daylight's VPP technology can truly interface with traditional grid dispatch systems (SCADA/ADMS), rather than just staying at the blockchain ledger level. |

| Evan Caron | Co-founder & CSO | Power Trading Operator. Evan was the Venture Lead at Riverstone Holdings (an energy fund managing over $40 billion) and served as CEO of ClearTrace and Director at MP2 Energy (later acquired by Shell). He is an expert in wholesale power market trading, knowing how to maximize returns for battery assets through Arbitrage, Frequency Regulation, and Capacity Markets. His presence is the basis for Daylight's promise to users of "electricity bills cheaper than the grid." |

| Dallas Griffin | Co-founder | Business Operations. A graduate of the McCombs School of Business at UT Austin, Dallas is responsible for translating complex energy products into subscription services that consumers can easily understand, and managing a vast network of local installers. |

Technical Architecture

Physical Layer: Hardware & Compatibility: Daylight adopts a strategy of "Hardware Neutrality" parallel with "Deep Integration." The platform supports connecting multiple brands of inverters (e.g., SolarEdge, Enphase), home batteries (e.g., Tesla Powerwall, LG Chem), smart thermostats (e.g., Nest, Ecobee), and EV chargers. This broad compatibility lowers the entry barrier for users, allowing existing devices to access the network.

Orchestration Layer: This is Daylight's technical heart, responsible for aggregating thousands of discrete home energy devices into a schedulable whole.

- Telemetry: Real-time collection of voltage, frequency, generation, and load data from each node. Data granularity determines VPP response speed. Daylight uses IoT technology to achieve sub-second data collection.

- Modulation: Dynamically adjusting device operation based on grid instructions or price signals. For example, when grid frequency drops, instantly commanding thousands of batteries to discharge simultaneously to support frequency; or during peak load, fine-tuning the set temperature of tens of thousands of thermostats to reduce total load.

- Forecasting: Using machine learning models, combined with weather forecasts and user historical behavior, to predict generation and load curves for the next 24 hours, thereby optimizing battery charge/discharge strategies (e.g., charging at price troughs, discharging at peaks).

Protocol Layer: Daylight Network & Data Verification. Validators or nodes need to prove they actually generated or curtailed a specific amount of power. This usually involves putting IoT device signature data on-chain to prevent data falsification (such as fake generation data generated by simulators).

Business Model

Supply Side Innovation: Subscription Model: The biggest barrier to the adoption of traditional residential solar is high upfront costs (typically $20k-$40k). Daylight introduced a subscription service similar to Netflix.

- Zero Down Payment: Users do not need to pay for hardware.

- Fixed Monthly Fee: Users pay a fixed subscription fee, designed to be lower than their original average electricity bill.

- Fully Managed Service: Daylight is responsible for device installation, maintenance, and insurance.

- Value Logic: Users get cheaper electricity and backup power (outage protection), while Daylight gains control over distributed energy assets.

Demand Side Monetization: Multiple Revenue Streams: How does Daylight make money from these assets? The answer lies in Revenue Stacking.

- User Subscription Fees: Provide stable Base Load Revenue.

- Wholesale Market Arbitrage: Charging when prices are low (e.g., late night or noon), selling to the grid when prices are high (e.g., evening).

- Ancillary Services: Providing frequency regulation, voltage support, and spinning reserve services to the grid. These services are often billed by the second and have extremely high unit prices.

- Capacity Market: Committing to provide power during specific future time periods to receive Capacity Payments from grid operators.

- Carbon Credits & REC Trading: Generated Renewable Energy Certificates (RECs) and carbon reduction amounts can be sold in compliance or voluntary markets.

Marketplace: Empowering Local Installers. Daylight does not attempt to build a massive self-operated construction team but connects local small and medium-sized solar installers through a Marketplace.

- Customer Acquisition Empowerment: Using Web3 community and token incentives (Sunnyside program) to lower customer acquisition costs and distribute leads to certified installers.

- Financing Empowerment: Local installers typically lack the capital to provide "zero down payment" services. Daylight uses its massive capital pool to provide bridge funding for installers, so they only need to focus on construction without bearing the pressure of advancing funds.

- Standardized Delivery: Standardizing construction standards and data upload formats for installers through software tools to ensure asset quality.

"Equity-Debt Separation" Behind the $75M Financing

The $75 million financing was strictly divided into two parts: $15 million Equity Financing and $60 million Project Finance Facility.

In the energy industry, assets (like solar panels) are heavy capital investments with long return cycles (10-20 years), but stable cash flows. If Venture Capital (VC) money is used to buy solar panels, due to VCs' extremely high return requirements (annualized 20-30%+) and equity dilution, it is extremely uneconomical.

- Role of Turtle Hill Capital: They provide a type of Non-recourse Debt. This money is specifically used to purchase equipment and pay installation fees.

- SPV Structure: Daylight establishes a Special Purpose Vehicle (SPV) to hold these energy assets. Turtle Hill's loan is issued to this SPV, and repayment sources are limited to the cash flow generated by these assets (user subscription fees + power sales revenue). If the SPV goes bankrupt, creditors can only confiscate the assets and cannot claim against Daylight's parent company assets.

- Advantage: This model allows Daylight to deploy hardware on a large scale through high Leverage without diluting equity or consuming valuable operating capital. This solves the "chicken or egg" scaling problem that gives DePIN projects the biggest headache.

The $15 million equity funding led by Framework Ventures focuses on high-risk, high-reward areas:

- Protocol Development: Refining DayFi smart contracts, cross-chain bridging, and data validation oracles.

- Market Expansion: Recruiting teams, brand marketing, and community incentives.

- Compliance Construction: Addressing regulatory compliance costs with SEC and FERC.

Case Study #2: Fuse Energy

Founded by former Revolut core executives Alan Chang and Charles Orr, Fuse Energy's core vision is to build a vertically integrated energy giant "Source-to-Socket." Unlike traditional asset-light energy retailers, Fuse insists on asset-heavy operations, aiming to own power generation assets, trading infrastructure, retail licenses, and eventually consumer hardware terminals.

Vertically Integrated Asset-Heavy Architecture

Fuse Energy's business model is an attempt at vertical integration of the traditional energy industry chain. In the traditional power market, Generators, Transmission, Distribution, and Retailers/Suppliers are usually separate entities. This fragmentation leads to conflicts of interest and efficiency losses between links. Fuse attempts to internalize these links to form a closed-loop ecosystem.

Layer 1: Renewable Generation Assets (Generation): Unlike many asset-light retailers that merely buy "Green Certificates" (RECs) for greenwashing, Fuse is committed to owning physical generation assets.

- Asset Portfolio: The company currently owns and operates 18 MW of solar and wind assets and claims to have a project pipeline of over 1 GW in the UK, US, and Europe.

- Strategic Logic: Owning generation assets allows Fuse to capture the spread between the marginal cost of energy production (LCOE, typically lower for renewables) and wholesale market prices (usually marginally priced by expensive natural gas). This spread is the economic basis for Fuse to provide electricity below market prices.

- 1 TW Vision: The company's long-term vision is to deploy 1 TW (Terawatt) of low-cost solar and storage, an extremely ambitious goal equivalent to rebuilding the entire US grid scale.

Layer 2: Proprietary Trading Stack: Fuse built an internal power trading team instead of outsourcing to third-party aggregators or giants like Shell/BP as most small retailers do.

- Operating Mechanism: Using real-time high-frequency data (Minute-by-minute data) collected from smart meters and DERs, Fuse's quantitative team can forecast demand curves more accurately than competitors.

- Arbitrage Model: By arbitraging between the Wholesale Market, Balancing Mechanism, and Ancillary Services market, Fuse maximizes the time value of electricity. For example, buying power during negative price periods to store in user batteries and selling during peak periods.

Layer 3: Direct-to-Consumer Retail Supply: This is the touchpoint for Fuse to establish a connection with users.

- Market Penetration: As of 2025, Fuse has about 200,000 household users in the UK.

- Pricing Strategy: Fuse adopts an extremely aggressive pricing strategy. Comparison data shows that Fuse's Fixed Tariff is typically cheaper (e.g., saving £68 annually) than its main competitor Octopus Energy. This low-price strategy is a typical internet "burn cash for growth" model aimed at quickly acquiring user scale.

- User Experience: The registration process is compressed to under 3 minutes, supporting uploading old bills for automatic switching, providing real-time bill transparency, solving the pain points of opacity and slow response in traditional energy services.

Layer 4: Hardware & Infrastructure: To deepen its moat, Fuse is venturing into hardware manufacturing and distribution.

- Project Zero Hardware: The company plans to launch Plug-and-Play micro solar and battery kits. This hardware does not require expensive professional electrician installation; users can deploy it directly, lowering the entry barrier for distributed energy.

- Installation Platform: Similar to the "Uber Eats for installations" model, Fuse established an installer marketplace to standardize installation processes and financing schemes, accelerating the deployment of heat pumps, charging piles, and batteries.

Crypto-Native Token Mechanism

The economic model of $ENERGY designs a closed-loop supply and demand system:

A. Acquisition Side (Earn - Supply): Users earn tokens through "Verifiable Energy Actions":

- Load Shifting: Reducing usage during grid congestion (e.g., delaying laundry, lowering heating).

- Energy Export: Feeding power from home batteries or solar panels back to the grid during peak periods.

- Automated Response: Authorizing Fuse to automatically control smart devices in the home (VPP model).

B. Consumption Side (Burn - Demand): Tokens are not just points but vouchers for purchasing power. Users can burn tokens to exchange for: - Hardware Discounts: Buying EV chargers, home batteries, solar panels in the Fuse store.

- Bill Deduction: Directly deducting from monthly electricity bills.

- Third-Party Benefits: Redeeming gift cards from 100+ brands (like Amazon, Uber, etc.).

C. Value Anchor: The token's value is pegged to the real economy through a "Burn" mechanism. When users burn tokens to get discounts, Fuse essentially buys back these tokens with its profits. This creates deflationary pressure, and the token's value support comes from profits of Fuse's physical business (hardware sales gross margin, power trading arbitrage profits).

Revolut-Style Savage Growth

Fuse Energy represents the Revolut of the energy industry, seamlessly integrating hardware, software, services, and financial incentives. A $5 billion valuation corresponds to $400 million ARR, a Price-to-Sales (P/S) ratio of about 12.5x. This is far higher than traditional energy retailers (typically 0.5-1.5x) and close to valuation multiples of high-growth SaaS or infrastructure software companies. This indicates investors do not view Fuse as a company selling electricity, but as an energy internet platform.

Despite rapid revenue growth (8x year-over-year), Fuse's financial health is questioned. A Sifted investigation shows that its UK entity Fuse Energy Supply recorded an operating loss of £4.8 million alongside £10 million in revenue in 2024, with an operating margin of -48%.

- Customer Acquisition Cost (CAC): Aggressive low-price strategy means losing money upfront for every user acquired.

- R&D Investment: Maintaining a large software and quantitative team is costly.

- Hardware Subsidies: Incentives for early adopters' hardware.

Case Study #3: 00451.HK x Pharos: Double DAT

GCL New Energy (GCL New Energy Holdings Limited) is a leading PV power station operator in China. After undergoing several years of debt restructuring and asset-light transformation. Pharos is a Layer 1 blockchain platform focused on "RealFi" (Real Finance).

Digital Asset Treasury

In January 2026, GCL New Energy announced a strategic investment agreement with Pharos Foundation. This deal is not a simple financial investment but a deep binding of interests.

- Equity Level: Pharos Foundation subscribed for approximately 186.5 million new shares of GCL New Energy, accounting for about 10.71% of the enlarged share capital. The transaction consideration was approximately HK$193 million (about $34.2 million). This means a foundation entity became a core shareholder of a listed energy company, a situation extremely rare in capital markets.

- Rights Swap: As part of the consideration, GCL New Energy obtained rights to subscribe for future equity in Pharos, as well as options to purchase digital tokens issued by Pharos at a specific price.

Data Asset Token

The core grip of the cooperation is Pharos's Data Asset Token (DAT) framework.

PV power stations are typical heavy-asset, long-cycle investments with extremely poor liquidity. By converting them into standardized data assets on the DePIN network, GCL implies attempting to Securitize "future cash flows" in advance and sell them to global cryptocurrency investors, rather than being limited to local banks or institutional investors. Furthermore, blockchain-based traceable data can provide the highest level of ESG transparency, helping obtain higher valuation premiums in capital markets.

For Pharos, as a Layer 1 public chain focusing on "Inclusive Finance" and RWA, its biggest pain point lies in the lack of high-quality, large-scale underlying assets. Binding with GCL New Energy allows it to directly access tens of gigawatts of PV assets and massive energy data.

- IoT Sensing Layer:

- Deploying smart meters and inverter data collectors integrated with Pharos SDK in GCL's PV stations.

- These devices have independent Device IDs (DID) and directly digitally sign collected generation data (voltage, current, generation amount).

- Key Point: Data is confirmed at the source, preventing human tampering.

- Validation Layer:

- Signed data is transmitted to the Pharos network.

- The DAT protocol uses Zero-Knowledge Proofs (ZKP) to verify the authenticity and integrity of data without leaking commercial secrets (such as specific client lists).

- Verified data is packaged on-chain, forming immutable "Data Certificates."

- Tokenization Layer:

- Smart contracts convert data certificates into financial assets based on preset rules.

- For example: For every accumulated 1 MWh of green power data, a "Green Certificate Token" is automatically minted; or based on real-time electricity prices, corresponding accounts receivable tokens are generated.

Machine Connection

With the exponential breakthroughs in Artificial Intelligence (AI) technology, especially the maturity of Multimodal Large Models and Vision-Language-Action (VLA) models, the robotics industry is leaping from traditional "Automation" to "Embodied AI." This paradigm shift not only reshapes the robotics technology stack but also profoundly changes the value distribution and business logic of the industry chain.

| Projection Agency | Sub-sector | 2025 Est. Size | 2030/2035 Forecast | CAGR | Core Drivers |

|---|---|---|---|---|---|

| Grand View Research | Humanoid Robots | $1.55 Billion | $4.04 Billion (2030) | 17.5% | Labor shortage, AI maturity |

| MarketsandMarkets | Humanoid Robots | $2.92 Billion | $15.26 Billion (2030) | 39.2% | Service sector demand, falling hardware costs |

| Goldman Sachs | Humanoid Robots | - | $38 Billion (2035) | - | AI model breakthroughs, BOM cost reduction |

Industry Chain Breakdown

Upstream Core Components: Value Highlands and Localization Bottlenecks

Compute Chips and AI Platforms: This is currently the top of the value chain and the link with the highest technical barriers. NVIDIA almost monopolizes the on-board computing market for high-end embodied intelligent robots with its Jetson Thor platform and Orin chips. The Thor platform is designed specifically for humanoid robots, providing up to 800 TOPS of computing power, capable of simultaneously running complex Transformer models and high-frequency motion control algorithms. It integrates functional safety features ensuring reliability in human environments. Although Chinese chip manufacturers like Horizon Robotics and Black Sesame Technologies are catching up, there is still a significant gap in ecosystem construction (such as CUDA alternatives) and software toolchain maturity.

Precision Sensors: The Robot's "Senses"

- Visual Sensors: RGB-D cameras and LiDAR are current standards. With the advancement of Tesla Optimus's pure vision solution, camera-based 3D reconstruction and depth estimation algorithms are becoming crucial, reducing reliance on expensive LiDAR but increasing computing requirements.

- Tactile Sensors: This is key to achieving dexterous manipulation and is currently an industry shortcoming. To allow robots to pick up a strawberry without crushing it, high-sensitivity tactile arrays are needed. The global tactile sensor market is expected to grow explosively from $18.6 billion in 2025 to $66 billion in 2035. Currently, capacitive sensors dominate, but novel sensors based on Visuotactile technology are iterating rapidly in labs.

- Six-axis Force/Torque Sensors: Installed at wrists and ankles to sense external forces. Due to high technical barriers, the localization rate in China is still low (<20%); high-performance products still rely on imports, representing a bottleneck restricting cost reduction for humanoid robots.

Actuators: The Robot's "Muscles": Actuators account for 40%-50% of the humanoid robot BOM (Bill of Materials) cost, making them the core area for cost reduction.

- Rotary Joints: Usually composed of "Frameless Torque Motor + Harmonic Drive + Dual Encoders." Chinese manufacturers like LeaderDrive have broken foreign monopolies in the harmonic drive field, possessing global competitiveness and forcing international giants like Nabtesco to cut prices.

- Linear Joints: Mainly used for knees and elbows, the core component is the Planetary Roller Screw. Compared to ball screws, it can withstand greater loads and impacts with longer life, but machining difficulty is extremely high, requiring ultra-high precision grinders. Currently, this market is mainly controlled by European (Rollvis) and Japanese manufacturers, with an extremely low localization rate. It is a hot spot for primary market investment and a fortress that Chinese manufacturing urgently needs to conquer.

- Dexterous Hands: Coreless Motors are the core drive source for dexterous hands, featuring small size, high speed, and fast response. Chinese companies like Moons' are leading in this field and have entered the supply chains of major global humanoid robot manufacturers.

Midstream Body Manufacturing: Blossoming and Route Disputes

A distinct US-China duopoly has formed in the humanoid robot field, with different technical focuses.

- Western Camp: Represented by Tesla (Optimus), Figure AI, and Agility Robotics. They focus on End-to-End AI Algorithm breakthroughs and rapid verification of Commercial Scenarios. Figure AI's collaboration with BMW demonstrates the potential application of humanoid robots on automotive assembly lines, while Tesla leverages its autonomous driving data loop advantage to lead in visual perception and motion planning.

- Chinese Camp: Represented by Unitree, Agibot, Ubtech, and Fourier Intelligence. The advantage of Chinese enterprises lies in Extreme Cost Control and Rapid Hardware Iteration. The G1 humanoid robot released by Unitree is priced as low as 99,000 RMB (about $16,000), shattering industry expectations, greatly impacting the market pricing system, and accelerating the process of humanoid robots moving from labs to commercial applications. Chinese companies tend to strengthen body hardware and motion control (cerebellum) first, then gradually fill in upper-level cognitive AI (cerebrum).

Downstream Application and System Integration: The Era of Scenario Definition

In the AI era, the role of System Integrators (SI) is shifting from "hardware assembly" to "data and algorithm implementation." Whoever can help customers clean data and fine-tune models will hold the discourse power. Specialized foundation model service providers (MaaS - Model as a Service) for robot motion control may emerge in the future, providing a universal intelligent base for robots in various industries.

Innovation in RaaS Model: From Selling Iron to Selling Labor

Direct Sales (Capex) is the traditional equipment sales model, suitable for large automotive factories and top 3C manufacturing enterprises. These customers are well-funded, have strong equipment maintenance capabilities, and wish to own assets to ensure data safety and production stability. For robot manufacturers, this model brings quick cash return, but market penetration speed is limited by customers' capital expenditure budgets.

Robot-as-a-Service (RaaS) is the most important emerging business model in the AI era. It converts the high initial investment of robots into monthly operating costs (Opex). The RaaS model shows superior Return on Investment (ROI) in logistics, security, and some industrial scenarios.

| Comparison Dimension | Traditional Purchase (Capex) | RaaS (Opex) | Advantage/Disadvantage Analysis |

|---|---|---|---|

| Initial Investment | High ($100k-$500k/system) | Low (Only 1st month rent or deployment fee) | RaaS greatly lowers entry barrier, benefiting SMEs |

| Cash Flow Impact | One-time large expense on Balance Sheet | Recorded as OpEx, preserving cash flow | Suitable for startups & rapid expansion phase |

| Scalability | Expansion requires re-procurement, long cycle | Scale up/down on demand, high flexibility | Perfectly matches peak/off-peak fluctuations in e-commerce logistics |

| Maintenance & Upgrade | Need self-built team or buy maintenance service | Included in subscription, OTA continuous upgrades | Under RaaS, tech obsolescence risk is borne by supplier |

| ROI Cycle | Typically 3-5 years | Typically <18 months | RaaS reflects cost reduction & efficiency gains faster |

MachineFi or Machine RWA

In the traditional model, RaaS is a B2B leasing relationship: robot manufacturers own the assets, and corporate clients pay monthly rent. This model faces two bottlenecks:

- Low Capital Efficiency: Manufacturers need massive balance sheet funds to hold robot inventory.

- High Entry Barrier: Retail investors cannot participate in this high-growth market.

| Dimension | Traditional Leasing (RaaS 1.0) | Tokenized Leasing (RaaS 2.0 / MachineFi) |

|---|---|---|

| Funding Source | Bank loans, venture debt | Global retail investors, DeFi liquidity pools |

| Balance Sheet | Assets stuck on manufacturer's books | Assets sold to DAO/Community (Off-balance sheet) |

| Payment Settlement | Monthly/Quarterly (Net 30/60) | Real-time stream payment (Pay-per-task) |

| Utilization Risk | Client bears fixed rent | Risk sharing (Revenue split based on output) |

| Secondary Market | None (Zero liquidity) | RCM protocols provide 24/7 liquidity |

Case Study #1: XMAQUINA

Facing the potential labor displacement crisis caused by automation, XMAQUINA does not attempt to block technological progress through policy, but financializes robot productivity through blockchain technology, enabling ordinary individuals to co-own, co-govern, and benefit from the labor of autonomous robots by holding tokens ($DEUS).

XMAQUINA's business architecture is ingeniously designed to create value for the ecosystem and $DEUS holders through two mutually reinforcing business segments: Investment DAO and Infrastructure Launchpad.

| Comparison Dimension | XMAQUINA DAO | Machine Economy Launchpad |

|---|---|---|

| Role | Investor / Asset Holder | Incubator / Platform Service Provider |

| Core Assets | Robot company equity, physical machine ownership | Sub-DAO tokens, protocol revenue |

| Revenue Sources | Equity exit returns, machine operation dividends | Listing fees, 5% Sub-DAO token allocation, trading fees |

| Risk Profile | Capital intensive, long return cycle | Tech intensive, strong network effects |

| Benchmarked Entity | SoftBank Vision Fund | CoinList, Polkastarter |

Pillar 1: XMAQUINA DAO (Robot Investment Bank)

The operation model of XMAQUINA DAO is similar to a decentralized Venture Capital Fund (VC) or asset management company. Its core function is to pool community capital to invest in four high-growth verticals of the robotics industry:

- Humanoid Companies: Directly acquiring equity in top humanoid robot manufacturers at the Pre-IPO stage. This is seen as the highest return track, similar to investing in Tesla or Boston Dynamics early on.

- Physical AI Stack: Investing in upstream core technologies of the robot industry chain, including actuators, sensors, specialized chips (competitors to NVIDIA Jetson), and edge computing infrastructure.

- Robotics Protocols: Supporting Web3 projects that provide data exchange, mapping services, or communication standards for robots.

- Humanoid AI: Focusing on AI software companies building "brains" for general-purpose robots, i.e., Embodied AI driven by Large Language Models (LLMs).

XMAQUINA has successfully invested in Apptronik through a community governance proposal. Apptronik is one of the world's leading humanoid robot companies, with its flagship robot Apollo designed for warehousing logistics and manufacturing, considered a strong contender against Tesla Optimus. This investment not only brought potential huge equity appreciation returns to the DAO but also established XMAQUINA's reputation and influence in the traditional robotics industry.

Pillar 2: Machine Economy Launchpad (The Launchpad)

The Launchpad allows third-party developers, robot manufacturers, and even entrepreneurs owning robot fleets to launch their own sub-DAOs on XMAQUINA's platform.

- Function: The platform provides a full "Tokenization Toolkit," including compliant legal wrappers (SPV setup), smart contract templates, governance modules, and connection interfaces with the peaq network.

- Value Capture: In exchange for incubation services, every sub-DAO launched on the platform must contribute 5% of its total token supply to the XMAQUINA main DAO. This means as more robot projects launch through XMAQUINA, the main DAO's treasury will automatically accumulate an exponential asset portfolio of the entire industry.

- Protocol Fees: Besides token allocation, the launchpad also charges certain Protocol Fees, which flow directly into the treasury for $DEUS buybacks or dividends.

XMAQUINA does not directly "own" robots on-chain because blockchain addresses lack legal personality.

- Legal Wrapper: Every sub-DAO or machine pool corresponds to an SPV (usually an LLC or Foundation) in the real world. This SPV holds the robot's property rights certificate, purchases insurance, and signs maintenance contracts.

- Token Mapping: On-chain tokens represent rights to revenue or governance of that SPV. This structure connects on-chain liquidity with off-chain legal liability, while also isolating single-asset risks (if one robot causes an accident, it won't implicate the entire DAO).

Potential Risks

The entire direction is still a relatively new business model exploration, so there will inevitably be many potential pitfalls.

Fast Technology Iteration: Robotics technology iterates extremely fast. Today's advanced robots may become electronic waste in 3 years. If assets invested by the DAO depreciate faster than the revenue they generate, investors will face principal loss. The DAO needs to establish strict depreciation models and reserve a large portion of revenue in smart contracts as a "Replacement Fund," but this will lower current APY.

Unit Economics: Robots are currently still expensive. A humanoid robot may cost up to $50k-$150k. In regions with abundant cheap labor, the ROI of robots may be negative. XMAQUINA must precisely select markets with high labor costs (like Western Europe, Japan) for deployment.

Case Study #2: Robo.ai

Robo.ai is a very special case. It simultaneously covers the energy and robotics tracks, and even beyond energy and robotics. The grand vision of the company's new strategy may far exceed its current capability limits. The entire company will either take off instantly or...

Relying on the UAE's "We the UAE 2031" national vision, Robo.ai has built a closed-loop ecosystem through deep strategic binding with W Motors, Zand Bank, and Arkreen: not only creating smart terminals (vehicles, eVTOL) but also converting these assets into financial nodes via blockchain technology, utilizing regulated stablecoins for Machine-to-Machine (M2M) payments, and participating in energy dispatch through Virtual Power Plant (VPP) technology.

| Dimension | NWTN Inc. (Old Strategy) | Robo.ai Inc. (New Strategy - AIIO) |

|---|---|---|

| Core Positioning | High-end Green Mobility Solution Provider | Decentralized AI Asset & Machine Economy Platform |

| Key Products | Luxury Electric Vehicles (Passenger EVs) | Intelligent Robot Terminals (Robotaxi, eVTOL, Logistics) |

| Tech Focus | Vehicle Engineering, Battery Assembly | AI Operating System (Robo AI OS), Blockchain (DePIN), VPP |

| Revenue Model | One-time Hardware Sales | Hardware Sales + Asset Tokenization Yield + Energy Data Service Fees |

| Market Region | UAE Domestic | MENA, APAC, Global South Markets |

The company's narrative expectation is directly benchmarked against Tesla, painting a magnificent blueprint, but facing severe challenges at the execution level.

| Dimension | Tesla (TSLA) | Robo.ai (AIIO) |

|---|---|---|

| Ecosystem | Closed (Apple Model): Self-built Supercharger network, proprietary FSD software, own VPP platform (Autobidder). | Open (Android/Web3 Model): Based on DePIN protocols (Arkreen), compatible with 3rd-party hardware, cross-chain payments. |

| Payment System | Fiat/Credit Card system, human-centric. | Stablecoin/Smart Contract system, machine-centric. |

| Energy Strategy | Selling Powerwall/Megapack hardware, centralized dispatch via Autobidder. | Vehicle as Miner, guiding user participation in grid balancing via blockchain incentives. |

| Core Market | Global market, focused on US/China/EU. | Focused on MENA, South Asia, and "Belt and Road" countries. |

| Commercial Loop | Relying on FSD subscription and Robotaxi service fees. | Relying on RWA asset yields, trading fees, and token economy incentives. |

Additionally, its strategic cooperation may involve a large number of related-party transactions, so many details require deeper DD to confirm, but its track layout clearly hits the future direction.

Autonomous Mobility

The cornerstone of Robo.ai's mobility strategy is its wholly-owned subsidiary Astra Mobility Meta. On October 9, 2025, Astra signed a milestone commercial agreement with Dubai-based W Motors Automotive Group. W Motors committed to purchasing no less than 30,000 smart vehicles within five years. This order volume is crucial for an emerging OEM, directly solving the "idle capacity" and "order uncertainty" problems commonly faced by new car makers.

RoBUS: Commercial Bus Network for the "Global South"

To cover the mass transit market, Robo.ai established a joint venture RoBUS with Pakistan's JW Group.

- Market Positioning: RoBUS targets emerging markets (i.e., "Global South") such as the Middle East, Africa, South Asia, and Southeast Asia. These regions are undergoing rapid urbanization, have urgent demand for cost-effective green public transport, and are more price-sensitive than European and American markets.

- Product Matrix:

- RO1: Green Smart Luxury Coach.

- RO2: Green Smart City Bus.

- RO3: Premium Business Vehicle.

- Management Configuration: Calculating former NIO, Ford, and Volvo executive River Zhang as Chief Industrial Officer shows Robo.ai's attempt to introduce mature automotive industry manufacturing standards into this joint venture. The strategic significance of RoBUS lies in leveraging China's supply chain cost advantages and JW Group's distribution network (over 400 distributors) to quickly capture the bus electrification share in emerging markets.

RoVTOL, a joint venture established with Ewatt Aerospace, aims to develop and deploy electric vertical take-off and landing vehicles. eVTOL is viewed not as an independent aviation business but as another "node" in the DePIN network. This means RoVTOL aircraft will adopt the same digital wallet, identity authentication, and energy management protocols as Astra ground vehicles, achieving air-ground integrated data and value flow.

Vehicle-as-a-Node

Robo.ai made a strategic investment in the DePIN platform Arkreen. Arkreen is a Web3-based green energy data network, whose function is to convert physical world energy behaviors (generation, storage, consumption) into on-chain trusted data.

Energy data generated by vehicles no longer sleeps in servers but is minted into Carbon Credits or Renewable Energy Certificates (RECs) and traded on on-chain markets.

Robo.ai collaborates with Zand Bank to drive the tokenization of Real World Assets (RWA). By packaging the assets of 30,000 Astra vehicles or RoVTOL fleets on-chain, investors can purchase "fractional shares" representing vehicle ownership. These shares can circulate on compliant digital asset exchanges, allowing Robo.ai to recover funds faster for reproduction, while investors can share fleet operating revenues (such as rent, advertising fees, carbon sink benefits).

Virtual Power Plant (VPP) and Collaborative Dispatch Algorithms

For the Middle East region, with the increasing proportion of solar power generation, the grid's demand for energy storage and frequency regulation resources has increased sharply. Robo.ai's fleet is a natural VPP resource. Robo.ai showed lower Rejection Rate, lower cost, and higher dispatch efficiency in VPP collaborative dispatch. This means Robo.ai's fleet can respond to instructions faster than competitors when participating in grid ancillary services, thereby obtaining higher grid compensation revenues.

Infrastructure and Compute Base

Robo.ai established a joint venture with Tachyon9 Corporation, dedicated to building high-performance AI data centers in the Middle East and Asia-Pacific regions. For chip supply, Robo.ai signed a distributor agreement with The Ghazi Group. In the context of tight global high-performance AI chip supply, ensuring a stable source of GPUs is a prerequisite for building AI infrastructure.

Potential Risks

"Production Hell": This is a threshold all new car makers must cross. Although W Motors has experience building supercars, the supply chain management, quality control, and capacity ramp-up difficulty for mass-producing 30,000 commercial vehicles is enormous. The goal of SOP in 2026 is very aggressive, and any delay could lead to cash flow breakage and reputation damage.

Convertible Note Dependence: The company relies on convertible note financing. If the stock price falls, note conversion will lead to significant dilution of existing shareholders' equity. Moreover, as of the end of 2025, the company's current ratio was only 0.3, indicating huge short-term debt repayment pressure. Before achieving positive operating cash flow, the company is highly dependent on external capital.

Integration Complexity: Robo.ai attempts to integrate five distinct fields: automotive manufacturing (Astra), aviation engineering (RoVTOL), blockchain protocols (Arkreen), banking compliance (Zand), and data centers (Tachyon9). This requires extremely strong cross-domain system integration capabilities. A disconnect in any link (e.g., vehicle hardware failing bank security certification, or DePIN network congestion) could cause the entire commercial loop to fail.