The Era of Great Infrastructure Integration

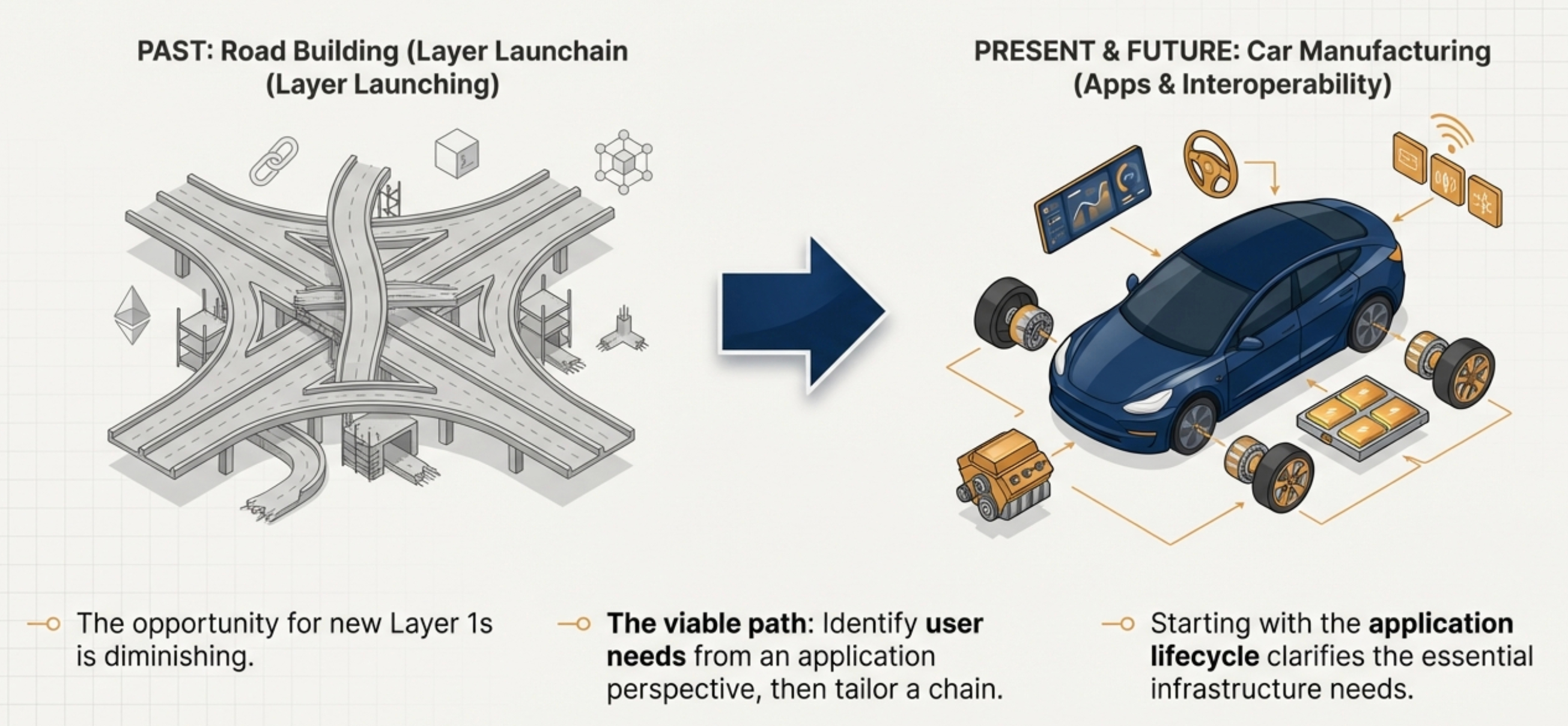

Cryptocurrency infrastructure is undergoing a profound paradigm shift from "Road Building" (Chain Development) to "Vehicle Manufacturing" (Applications & Interoperability). It is increasingly difficult to find new opportunities at the chain level itself; the only viable path now is to launch chains stemming from successful applications. Conversely, most chains that started as infrastructure without a clear product-market fit (PMF) are destined to fade away. From the perspective of business integration, prioritizing chain-level infrastructure at the outset offers little value.

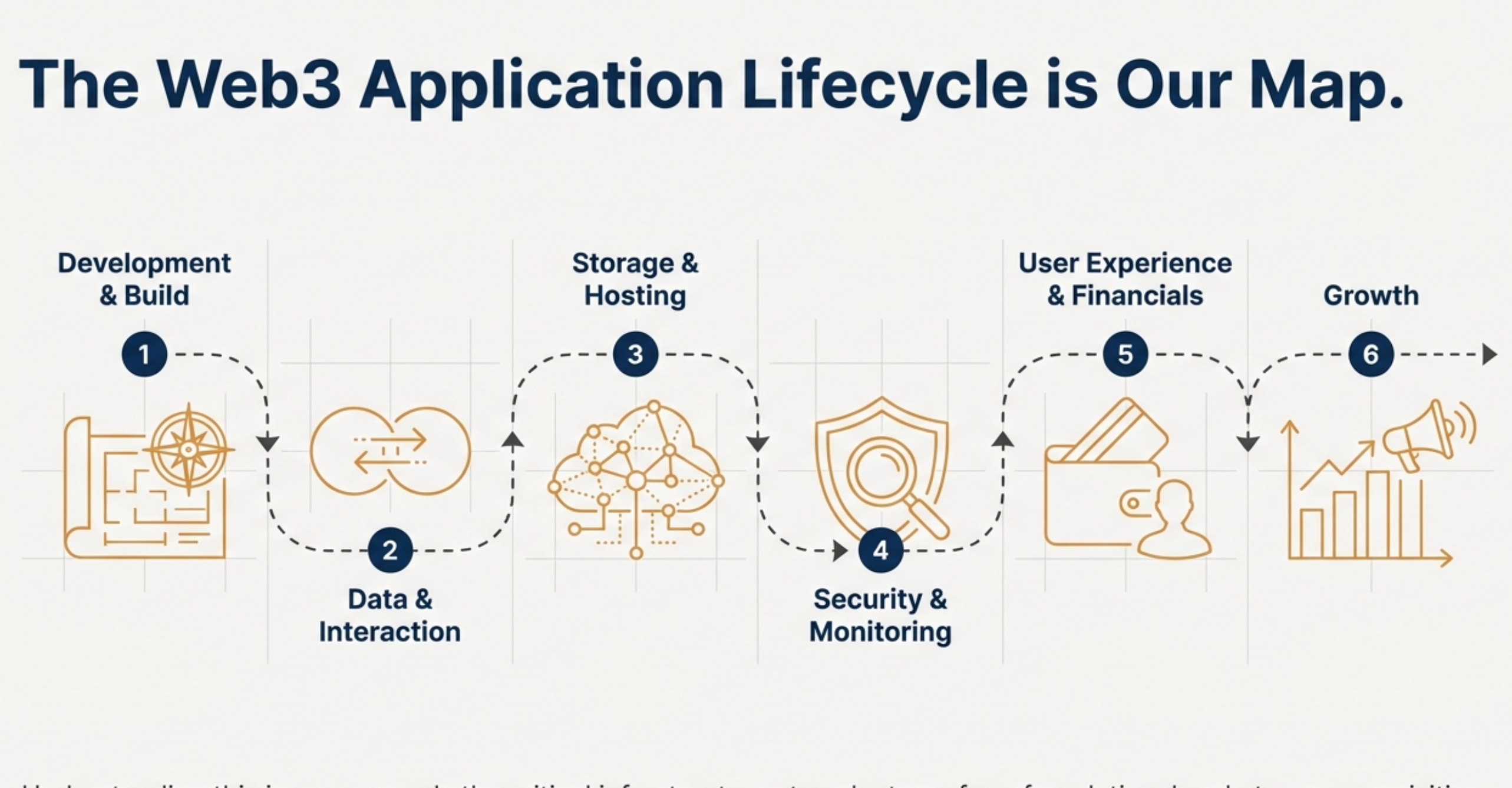

Analyzing the lifecycle of an application helps us clarify the rigid demand for infrastructure and services within the industry.

1. Development & Build Phase

This is the "foundation laying" stage, primarily involving the selection of underlying protocols and the writing of smart contracts.

- Underlying Blockchain Networks (Layer 1 / Layer 2):

- Selection: Ethereum, Solana, BSC, or Layer 2 solutions like Arbitrum, Optimism, Base.

- Services: Testnets and Faucets (for acquiring test tokens).

- Development Frameworks & Environments:

- Tools: Hardhat (Mainstream for EVM), Foundry (High performance), Anchor (Solana). These are used for compiling, testing, and deploying smart contracts.

- Services: Remix IDE (Online editor), OpenZeppelin (Standard contract libraries, e.g., ERC-20, ERC-721 templates).

- Interoperability:

- If the application requires multi-chain operation, cross-chain communication protocols must be integrated.

- Services: LayerZero, Wormhole, Chainlink CCIP.

2. Data & Interaction / Runtime Phase

Once the application is live, the frontend must communicate with the blockchain. Since querying blockchain nodes directly is both slow and expensive, a middleware layer is required.

- Node Providers & RPC Services:

- The "Gateway" for application-blockchain dialogue. Self-hosting nodes is cost-prohibitive; third-party services are standard.

- Services: Alchemy, Infura, QuickNode, Ankr.

- Indexing & Querying:

- Blockchain data is linear and difficult to query directly (e.g., "Show all NFTs owned by User A"). Indexers organize this data.

- Services: The Graph (Decentralized indexing), SubQuery, Dune API (Analytics), Moralis.

- Oracles:

- If smart contracts require off-chain data (prices, weather, sports scores), oracles are needed to feed this data.

- Services: Chainlink, Pyth Network, API3.

3. Storage & Hosting

- Decentralized Storage:

- Services: IPFS (Most common, hosted via services like Pinata), Arweave (Permanent storage), Filecoin.

- Frontend Hosting:

- While AWS/Vercel can be used, many projects opt for decentralized hosting to ensure censorship resistance.

- Services: Fleek, 4EVERLAND.

4. Security & Monitoring

Crucial throughout the lifecycle, covering both pre-deployment and runtime.

- Code Auditing:

- A mandatory step before going live.

- Services: CertiK, SlowMist, OpenZeppelin, Trail of Bits.

- Real-time Risk Control & Monitoring:

- Monitoring for abnormal transactions, hacks, or contract exploits during runtime.

- Services: Forta (Decentralized monitoring bots), Tenderly (Debugging & simulation), Sentio.

5. UX & Financials

This is the "Last Mile" where users interact with the app, determining conversion rates

- Wallets & Auth:

- Components for user connection. The trend is "Embedded Wallets" (Login via Email/Socials).

- Services: WalletConnect, RainbowKit, Privy (Web2 experience), Dynamic, Particle Network.

- On/Off Ramps:

- Allowing users to purchase crypto directly via credit card.

- Services: MoonPay, Transak, Ramp Network.

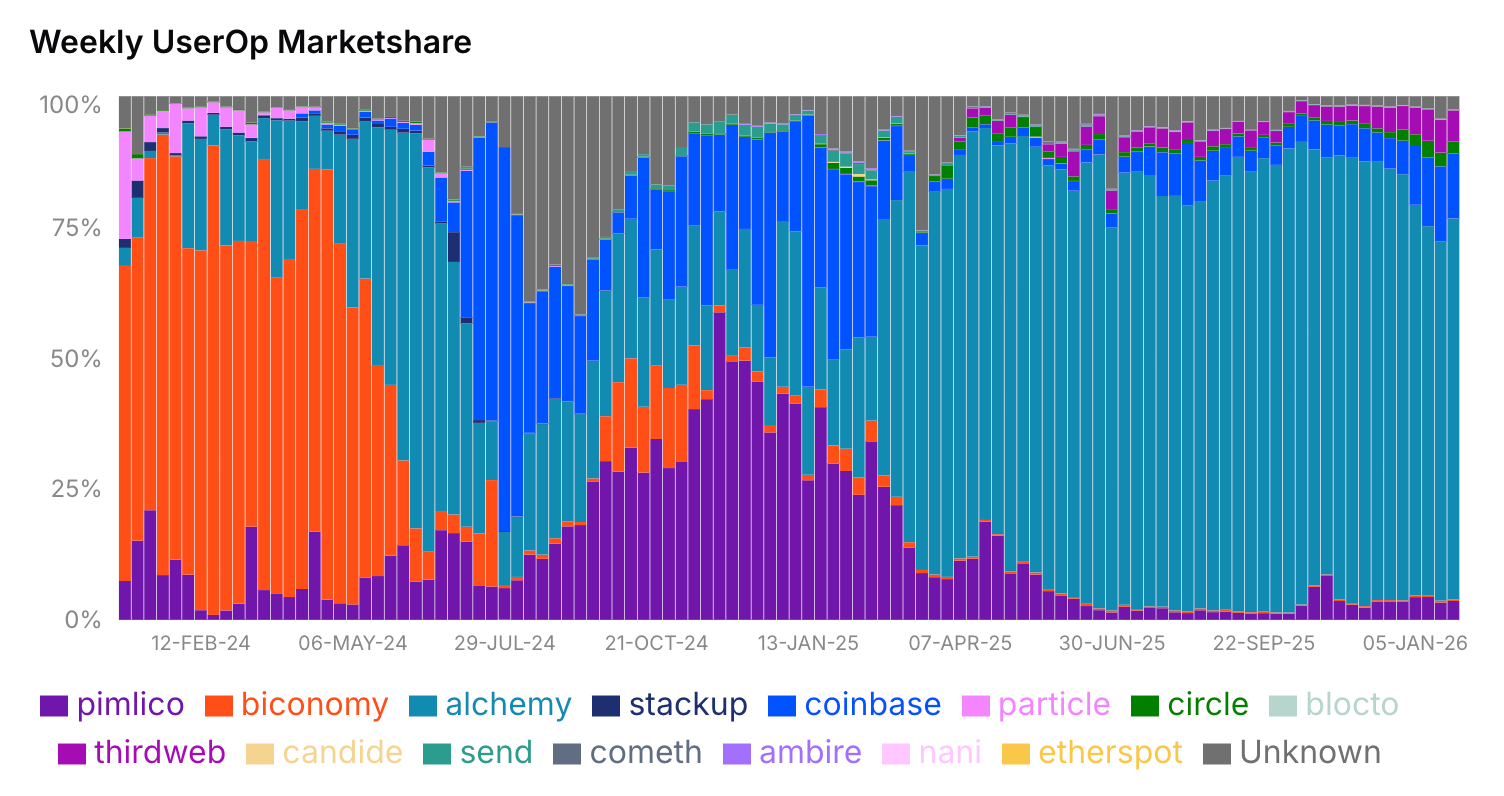

- Account Abstraction / Paymaster:

- Allows projects to subsidize Gas fees for users, lowering entry barriers.

- Services: Biconomy, Stackup, Safe (Multi-sig).

6. Growth & Liquidity

The stage where an app moves from "usable" to "valuable." The goal is to ensure assets have a trading venue, depth, active players, and transparent data.

- Growth & Quests Platforms:

- Web3 "Marketing" relies heavily on on-chain behavioral incentives (Quests for Airdrops/OATs). This is core infrastructure for early user acquisition

- Services:

- Galxe: The largest on-chain credential network.

- Layer3 / Zealy: Interactive quest platforms.

- RabbitHole: Growth platform focused on on-chain skills.

- Market & Publicity:

- Web3 promotion relies on media and conference organizers.

- Media is usually priced per article or annual retainer; Conferences are calculated per event.

- Services: CoinDesk, Blockworks, TechFlow; Token2049, ETHGlobal, TintinLand.

- Liquidity Venues (DEXs):

- Apps need a trading venue for their tokens. This is rarely self-built, utilizing existing DEX infrastructure instead.

- Market Making Services:

- While technically a "service" rather than code "infrastructure," it is vital for token markets to maintain order book depth.

- Services: Wintermute, GSR, DWF Labs.

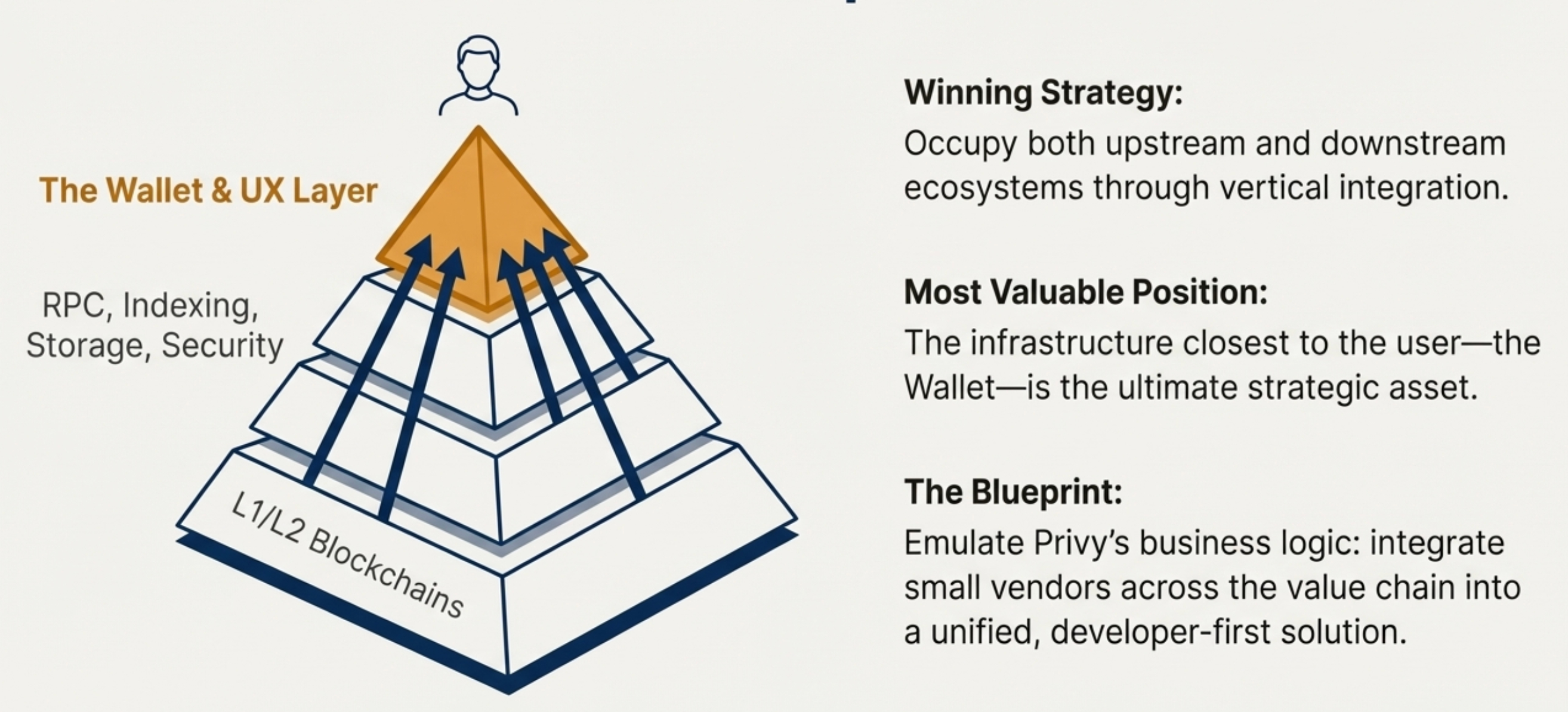

In the context of this great consolidation, infrastructure and service providers that occupy both upstream and downstream ecosystems will hold advantageous positions, continuously widening their scope.

From the perspective that "the token is the biggest product," Exchanges and Market Makers capture the most profit. However, from a future user-product perspective, the ecosystem niche closest to the user holds the most value. Undoubtedly, this is the Wallet. Privy is the quintessential example here; we can replicate their business logic by integrating small vendors across every link of the infrastructure chain to offer a complete solution. Aside from the chain level, tools that survive will be those with proven technical strength and stable cash flow businesses.

Privy Integration Case in WaaS

Wallet-as-a-Service (WaaS) is the "Last Mile" for Web2 users entering the Web3 world. Its core value lies in eliminating the cognitive barrier of Seed Phrases. Through Multi-Party Computation (MPC) or Account Abstraction (AA), users can create and manage on-chain accounts seamlessly via email, social accounts, or biometrics. The direction of this sector was confirmed when Stripe acquired Privy: Wallet infrastructure is no longer just a SaaS service; it is the strategic choke point connecting web2 and web3, it's also a business of selling traction.

In 2025, the technological roadmap for WaaS has highly converged:

- Key Management: Widespread adoption of MPC-TSS (Threshold Signature Schemes). Private keys are sharded, stored separately across the user's device, the service provider's server, and a third-party cloud. Transaction signing requires coordination of these fragments, meaning no single entity holds the full private key, balancing "non-custodial" security with "custodial" convenience.

- Execution Environment: Leading players like Privy have introduced hardware-isolated Trusted Execution Environments (TEEs) to further enhance key management security and prevent internal malicious acts.

Most projects employ a combination tech stack: pure MPC, TEEs, or an MPC + TEE hybrid.

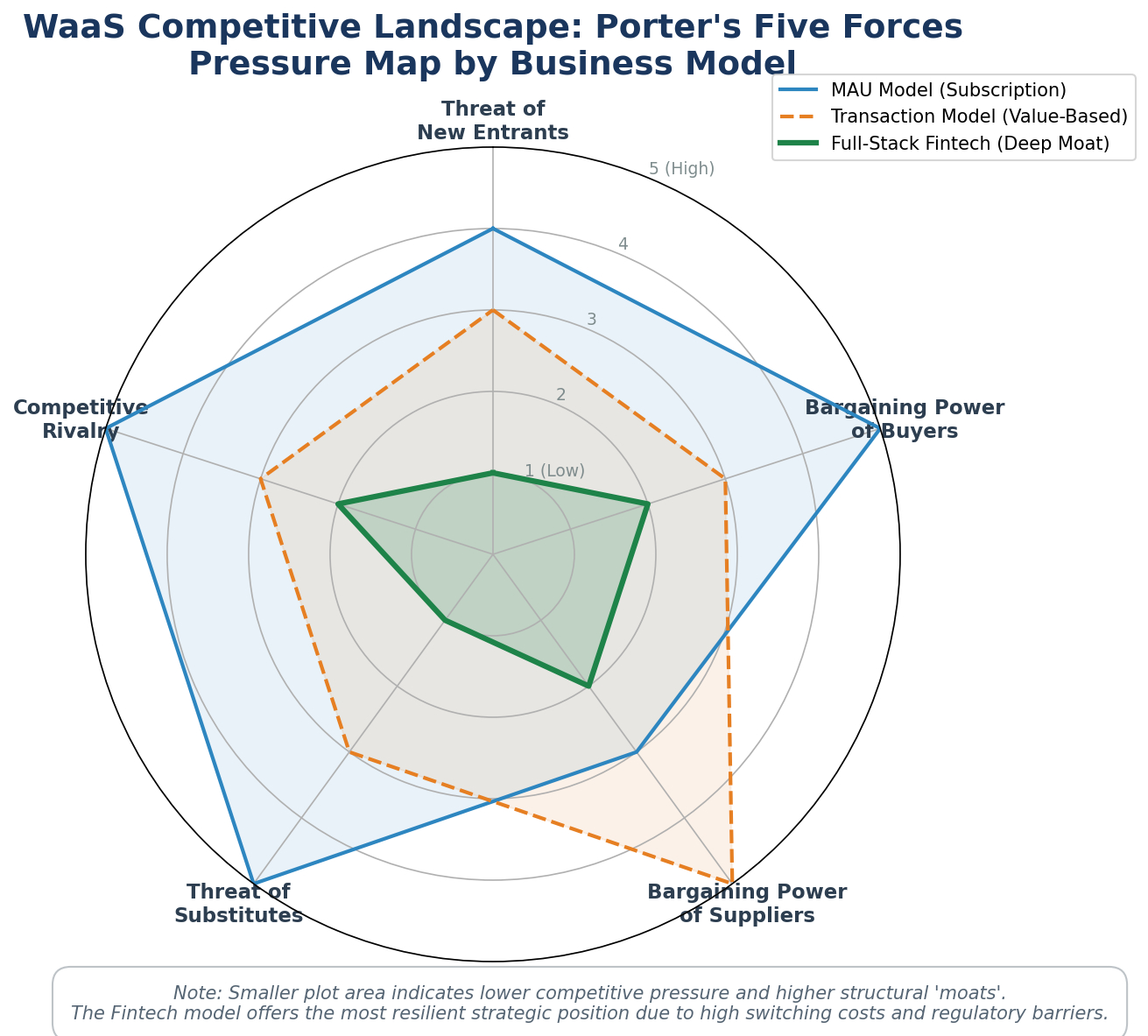

The business model for WaaS is evolving from simple SaaS subscriptions to "Value Sharing."

- MAU (Monthly Active Wallet) Model:

- Mechanism: Charged based on the number of unique wallets logging in or transacting monthly.

- Pricing: ~$0.05 - $0.20 / MAW. Enterprise clients usually have a monthly Platform Fee of $500 - $2,000.

- Transaction/Volume Model (Value-Based):

- Mechanism: A micro-fee per transaction or volume, or bundled into "Gas Sponsorship" services.

- Advantage: Popular in GameFi and DeFi, as costs are directly linked to protocol revenue.

- Full-Stack Embedded Fintech Model:

- Mechanism: Combining On/Off-Ramps and Bridging. The WaaS provider earns via spreads or rebates from fiat/cross-chain aggregators rather than just software fees.

Before 2023, Privy focused on privacy. By the time of its acquisition in 2025, it had defined the interaction standard for Consumer Crypto Apps through outstanding performance in high-traffic applications. Its core moat lies in an extreme Developer Experience (DX) and an architecture that isolates user privacy.

Privy provides a comprehensive solution: asset custody, user entry, identity verification, and transaction signing, enabling B-side clients to scale rapidly. The product suite is built around a core thesis: Onboarding should be decoupled from Custody but seamlessly integrated into the application lifecycle. This achieves "Progressive Authentication"—users interact via standard Web2 methods (email/socials) and only trigger underlying crypto elements when value transfer occurs.

Product Solution

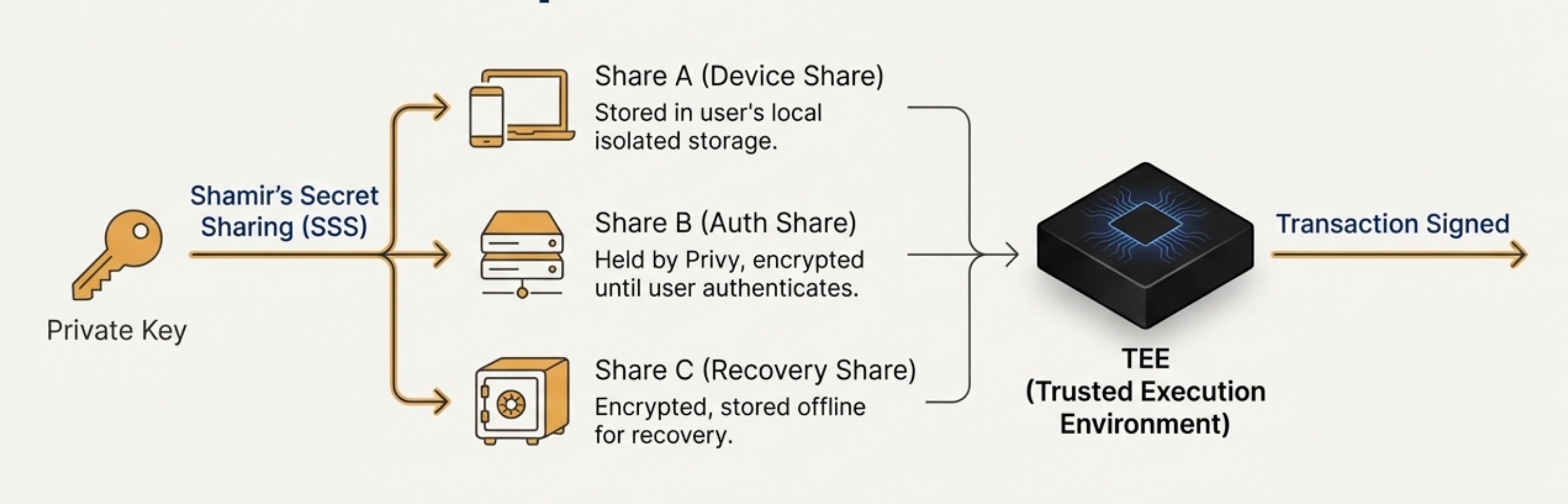

Privy represents a typical SSS + TEE solution. It uses the Shamir Secret Sharing (SSS) algorithm to manage private keys. In this model, the private key never exists or is stored in full in a single location. Instead, it is encrypted and split into "Shares." A typical implementation involves a 2-of-3 Quorum:

- Share A (Device Share): Stored in the isolated storage of the user's local device (e.g., Browser LocalStorage or Mobile Secure Enclave). This ensures the user retains physical control.

- Share B (Auth Share): Held by Privy’s servers in an encrypted state. It can only be decrypted and accessed after the user successfully authenticates (e.g., via a JWT from an OAuth provider). Privy cannot unilaterally decrypt this to reconstruct the key.

- Share C (Recovery Share): A redundant share, usually encrypted and stored offline or held by a third-party recovery service. It is protected by a user-set strong password or a separate auth factor (like a Passkey). If a device is lost (Share A is lost), Shares B and C can reconstruct the key.

For operations requiring key reconstruction, Privy does not use standard cloud server memory. Instead, it utilizes Trusted Execution Environments (TEEs/Enclaves) like AWS Nitro Enclaves or Intel SGX. This ensures that even during the millisecond where shares combine to sign a transaction, the data is completely isolated from the main OS and memory.

However, facing the user, the strategy is "Web2 Experience First, Web3 Settlement Later." In Privy, "Identity" and "Wallet" are treated as distinct but closely related entities. The core data structure is the "User Object." A user object can link multiple authentication methods (DID). A user might log in via Farcaster on mobile and Email on desktop; Privy resolves these disparate logins into the same user identity, ensuring access to the same embedded wallet. This service is a necessity for most applications.

Business Model

Privy remains a To-B business, or more accurately, To-D (Developer). It bundles underlying infrastructure layers essentially telling developers: "Just use Privy; focus on your business logic, and handle the rest via our simple SDK." Their Client-Side SDK covers React (Web), React Native (Mobile), iOS, Android, Unity, and Flutter. These SDKs handle UI components and local storage logic for Share A, interacting directly with device hardware to ensure sensitive operations happen on the client side.

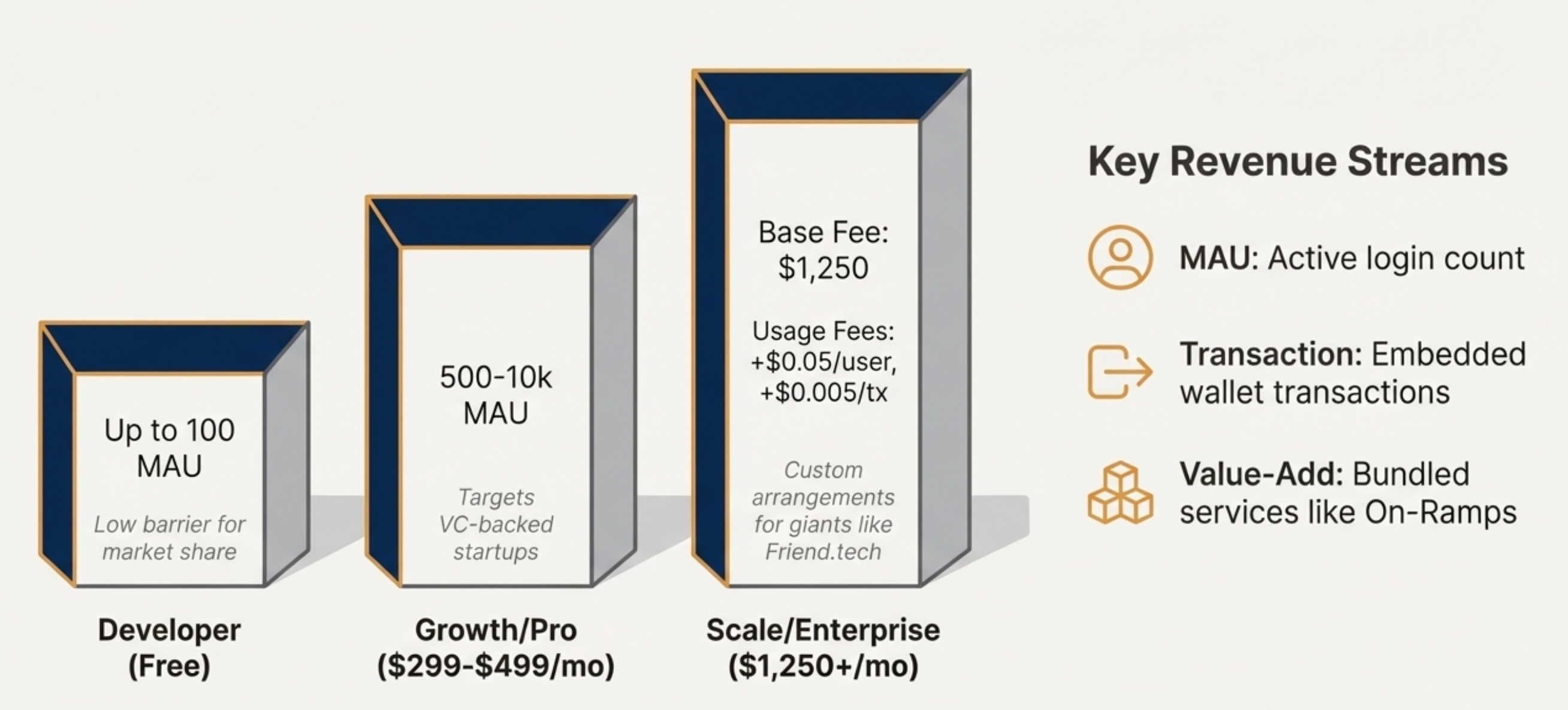

Revenue combines the three models mentioned:

Revenue combines the three models mentioned above:

- Metrics

- MAU: Any active login counts, regardless of transactions.

- Transaction: Any transaction sent by the embedded wallet.

- Developer/Free Tier: Low entry barrier (up to 100k monthly transactions or ~100 MAW free). Crucial for early market share.

- Growth/Pro Tiers: $299 - $499/month, covering ~2,500 to 10,000 MAW. Targets VC-backed startups with PMF.

- Overages:

-

10K users: $0.05 per new user/month.

-

100K transactions: $0.005 per transaction.

-

- Enterprise Tier: Custom pricing for massive apps (e.g., Friend.tech, Blackbird), including volume discounts on MAW but introducing transaction-based fees ($0.001–$0.005) to cover TEE and RPC costs.

Packages Behind Privy

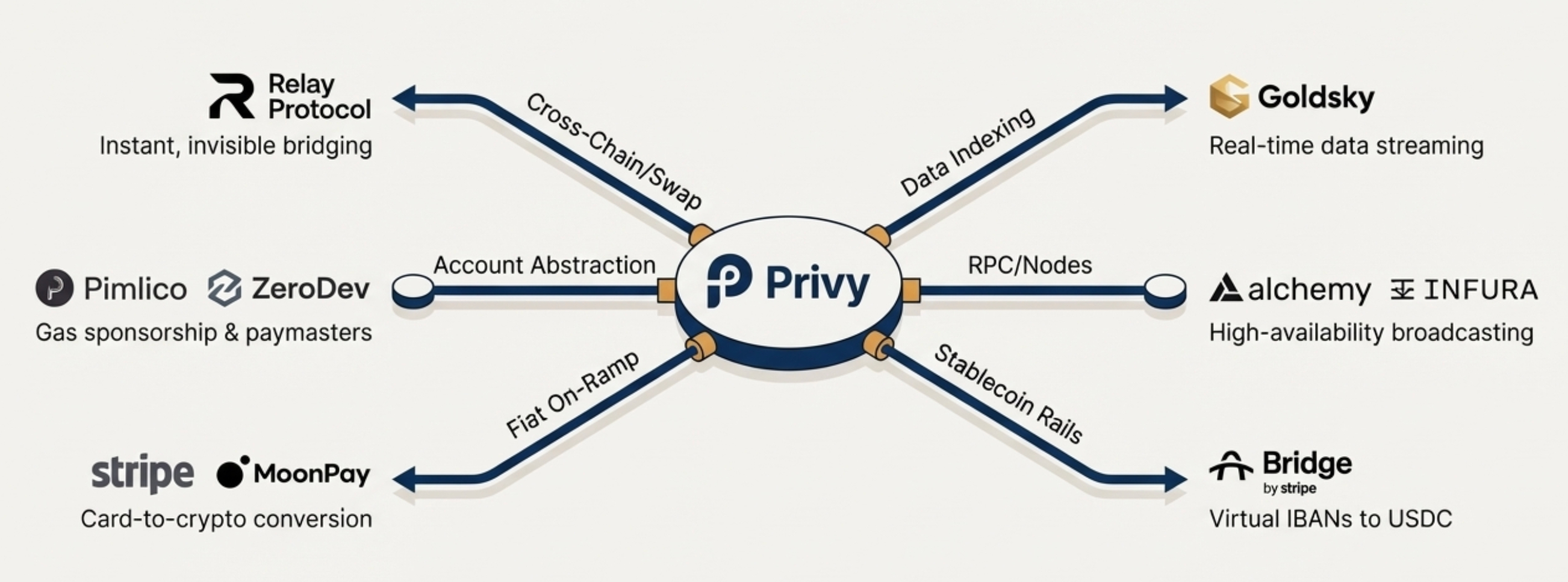

Essentially, Privy acts as a Middleware layer, orchestrating interactions between users, blockchains, data providers, and liquidity protocols. It is a highly effective "Integrator."

| Component | Partner/Provider | Usage |

|---|---|---|

| Cross-Chain/Swap | Relay Protocol (Reservoir) | Instant settlement & liquidity |

| Indexing | Goldsky | Real-time subgraph mirroring |

| Gas Analysis (AA) | Pimlico, ZeroDev | Paymaster infrastructure |

| RPC/Nodes | Alchemy, Infura | Connectivity & Broadcasting |

| On-Ramp | Stripe, MoonPay, Coinbase | Card -> Crypto |

| Stablecoin Rails | Bridge (Stripe) | Issuing, Redemption, Virtual IBANs |

Relay Protocol & Invisible Bridging

One of the biggest friction points in Web3 is "Wallet Funding." Privy solves this via deep integration with Relay Protocol.

- Instant Bridging: Relay uses an Intent-based architecture. "Solvers" detect a cross-chain request and instantly front the funds on the destination chain, settling later. This cuts wait times from 20-30 minutes to seconds.

- Deposit Addresses: Privy uses Relay to generate temporary "Deposit Addresses." Users can send funds from a CEX (like Coinbase) to this address; Relay detects it and automatically bridges/swaps it to the target token on the target chain (e.g., User sends ETH -> App receives USDC on Base). This "Invisible Bridging" is critical for onboarding.

- Atomic Swaps: Supports using USDC on Polygon to pay for an NFT mint on Zora. This is the core of Privy’s "Chain Abstraction."

Account Abstraction (ERC-4337) & Smart Wallets

While standard Privy wallets are EOAs, the platform actively adopts AA standards.

- Bundlers & Paymasters: Integrations with Pimlico and ZeroDev handle the heavy lifting of ERC-4337, enabling Gas Sponsorship and batch transactions. And also support Coinbase smart wallets.

- EIP-7702 Support: Privy is moving to support EIP-7702, allowing standard EOAs to temporarily "upgrade" to smart accounts during a session, combining compatibility with programmability.

Here is the translation of the missing section, polished to match the professional tone of the previous text:

RPC / Nodes

Multi-Source RPC Aggregation: For standard RPC traffic, Privy ensures high availability by aggregating connections from major providers (such as Alchemy and Infura). This redundant design prevents scenarios where downtime from a single node provider renders the entire wallet service unavailable.

Data Indexing and Real-Time State Sync

To read blockchain states (e.g., "Does this user own a specific NFT?" or "What is the balance?"), Privy relies on specialized indexing services.

-

Goldsky Partnership: Research indicates that Privy relies heavily on Goldsky to provide high-performance Subgraphs and real-time data replication. Goldsky's "Mirror" product allows Privy-powered applications to stream on-chain data directly into their backend databases, bypassing the high latency and rate limits of standard RPC calls.

-

Multi-Source RPC Aggregation: For standard RPC traffic, Privy ensures high availability by aggregating connections from major providers (such as Alchemy and Infura). This redundant design prevents scenarios where downtime from a single node provider renders the entire wallet service unavailable.

Fiat Channels: Synergy between Stripe & Bridge

Prior to its acquisition, Privy maintained integrations with third-party on-ramp channels like MoonPay and Coinbase Pay. However, the post-acquisition landscape places Stripe and Bridge at the center of the fiat-to-crypto workflow.

-

Bridge Integration: Bridge (now a Stripe subsidiary) provides a stablecoin orchestration layer. Privy has integrated Bridge's issuance and redemption APIs, allowing developers to issue virtual bank accounts (IBANs) for users. When fiat currency is sent to these accounts, it is automatically converted into USDC and minted into the user's Privy wallet.

-

Stripe Onramp: The native Stripe Onramp is now the preferred method for card-based funding. It leverages Stripe's existing fraud detection (Radar) and authentication (Identity) stacks to provide the highest authorization rates in the industry for crypto purchases, effectively solving the bank decline issues often faced by traditional crypto on-ramp channels.

User stickiness is extremely high; once a product integrates Privy, migration is difficult, because once the developers used it, the migration to other solution is so hard.

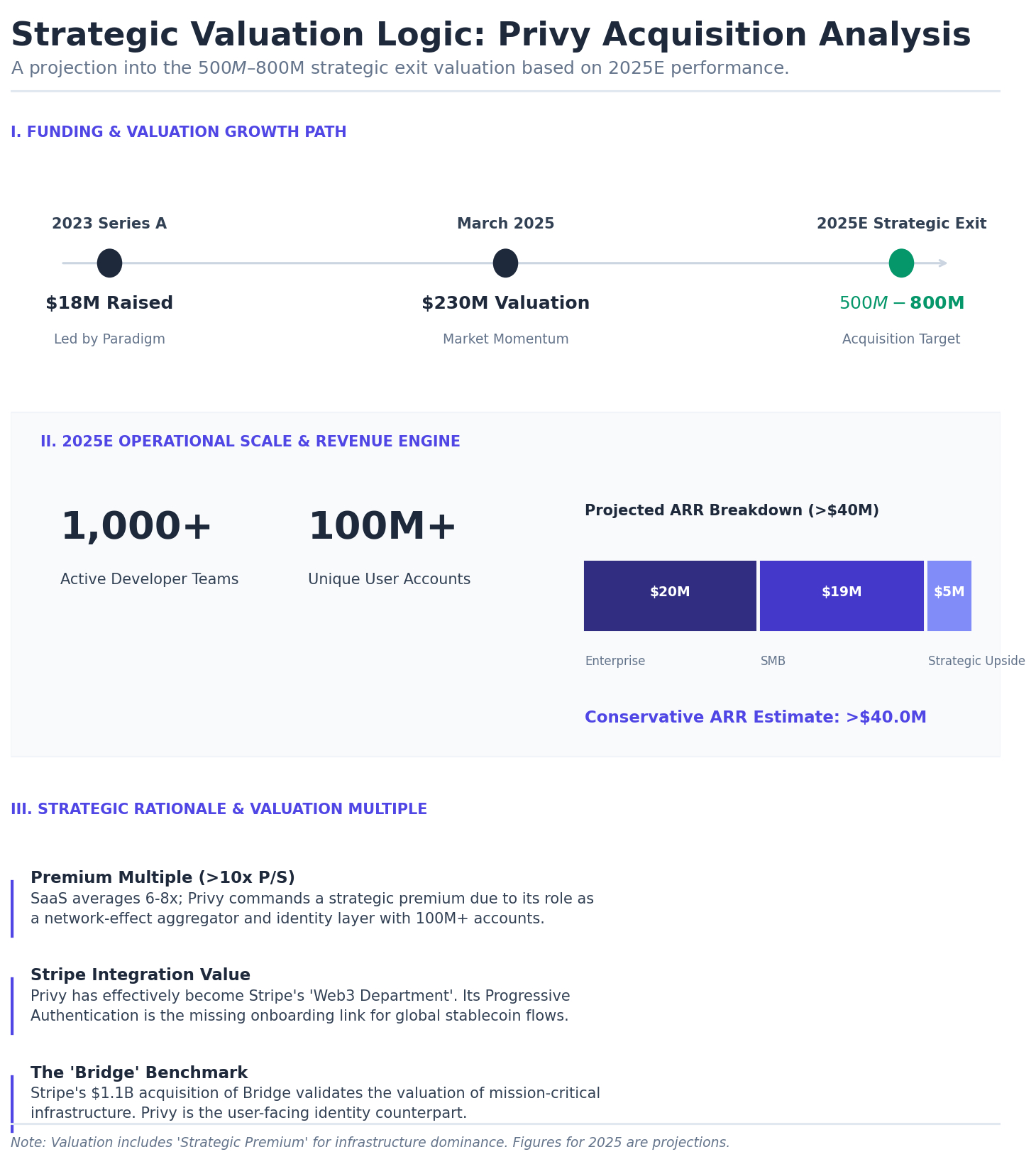

Valuation Metrics

- Valuation & Funding: Raised $18M led by Paradigm in 2023. By March 2025, valuation hit $230M. Considering the strategic value and Stripe’s concurrent $1.1B acquisition of Bridge, the acquisition valuation is estimated between $500M - $800M.

- Scale: By end of 2025, serving 1,000+ teams and 100M+ user accounts.

- Revenue Estimate: Assuming 50 Enterprise clients ($300k-$500k ACV) = ~$20M. 950 SMB clients (~$20k ACV) = ~$19M. Plus Stripe payment splits. Conservative ARR estimate is >$40M.

- Competitiveness: The core isn't just tech, but the "Progressive Authentication" design and Stripe integration. It effectively became Stripe's "Web3 Department."

- Valuation Multiple: Likely >10x P/S.

Weaknesses and Strategic Entry Points

Privy categorizes its chain support capabilities into two tiers based on the depth of integration, with the first tier being the most robust. This tier includes all mainstream Ethereum Virtual Machine (EVM) compatible chains (such as Ethereum Mainnet, Base, Arbitrum, Optimism, Polygon, Zora, Blast, Linea, Scroll, Avalanche C-Chain) as well as Solana.

For these chains, Privy provides full-stack services, including RPC node management, Transaction Simulation, Gas estimation, and deep integration with embedded wallets.

The SDK allows developers to configure a "Default Chain" and a list of "Supported Chains." For example, an application built on Base can force the wallet to connect to the Base network upon initialization, preventing users from accidentally incurring expensive Gas fees on the Ethereum mainnet due to operational errors.

However, the remaining second tier offers only signing support, covering networks like Bitcoin, Sui, Tron, and Aptos. For these networks, Privy does not provide the advanced sendTransaction method (meaning it does not handle RPC broadcasting or Gas estimation). Instead, it offers key derivation and "Raw Signing" interfaces. Developers must use chain-specific libraries (such as TronWeb or BitcoinJS) to construct transaction binary data, pass its hash to Privy for signing, and then broadcast it themselves. Theoretically, for Privy, this supports any blockchain using standard cryptographic curves (secp256k1 or ed25519), ensuring clients are not locked out if they choose niche networks.

Another aspect that is not currently a security breach but could become a potential security incident in the future is Privy's architectural choice regarding key management. Privy does not use TSS technology where the "private key is never reconstructed"; instead, it selected the Shamir Secret Sharing (SSS) route. The critical distinction in the SSS signature mechanism is that the private key is still exposed during the following process:

- When a signature is required, Privy collects the fragments (shards).

- It reconstructs the complete private key within an isolated environment (formerly iframes, now primarily pushing TEE / SGX Secure Enclaves).

- It uses the complete private key to sign the transaction.

- Once signing is complete, the private key is immediately wiped from memory.

The reason a major player like Privy still utilizes SSS is that TSS (especially Multi-Party Computation signing) is computationally complex, slower, and had not undergone extensive real-world testing at the time of their adoption. The SSS algorithm is extremely simple, fast, and mature. Additionally, TEEs compensate for the security shortcomings. Privy's introduction of TEEs is equivalent to placing an "absolute black box" in the cloud; the private key is reconstructed only within this box, and external parties (including Privy employees and hackers) cannot peek inside.

While such an architecture is understandable in the current market context, recent security incidents have revealed that TEEs are not impervious to theft or exploits. Therefore, from a technical security standpoint, it is highly probable that Privy will not serve as the most secure channel for storing significant amounts of user assets.

Based on these two reasons, there are clearly more opportunities remaining in this market.

M&A of Full-Process Infrastructure and Services

Building on the Privy acquisition logic, we can construct a competitive, comprehensive infrastructure provider covering broader upstream and downstream sectors.

In infrastructure, P/E ratios are typically N/A or negative. Despite high SaaS margins (70%+), Customer Acquisition Costs (CAC) are high, and profits are reinvested into R&D. Therefore, we focus on the Price-to-Sales (P/S) Ratio as the core valuation anchor.

Core WaaS Infrastructure: Pick Openfort First

In the mid-market, Web3Auth (formerly Torus) is a pluggable infrastructure acquired by Consensys. Its core Distributed Key Generation (DKG) network makes it more of a key management protocol than a SaaS product, now a core component of MetaMask.

Openfort

Openfort positions itself as "Wallet-as-a-Service" (WaaS) infrastructure, primarily serving Web3 gaming and consumer-grade applications. Its core selling points are a "Headless" wallet architecture and open-source key management, aiming to deliver an ultimate user experience (frictionless interaction). Its core components can essentially perform at least 80% of Privy's functionality, including:

- OpenSigner (Core Technology):

- This is an open-source, non-custodial key management solution.

- Features: Allows developers to self-host, avoiding vendor lock-in.

- Performance: Extremely fast signing speed; officially claimed to be <200ms, outperforming Privy and Dynamic in benchmark tests.

- Embedded Wallets:

- Supports EVM (Ethereum ecosystem) and SVM (Solana ecosystem).

- Generates wallets via social accounts (Google, Email, etc.) or custom authentication systems (like Clerk, Better-Auth), eliminating the need for users to manage seed phrases.

- Smart Accounts:

- Based on ERC-4337 and EIP-7702 standards.

- Functions: Supports Gas Sponsorship, Batch Transactions, and Session Keys (used for in-game operations that require actions without frequent signing).

- Orchestration:

- Handles multi-chain transaction routing, Nonce management, retries, and Gas spike protection to ensure transaction success rates under high concurrency.

- Global Wallet:

- Allows users to use the same wallet identity across different applications (cross-app interoperability), building an ecosystem-level unified login experience.

- SDKs & Tools:

- Provides SDKs for React, Unity, Unreal (via API), Node.js, Swift, React Native, etc.

- Console: Offers detailed user analytics, transaction monitoring, and Webhooks configuration.

In terms of the technical solution, both Openfort and Privy use Shamir's Secret Sharing (SSS) technology to shard private keys and utilize Secure Enclaves to protect the key reconstruction process. However, Openfort was designed for Smart Accounts from day one. Native integration of Bundlers, Paymasters (sponsorship), and Session Keys are all part of its core API, eliminating the need to piece together other service providers. Because it is native AA, it handles Session Keys (temporary authorization without frequent signing) much more smoothly and deeply than Privy, which is critical for blockchain gaming (GameFi).

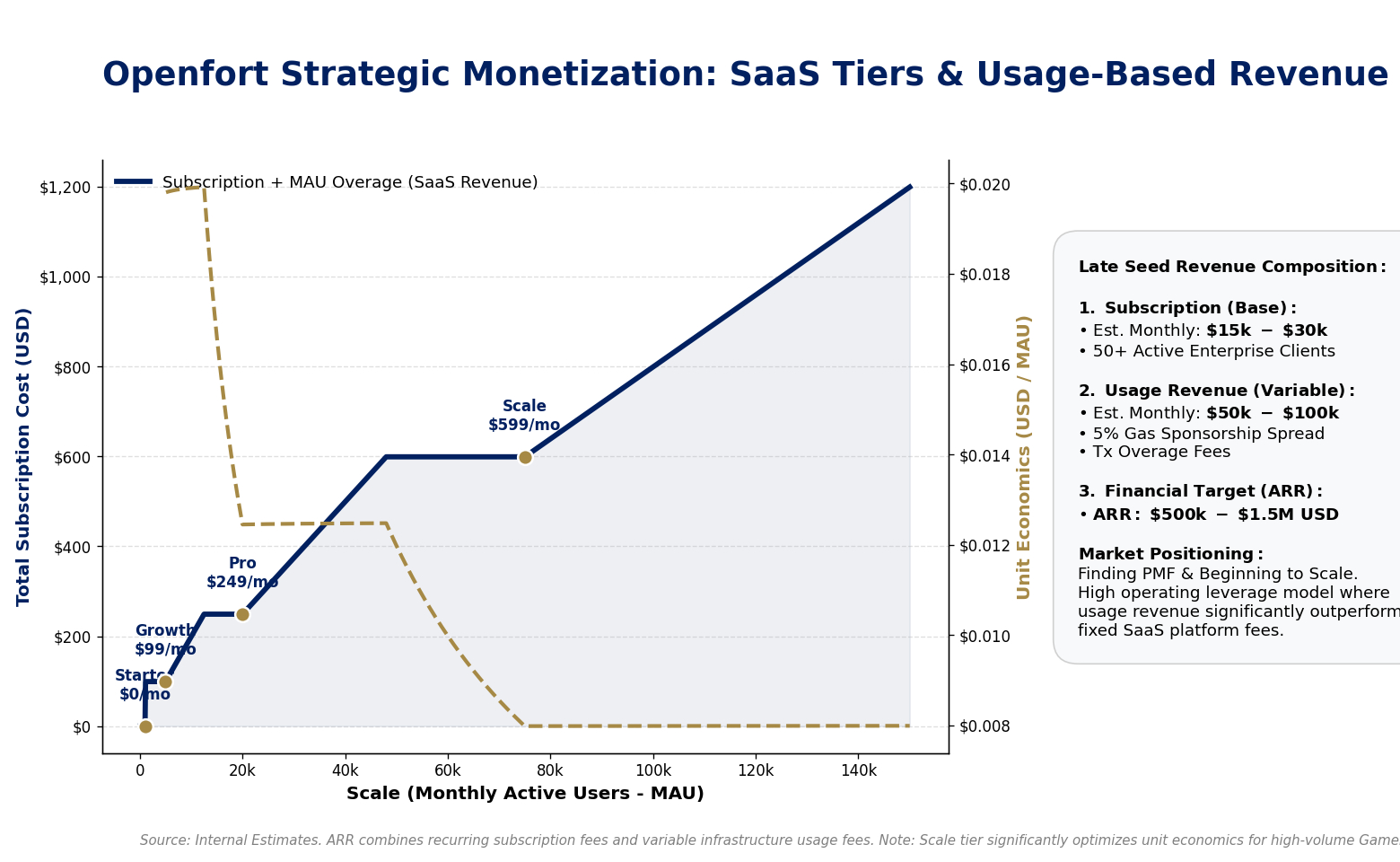

In terms of its Business Model, Openfort also adopts a typical "SaaS Subscription + Usage-based" model. Its pricing strategy is highly transparent, designed to attract developers with a low barrier to entry and generate profit as their applications scale.

Pricing Tiers:

- Starter (Free Version):

- Cost: $0/month.

- Limits: 1,000 MAU (Monthly Active Users), 500 transactions.

- Growth:

- Cost: $99/month.

- Limits: 5,000 MAU, 25,000 transactions.

- Overage Fee: $0.02 / MAU.

- Pro:

- Cost: $249/month.

- Limits: 20,000 MAU, 100,000 transactions.

- Overage Fee: $0.0125 / MAU.

- Includes: Priority support and SLA.

- Scale:

- Cost: $599/month.

- Limits: 75,000 MAU, 350,000 transactions.

- Overage Fee: $0.008 / MAU.

Additional Revenue Sources:

- Gas Sponsorship Fee: If utilizing Openfort's Paymaster for Gas sponsorship, the platform charges a 5% service fee.

- Transaction Overage Fees: Transactions exceeding the plan limits are charged at $1 - $2.5 per 1,000 transactions.

Revenue Estimation:

- Subscription Revenue: Assuming 50+ clients with an average adoption of Pro/Scale tiers ($250-$600/month), monthly revenue is approximately $15k - $30k.

- Usage Revenue (The Bulk): Assuming 2 million monthly transactions (based on a cumulative growth curve hitting 10 million), overage fees and Gas service fees likely generate a monthly flow of $50k - $100k.

Therefore, the ARR (Annual Recurring Revenue) Estimate currently falls within the $500k - $1.5M USD range. As an infrastructure company in the late Seed stage, this revenue scale is consistent with the phase of "Finding Product-Market Fit (PMF) and beginning to scale."

Valuation Analysis:

Based on the $3M Seed Round financing in 2023, the Post-money Valuation at that time can be estimated between $12M - $20M. Considering the business growth throughout 2024-2025 (scaling from early stage to over 10 million transactions), its current internal valuation or secondary market valuation (if any) should see a significant increase.

Particle Network

Particle Network represents a highly successful case of transformation, executing a significant leap from Wallet-as-a-Service (WaaS) to a "Chain Abstraction" Layer-1. From an infrastructure perspective, it now possesses a full stack: the underlying blockchain, infrastructure services, and its own user-facing applications. Its core product line now includes:

- Universal Accounts: Its flagship product. It allows users to interact on any blockchain (EVM and non-EVM like Solana and Bitcoin) using a single account address (and a single balance), eliminating the need for manual cross-chain bridging.

- Universal Liquidity: Automatically aggregates user assets dispersed across different chains. For example, a user can purchase an NFT on Base using USDC held on Polygon, with the underlying layer automatically handling the swap and payment.

- Universal Gas: Users can pay Gas fees with any token (e.g., USDC, USDT). The underlying layer automatically settles via the PARTI token, solving the pain point of users needing to hold multiple native tokens like ETH, SOL, or MATIC.

- Particle Chain: A Layer-1 blockchain built on Avalanche, serving as the Universal Settlement Layer for all cross-chain transactions.

- UniversalX: A Decentralized Exchange (DEX) based on chain abstraction technology. It acts as a benchmark application for their technology, supporting seamless, imperceptible cross-chain trading.

- Wallet-as-a-Service (WaaS): Their original business, providing embedded wallet services. It allows users to generate wallets via Web2 methods like Google, Twitter, or Email, integrated with MPC (Multi-Party Computation) technology for security.

Revenue Model Evolution:

Initially, the model was primarily based on SaaS Subscription Fees (WaaS):

- Charged to developers.

- Free Tier: First 2,000 Monthly Active Users (MAU) are free.

- Paid Model: Beyond the free tier, subscriptions are charged per MAU.

Business Model Innovation: Particle introduced "Universal Accounts," allowing users to interact across multiple chains (EVM, Solana, BTC) with a single address and pay Gas with any token. Consequently, its revenue sources expanded from pure B2B SaaS to include underlying Gas exchange spreads and potential cross-chain protocol fees.

During the MEME craze, the team demonstrated great flexibility by pivoting towards Protocol/Transaction Fees (Token Value Accrual), generating approximately $4 million in fee revenue in the first month of launch. While current volumes are likely far below the levels seen in early 2025, the token $PARTI currently has a Circulating Market Cap of approximately $45 million - $48 million, with a Fully Diluted Valuation (FDV) of around $100 million. From an equity valuation perspective, there should be significant room for a discount.

RPC Node Services: Try Small and Effective Ones

The current Node/RPC sector is exhibiting a distinct trend of "Polarization" and "Vertical Integration":

-

Commoditization & Price War: Basic RPC requests (such as

eth_blockNumber) have become completely commoditized. Decentralized aggregators like dRPC have driven prices down to extremely low levels (e.g., $6 per 1M requests), forcing traditional centralized service providers to pivot. -

Value Chain Ascension: To combat commoditization, giants like Alchemy and QuickNode are expanding into Account Abstraction, Embedded Wallets, and Data Indexing through acquisitions and R&D. Stripe’s acquisition of Privy is a landmark event in this trend, signifying that payment giants are beginning to integrate underlying RPC infrastructure by controlling the wallet entry point.

-

Valuation Arbitrage Window: While Tier 1 giants (like Alchemy) boast valuations as high as $10.2 billion, the Tier 2 and Tier 3 markets contain numerous "Hidden Champions." These companies possess healthy cash flows and deep technical moats but are undervalued. These targets typically focus on Hosting or Validator services as their core business, offering cash flow stability that is superior to the pure SaaS model.

The valuation of such companies may exceed $20 million. This is because companies in the mid-to-tail range are often not cash-strapped; many have been bootstrapped since inception and have never raised external funding. Conversely, companies with excessively low valuations often lack sustainability.

GetBlock

GetBlock is a quintessential "Lean, Tech-Heavy, and Capital-Light" Web3 infrastructure provider. Unlike unicorns like Alchemy or Infura that have raised massive amounts of capital, GetBlock focuses on the high-end market of "Dedicated Nodes." It supports 100+ mainstream blockchains with extremely broad coverage, including many non-EVM heterogeneous chains (such as Solana, Tron, Bitcoin, TON). This is highly valuable for acquirers looking beyond the Ethereum ecosystem. Following Alchemy's acquisition of Bware Labs, GetBlock remains one of the few independent targets in the market with a mature dedicated node technology stack.

In 2025, GetBlock underwent a major product restructuring, shifting from simply "Selling Nodes" to offering more refined "Compute Resource Services."

- RPC Nodes (Core Business):

- Shared Nodes: Their flagship product. The biggest upgrade in 2025 is Archive Data support, allowing users to query historical data without purchasing expensive dedicated nodes.

- Dedicated Nodes: Provides enterprise clients with exclusive server resources, Unlimited RPS (Requests Per Second), and support for custom plugins and advanced configurations.

- AppChain Service (Beta):

- A new business line launched in 2025, designed to help developers deploy Layer 3 / AppChains. Similar to "Rollup-as-a-Service," it provides one-click infrastructure support for GameFi or DeFi projects launching their own chains.

- Block Explorers:

- Provides explorer building services for long-tail public chains or private chains that lack official browsers.

- Web3 Developer Tools:

- Access Tokens Management: Supports multi-project and multi-team collaboration.

- MEV Protection: Private RPC endpoints offering protection against MEV (Maximal Extractable Value) on select networks.

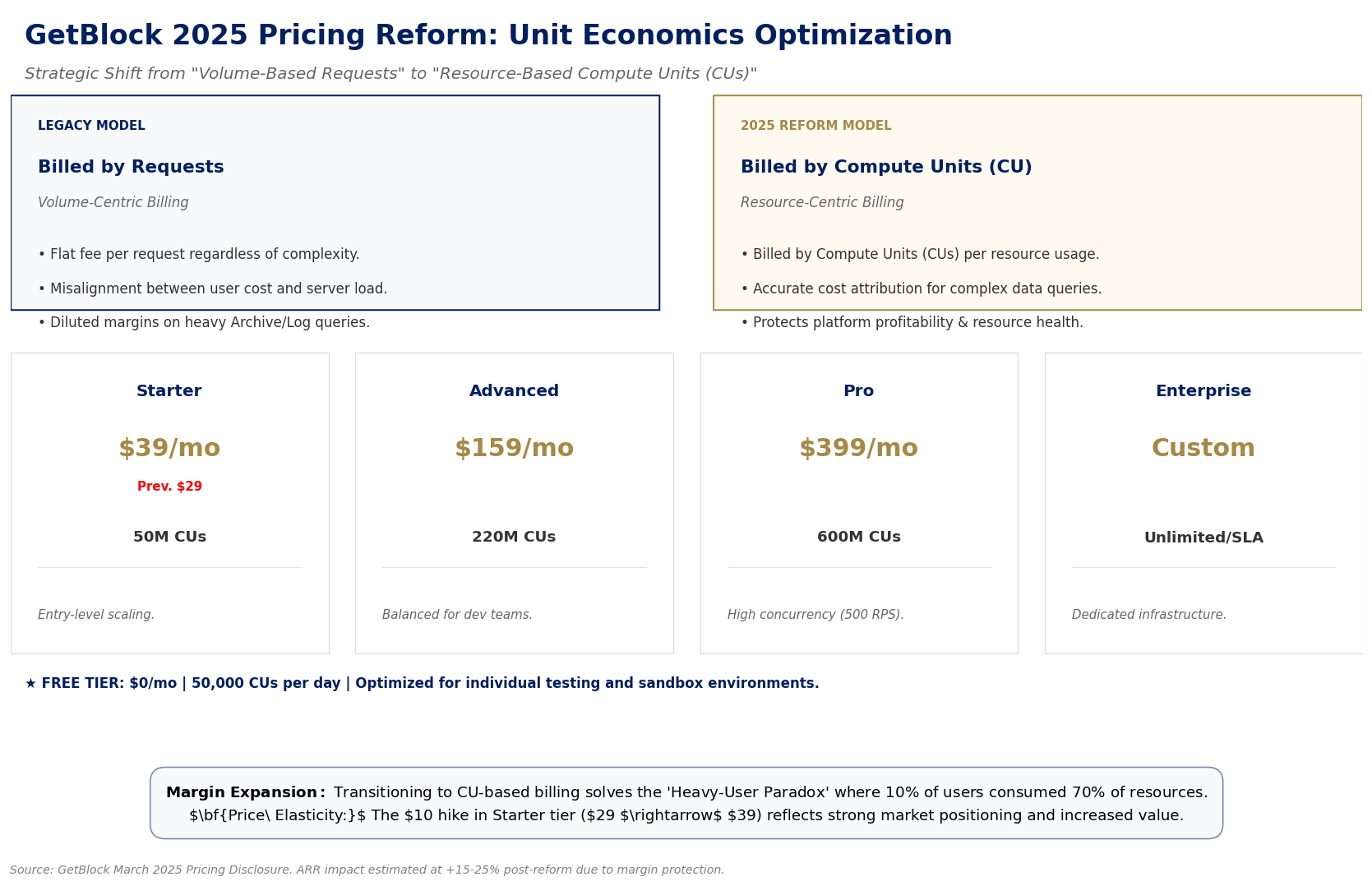

In March 2025, they implemented a significant Pricing Model Reform.

- Billing Unit Transformation:

- Old Model: Billed by Requests.

- New Model (From 2025): Billed by Compute Units (CUs).

- Reasoning: Different requests consume different amounts of resources (e.g., checking a balance is cheap; querying historical logs is expensive). While the new model is more complex for users to calculate, it ensures healthier profit margins for the platform.

- Specific Pricing Tiers:

- Free: $0/month, 50,000 CUs/day, suitable for individual testing.

- Starter: $39/month (previously $29), includes 50 million CUs.

- Advanced: $159/month, includes 220 million CUs.

- Pro: $399/month, includes 600 million CUs, enjoying high concurrency of 500 RPS.

- Enterprise: Custom pricing, typically in the $1,000 - $5,000+/month range.

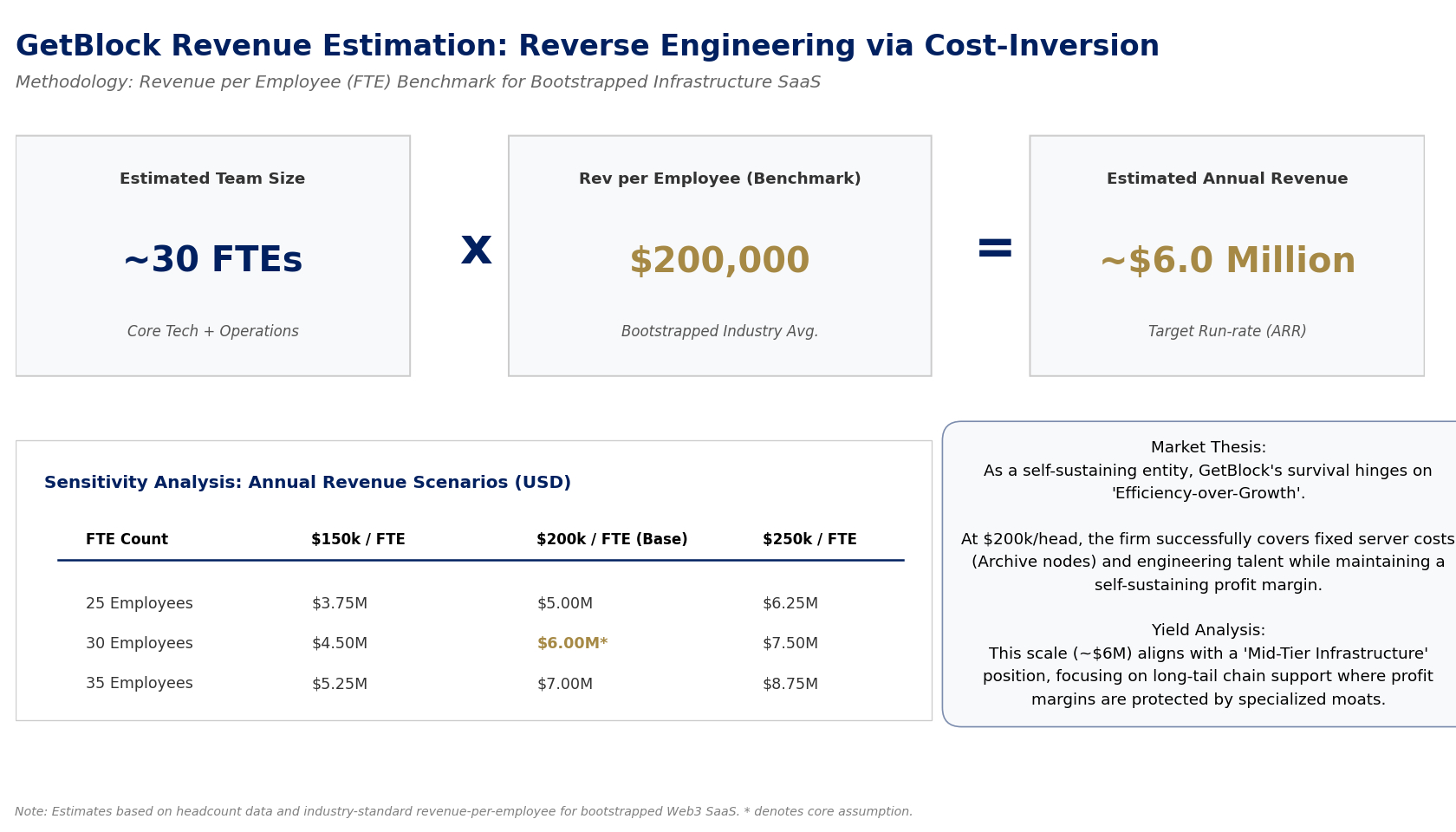

Since GetBlock does not disclose financial reports and is likely Bootstrapped, we must estimate its revenue through "Reverse Engineering" combined with its business data. We use the "Revenue per Employee" cost-inversion method (the most accurate for this context):

- Team Size: Approximately 25-35 people (Core Tech + Operations).

- Industry Standard: For a self-sustaining (Bootstrapped) SaaS company, each employee must generate $150k - $250k in revenue to cover salaries and server costs while maintaining a slim profit.

- Calculation:

30 employees × $200,000 = $6,000,000 ($6 Million).

As a private enterprise that has not been overly financialized, its valuation depends entirely on negotiation. Alchemy once commanded a valuation multiple as high as 100x (in 2022). Although the secondary market has since cooled (according to PM Insights data, its shares trade at a ~60% discount in the secondary market, implying a valuation of ~$3B-$4B and a P/S of ~18x), it still enjoys an "Ecosystem Monopoly" premium. However, mid-to-tail companies are closer to traditional SaaS models where the business is commoditized, meaning valuations cannot reach those heights. We assign GetBlock a conservative P/S multiple of 5x - 6x (due to the lack of top-tier VC backing and the long-tail nature of its business).

Allnodes

In 2025, Allnodes' product line expanded from simple "Node Hosting" to encompass "Stablecoin Yield" and "Enterprise-Grade Hardware Services."

- Node Hosting (Core Business):

- Staking Nodes: Supports mainstream public chains like Ethereum, Solana, and Cardano. Users retain their private keys (non-custodial) and only pay a monthly server fee.

- Masternodes: Supports established PoS/Masternode coins like Dash, Syscoin, and PIVX. This is Allnodes' original business, where it still holds significant market share.

- Full Nodes: Provides RPC access and data query services for developers.

- Liquid Staking & Stablecoin Yield (2025 New Highlight):

- Resolv USR Integration: A strategic product added in 2025. Allnodes integrated the Resolv (USR) stablecoin protocol, allowing users to directly stake USDT/USDC to mint USR and earn yields via delta-neutral strategies. This signals a significant entry into the DeFi yield layer.

- Infrastructure as a Service (IaaS):

- Solana Bare-Metal Servers: A new service launched in July 2025. Addressing the extremely high hardware requirements for Solana validators, this provides Bare-Metal Servers (non-virtualized cloud servers) located in North America and Europe to reduce latency and improve validation success rates.

- Enterprise Solutions: Offers white-label node services and dedicated APIs for institutional clients.

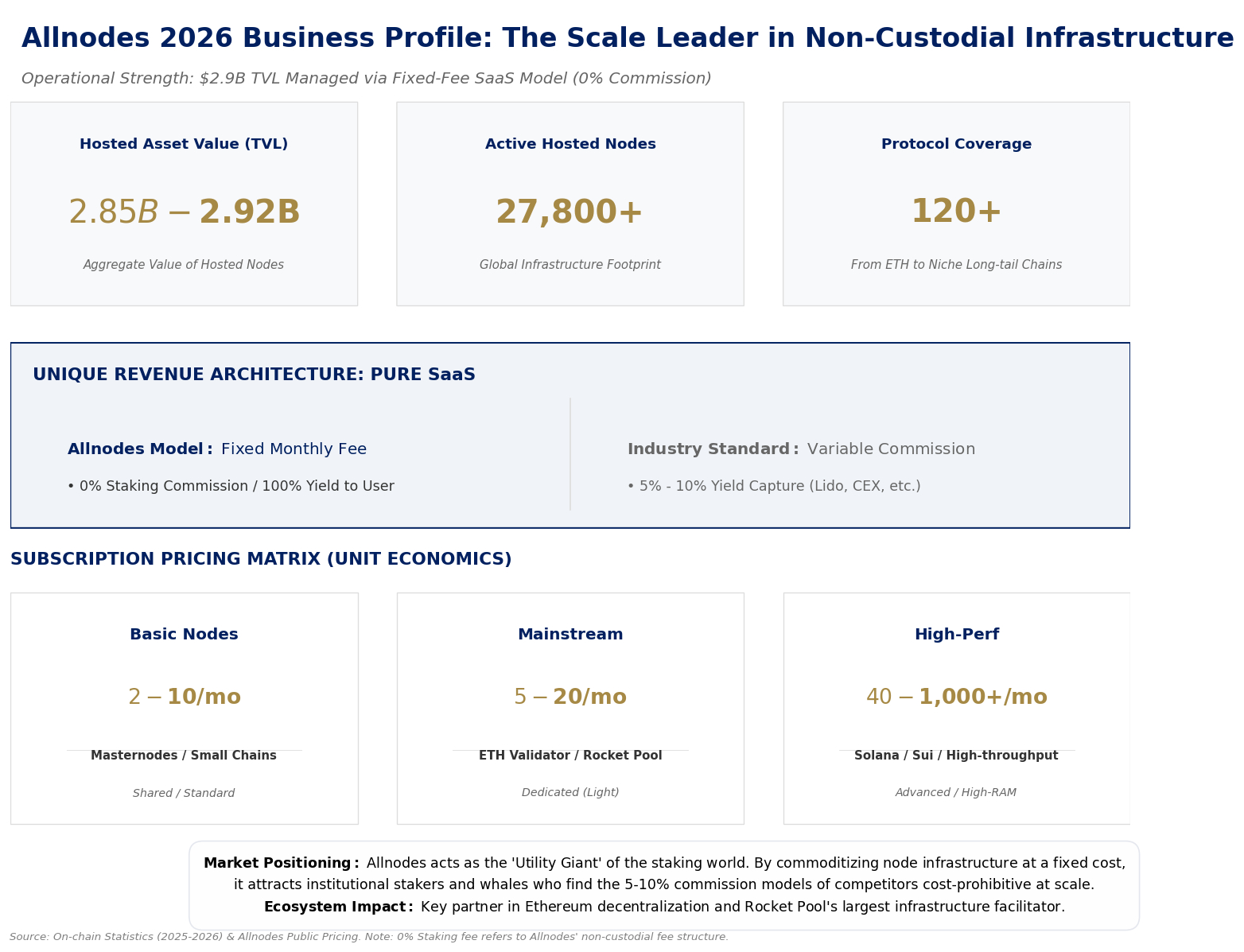

Business Data (Based on On-Chain Statistics):

- Value of Hosted Nodes: Approximately $2.85 Billion - $2.92 Billion.

- Hosted Node Count: 27,800+ active nodes.

- Note: This refers to actual running nodes, not just user accounts. Allnodes is one of the single largest providers of running nodes in the market.

- Supported Protocols: 120+ (Extremely high coverage, including many niche/long-tail chains).

- Network Share:

- Ethereum: Although a non-custodial platform, as an infrastructure provider, it supports thousands of Ethereum validator nodes.

- Rocket Pool: It is a key node operator partner within the Rocket Pool ecosystem.

Revenue Model: Allnodes operates on a pure SaaS subscription model (monthly/yearly fees) and takes almost 0% commission from user staking yields (0% Staking Fee). This differs significantly from Lido or general Staking Pools.

- Basic Nodes (Masternodes/Small Chains): $2 - $10 / month.

- Advanced Nodes (ETH Validator): $5 - $10 / month.

- High-Performance Nodes (Solana/Sui): $40 - $1,000+ / month (depending on hardware configuration).

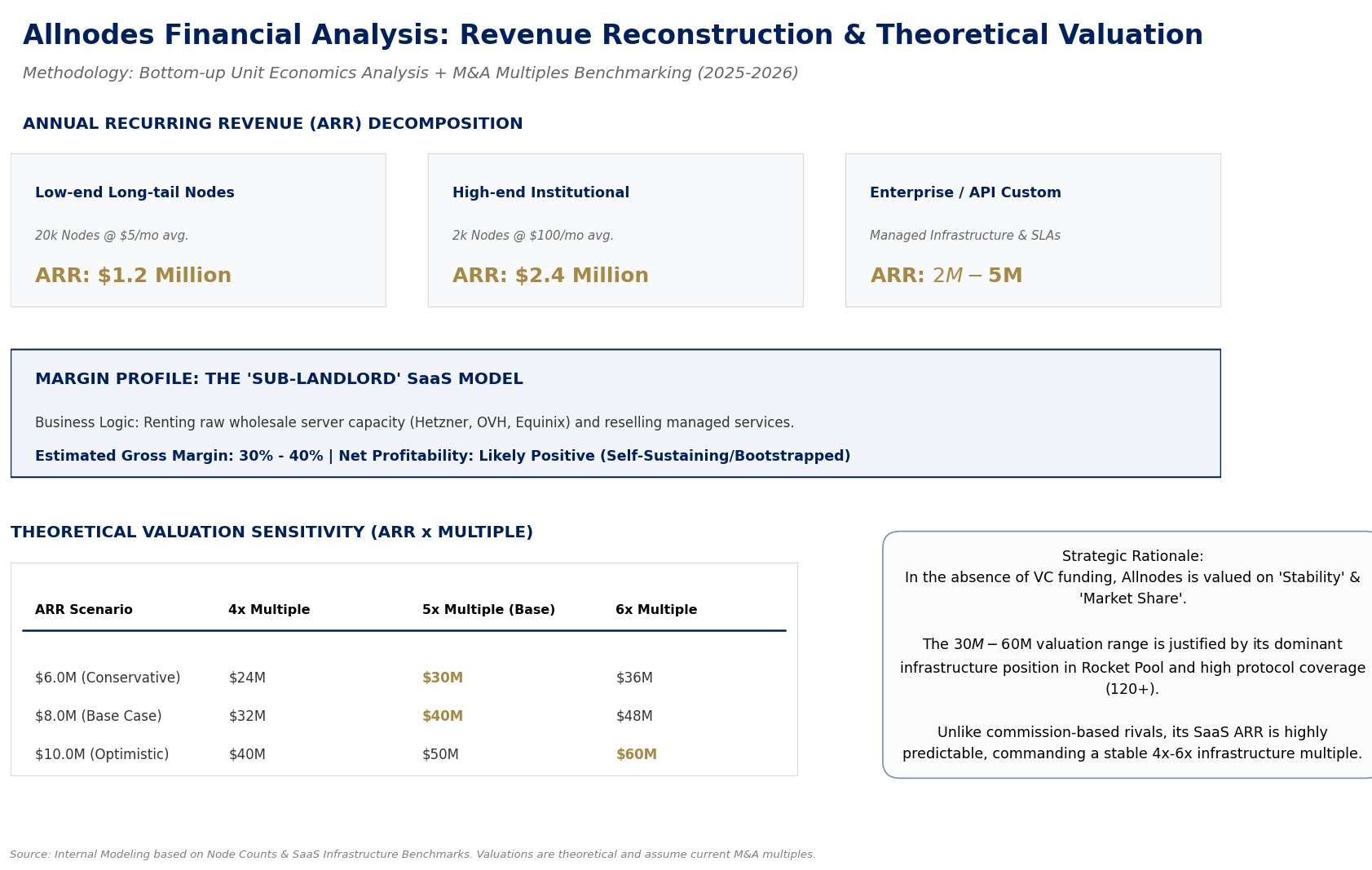

Since Allnodes is a private company and does not disclose financial reports, we must estimate its revenue based on public pricing and node scale.

- Annual Recurring Revenue (ARR) Estimation:

- Low-end Long-tail Nodes: Assuming 20,000 nodes are basic nodes averaging $5/month → $1.2M/year.

- High-end/Institutional Nodes: Assuming 2,000 nodes are high-performance/RPC nodes averaging $100/month → $2.4M/year.

- Enterprise/API Customization: Conservatively estimated at $2M - $5M/year.

- Comprehensive Estimate: Allnodes' annual revenue is likely in the $6 Million - $10 Million range.

- Margin Analysis: Since it operates on a "Sub-landlord" model (renting data center resources from giants like Hetzner/OVH and reselling management services), excluding server costs, its gross margin is likely around 30%-40%.

Lacking VC pricing, we reference M&A multiples for similar SaaS infrastructure (4x - 6x ARR). Theoretical Valuation: In the range of $30 Million - $60 Million.

Strategic Takeaway: From a business perspective, if an acquisition of a node provider cannot be completed, the preferred alternative is to directly integrate their services and then bundle them into a consolidated offering for sale.

Data Indexing: Depending on Our Preference

The indexing technology stack has clearly diverged into three distinct generations:

- Generation 1 (Monolithic Architecture): Represented by early Subgraphs from The Graph. Indexing nodes must run a Full Node concurrently with indexing logic, fetching data block-by-block via RPC requests. This model is sustainable on Ethereum Mainnet (12-second block times) but is functionally unusable on high-speed chains like Solana (400ms block times).

- Generation 2 (Modular Architecture): Represented by Subsquid and Covalent. These solutions decouple "Data Storage" (Archive) from "Data Transformation" (Processor). Raw data is extracted in batches and stored in a Data Lake; developers only query the storage layer without needing to interact with blockchain nodes directly. This architecture drastically reduces indexing costs.

- Generation 3 (Streaming Architecture): Represented by Envio and Goldsky. Utilizing Firehose or similar log-streaming technologies, data is pushed directly via gRPC from the node's mempool or consensus layer. This eliminates polling wait times and is currently the only architecture capable of supporting parallel EVM and high-frequency DeFi transactions.

Business Model Differentiation: The sector is primarily divided by whether the entity has issued a Token.

- Tokenized Protocols (The Graph, SubQuery, Covalent, Subsquid): Their valuation logic is based on "Network Utility" and "Governance Rights." Revenue typically circulates in the form of tokens (burning query fees or payments to nodes). Calculating P/E (Price-to-Earnings) is extremely complex, often resulting in massive premiums or low-valuation traps caused by token inflation.

- Equity-Based Companies (Bitquery, Goldsky, Blockchair, Envio): These follow traditional SaaS valuation logic. Revenue is in Fiat or Stablecoins, and clients are exchanges, government agencies, and VCs.

Strategic Analysis: From a business perspective, a token is not essential. Returning to fundamentals, a healthy SaaS P/S multiple in Web3 infrastructure typically falls between 8x - 15x.

We exclude The Graph (Too large), Goldsky (Too expensive), and Subsquid (Tokenized valuation is too high). Among the remaining mid-to-tail companies, our strategy focuses on:

- Acquiring companies with actual cash flow and stability.

- Selecting "Distressed/Turnaround" companies that are undervalued due to legacy ecosystem positioning but carry high transformation risks.

- Betting on companies pivoting towards data infrastructure for Prediction Markets.

Recommendation: For a stable business with cash flow, Bitquery remains the best choice as it is the target we are most familiar with and can operate immediately.

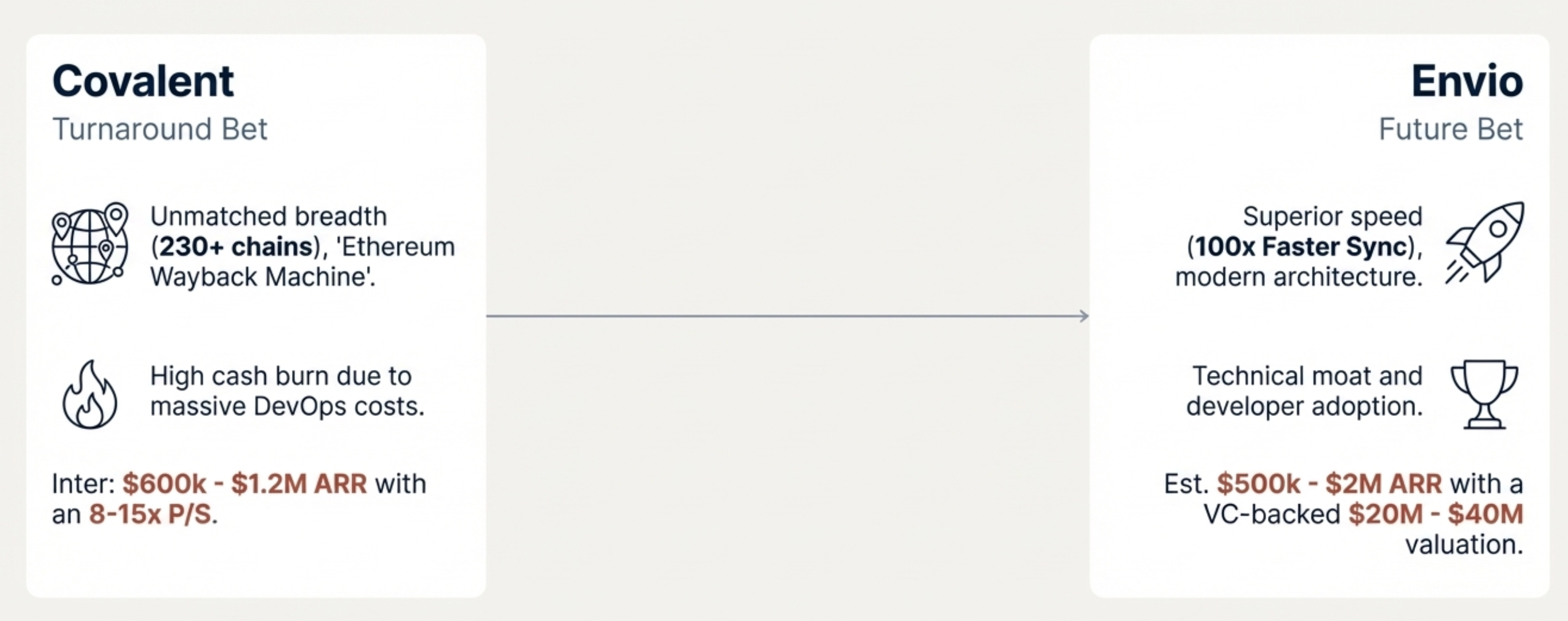

Distressed / Turnaround Target: Covalent

Covalent has repositioned itself as "The Data Layer for AI," with core products revolving around "Long-term Availability" and "AI Readability."

- Ethereum Wayback Machine (EWM):

- Core Pain Point: To scale (EIP-4844), Ethereum nodes now discard historical data (Blobs) older than 18 days. Without a third party, querying old history is impossible.

- Solution: Covalent permanently preserves this data via its decentralized network, ensuring Data Availability (DA) and becoming the "Archive" of Ethereum history.

- GoldRush API (Flagship Product):

- Function: A unified API interface supporting 230+ blockchains.

- AI Enhancement: Launched "Structured Data for AI" in 2025, which cleans complex on-chain raw data (like hex code) into semantic, structured data specifically for direct reading and training by AI Agents and Large Language Models (LLMs).

- Covalent Network (Decentralized Physical Infrastructure):

- Users can run "Block Specimen Producers" nodes to index data and earn rewards.

- Client Side SDKs (GoldRush Kit):

- Provides developers with ready-made frontend components (e.g., wallet transaction history, NFT displays), similar to a Web3 version of Stripe Elements.

The Moat: Covalent's strength lies in the breadth of its coverage and the depth of its data.

- Ecosystem Coverage: Supports 230+ blockchains (Industry-leading, far exceeding The Graph).

- Data Scale: Indexed 100 Billion+ semantic transactions; enriched data for 300 Million+ wallet addresses.

- API Volume: Processed over 17 Billion API requests in 2025.

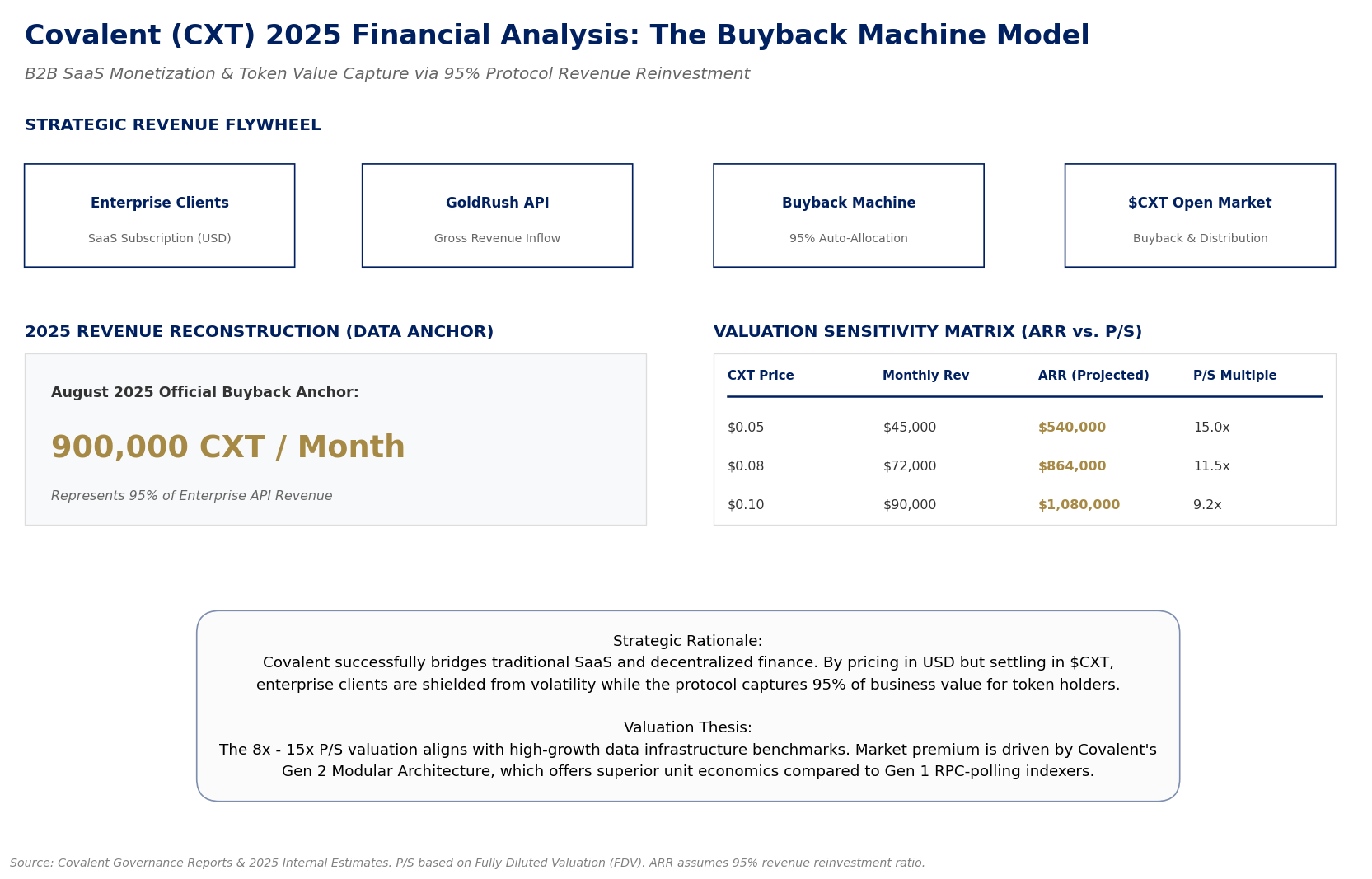

Model & Valuation (Revenue & Buyback) Covalent has adopted a very direct "Fee Switch" model, binding SaaS revenue to token value.

- Business Model:

- B2B SaaS Subscription: Enterprise clients pay USD/Stablecoins for the GoldRush API.

- Buyback Machine: 95% of API revenue is automatically used to purchase $CXT tokens on the open market, which are then burned or distributed as staking rewards.

- Revenue Estimate (2025):

- Official Data Anchor: Covalent disclosed a buyback of approximately 900,000 CXT in August 2025.

- Projection:

- Based on 2025 token prices (assuming a range of $0.05 - $0.10), monthly buybacks are likely around $50k - $100k.

- Anualized Revenue (ARR): Estimated protocol revenue for 2025 is between $600k - $1.2M.

- Valuation: This places the valuation at approximately 8x - 15x P/S.

Potential Risk: Supporting 230 chains sounds impressive, but it implies extremely high DevOps Costs.

- Calculation: Assuming node maintenance costs $500/month per chain (conservative estimate), 200 chains equal a baseline burn of $100k/month.

- Cash Burn: If annual revenue is only ~$1M while server and labor costs far exceed this, the company is Burning Cash. The team may eventually be forced to abandon support for long-tail chains to cut costs.

Future Bet Target: Envio

Envio is positioned as "Modern Blockchain Indexing," solving the slow speed and development complexity of older protocols like The Graph. It is also aggressively expanding into data infrastructure for prediction markets.

- HyperIndex (Flagship Product):

- Definition: A high-performance indexing framework for EVM-compatible chains.

- Core Function: Allows developers to auto-generate indexing code by defining a Schema. Supports Multi-chain Aggregation (querying Ethereum, Arbitrum, Optimism, etc., in a single API).

- Tech Differentiation: Supports logic written in ReScript, TypeScript, JavaScript, and Rust, making it friendlier to Web2 developers than The Graph (which only supports AssemblyScript).

- HyperSync (Core Moat):

- Definition: An ultra-high-speed Data Extraction Layer.

- Principle: It bypasses traditional JSON-RPC requests (the main bottleneck) and instead "streams" data directly from optimized archive nodes.

- Performance: Benchmarks show it is 100x - 1000x faster than standard RPC when syncing large amounts of historical data.

- Status: This is Envio's most potent technology and is even integrated by some competitors.

- HyperRPC (2025 Addition):

- Provides developers with optimized RPC endpoints specifically for high-frequency data reading scenarios, complementing HyperSync.

Market Penetration: Envio is currently in the phase of capturing developer mindshare, with strong technical penetration metrics.

- Coverage: Supports 50+ EVM compatible chains, including Ethereum, Polygon, Arbitrum, Optimism, Base, Linea, Scroll, Blast, Gnosis, and the Fuel (non-EVM) network.

- Partners: Listed as a recommended indexing solution in the official documentation of Arbitrum, Celo, and Rootstock.

- Benchmarks:

- Indexing 100,000 Ethereum blocks takes only 7.9 seconds

- In complex DeFi indexing scenarios (like Uniswap V2 swap analysis), it is 3-5x faster than Subsquid and 60x+ faster than The Graph.

Business Model & Valuation: Envio utilizes a classic Freemium SaaS model and does not rely on tokenomics, making its business model clear and healthy.

| Development | Production Small | Production Medium | Production Large | Dedicated | |

|---|---|---|---|---|---|

| Price | Free | $70 | $300 | $800 | Custom |

| Included Indexing Hours | 750 | 800 | 800 | 800 | Custom |

| Additional Indexing hours | - | $0.1 / hour | $0.2 / hour | $0.5 / hour | Custom |

| Multichain Indexing | ∞ networks | 5 networks | 10 networks | 15 networks | ∞ networks |

| Query Rate Limit | 100 / minute | 250 / minute | 1,000 / minute | 2,000 / minute | 5,000 / minute |

| Approx Storage | 0.1 million | 1 million | 10 million | 100 million | Unlimited |

| Number of Contracts | 100 | 1,000 | 10,000 | 50,000 | Unlimited |

| No Auto-Deletion Over Limits | ✗ | ✓ | ✓ | ✓ | ✓ |

| Reorg Mode | ✗ | ✓ | ✓ | ✓ | ✓ |

| Static Production Endpoint | ✗ | ✓ | ✓ | ✓ | ✓ |

| Backups | ✗ | ✓ | ✓ | ✓ | ✓ |

| Alerting & Monitoring | ✗ | ✓ | ✓ | ✓ | ✓ |

| IP Whitelisting | ✗ | ✓ | ✓ | ✓ | ✓ |

| Long Term Discount | ✗ | ✓ | ✓ | ✓ | ✓ |

| Effects API Cache Management | ✗ | ✗ | ✓ | ✓ | ✓ |

| Private Deployments | ✗ | ✗ | ✗ | ✗ | ✓ |

| Hosted Analytics Portal (Add-on) | ✗ | ✗ | ✗ | ✗ | ✓ |

| Direct Database Access | ✗ | ✗ | ✗ | ✗ | ✓ |

| Infrastructure | Basic | Standard | Standard | Standard | Dedicated |

| Support | Community | Standard | Standard | Standard | Premium |

| Ideal For | Development | Small Projects | Growing Applications | Large Applications | Custom Needs |

Revenue Estimate: As a private company in the Early Stage, the current focus is on User Growth rather than profit maximization. We estimate its ARR is likely in the $500k - $2M range, typical for a Seed/Series A SaaS company.

Valuation: Envio is a key infrastructure bet for Maven 11 Capital. Although specific amounts are undisclosed, referencing similar infrastructure projects at early stages (like Subsquid or Goldsky), and considering its VC backing, we estimate the current valuation to be in the $20 Million - $40 Million range.

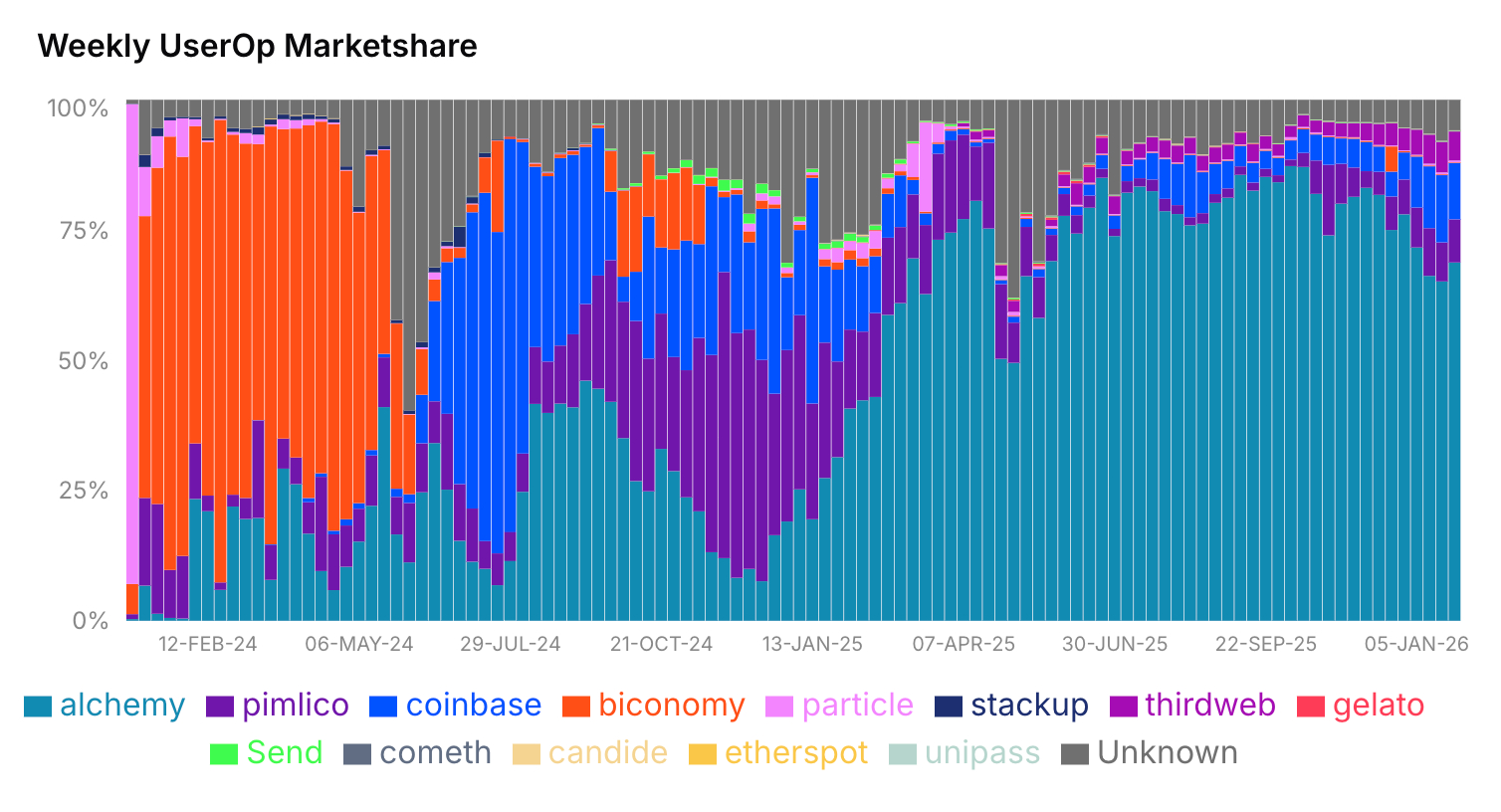

Account Abstraction (AA): Nice to Have, But not Essential

Account Abstraction (AA) is the key puzzle piece in the Ethereum roadmap to achieve "Mass Adoption." Through ERC-4337 and EIP-7702 standards, Smart Contract Wallets (Smart Accounts) are enabled to support advanced features such as Gasless payments, Social Recovery, Batch Transactions, and Session Keys.

The infrastructure is primarily divided into two roles:

- Bundler: Replaces traditional Validators to receive UserOperations (UserOps) and bundles them into transactions on-chain.

- Paymaster: A smart contract that pays Gas fees on behalf of users, typically in exchange for fiat currency or ERC-20 tokens.

The business model for AA infrastructure in 2025 appears particularly difficult, characterized by "thin margins."

- Bundler Economic Model: Theoretically, a Bundler earns the spread between the user's Priority Fee and the actual on-chain Gas cost. However, because Bundlers are Permissionless, market competition is extremely fierce, compressing this spread to near zero. Bundlers are gradually becoming a Public Good or a complimentary feature offered by RPC providers.

https://www.bundlebear.com/erc4337-overview/all

-

Paymaster Economic Model: This is currently the primary source of revenue. Providers typically charge a 5%-15% surcharge on top of the sponsored Gas fees. Additionally, Paymasters serve as important entry points for fiat on-ramps; projects like Stackup earn fees from fund flows by integrating fiat payment channels.

-

Module Stores: Projects like Biconomy are attempting to establish "Module Stores," where developers pay licensing fees to purchase advanced modules (e.g., biometric verification modules).

Strategic Analysis: Therefore, some technical service providers in this sector will face market compression and be forced to pivot or sell. What we are likely to acquire is a set of infrastructure technical solutions rather than a business with active cash flow. If the goal is to acquire a foundational tech stack, there is no need to prioritize targets with existing business operations, as most of that market share has already been captured by giants like Coinbase and Alchemy. Consequently, acquiring a tech stack at a low valuation in this sector is a more realistic strategy. If an acquisition is not feasible, utilizing infrastructure from major providers is a viable alternative, as costs will inevitably decrease over time.

Etherspot

Etherspot functions more like an Open-Source Technology Provider and an Enterprise Customization Service, focusing on the underlying infrastructure of Account Abstraction. It is the developer of Skandha (Bundler) and Arka (Paymaster). Etherspot not only provides WaaS but also offers backend AA support for other wallets (such as Trust Wallet). Its technical barriers are high (MEV-resistant, P2P mempool), but precisely because it focuses on B2B White-Label solutions, its valuation is undervalued due to a lack of consumer-facing brand equity.

Etherspot's technology stack is highly complete and independent (it does not rely on third-party Bundlers):

- Skandha Bundler: A modular Bundler built on TypeScript. It not only supports ERC-4337 but also integrates P2P interfaces and is listed by the Ethereum Foundation as one of the reference implementations. Owning an independent Bundler gives Etherspot significant autonomy over cost control.

- Arka Paymaster: An open-source Paymaster service supporting multi-chain deployment. It allows project owners to customize sponsorship logic (e.g., "Free Gas for NFT Holders").

- TransactionKit: A UI component library designed specifically for React developers, enabling complex batch transaction logic via simple Hooks.

- EIP-7702 Infrastructure: Etherspot received a Grant from the Ethereum Foundation specifically to build Mempool nodes for EIP-7702, positioning it on the technical high ground for the next generation of standards.

Business Model: Etherspot adopts a model combining Developer Subscriptions and Enterprise Customization Fees. Its pricing strategy is aggressive, aiming to capture the long-tail market through low prices while serving top-tier clients with premium pricing.

- Developer Tiers:

- Free: 350k Credits/month (Suitable for testing).

- Developer: $396/year (~$33/month), includes 20 million Credits.

- Startup: $792/year (~$66/month), includes 80 million Credits.

- Scale: $2,400/year (~$200/month), includes 800 million Credits.

- White-Label Services: Provides full-suite custom development and operations for wallet backends for enterprises (e.g., Exchanges, Web2 Apps). This fee structure typically involves a high Project-based Fee plus an annual Retainer.

Financial Context: Etherspot is unique as it originated as the incubated product/technical department of the Pillar Project. Having raised approximately $21 Million (113,000 ETH) in its 2017 ICO, their funding source is likely derived from these accumulated legacy funds.

Market & Media Services: Differentiated Value-Added Parts

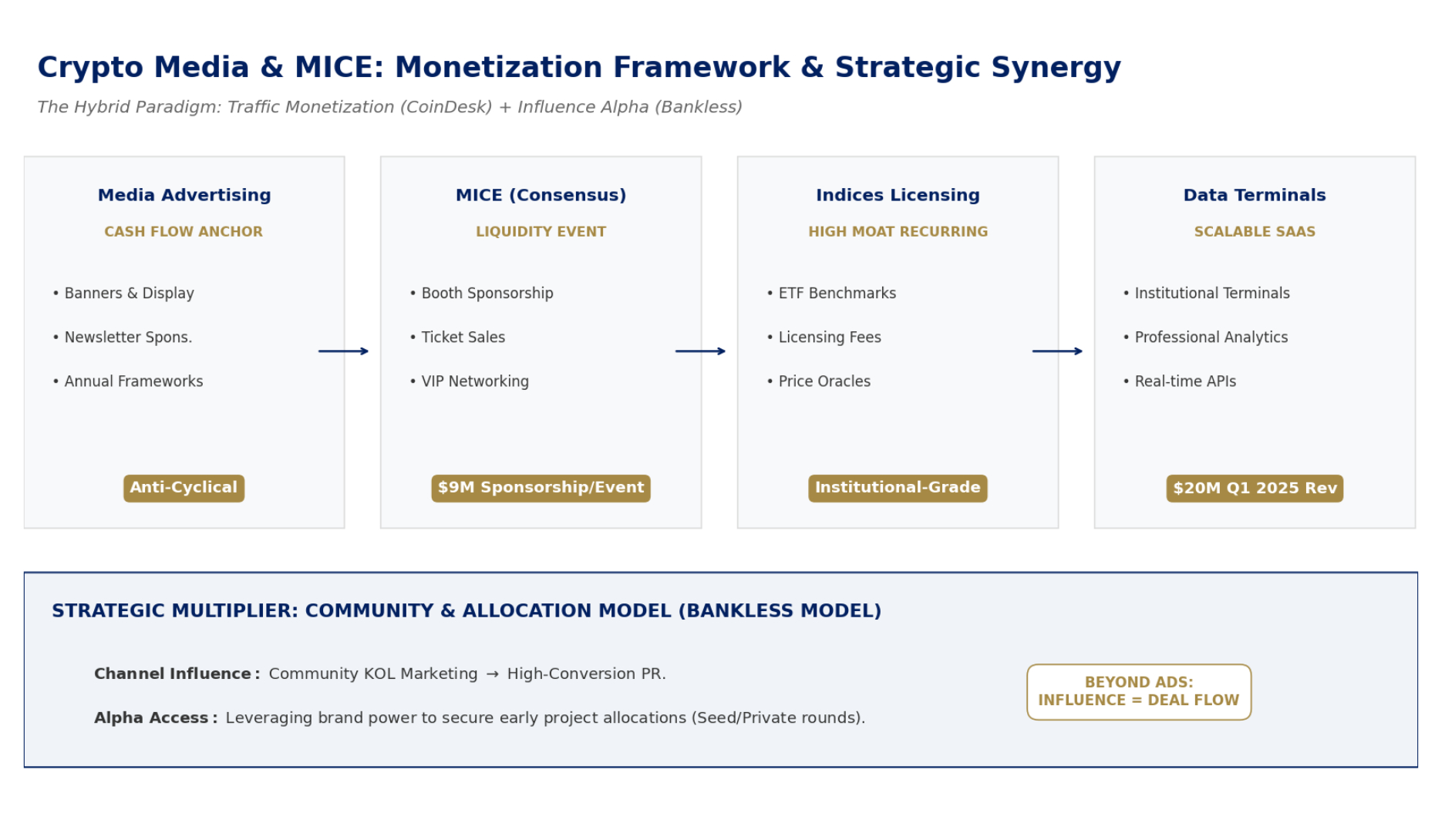

The Crypto Media and MICE (Meetings, Incentives, Conferences, and Exhibitions) sector is a quintessential business model: once brand channels are firmly established, it generates robust cash flow, demonstrates strong anti-cyclical resilience, and offers a clear pathway for monetizing influence.

Crypto media represents a unique promotional channel within Web3. Compared to traditional media, it commands higher pricing and delivers more direct conversion rates. CoinDesk serves as the prime example of successfully integrating exhibitions with media. Its business model encompasses:

- Media Advertising: Traditional Banners, Newsletter sponsorships, and Annual Framework Agreements.

- Consensus Conference: Sponsorship revenue from a single event can reach $9 Million.

- CoinDesk Indices: Charging index licensing fees to ETF issuers (such as Grayscale). This represents high-margin, high-barrier recurring revenue.

- Data Subscriptions: Professional data terminals targeting institutions. Q1 2025 data indicates that revenue from its subscription services reached $20 Million.

Strategic Conclusion: If we layer Community and Key Opinion Leader (KOL) Marketing on top of standard market promotion—leveraging media influence to secure early project allocations (similar to the Bankless model)—these elements can be consolidated into a highly effective, comprehensive service business.