Polymarkt

Compliance Road

- July 2025 — Acquisition of QCX & Closure of Regulatory Investigations

- Acquisition: Polymarket acquired QCX (aka QCEX), a CFTC-licensed derivatives exchange and clearinghouse, for $112M.

- Impact:

- Gained regulatory infrastructure to operate legally in the U.S.

- Access to a licensed exchange for event contracts.

- CEO Shayne Coplan called it a “significant step” toward U.S. access.

- Regulatory Relief:

- DOJ & CFTC concluded investigations without filing charges.

- Focus of probes: whether U.S. users could still access Polymarket despite prior restrictions.

- Positioning:

- Acquisition + investigation closure removed major hurdles.

- Positioned Polymarket as a disruptor to traditional betting markets (esp. sports)

- August 2025 — Trump Jr. as Adviser & Investment from 1789 Capital

- Adviser Appointment:

- Donald Trump Jr. joined as an adviser (Aug 26, 2025).

- Goal: Strengthen political & business networks before U.S. relaunch

- Investment:

- 1789 Capital (venture firm backed by Trump Jr.) invested in Polymarket.

- Amount undisclosed.

- Significance:

- Aligned Polymarket with influential U.S. political and financial figures.

- Boosted credibility in election-related prediction markets.

- Adviser Appointment:

- September 2025 — CFTC No-Action Letter & U.S. Launch Approval

- Regulatory Breakthrough:

- On Sept 3, 2025, CFTC granted a no-action letter (Divisions of Market Oversight & Clearing and Risk).

- Exempted Polymarket from some swap data reporting & recordkeeping requirements.

- Effectively gave green light to operate in the U.S.

- Public Announcement:

- CEO Shayne Coplan on X:

Polymarket has been given the green light to go live in the USA by the @CFTC. - Marked the end of a 3-year hiatus for U.S. users.

- CEO Shayne Coplan on X:

- Strategic Timing:

- Announcement came days after Trump Jr. joined as adviser.

- Signaled a softened regulatory stance toward prediction markets.

- Next Steps:

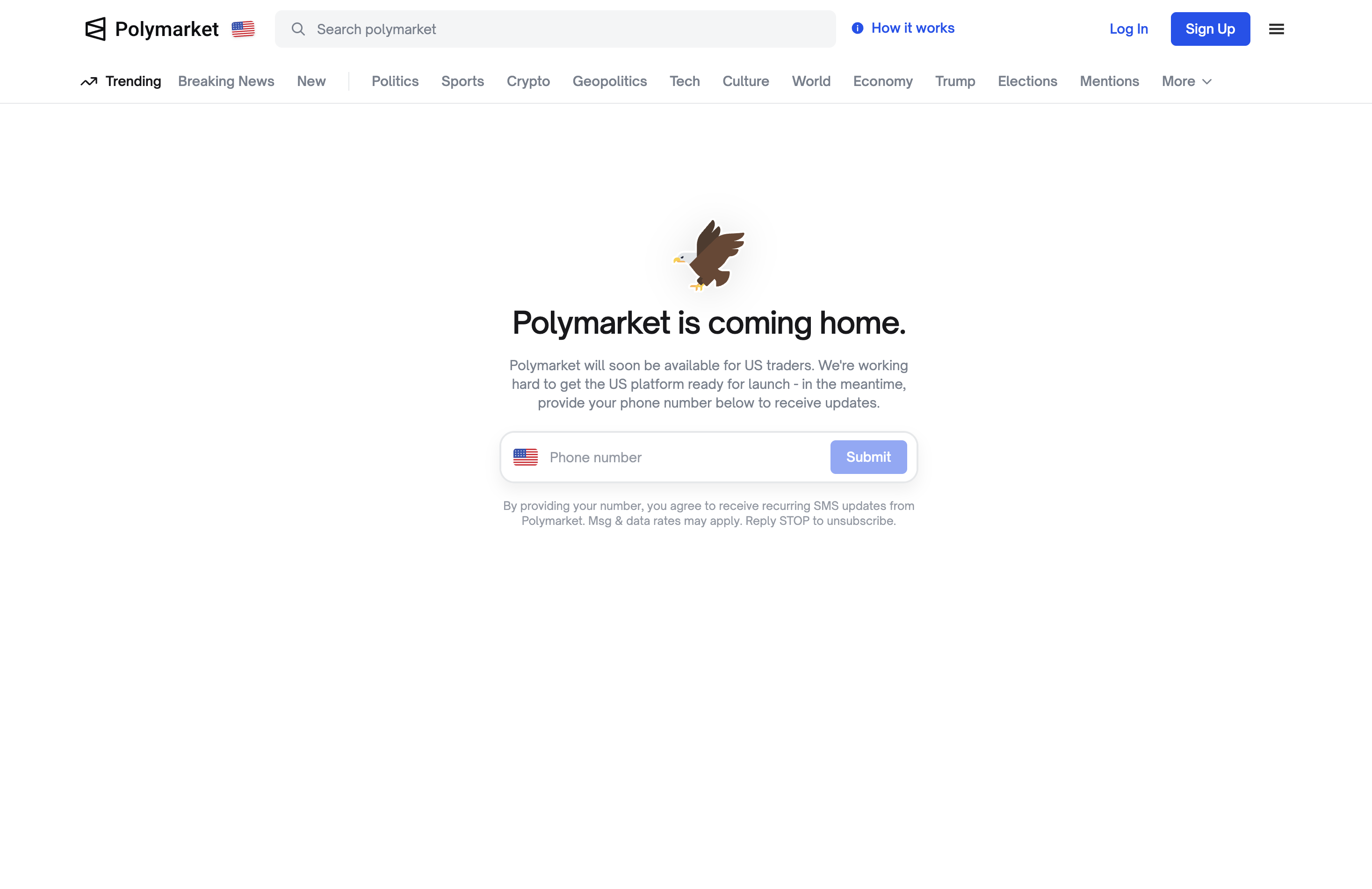

- Opened early-access sign-ups at polymarket.com/usa

- Full rollout expected imminently.

- Regulatory Breakthrough:

Kalshi

User Portal

- Website + App

- Robinhood: Kalshi integrated its prediction markets into Robinhood's app, granting access to over 25 million users for event-based trading. This move boosted adoption, with sports markets seeing rapid growth. Additionally, Kalshi introduced responsible gambling tools, including deposit limits and self-exclusion options, to address regulatory concerns.

- Webull

Backers - Kalshi raised $185 million in a Series B round led by Paradigm, with participation from Sequoia Capital, Multicoin Capital, and others. The funding valued the company at $2 billion, aimed at expanding its tech team and brokerage integrations. CEO Tarek Mansour highlighted plans for new market verticals, including iGaming and institutional data sales.

Differentiation

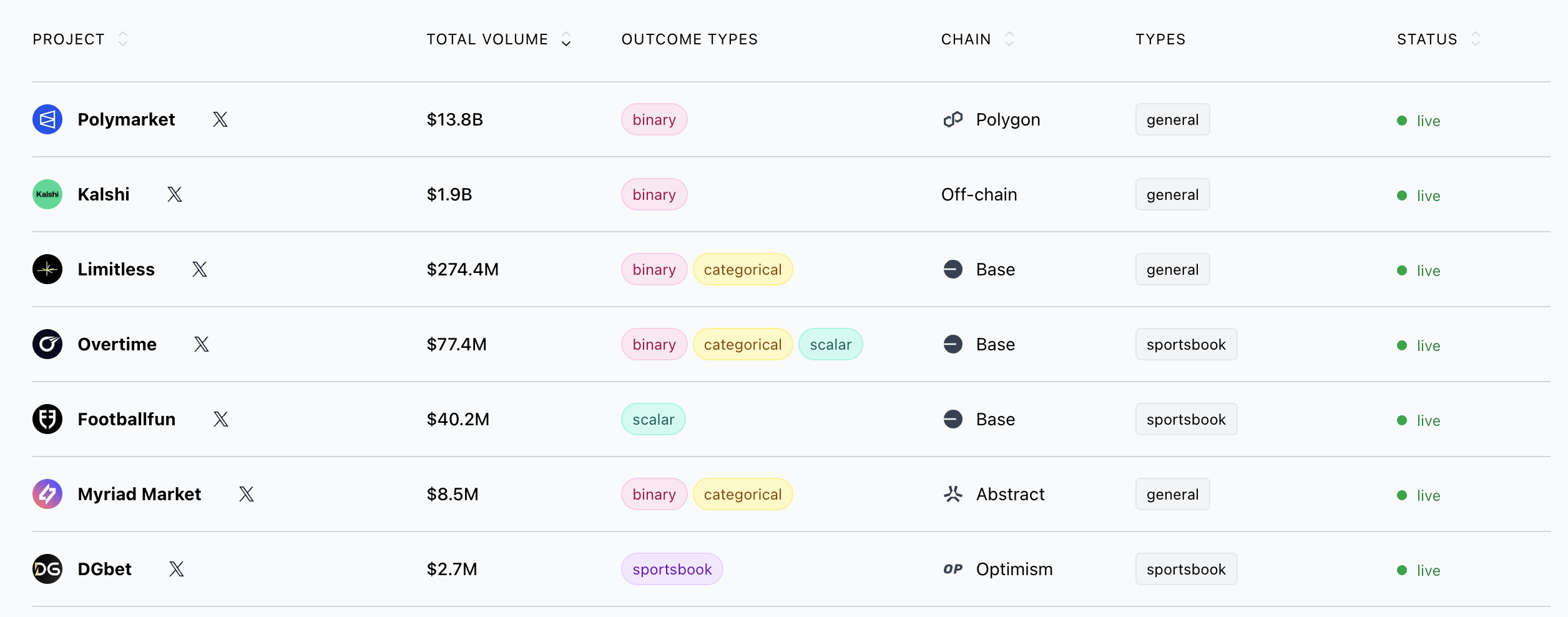

| Aspect | Kalshi | Polymarket |

|---|---|---|

| Regulatory Status | Fully CFTC-regulated designated contract market since 2020; won key court battles in 2024-2025 for political and sports markets. Faces state-level gambling disputes but operates nationwide. | Settled with CFTC in 2022 ($1.4M fine); investigations closed in July 2025 without charges. Acquired QCX for compliance; received no-action letter in September 2025 for U.S. relaunch. Blocked in some countries like France and Poland. |

| Technology and Platform | Traditional fintech infrastructure; centralized exchange with cash-collateralized trades and segregated funds. Integrates with brokerages; exploring AI for predictions. | Decentralized on Polygon blockchain; uses USDC and smart contracts for transparency and composability in DeFi. No fees on trades, enabling high liquidity. |

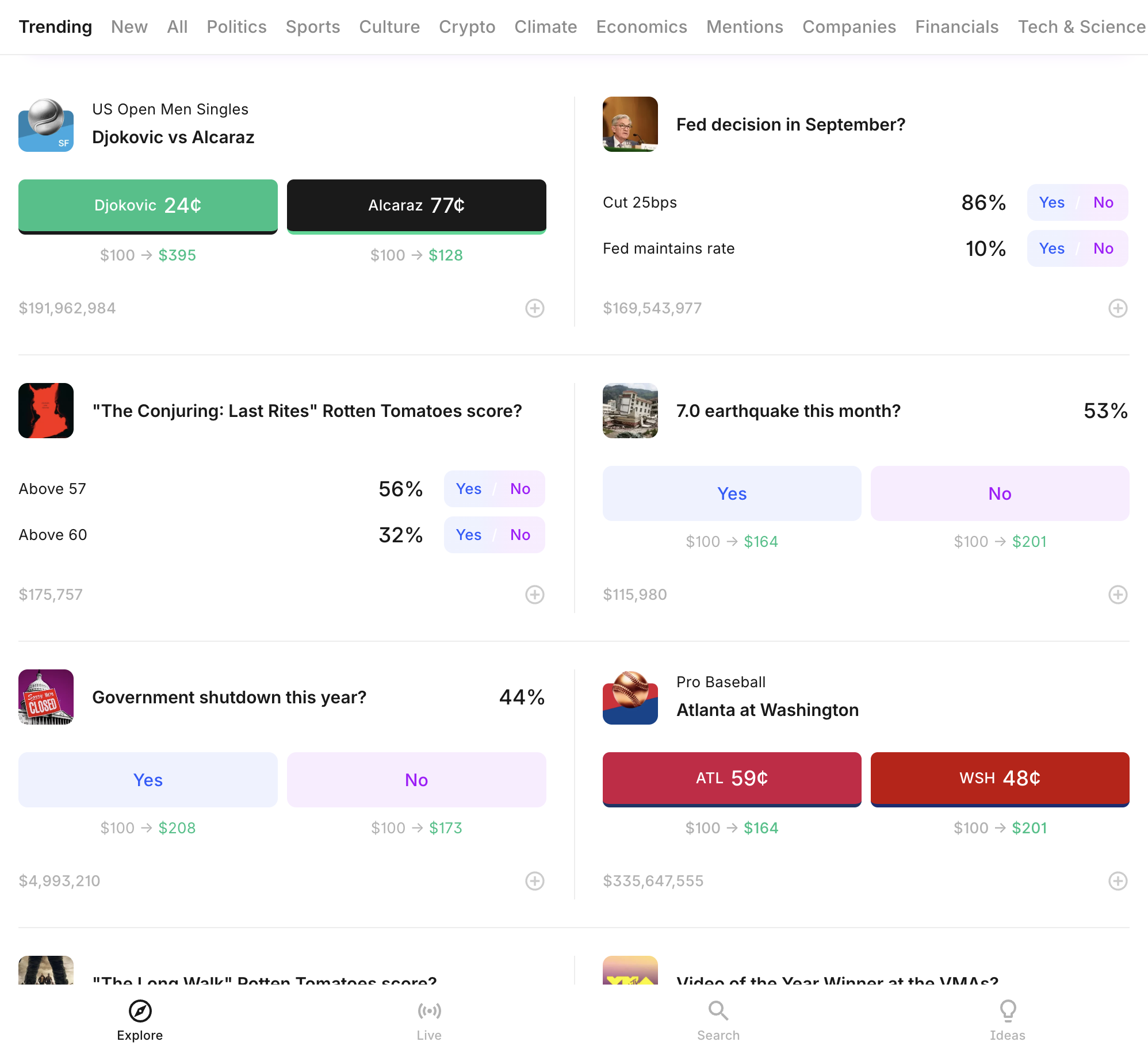

| Markets Offered | Focuses on finance/economics (e.g., inflation, rate cuts), politics, sports, weather, entertainment, and tech IPOs. Longer-dated options; expanding to parlays and iGaming. | Broader, reactive topics including crypto, politics, sports, current events, and pop culture. Shorter-term bets; high volume in elections and breaking news. |

| User Access and Restrictions | Available in all 50 U.S. states; open to retail and institutional users via fiat or stablecoins. No geo-blocks in U.S. | Relaunched in U.S. in September 2025; global access but restricted in certain jurisdictions. Crypto-native, appealing to DeFi users. |

| Trading Mechanisms and Currency | Maker-taker fees (0.07%-7%); rebates up to 1%; interest on idle funds (4.05% APY). Fiat and stablecoin deposits; yes/no contracts with $1 payout. | No trading fees; USDC on Polygon; shares traded based on probabilities, resolved via oracles. |

| Funding and Valuation | Total funding: ~$291M; $185M Series B in 2025 at $2B valuation. Investors: Paradigm, Sequoia, Multicoin. | Total funding: ~$300M; $135M Series D in 2025 at $1B+ valuation. Investors: Founders Fund, General Catalyst, Vitalik Buterin. |

| Trading Volume and Liquidity | ~$1B monthly in 2025; 100x growth YoY, driven by sports (79% of volume). 1500+ markets; focuses on depth in regulated categories. | $8B in 2025 bets; $1B in July alone. 30,000+ active traders; excels in high-liquidity events like elections. |

| Accuracy and Reliability | Relies on crowd wisdom; accurate for economic indicators but faces ambiguity in resolutions. No specific rate cited, but praised for hedging utility. | 94% accuracy; often outperforms polls, e.g., in elections. Oracle-based resolutions; occasional disputes. |

| Key Partnerships and Hires | Partnerships: Robinhood, Webull; Adviser: Donald Trump Jr. | Partnerships: X (Elon Musk); Adviser: Donald Trump Jr.; Investor: 1789 Capital. |

| Pros | Strong regulatory compliance; fiat accessibility; interest on funds; institutional appeal. | No fees; global liquidity; DeFi integration; fast resolutions for breaking news. |

| Cons | Fees reduce net gains; limited to regulated markets; state gambling challenges. | Crypto volatility; past U.S. ban; oracle risks. |

Product Design

- The UI design is almost same

- The layout for the same width is just like copy and paste

- Offchain Clearing

- For the past three years, MIAXdx has been the clearinghouse for contracts traded on KalshiEX LLC (“Kalshi”). Following regulatory approval from the Commodity Futures Trading Commission (“Commission”), Kalshi has begun clearing its contracts through Kalshi Klear LLC (“Kalshi Klear”), an affiliate of Kalshi.

- 4.00% APY interest on holdings, so money grows while you trade. Interest rates are subject to change at any time and are only paid to people with balances of $250 or more.

- Trading Hours

- Thursday: 22 hours (closed for maintenance 3:00–5:00 AM ET)

- Business Model: Charge fees on Debit Deposit and Withdrawal, and Trading

Limitless

- Limitless Exchange is a decentralized prediction market platform built on Base

- Focus: Token + Stocks Price Prediction

- Hourly, Daily, Weekly

- Besides that, only cover Economy, Company News

- Points Program

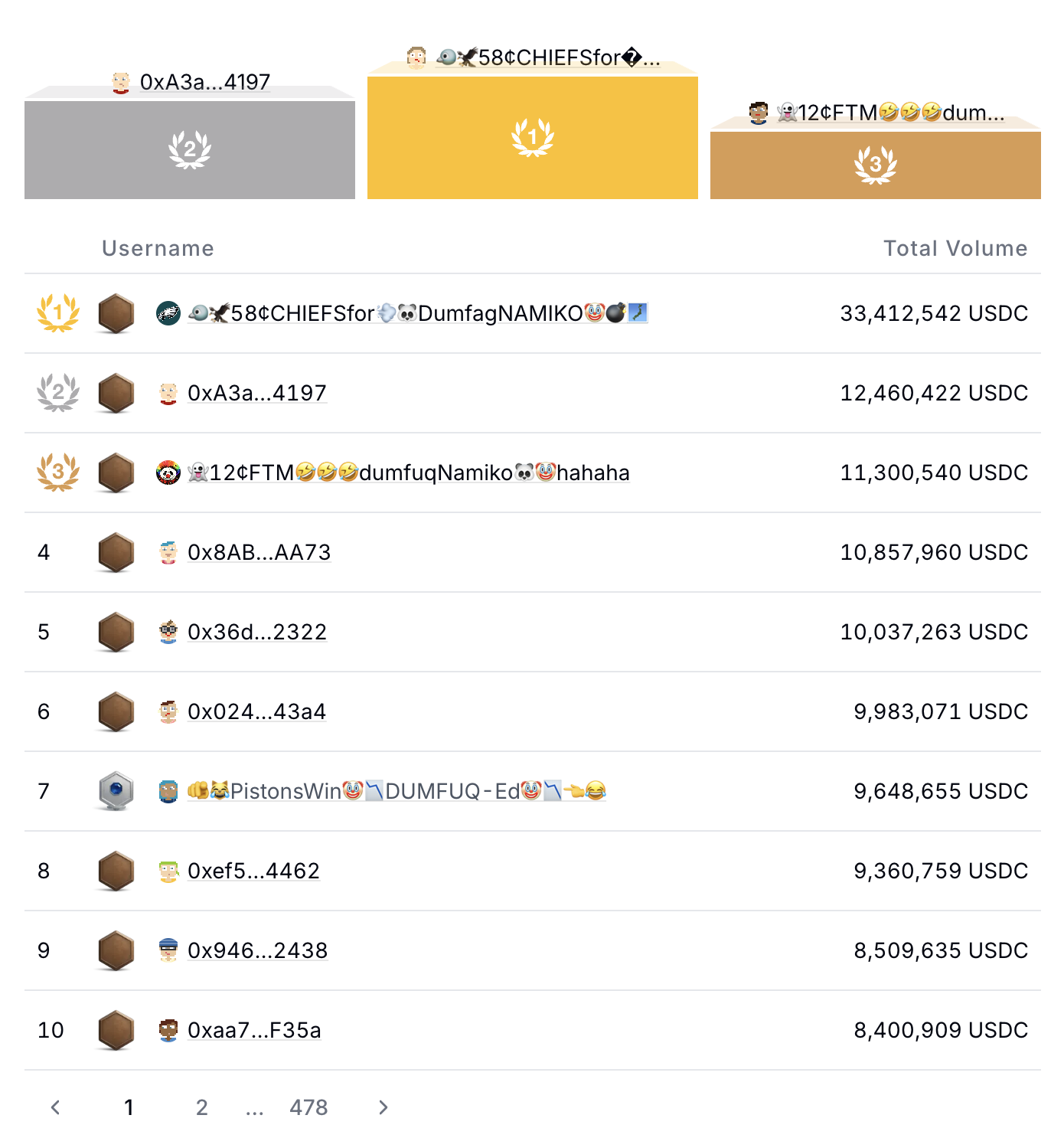

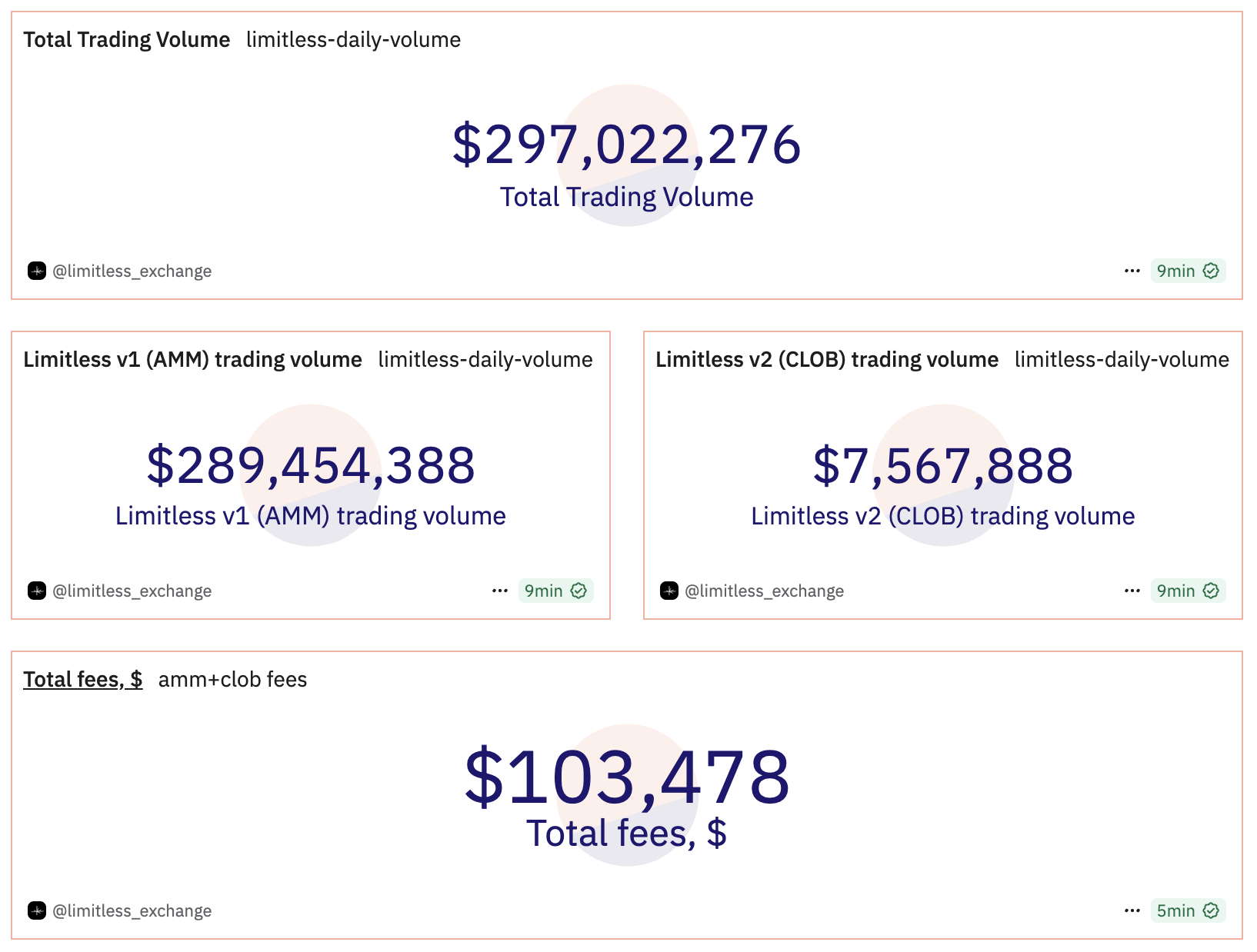

- Total trading volume: 297M

- 4776 People

- Mechanism

- Gnosis Conditional Tokens

- Pyth Oracle

- Stats

- Backers

| Round | Amount | Valuation | Date | Investors |

|---|---|---|---|---|

| Strategic | $ 4 M | -- | Jul 01 | Coinbase Ventures, 1confirmation, Maelstrom Capital, Collider Ventures, Paper Ventures, Public Works, Punk DAO, Node Capital, WAGMi Ventures |

| Seed | $ 3 M | -- | Sep 17, 2024 | 1confirmation*, Paper Ventures, Public Works, Collider Ventures |

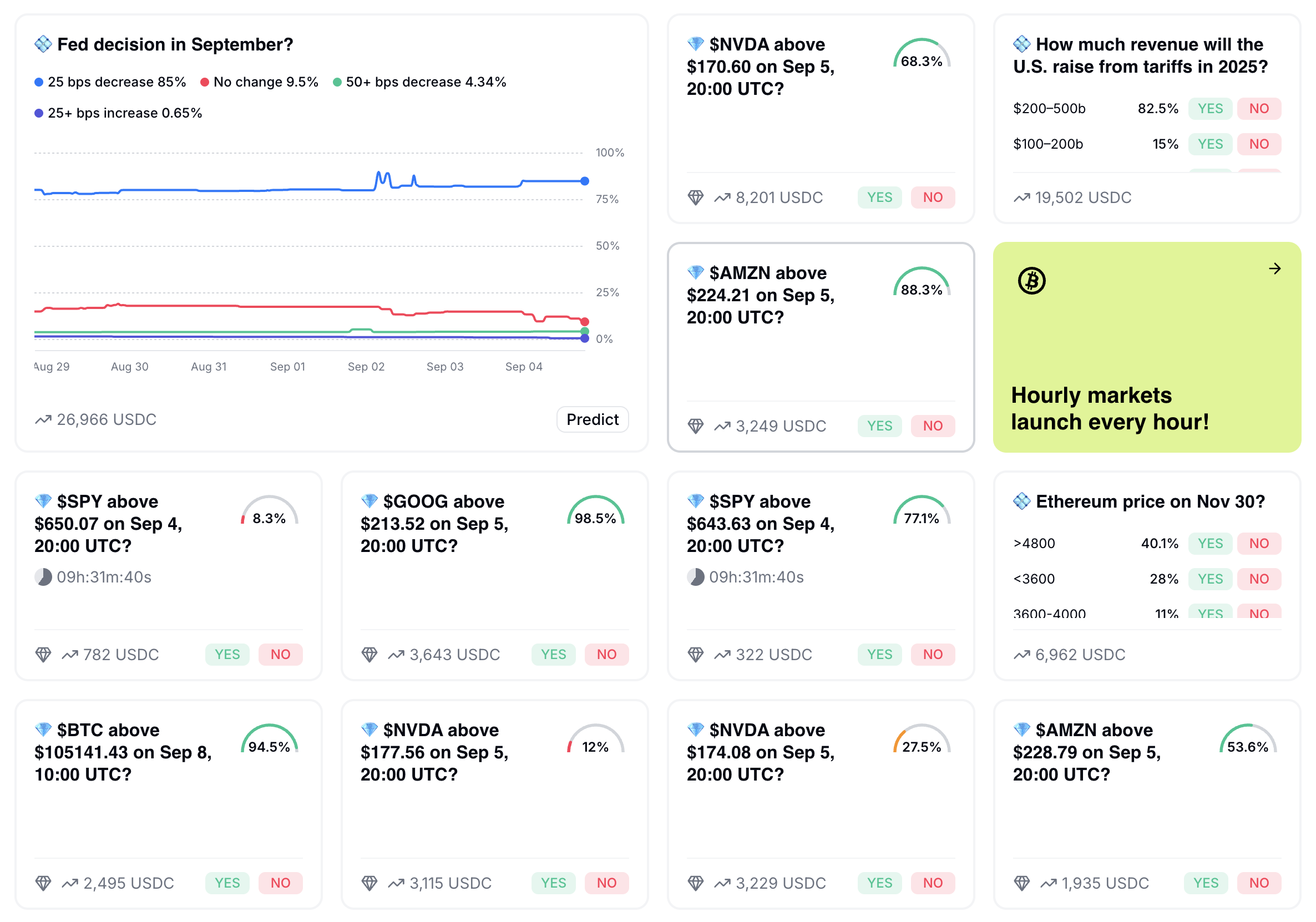

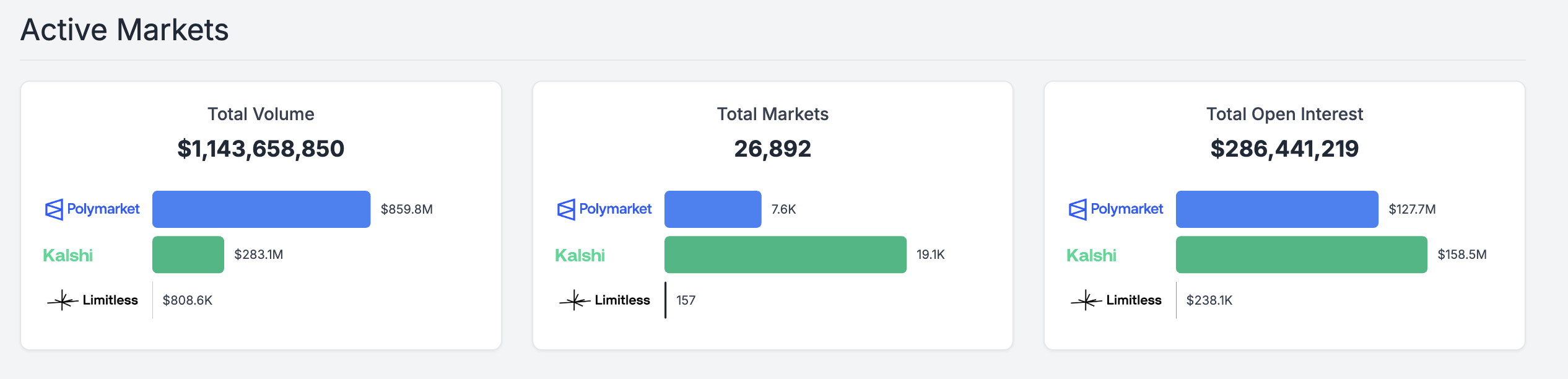

- Comparison across Polymarket, Kalshi, Limitless

- Polymarket: Dominates volume (75%), but lags in market count and open interest. This points to a strategy of concentrating on high-profile, liquid events, appealing to crypto users and yielding higher average trade sizes (≈$113K per market vs. Kalshi's ≈$15K).

- Kalshi: Leads in markets (71%) and open interest (55%), suggesting a broader, more diversified ecosystem. Its regulated status allows for U.S.-centric features like fiat integration and sports betting, fostering steady engagement despite lower volume.

- Limitless: A distant third across all metrics, representing <1% of the totals. As a decentralized, social prediction protocol on Base, it's designed for easy market creation and community sharing, but these stats indicate it's still building traction. Its focus on nonstop hourly/daily crypto and stock markets could position it for growth in niche areas, but current data shows it's not yet competitive with the leaders

Sports

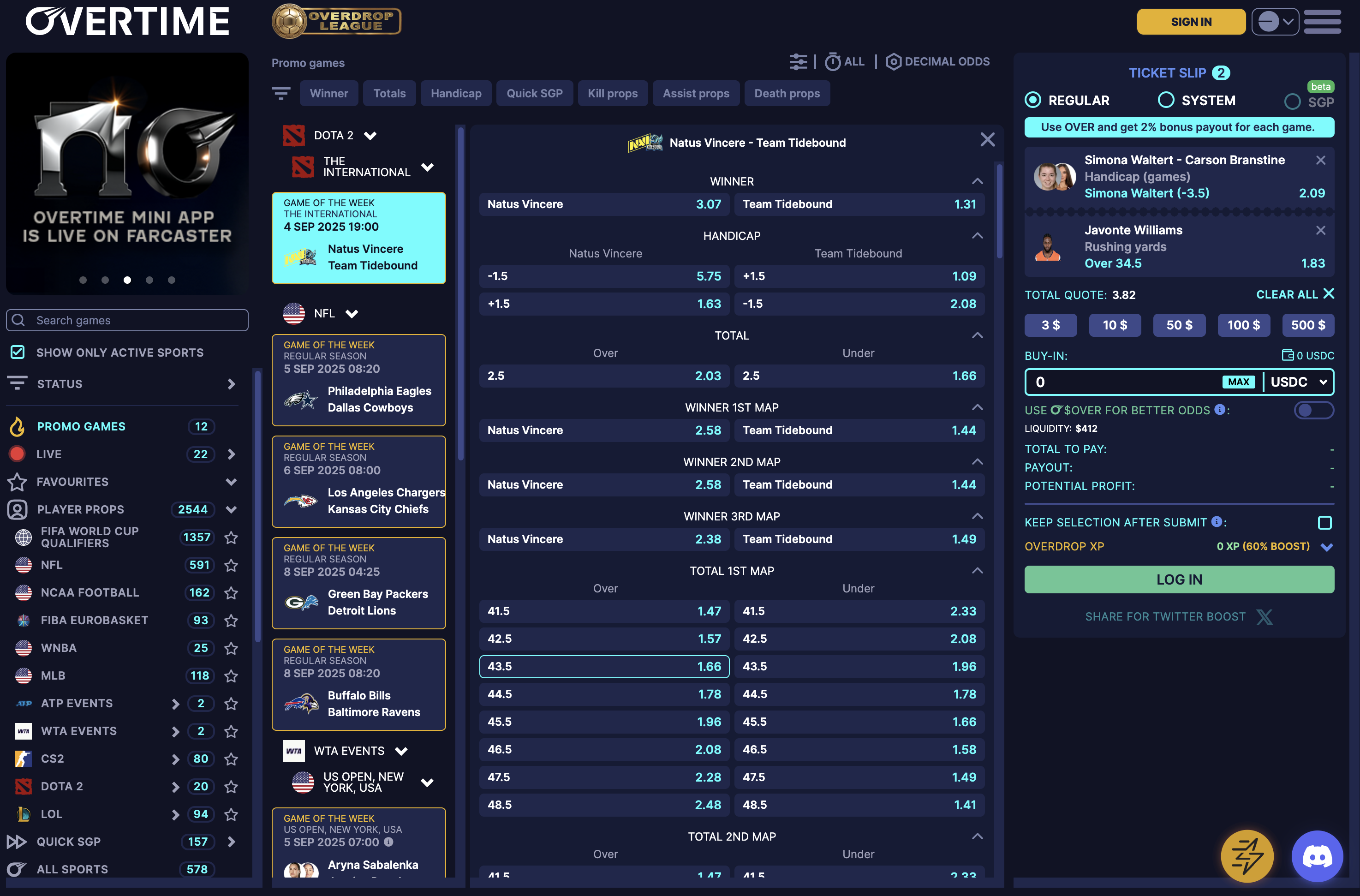

Overtime

- Previous Thales Mrket. Overtime is the sportsbook to deliver decentralization, instant liquidity, and competitive odds in one platform. Like Rollbit.

- Thales Protocol was born in 2021 as a permissionless, orderbook-based peer-to-peer Positional Markets platform deployed on Ethereum Mainnet and powered by Chainlink price feeds.

- More like a gambling and lottery platform.

- History

- October 2022: Launches World Cup incentives with 50,000 OP and 30,000 THALES rewards on Optimism.

- February 2023: Expands to Arbitrum, marking a significant L2 migration for deeper liquidity and lower fees.

- November 2022–Ongoing: Runs community events like Fantasy Premier League (FPL) mini-leagues with prizes (e.g., $5,000 in 2025).

- January 2024: NFL Playoffs rewards program with 40,000 ARB tokens.

- August 2024: Upgrades to V2, fully replacing V1, with enhanced features like embedded Speed Markets.

- March 2025: Adopts Chainlink's Cross-Chain Interoperability Protocol (CCIP) for $OVER token transfers.

- August 2025: Overdrop Season 2 launches, distributing ETH and $OVER free bets monthly.

- Mechanism:

- V2 uses Merkle trees to create markets and push odds to the chain reducing the overall overhead cost and the possibility to push multiple odds at the same time.

- Creation

HOMEandAWAYpositions - for two-outcome positional markets (e.g. basketball)HOME,AWAYandDRAWpositions - for three-outcome positional markets (e.g. soccer)

- Trading

- Each position is priced by using the merkle tree root data pushed onchain. Odds are pushed onchain frequently avoiding outdated pricing. The contract then offers a strict price to the traders.

- Live AMM

- Anyone can provide liquidity for the Overtime's Sports AMM and gain exposure to it's performance.

- SportsAMM and ParlayAMM for positional markets, enabling instant liquidity without traditional bookmakers.

- Oracle: Chainlink

- Each markets are resolved by Results Data provided by Chainlink Sports Feeds.

- Odds come from Pinnacle Sportsbook and JsonOdds.

- Tokenomics

- $OVER is the native utility token, launched March 31, 2025

- Supply Details:

- Initial Total Supply: 69,420,000.

- Circulating Supply: ~63,420,000 (as of August 2025, after 6M+ burned).

- Burn Mechanism: Fees from trading and protocol activity are used to buy and burn $OVER, approaching 10% of supply burned.

- Utility:

- Betting Collateral: +10% XP boost.

- Free Bets: Distributed via Overdrop and events.

- Cross-Chain: Transferable via Chainlink CCIP.

- Deflationary: Burns reduce supply, tied to platform volume.

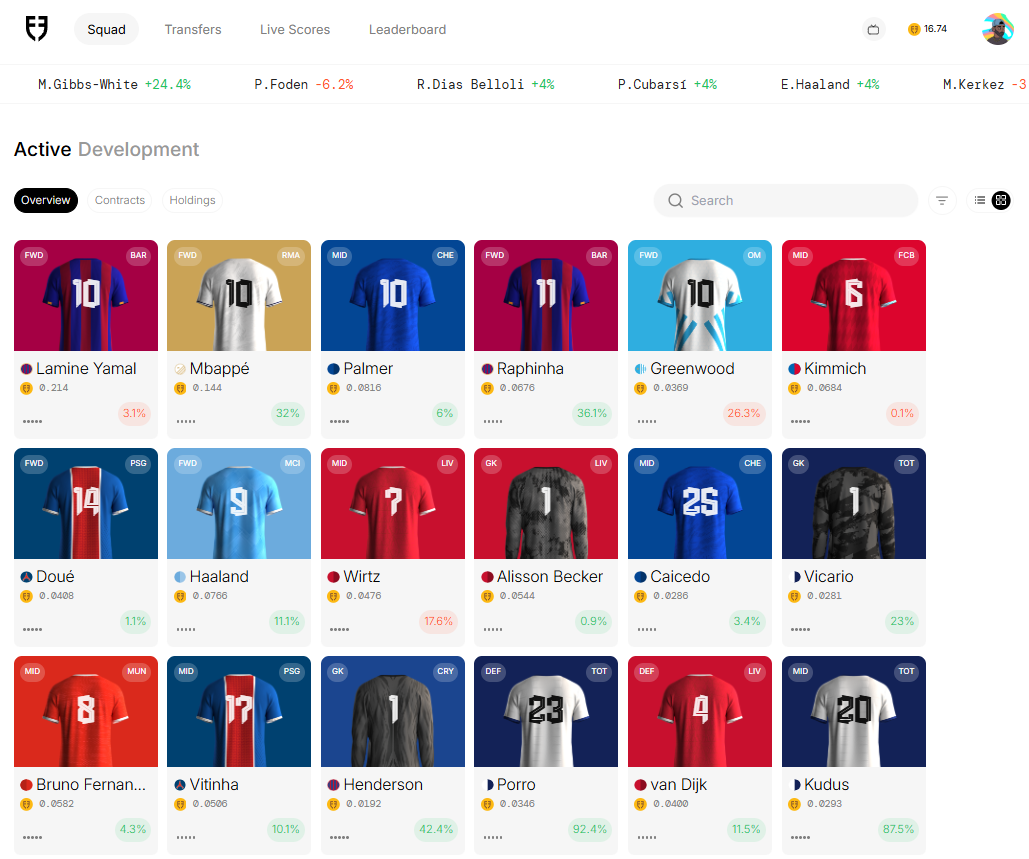

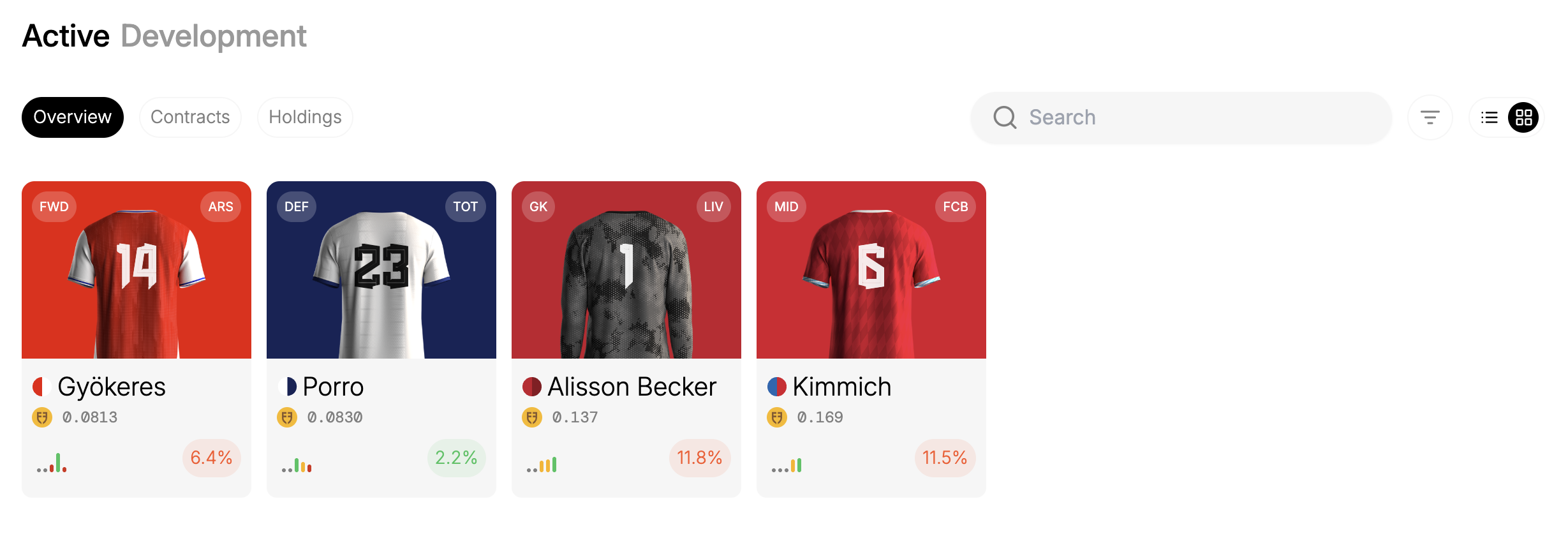

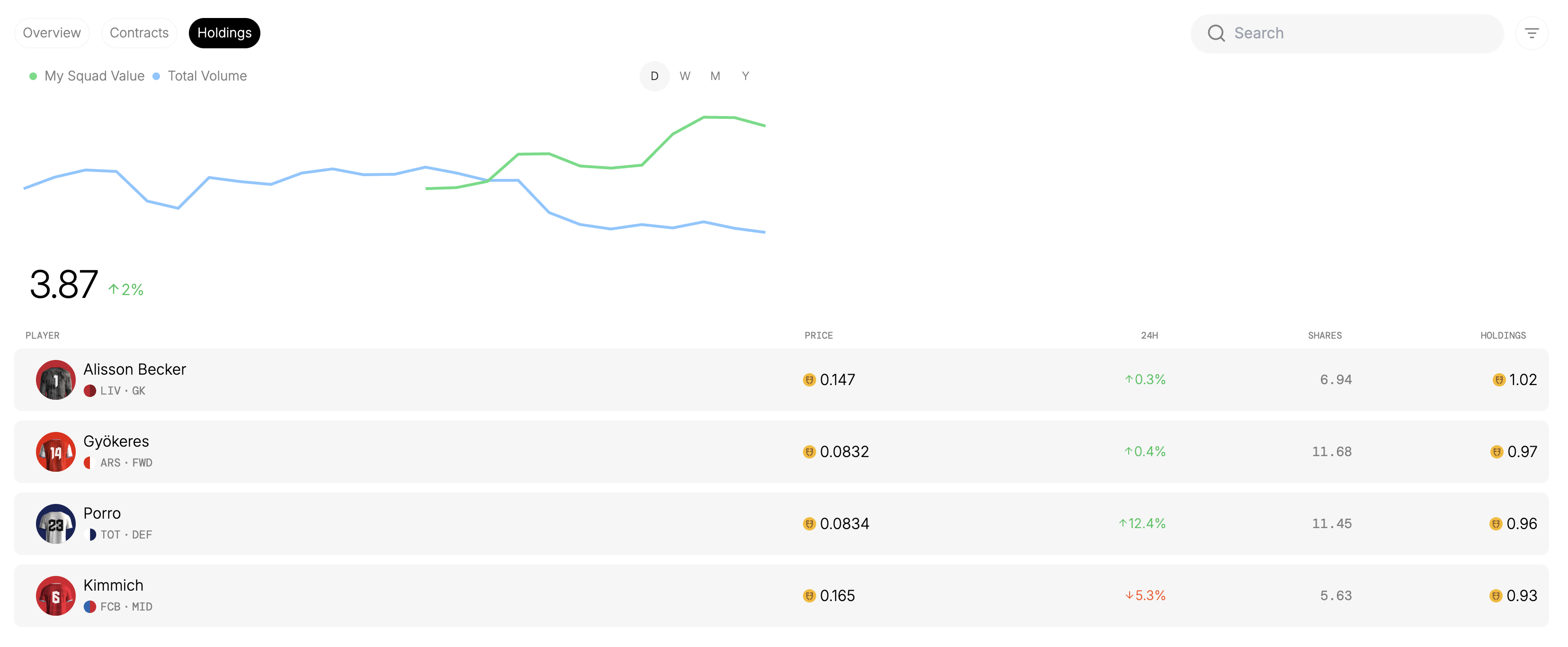

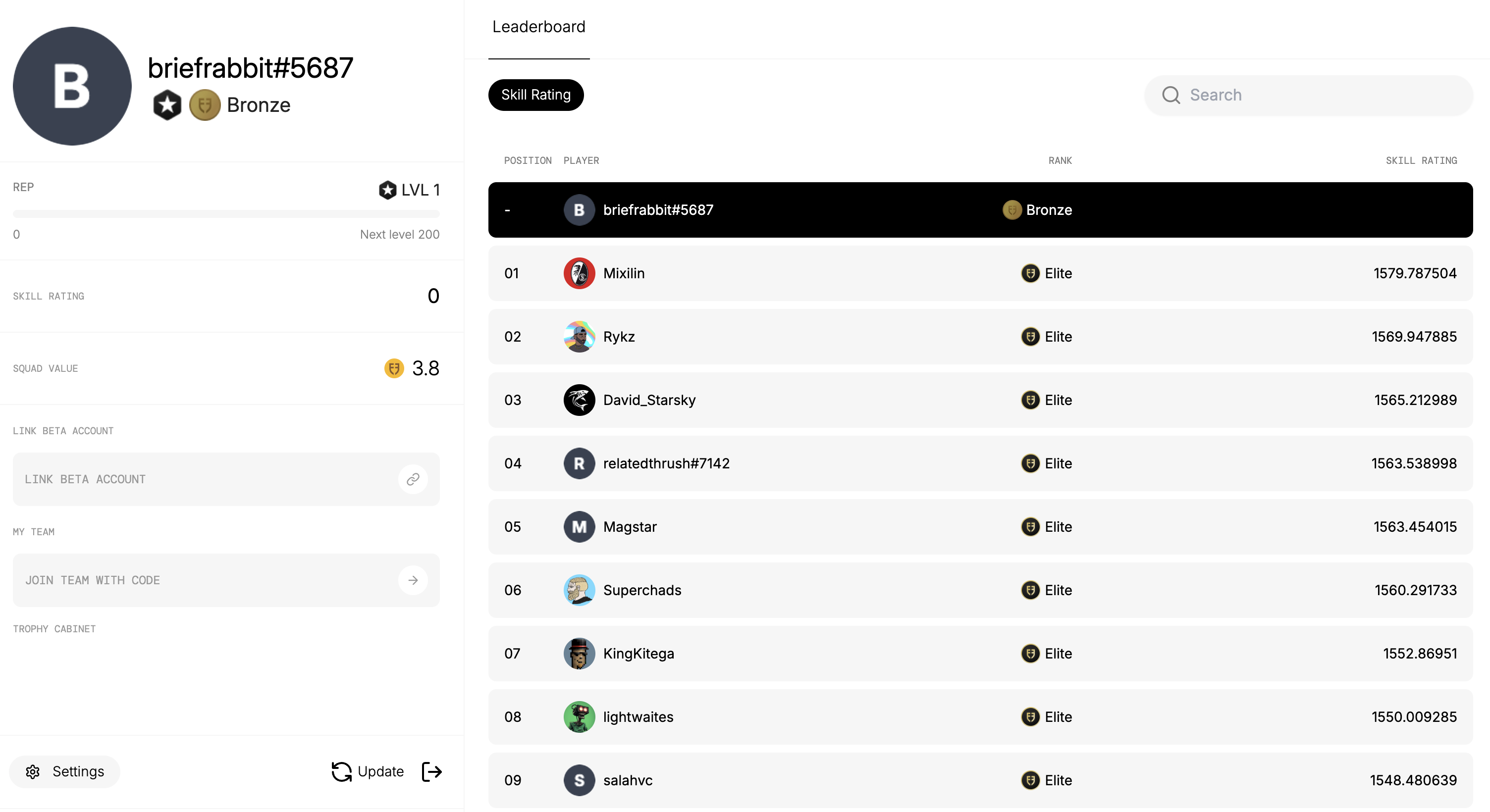

Football.fun

-

Positioning the sports platform. Not only the prediction market, combined with team mode to enhance the experience.

-

The Pro version is played with real money compared to FTP.

- Pro: USDC -> GOLD

- Free: Experience

-

Mechanism

- Currencies

- GOLD

- Tournament Points (TP): is what is used to open up Player Packs. TP is earned based on performance in the tournament with squad picks

- Skill Points (SP): is used to promote players that are in Development Squad.

- Packs: randomized packs that contain 4 players and award you varying number of shares. 2 maximum. Players from the English Premier League, La Liga, Bundesliga, Serie A, and Ligue 1.

- Pro Pack: Smaller amount of shares per player

- Epic Pack: Medium amount of shares per player

- Legendary Pack: Large amount of shares per player

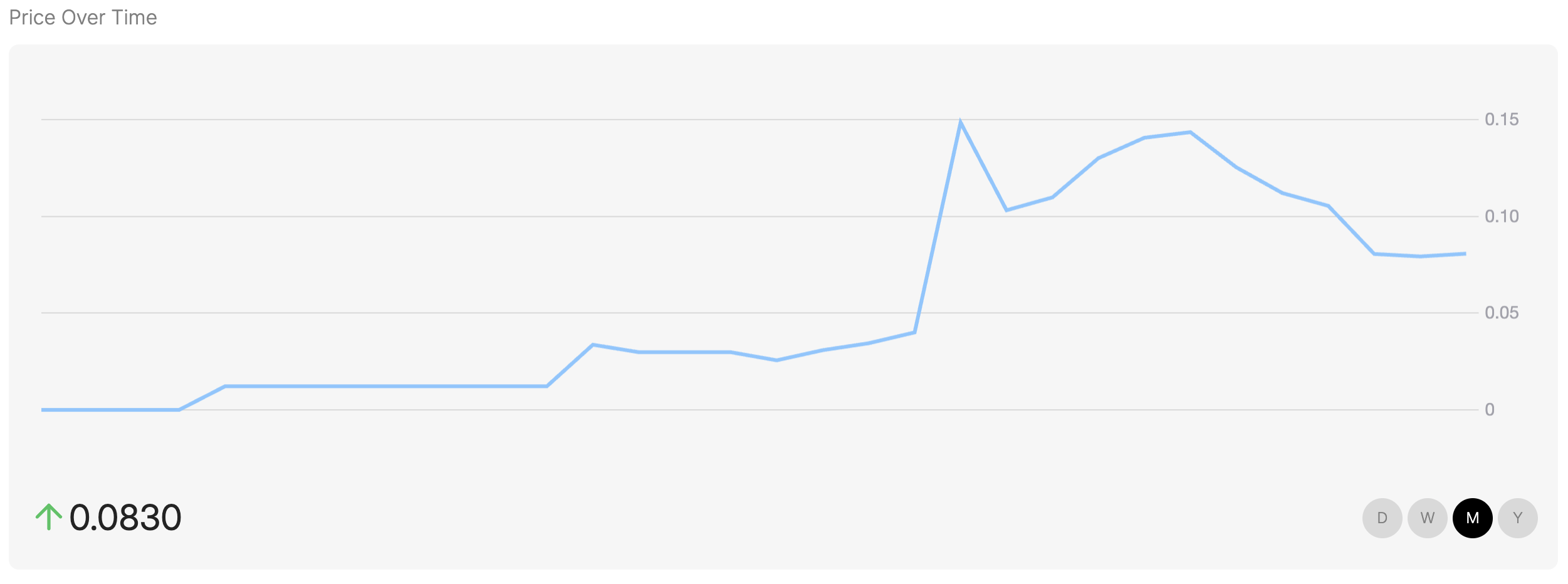

- Players

- All players have a maximum supply of 25M shares.

- The initial pool per player was 1.6M shares & 20K gold

- All shares are only tradeable via the FDF Marketplace

- Each player also comes with 4 contracts by default. Shares contract expires to 0, the player will not be entered into the upcoming tournament and is not eligible to win rewards.

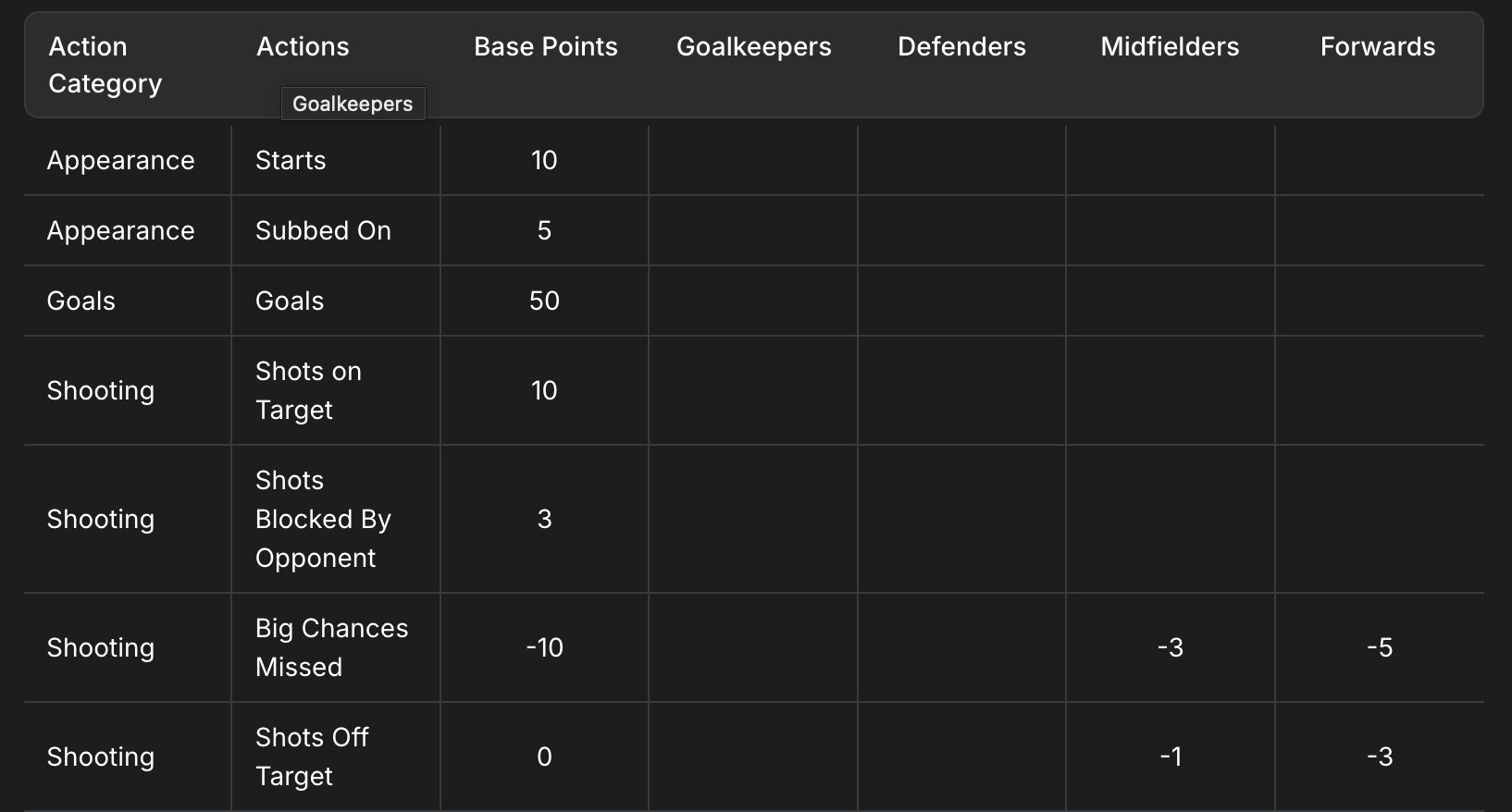

- Scoring Prediction Markets

- Goalkeepers score highly for clean sheets, saves, claiming the ball and even some for good distribution. But if they make mistakes they may struggle to get big points totals, even if they get a clean sheet.

- Defenders who get a clean sheet and make a lot of tackles, interceptions whilst contributing to the build up play will usually perform better than a defender who got a clean sheet but otherwise had a quiet game.

- Midfielders are generally expected to make a strong overall contribution to the game whilst getting a goal and/or assist to excel.

- Strikers who score but also miss many big chances will get beaten by more clinical finishers. They’ll score higher when they make an all round contribution to play as well as just goals and assists.

- Detailed Scoring

- Account Rep: progression system that allows users to earn status and unlock higher ranks

- Connecting your social accounts

- Linking your wallet (to verify trading history + activity)

- Completing Objectives

- Trading, Winning, and staying active

- Contributing high-quality content

- Being an engaged community member

- Winning challenges and events

- Currencies

-

Mode#1: Trading the player scoring in 2nd market

-

Mode#2: build the squads, earn TP to open pack, and sell players

-

Mode#3: promote Rep, and the high shares in 1st Market

- 1.6M = 20K, the initial market cap for one player is 312.5K, price is 0.0125

- 1.6M = 20K, the initial market cap for one player is 312.5K, price is 0.0125

-

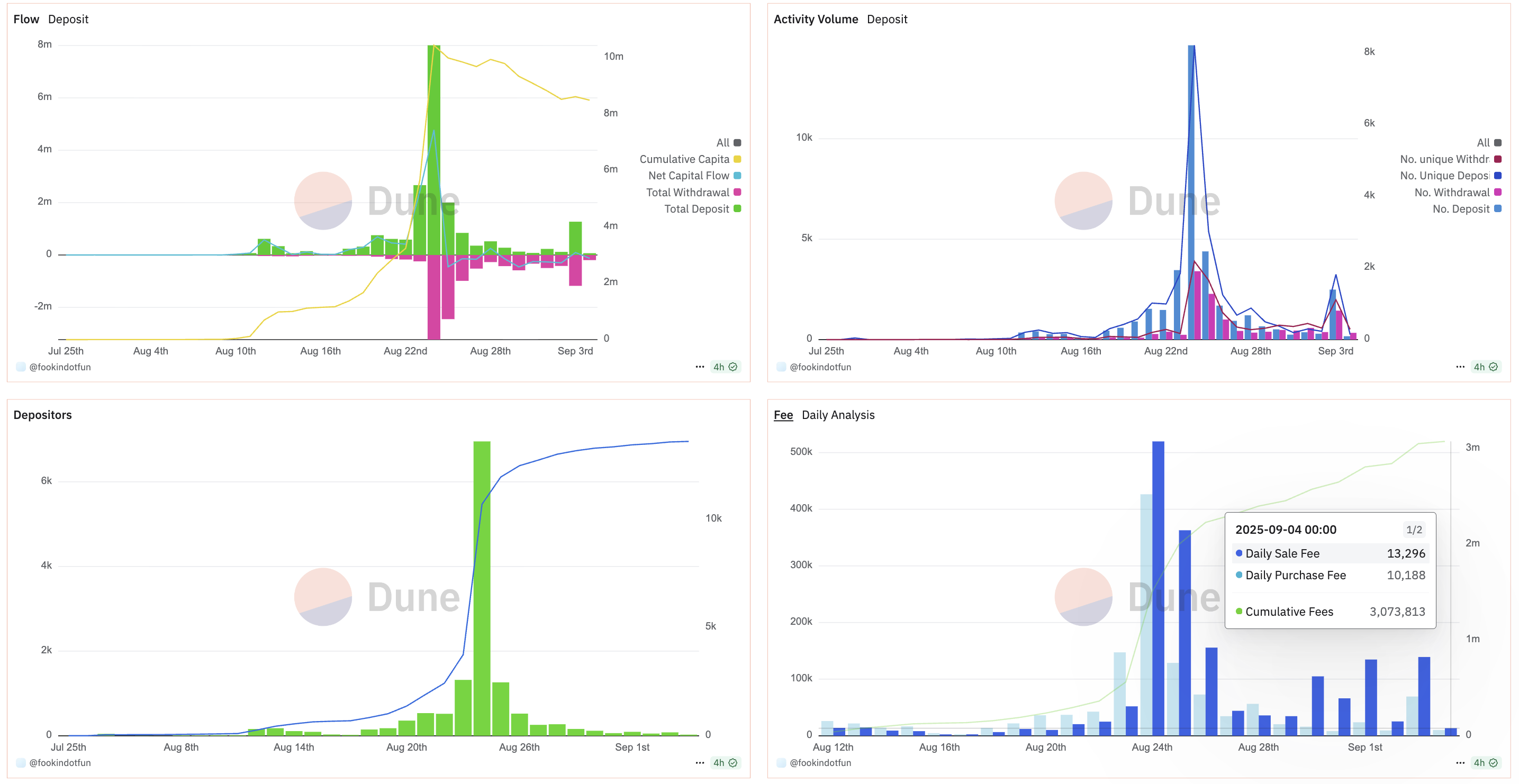

Business Model

- 5% trading fees, and variable fee for dump and surge volume.

-

Stats

- Total Users: 13K

- Peak: Aug 24

- Inflow: 8M

- Fees: 500K

- Cumulative Fees: 3M

Drafted.fun

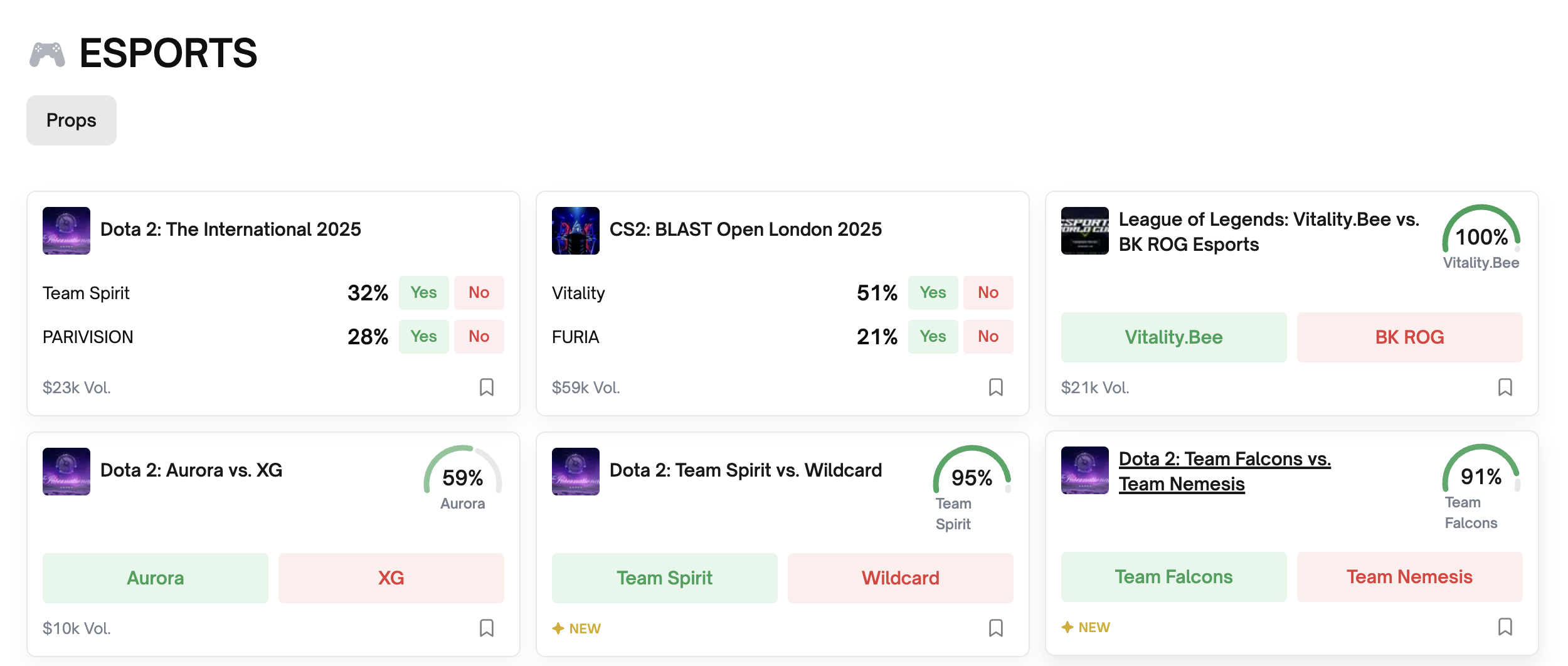

- Prediction platform for esports tournaments.

- First Tournament: The International 2025 (Dota 2).

- A total of 16 team tokens launched for TI2025, and each transaction involving these tokens carries a 10% platform fee.

- Full synchronization with matches and results

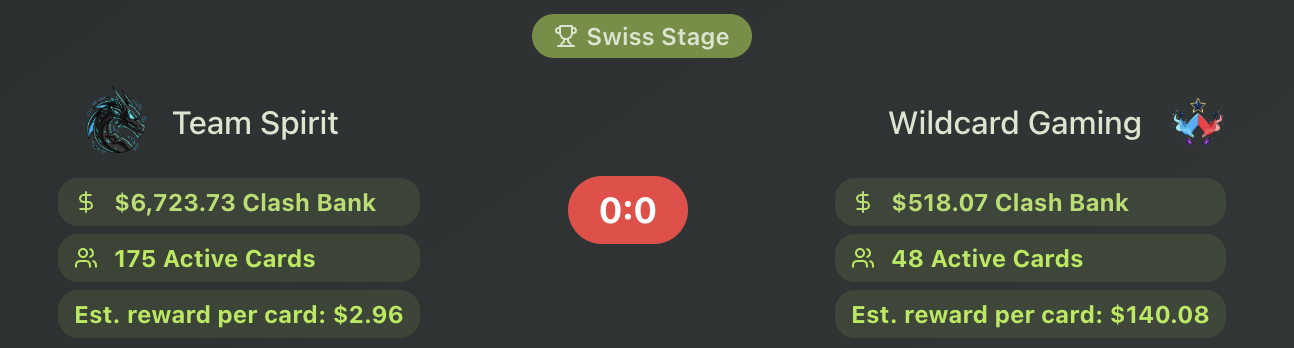

- Clash Bank — rewards after every game

- Aegis Bank — the grand prize pool distributed at the final

- Future Versions: CSGO, LoL, Valorant, PUBG

Card Packs

Every 24 hours, could receive 1 common pack for free. Don't forget to claim and open it.

Cards are not executed on-chain

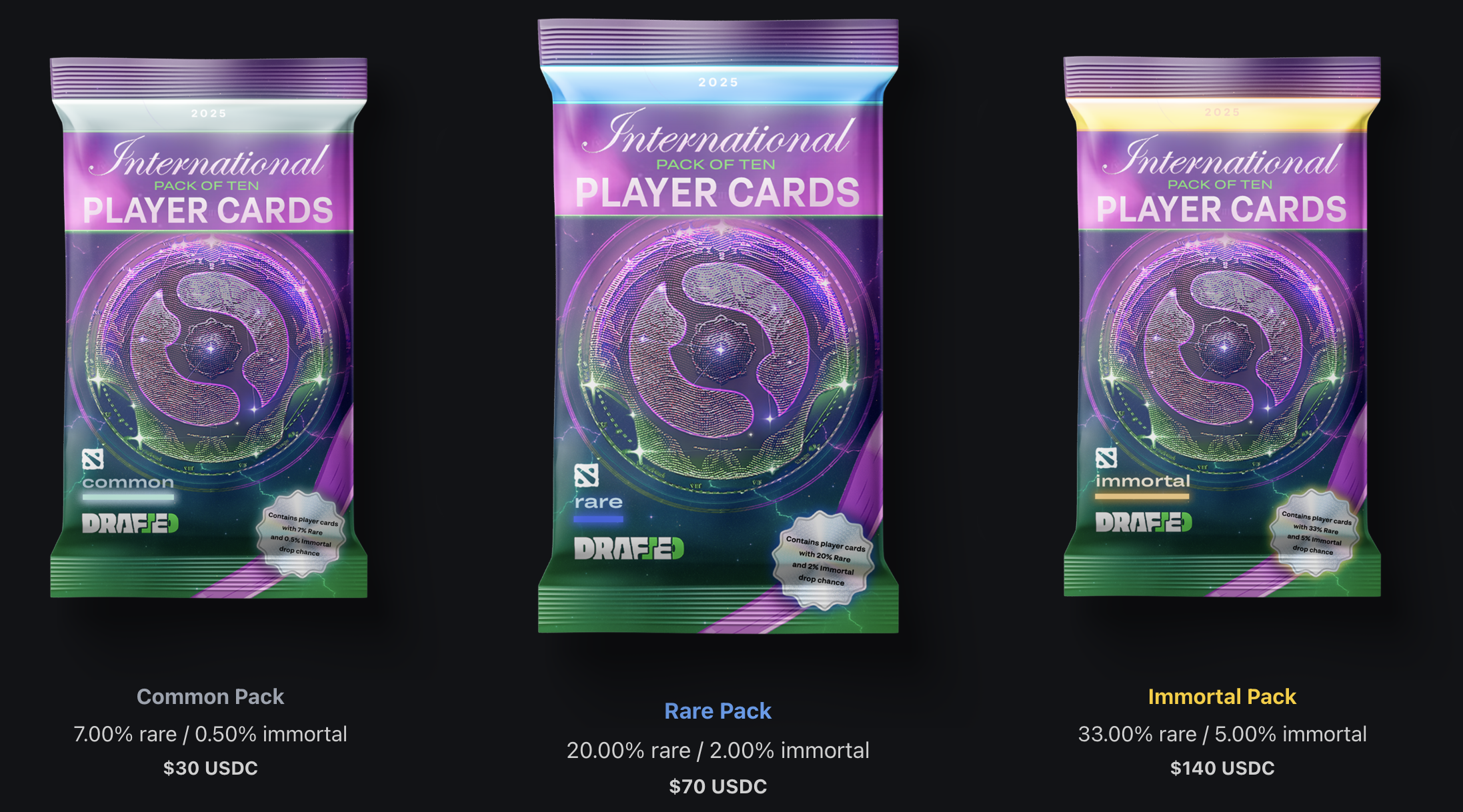

- Common Pack: Contains 10 random cards with probable rarity: Common 92.5% / Rare 7.0% / Immortal 0.5%

- Rare Pack: Contains 10 random cards with probable rarity: Common 78.0% / Rare 20.0% / Immortal 2.0%

- Immortal Pack: Contains 10 random cards with probable rarity: Common 62.0% / Rare 33.0% / Immortal 5.0%

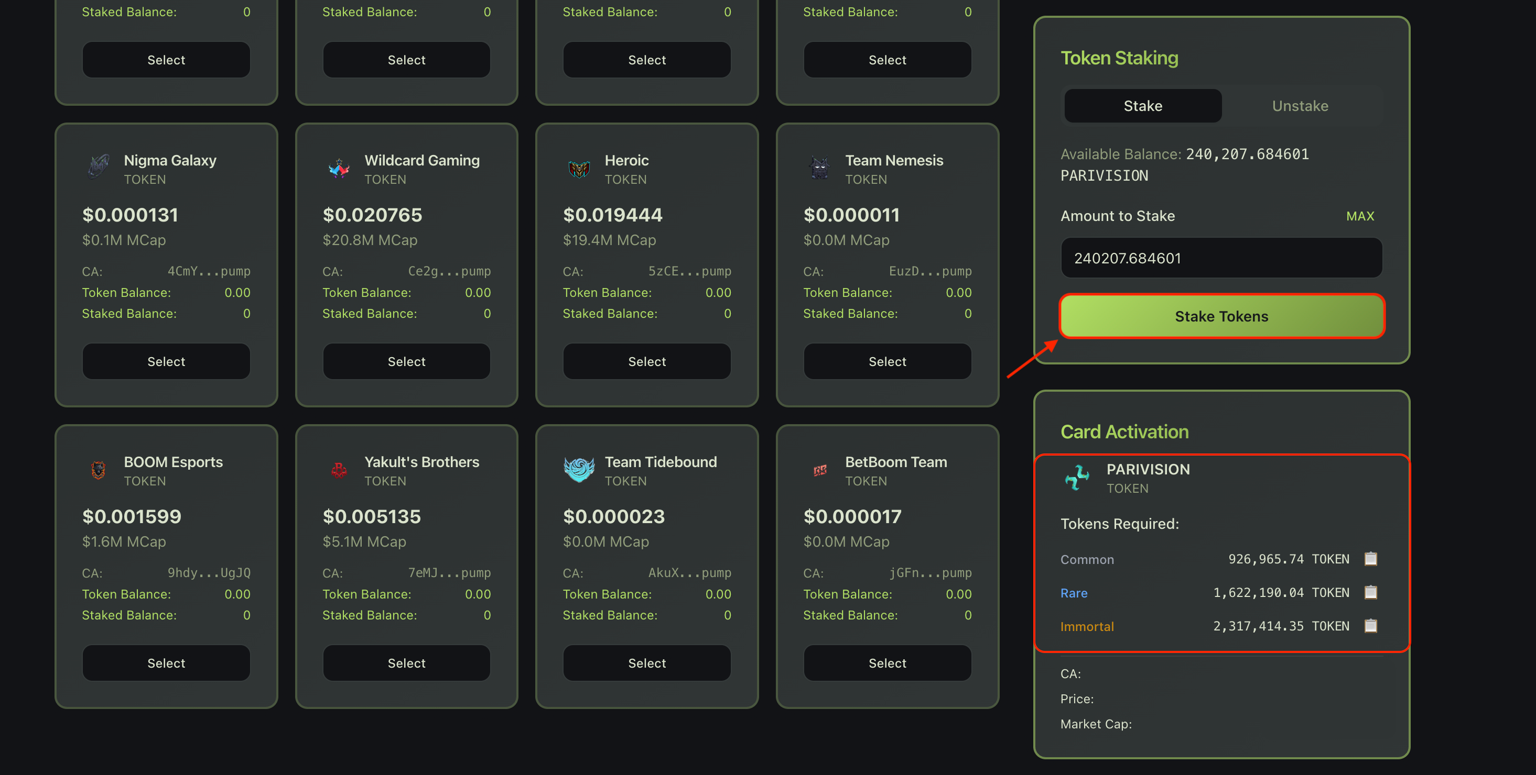

Buy and Stake Team Tokens to Activate Card

Every time a team with activated player cards wins a match at TI 2025, Win

Mechanism

- The 10% fee (via LP fee on Meteora DAMM) collected from token trading is distributed as follows:

- 40% → Clash Bank

- A portion of the fee fills the Clash Bank. This pool is distributed after each match to the active cards of the winning team.

- Ensures that every game directly rewards participants.

- Snapshot before every match, 70% distributed, 30% rolled over, leftovers go to Aegis if a team is eliminated.

- 20% → Aegis Bank

- Another portion of the fee goes into the Aegis Bank. This pool accumulates throughout the entire tournament.

- If a team is eliminated, the remaining balance of its Clash Bank is also added to the Aegis Bank.

- At the end of TI2025, the full Aegis Bank is distributed to the cards of the tournament champion.

- 30% → Referral Rewards

- With a 10% fee, this means a referrer earns up to 3% of their referrals’ trading volume.

- In addition, 30% of all purchased packs by referrals also go to the referrer.

- 10% → Platform fee

- 40% → Clash Bank

- Offchain oracle, not disclosed in docs

Live Games Compared to Polymarket

- Polymarket just get into this niche markets, and leave space for new comers

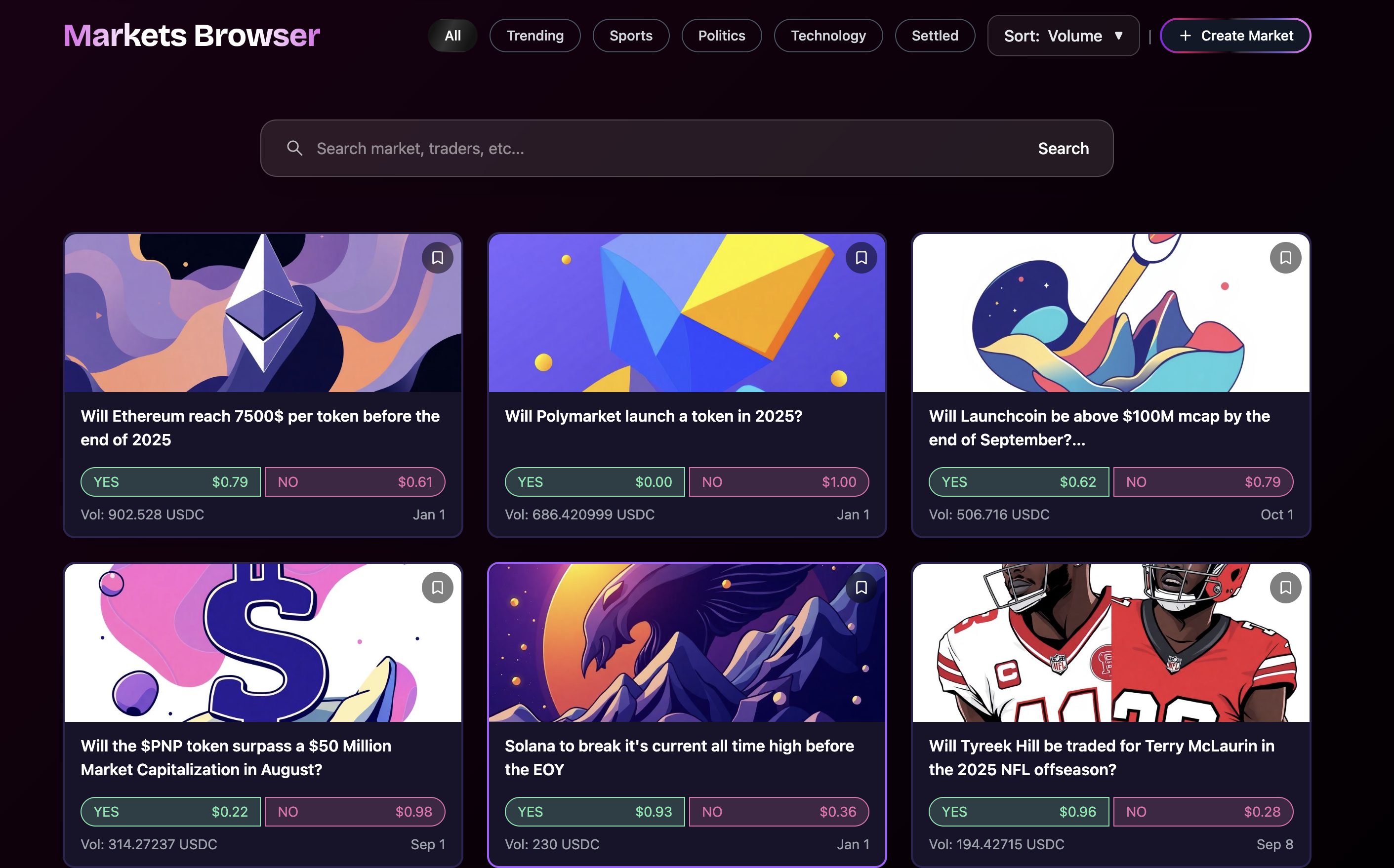

Pump.fun x Polymarket

- Make the opposite opinions into two separate pump.fun tokens

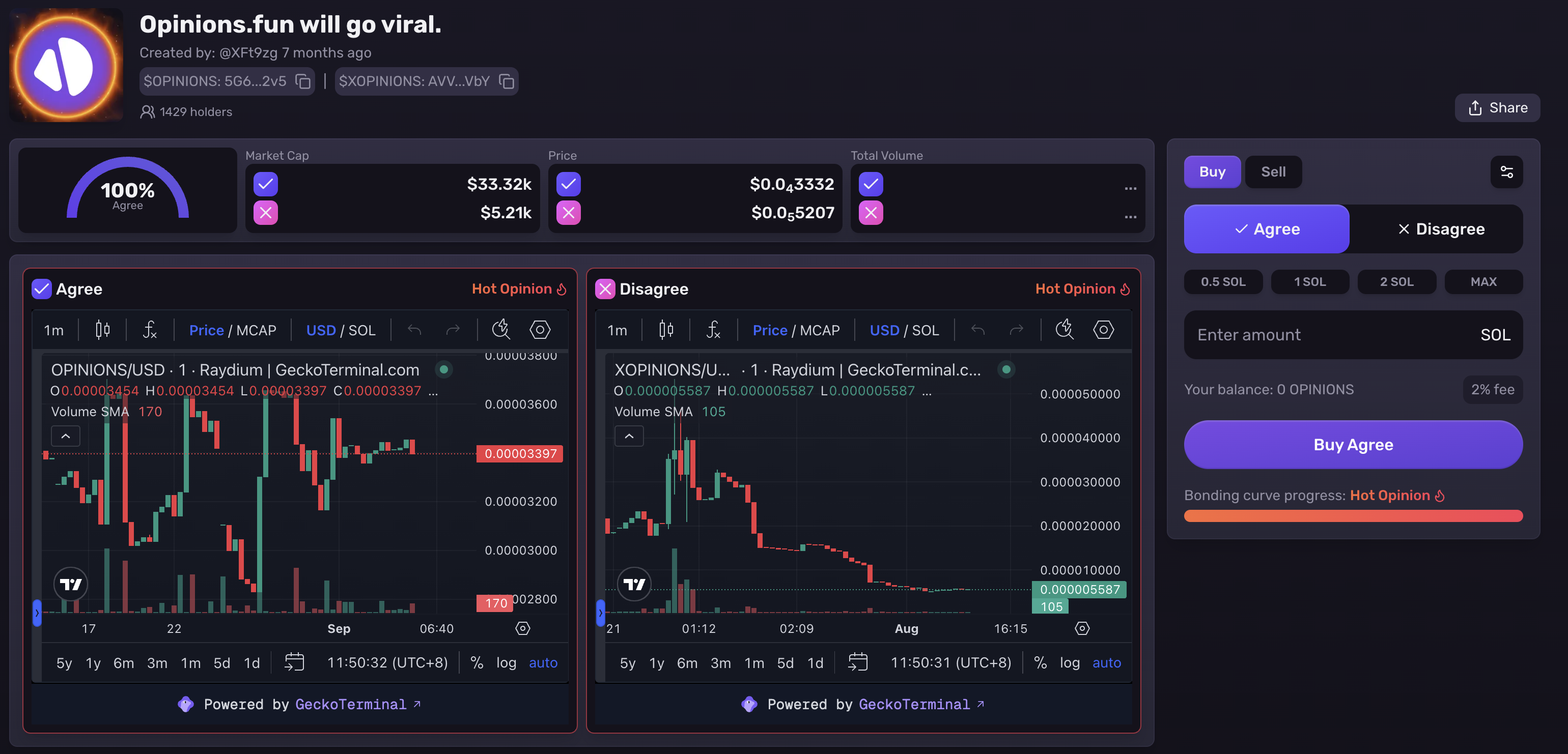

Opinons.fun

- Opinions.fun is permissionless, allowing anyone to launch an opinion market.

- Toly followed since V1

Mechanism

- MeteoraAG's DBC and DAMM V2 power each opinion launch, creating two independent tokens on separate bonding curves, immediately tradable after creation.

- Each opinion market is represented by two opinion tokens:

- Agree and Disagree.

- Users can trade, buy, sell, or hold these tokens.

- Opinion tokens that reach a market cap of $69K graduate and become “Hot Opinions”.

- Both agree and disagree tokens can independently reach this stage and graduate from the bonding curve to Meteora pools.

Fees Sharing

- Revenue from

- No fees for creating an opinion.

- 2% buy and sell fees on each trade

- 100%

- Meteora fees

- 10%: Opinion creator

- 10%: Original author of CT's most viral opinion

- 21.25%: Top 25 smart engagers on CT's most viral opinion X post, weighted by mindshare

Engagement with Kaito

- Leverage Kaito's proprietary mindshare and smart engagement data to track and automatically turn Crypto Twitter's most viral opinions into tradable markets, once they reach a certain mindshare and virality threshold.

- 1-2 new markets per week.

PNP Exchange

- Permissionless Prediction Markets DEX on Solana, launched in August 2024.

- Team: Darpit Rangari | pnp.exchange (@proxima424) / X , Indian

- Mechanism

- bonding curve is used to price decision tokens completely onchain. Instant liquidity and deterministic pricing, setting us apart from traditional exchanges.

- Oracle: LLM Oracle

Melee

- Initialize the project in May, 2025

Reference

- Prediction Markets Index

- Kalshi Help Center | Kalshi Help Center

- kalshi-fee-schedule.pdf

- Polymarket Analytics – Prediction Market Data, Analytics, and Dashboards

- Introduction to Overtime | Overtime Documentation

- FootballDotFun

- Football Fun Dashboard | FDF Tracker — Trades, Holders & Volume Analytics