Tag#1: SEC vs. Ripple – Legal Battle and Resolution

The Beginning

- December 2020, the U.S. Securities and Exchange Commission (SEC) sued Ripple Labs and its executives, alleging that Ripple’s sales of XRP constituted an unregistered securities offering totaling $1.3 billion. The SEC’s core argument was that XRP should be treated as a security (an investment contract, based on Howey Test), since buyers might expect profits from Ripple’s efforts. Ripple firmly denied this, asserting that XRP is a digital currency used for payments, not a security, likening it to Bitcoin and Ether (which regulators had deemed not securities). This set the stage for a high-stakes legal battle that lasted over four years.

Pivotal Moments

- July 2023: A federal judge delivered a split decision. She ruled that XRP is not a security when sold on public exchanges to retail investors, but institutional sales of XRP did violate securities laws. This partial win for Ripple clarified that programmatic (exchange) sales weren’t investment contracts, while direct sales to institutional clients fell under securities rules. Ripple was hit with civil penalties for the latter (including a ~$125 million fine and a temporary restriction on certain sales).

- October 2023: The SEC dropped its separate charges against Ripple CEO Brad Garlinghouse and co-founder Chris Larsen (who were accused of aiding and abetting securities violations). This narrowed the case to focus only on Ripple’s XRP sales.

- Late 2024: The SEC filed a notice of appeal, seeking to overturn the part of the ruling favoring Ripple’s retail sales. This signaled the SEC’s intent to challenge the judge’s interpretation that those XRP sales were not securities.

Case Resolution:

- March 2025, Ripple announced that the SEC had decided to drop its planned appeal, effectively ending the lawsuit. After years of uncertainty, the long-running case reached a conclusion without a higher court battle. Ripple’s CEO Brad Garlinghouse celebrated the outcome as the end of a challenging chapter, calling for a “rational, constructive” regulatory approach going forward. The final legal outcome largely upheld the 2023 court’s findings: XRP itself was not deemed a security in open market trading, although Ripple’s past institutional sales remained subject to penalties. Notably, because the case did not advance through an appeal, the district court’s ruling does not set a binding legal precedent for other cryptocurrencies. This means other crypto projects can’t directly rely on the XRP decision in their own SEC disputes, keeping the broader status of many tokens legally ambiguous.

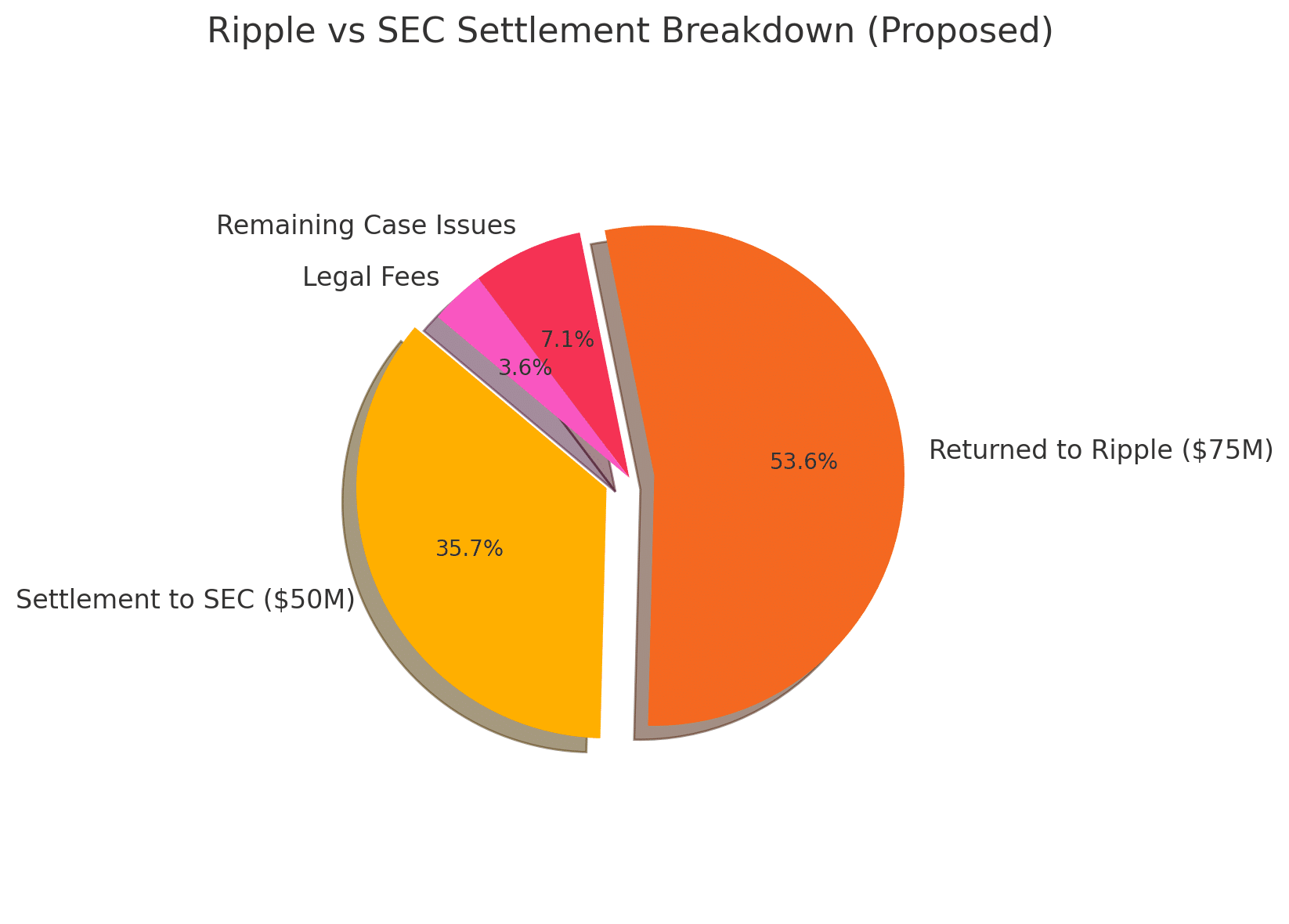

- June 2025, In Ripple vs SEC, both Ripple and the SEC recently submitted a joint motion seeking an “indicative ruling” that would effectively finalize a proposed $50 million civil penalty while returning $75 million of previously frozen XRP to Ripple. Many believe this move is a strategic effort to avoid further appeals and conclude the 4.5-year legal battle. p.s. PAC $75 million

Implications for XRP and the Crypto Market:

- XRP’s Market Reaction: With the legal cloud lifted, XRP’s price surged immediately on the news – jumping roughly 9–13%. Major U.S. exchanges, which had delisted XRP during the lawsuit, had already begun relisting the token after the 2023 ruling, restoring access and liquidity in the U.S. market.

- Regulatory Clarity for Ripple: The favorable outcome provided Ripple with much-needed regulatory breathing room. With no ongoing enforcement action, Ripple can operate its business (like payments and liquidity services) more freely in the U.S. without the “security” label hanging over XRP. This clarity has enabled Ripple to reengage with partners and even explore new opportunities previously on hold. Ripple had hinted at considering an IPO once the SEC case was resolved – a step now more feasible with the lawsuit behind it

- Business Expansion: Ripple can now focus on scaling its global payment network and XRP use cases instead of fighting in court. The company has signaled plans to grow its On-Demand Liquidity services and other XRP-powered products worldwide. New partnerships and pilot programs that were cautious due to the lawsuit may accelerate, knowing XRP has gotten a sort of regulatory green light in the U.S..

- Broader Crypto Precedent: Symbolically, Ripple’s win marked a rare setback for the SEC’s crypto enforcement campaign. It has emboldened the crypto industry’s calls for clearer laws rather than regulation-by-enforcement. However, because the case didn’t reach the appellate level, it did not establish a formal precedent to directly protect other tokens. Legal experts caution that each token may still face its own facts-and-circumstances analysis. In the absence of new legislation, questions about which digital assets qualify as securities remain unresolved. Still, the outcome is seen as a catalyst – prompting U.S. lawmakers to push harder for comprehensive crypto regulations in order to avoid protracted battles like Ripple’s in the future. Ripple’s win therefore serves more as political pressure: it encourages industry and lawmakers to push for clear rules so every project doesn’t face its own “Ripple-style” lawsuit.

- The case ended at the district-court level, not on appeal

- The Howey test is fact-intensive

- A split decision focused on sales context

- The SEC retains discretion to pursue other tokens

- The legislative gap persists

Tag#2: Ripple’s Global Remittance Model - ODL

On-Demand Liquidity (ODL), which uses the cryptocurrency XRP as a bridge currency to facilitate near-instant cross-border payments. In a traditional international remittance, a sender’s bank and the receiver’s bank often need pre-funded accounts in each other’s countries or must route funds through multiple correspondent banks – a slow and costly process. Ripple’s ODL eliminates the need for pre-funded nostro/vostro accounts in destination currencies.

- A sending institution uses ODL to convert the senders’ local currency into XRP at a crypto exchange in real time.

- That XRP is then transferred instantly over the XRP Ledger to a receiving exchange in the destination country.

- The receiving exchange converts the XRP into the recipient’s local currency, which is delivered to the recipient’s bank or mobile wallet.

ODL vs. SWIFT/Western Union: Traditional cross-border payment networks like SWIFT (used by banks worldwide) and money transfer operators like Western Union rely on a chain of intermediary banks or their own payout network in each country. These legacy systems, while widespread, have notable pain points: high fees, slow settlement, lack of transparency, and limited access for the underbanked. A SWIFT wire might hop through several correspondent banks, each taking a fee and adding delay. Western Union and similar remitters often charge sizeable commissions and currency exchange markups for instant transfers. In contrast, Ripple’s blockchain-based approach streamlines the process end-to-end:

| Aspect | Traditional Remittance (SWIFT / Western Union) | Ripple On-Demand Liquidity (ODL) |

|---|---|---|

| Speed | 1–3 business days (sometimes longer) for funds to clear. | Seconds to a few minutes for near-instant settlement. |

| Cost | 5–10 % of the amount sent (multiple intermediaries add fees). | Only a tiny on-ledger XRP fee + exchange spread → significantly cheaper. |

| Liquidity & Prefunding | Banks must keep large nostro/vostro balances abroad, tying up capital. | Liquidity sourced on demand via XRP → no pre-funded accounts needed. |

| Transparency | Limited end-to-end tracking; unclear intermediary fees and arrival time. | Full on-ledger traceability; settlement timing is visible and immediate. |

| Access | Requires correspondent banks or physical agents in each country; underserved corridors remain costly. | A local licensed exchange suffices; can reach underserved markets in Asia, Africa, etc., expanding global access. |

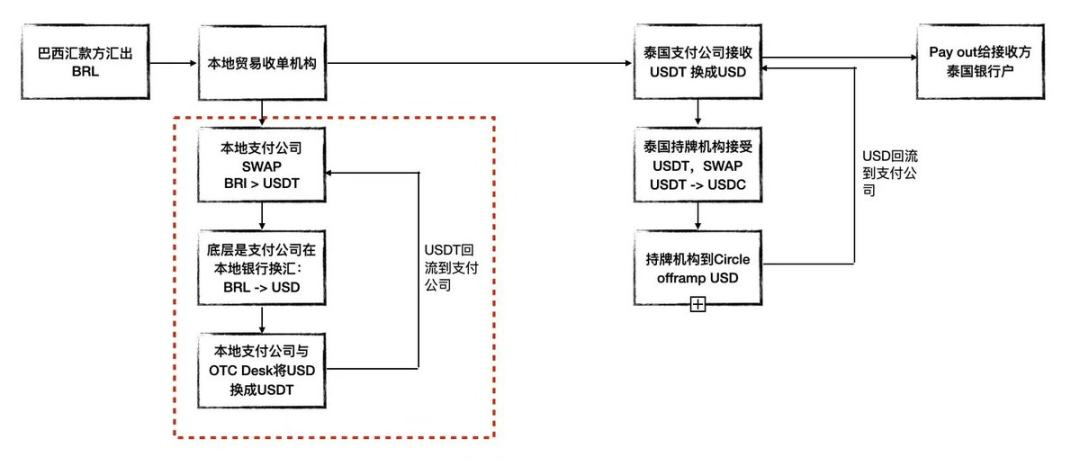

Comparison with USDT solution, USDT solution is highly rely on the channel and swap platform to swap USDT-USD. There must always be OTC desks ready to provide USDT on- and off-ramps. These desks tie up a large amount of capital, making this the single costliest segment of the entire flow—and it’s precisely where Tether’s moat is deepest.

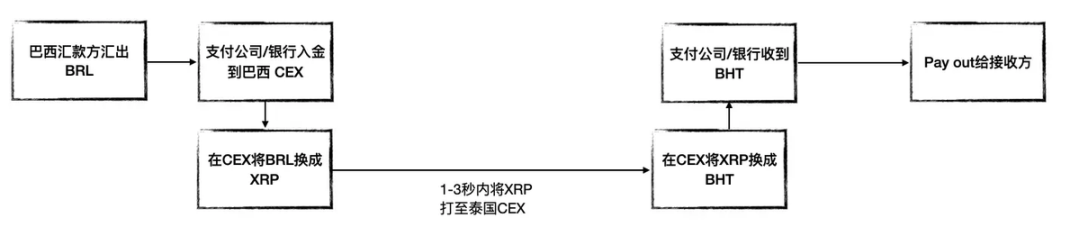

On the other side, Ripple solution is more tricky, directly build upon CEX. The process is: foreign currency is taken to a centralized exchange (CEX) through local banks or payment processors and swapped into XRP; the XRP is sent to a CEX in the receiving country; and there it is converted into the local currency. The diagram below, using Brazil-to-Thailand remittances, illustrates a BRL → XRP → THB path. In other words, Ripple is rebuilding a foreign-exchange market with XRP as its bridge currency.

BD Driven model, Ripple hold tons of Ripple, the value of XRP is sold to these local licensed exchanges. The cost is the BD, The revenue is the token sale. It is pretty similar like RUNE, but XRP is more blackbox, you can't tell the real liquidity in the market.

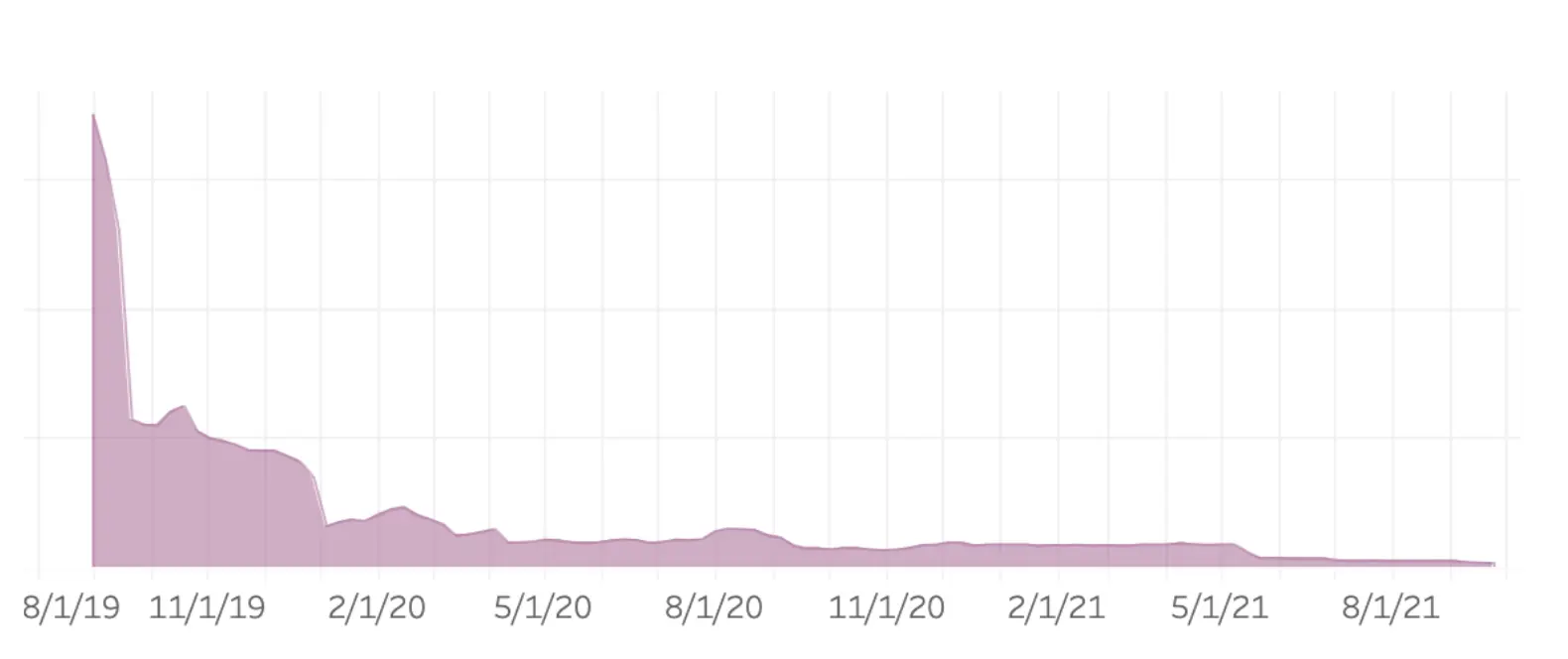

ODL volume incentives cost (9/1/2019 – 9/30/2021)

For Ripple, the basis for them to hold such big remittance network, they need to provide the ample liquidity in CEX, maintain the relationship with CEX. And most importantly, to persuade bank to integrated their services.

Major partnerships underpin Ripple’s strategy, providing market access and credibility. The company has built a network of 100+ financial institutions using its technologyThis includes global banks and payment providers such as American Express, Standard Chartered, Santander, and PNC Bank, which have tested or implemented Ripple’s solutions for cross-border payments. Ripple’s collaboration with SBI Holdings in Japan (through SBI Ripple Asia) has driven adoption of XRP for remittances in East Asia. In the Middle East and Latin America, partners like Tranglo and exchanges like Bitso have joined RippleNet to facilitate regional ODL corridors. Even several central banks have engaged Ripple for CBDC pilots, such as the Royal Monetary Authority of Bhutan and the Republic of Palau, to explore issuing digital currencies on private ledgers derived from XRP Ledger technology. Coins.ph in Philippines as well. These partnerships align with Ripple’s strategy of working within regulatory frameworks.

Business Model

- Transaction and Service Fees: Ripple operates an enterprise payment network (originally branded as RippleNet, encompassing earlier products xCurrent, xRapid/On-Demand Liquidity, and xVia). Banks and businesses pay fees to use Ripple’s network for real-time cross-border transactions, which provides a steady revenue stream. By leveraging Ripple’s infrastructure, institutions can settle international payments in seconds at a fraction of traditional costs, and Ripple earns usage fees on the volume transacted, but also pay lots of subsidy to this company, such as MoneyGram 15M in 2020 Q1.

- 2016~2020, 23M revenue

- Sales of XRP Holdings: Ripple periodically sells portions of its XRP holdings to institutional participants. As the primary issuer of XRP, these controlled sales have historically funded operations and growth. XRP functions as a bridge currency in Ripple’s payment system, and Ripple’s On-Demand Liquidity (ODL) service uses XRP to intermediate fiat currency swaps, eliminating the need for pre-funded nostro accounts. ODL usage drives indirect value for Ripple (through XRP demand and transaction fees) while providing near-instant liquidity for customers.

- 2013~2020, Sold 14.6B XRP

-

26 Institutions

- 70~96% Market Price

- 3~12 Months Lock-up

-

- Still Hold, as of March 31, 2025

- 4.562B held in Ripple wallets

- 37.13B locked in on-ledger escrow

- December 31, 2024

- 4,485,366,320 held in Ripple wallets

- 38,030,000,005 locked in on-ledger escrow

- 2013~2020, Sold 14.6B XRP

- Investments and Treasury Operations: Ripple actively invests in other fintech and crypto companies and manages a portfolio of digital assets. Profits from these strategic investments contribute to revenue when these assets appreciate or pay dividends. In addition, Ripple introduced lending services – for example, its Line of Credit product (launched 2020) allows customers to borrow funds using XRP as collateral, with Ripple earning interest on those loans.

- Hidden Road, is the global credit network for institutions. Prime brokerage, clearing and financing across traditional and digital assets, 1.25B Valuation, RLUSD Collateral

- Software Licensing & Infrastructure: As an enterprise software provider, Ripple may collect licensing or subscription fees for access to its blockchain solutions. In 2023, Ripple launched a Liquidity Hub platform for businesses to source crypto liquidity across assets, aiming to earn fees by serving as a turnkey liquidity provider for enterprises venturing into crypto. Ripple also offers a CBDC Platform for central banks to issue and manage central bank digital currencies, leveraging a private version of the XRP Ledger

| Year | Global Remittance Volume | RippleNet Total Processed | Ripple ODL Processed |

|---|---|---|---|

| 2018 | $689 B | N/A – pilot stage | N/A – pilot volumes |

| 2019 | $719 B | Not disclosed | Not disclosed – ODL value >100× QoQ; Q4 volume +550 % |

| 2020 | $702 B | Not disclosed | Not disclosed – ODL value 12× YoY (Ripple year-end report) |

| 2021 | $781 B | Not disclosed – RippleNet txns 2× YoY | Not disclosed – ODL ≈ 25 % of RippleNet volume; 25× YoY rise |

| 2022 | $794 B | >$15 B annualised payment run-rate | ≈ $15 B (Total ODL volume, 9× YoY growth) |

| 2023 | $818 B (est.) | Not yet published | Not yet published – ODL live in ≈ 40 countries |

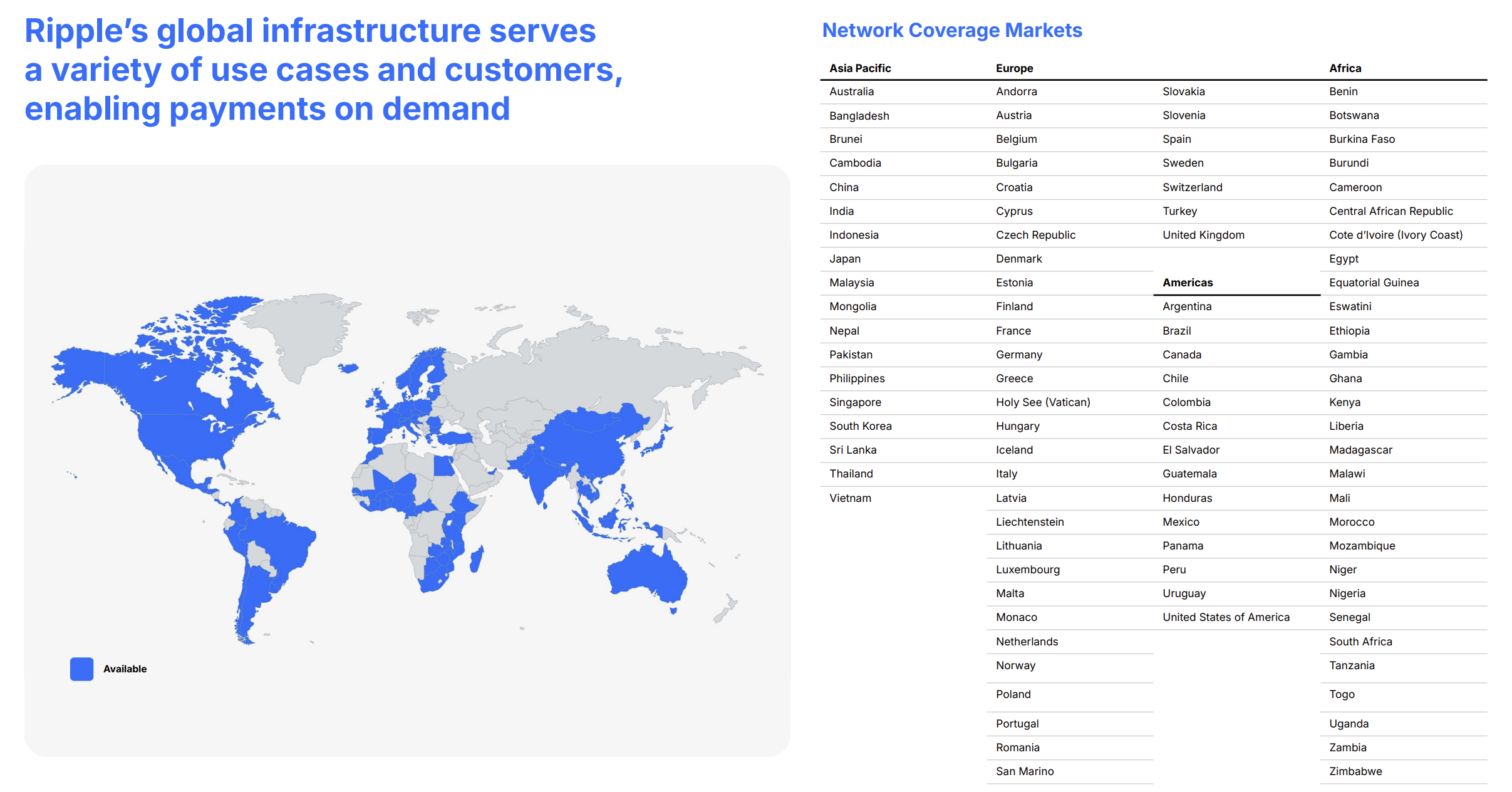

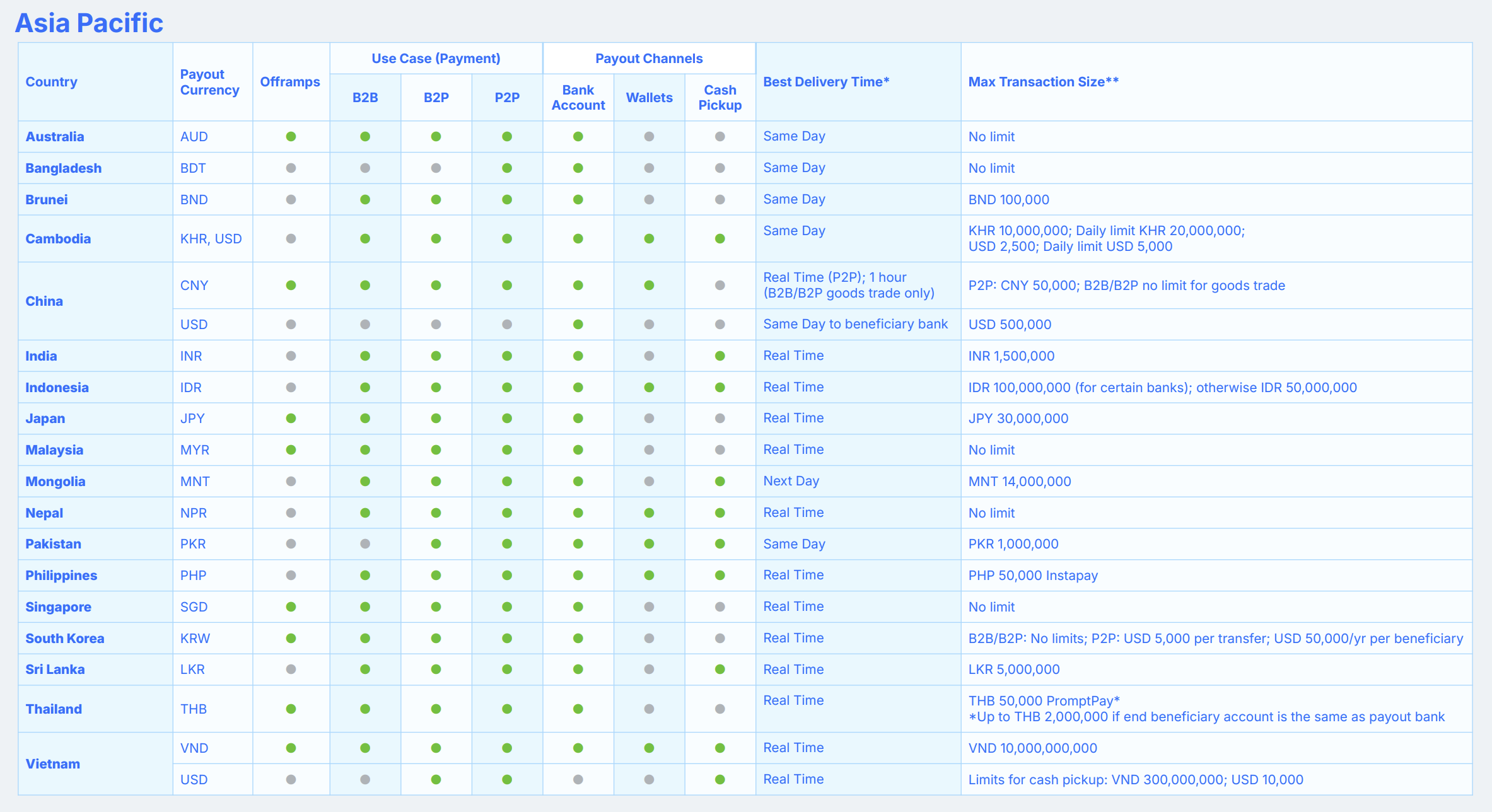

Network

RippleNet

RippleNet is Ripple’s decentralized global payments network connecting banks, payment providers and other financial institutions. Built on a shared blockchain framework (anchored by the XRP Ledger and Ripple’s protocols), RippleNet enables real-time messaging and settlement across different fiat rails

- Real-time payments and messaging (formerly “xCurrent”): Banks connect via API to RippleNet to exchange payment instructions and compliance data, then settle instantly. This ensures cross-border transactions clear in seconds, with end-to-end tracking and atomic certainty. (Ripple’s documentation highlights that RippleNet delivers “real-time settlement with bidirectional messaging”, fitting 24/7 operations including weekends.)

- On-Demand Liquidity (ODL, formerly “xRapid”): This service uses the XRP cryptocurrency to source liquidity for payments on the fly. Instead of pre-funding an account in the destination currency, a user pays into XRP, which is instantly converted and delivered abroad. ODL thus unlocks trapped capital and lowers costs. For example, Ripple estimates trillions in capital sit idle in nostro accounts; ODL dramatically reduces this by using XRP as a bridge currency.

- Single Integration / API (formerly “xVia”): Payment service providers and corporates can plug into RippleNet with a single standardized API. This lets them send global payments (to any RippleNet destination) without building new integrations for each corridor. xVia supports rich invoice data attachments, full transparency of payment status, and compatibility with existing compliance systems.

XRPL Ledger

The XRP Ledger (XRPL) is the decentralized blockchain technology underpinning XRP. Launched in 2012, XRPL was built specifically for payments and value transfer

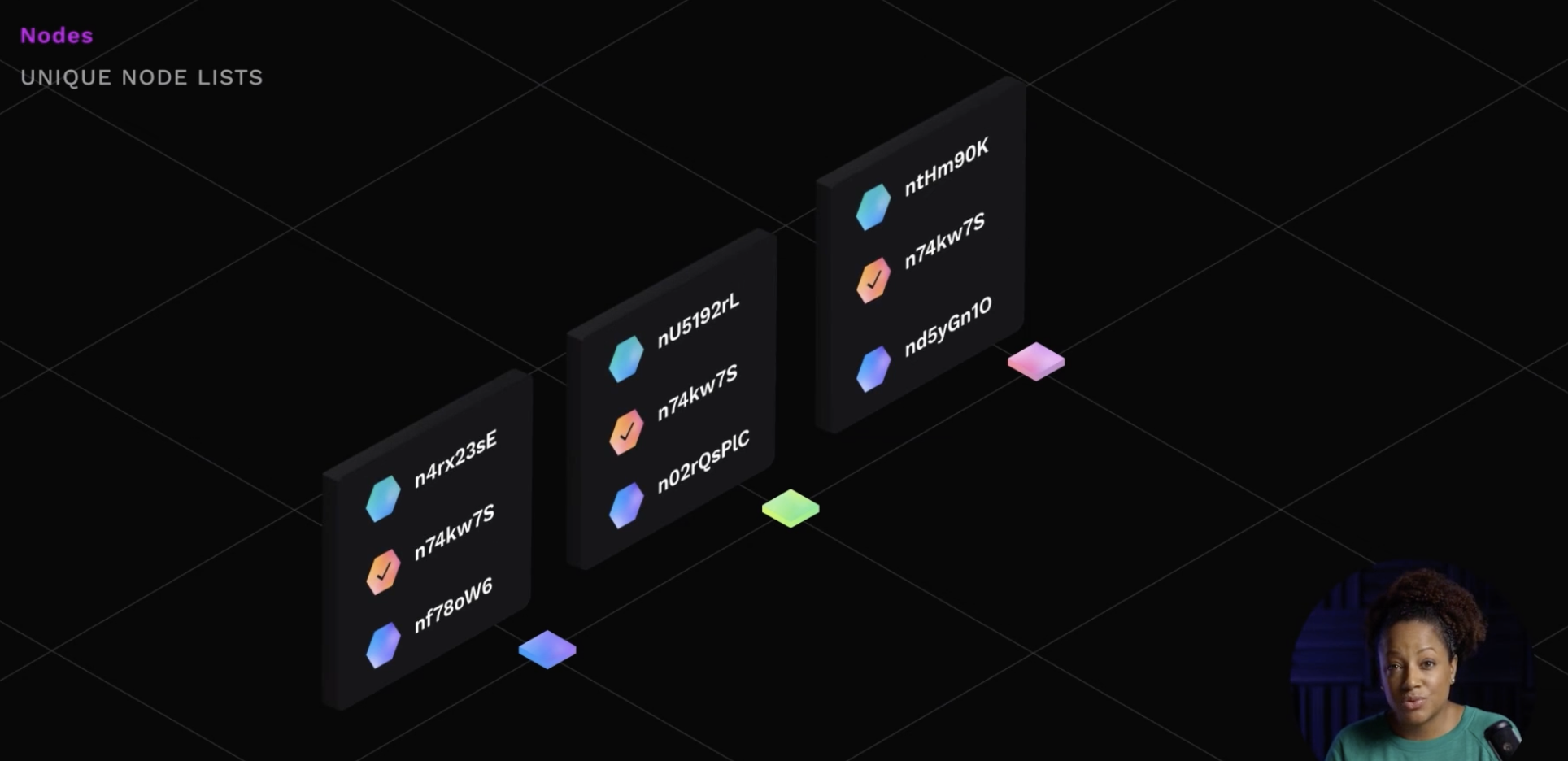

Consensus

- Ripple Protocol Consensus Algorithm, an implementation of Federated Byzantine Agreement, whereby a set of trusted validator nodes reach agreement on the order and validity of transactions every few seconds. This design allows XRP Ledger to confirm transactions in ~3–5 seconds without energy-intensive mining, making it highly efficient and eco-friendly. There are over 100 independent validators globally (institutions, exchanges, universities, and Ripple itself running a minority of nodes) that maintain the network’s integrity.

- Nodes: 907 (497 unmapped): Stock Nodes, Validator Nodes, Hub Nodes

- Validators: 180 (UNL, Unique Node List: 35)

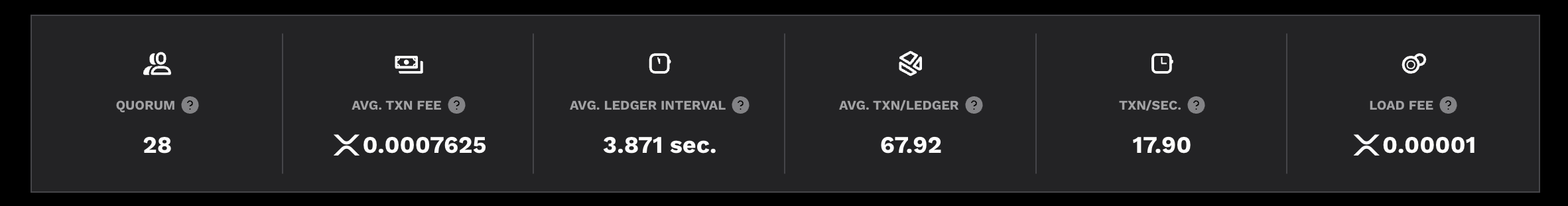

Performance

- Network fees are on the order of 0.00001 XRP per transaction

- Finalize in ~3–5 seconds

- TPS: ~18

On-Chain Activity

| On-Chain Activity | Q4 2024 | Q1 2025 | QoQ |

| Transactions | 167,669,856 | 105,537,589 | -37.06% |

| XRP Burned for Transaction Fees | 724,453 | 500,691 | -30.89% |

| Avg Cost per Transaction (in XRP) | 0.00345 | 0.00340 | -1.28% |

| Average XRP Closing Price (in USD) | 1.43 | 2.70 | 89.41% |

| Avg Cost per Transaction (in USD) | 0.004804 | 0.009180 | 91.10% |

| Volume on DEX (in USD) | 1,001,722,110 | 832,009,294 | -16.94% |

| Trustlines | 7,969,716 | 8,535,483 | 7.10% |

| Number of New Wallets | 709,545 | 423,727 | -40.28% |

| Regulation Efforts |

- DepositAuth, which lets an account strictly reject any incoming money from transactions sent by other accounts. Businesses can use this flag to comply with strict regulations that require due diligence before receiving money from any source

- Authorized Trust Lines feature enables issuers to create tokens that can only be held by accounts that the issuer specifically authorizes. This feature only applies to tokens, not XRP.

- Clawback have the ability to recover issued tokens after they are distributed to accounts.

- Multi-Signing is a method of authorizing transactions for the XRP Ledger by using a combination of multiple secret keys.

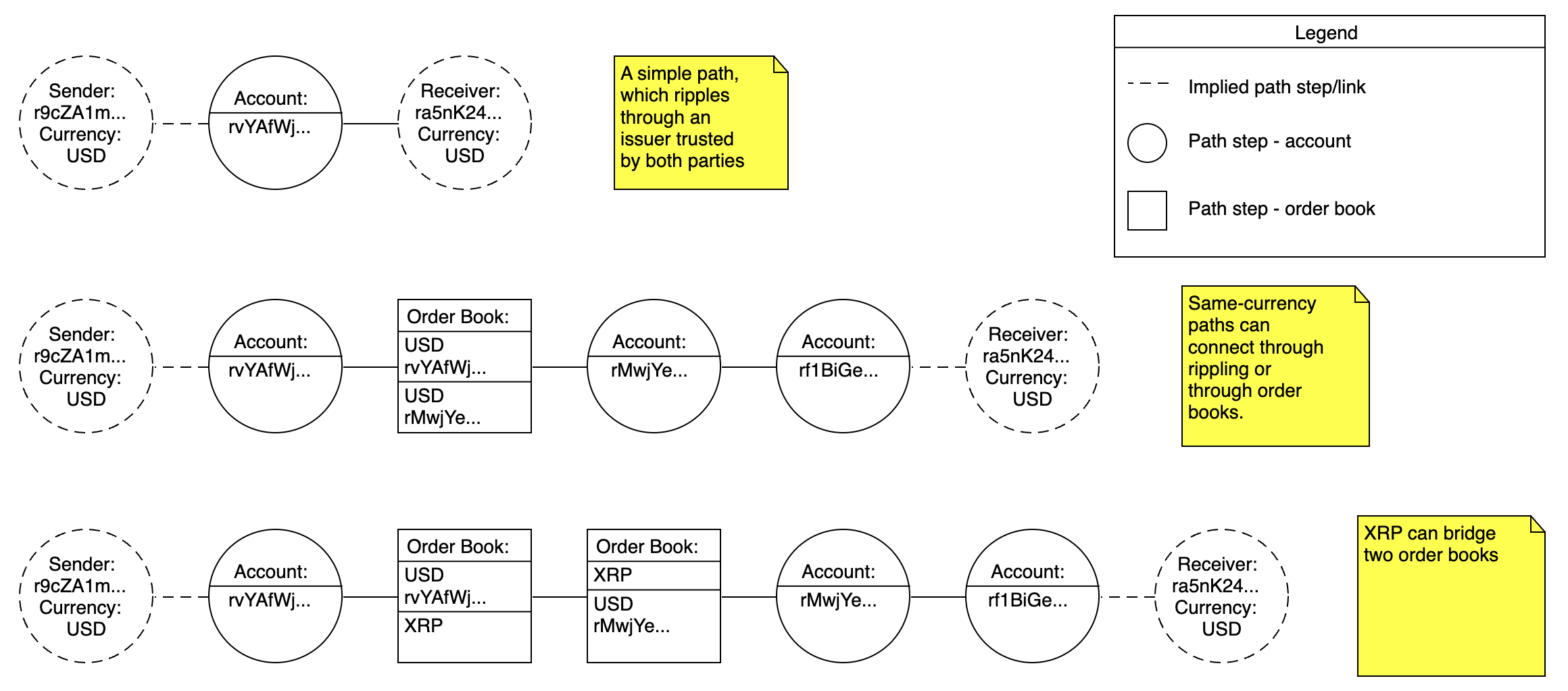

- Path define a way for tokens to flow through intermediary steps as part of a payment

XAO.DAO

The way towards decentralization, a next-gen governance engine built for the XRPL that empowers members to participate, vote, build, and fund real-world innovation.

When the XRP sales progress, the governance is finally out, Ripple now controls 1/3 of the supply.

EVM Sidechain

Bringing Ethereum Smart Contracts to XRPL: The XRP Ledger (XRPL) is known for its speed and efficiency in payments, but historically it lacked the smart contract capabilities that platforms like Ethereum offer. To bridge this gap, Ripple and its partners (notably Peersyst Technology) developed an EVM-compatible sidechain for XRPL. This sidechain is essentially a parallel blockchain that is compatible with the Ethereum Virtual Machine (EVM), meaning it can run Ethereum-like smart contracts and decentralized applications (dApps).

Separate Repo co-built by Peersyst, Axelar, Ripple

Technical Design and Architecture

The XRPL EVM sidechain is designed as a “federated sidechain” to the main XRP Ledger. Key elements of its design include:

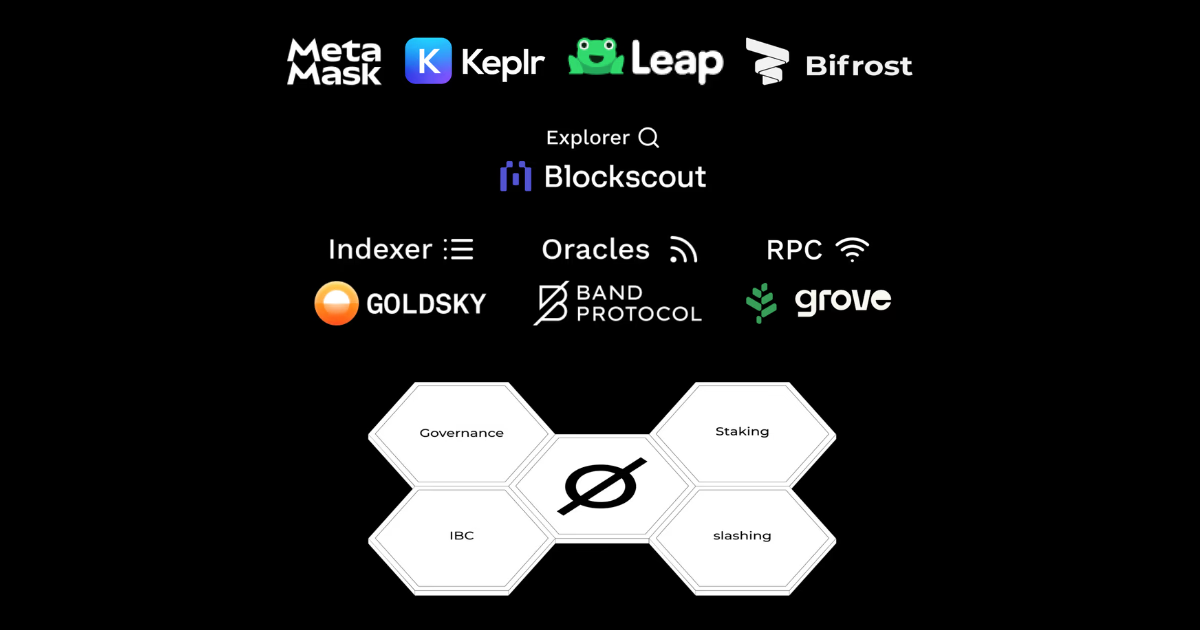

- Ethereum Compatibility: The sidechain supports Solidity smart contracts and the same EVM bytecode that runs on Ethereum, allowing developers to easily port over Ethereum dApps or write new ones for XRPL’s ecosystem. By being EVM-compatible, it can work with existing Ethereum developer tools (Remix, Truffle, Hardhat, etc.) and wallets like MetaMask.

- Block explorers (e.g. Blockscout) to view transactions and contracts

- Indexing services (e.g. Goldsky) for dApp developers to easily query data

- Oracle services (e.g. Band Protocol) to feed external data into smart contracts

- Wallet support from not just MetaMask, but also Cosmos ecosystem wallets like Keplr, Leap, and Cosmostationxrplevm.org.

- Consensus Mechanism: The sidechain uses a consensus algorithm distinct from the main XRPL. Notably, it leverages elements of the Cosmos blockchain framework – Peersyst has indicated the sidechain runs a Cosmos-Tendermint based EVM chain (“Cosmos EVM” is referenced)xrplevm.org. This implies the sidechain might use a Proof-of-Stake validator set (common in Cosmos zones) to achieve fast block times and finality. The Cosmos basis also enables inter-blockchain communication (IBC), which is built-in to Cosmos SDK chains, facilitating interoperability with other chains.

- Federation Bridge to XRPL: Assets (like XRP) can move between XRPL mainnet and the EVM sidechain via a secure bridging mechanism. When XRP is moved to the sidechain, it’s locked on the main ledger and a synthetic equivalent is issued on the sidechain for use in smart contracts. This federation process ensures that every sidechain XRP is backed 1:1 by real XRP on the main network, preserving integrity. A piece of software called a federator links the two ledgers, watching for lock/unlock events and validating transfers between them. This two-way bridge allows value to flow seamlessly: e.g. one can send XRP from XRPL to the sidechain, use it in a DeFi smart contract, then return it to the main ledger.

- Scalability: By offloading computationally intensive tasks (like DeFi trading, lending protocols, NFT marketplaces) to the sidechain, XRPL’s main network avoids congestion. The sidechain can handle these contracts without burdening the main ledger, and if it’s based on a modern PoS chain, it can scale throughput as needed (with faster block times than Ethereum L1 and lower fees). This effectively scales XRPL’s smart contract capacity while the main ledger continues to handle core payments and DEX functions at high speed.

- Interoperability: Uniquely, the XRPL EVM sidechain is being built with interoperability in mind. It plans integration with protocols like Axelar and support for IBC (Inter-Blockchain Communication). This means the sidechain could act as a hub connecting XRPL with other blockchain networks. For example, using Axelar or IBC, assets from other chains (Ethereum, Cosmos-based chains, etc.) could potentially be transferred into the XRPL sidechain’s DeFi ecosystem, and vice versa. It effectively places XRPL into the multi-chain universe, enabling cross-chain liquidity and interactions that were previously not possible for XRP Ledger.

Consensus: Proof of Authority (PoA) consensus model

- a set of trusted validators confirm transactions and produce blocks, ensuring fast finality and low-cost execution. This consensus mechanism aligns closely with the XRPL mainnet while optimizing for EVM compatibility.

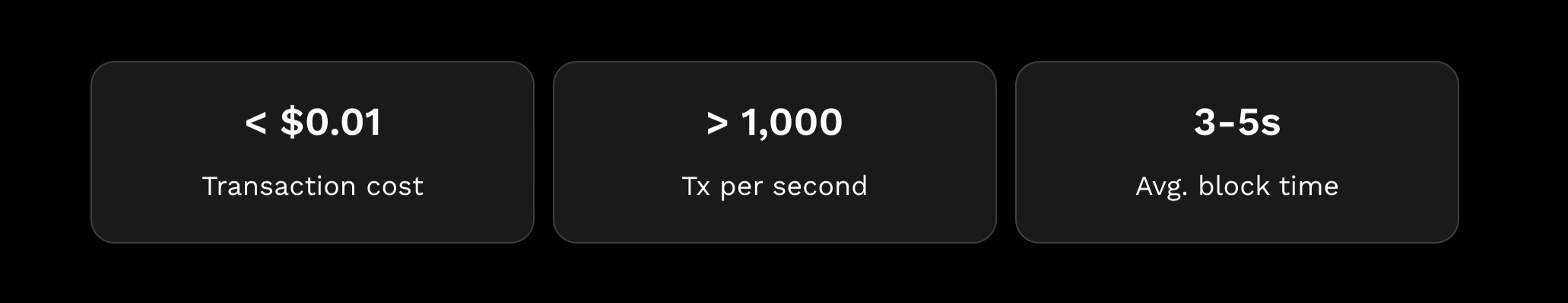

Performance

- Transaction Cost:

- Tps: >1000

- Block Time: 3~5s

Testnet is paused for 2 days

Stablecoin - RLUSD

Ripple USD (RLUSD) is a U.S. dollar–pegged stablecoin introduced by Ripple. Launched in December 2024, RLUSD is designed to maintain a stable value of 1 RLUSD = 1 USD. It is natively issued on the XRP Ledger and also made available on the Ethereum blockchain, making it a multi-chain stablecoin.

Straightforward fully-collateralized model:

- Ripple, through a licensed subsidiary, is the issuer of RLUSD. When users (or institutions) purchase RLUSD, an equivalent amount of USD is placed into reserve. Conversely, when RLUSD is redeemed for USD, the tokens are taken out of circulation (burned) and the corresponding USD is released from reserves. This mechanism ensures RLUSD’s supply is always matched by actual dollars.

- The reserves backing RLUSD are held in a segregated custodian account of cash and cash equivalents. According to Ripple, RLUSD reserves include actual USD deposits and short-term U.S. Treasury bills and other cash-equivalent assets. By holding highly liquid, low-risk assets, RLUSD can confidently honor redemptions even under stress scenarios.

- Transparency: Ripple has committed to regular third-party audits or attestations of the RLUSD reserve. In fact, monthly attestations by independent accounting firms are provided, verifying that the total RLUSD tokens in circulation are fully backed by the reserve assets on a 1:1 basis. This level of transparency is crucial for building trust, especially given past controversies with some stablecoins. Ripple emphasizes having “no reservations about our reserves” – a clear jab at less transparent competitors.

- Regulatory Oversight: RLUSD is issued under regulatory supervision. In early 2025, Ripple secured a New York Department of Financial Services (NYDFS) license for RLUSD. Gaining NYDFS approval (often via a BitLicense or a specific stablecoin license) indicates that RLUSD meets strict standards for reserve management, consumer protection, and compliance. New York’s regulators are known for thorough vetting (they oversee the likes of Paxos’ USDP and Gemini’s GUSD stablecoins), so RLUSD being greenlit suggests high confidence in its soundness. Being regulated also means RLUSD has features like blacklisting/clawback capabilities to comply with law enforcement requests – indeed, RLUSD’s token implementation on XRPL includes a “Clawback” feature allowing the issuer to retrieve tokens in certain conditions (important for enterprise and regulated contexts).

Use Cases

- On/OFF Ramps for Payments: A primary use case is as a settlement asset in Ripple’s payment products. In April 2025, RLUSD was integrated into Ripple’s cross-border payments platform (Ripple Payments). This means banks and payment providers using RippleNet can opt to use RLUSD for settlement instead of XRP or fiat. For example, a bank could convert local currency to RLUSD, transfer RLUSD across the XRP Ledger almost instantly, and convert out to another fiat at the destination. This provides the speed of crypto with the stability of a dollar – particularly useful for institutions that want to avoid crypto volatility. RLUSD essentially streamlines fiat->crypto->fiat flows by acting as a reliable intermediate token. It can also facilitate U.S. Dollar liquidity in corridors where USD is not easily accessible, by tokenizing USD on XRPL.

- Stablecoin for XRPL DeFi: RLUSD quickly became the largest stablecoin on XRPL. By end of Q1 2025, RLUSD reached a $244.2 million market cap combined across XRPL and Ethereum, with about $44.2 million on XRPL. This made it the top stable asset on XRPL’s DEX and AMM pools, providing a stable trading pair for XRP and other tokens. With the introduction of XRPL’s automated market maker (AMM) feature, having a trusted USD token is vital – traders can swap into RLUSD as a safe haven, and liquidity providers can create pools like XRP/RLUSD to earn fees. (Notably, an amendment in Jan 2025 enabled tokens with clawback like RLUSD to be used in XRPL AMMs, so now RLUSD is fully functional in liquidity pools). We’re also seeing yield opportunities: XRP holders can lend RLUSD or provide RLUSD liquidity to earn yields, contributing to a budding XRP DeFi scene.

- Institutional Treasury Use: Enterprises and crypto institutions can use RLUSD for treasury management. Since RLUSD is effectively a digital dollar with fast settlement, an institution can hold RLUSD to deploy funds quickly on-chain or to facilitate trades without going through bank wires. Ripple specifically markets RLUSD for Payment Service Providers, Remittance operators, exchanges, and even banks. For exchanges, RLUSD can be a reliable quote currency (trading pair) that is transparently backed – many exchanges have listed RLUSD in Q1 2025 (Kraken, Bitstamp, LMAX Digital, etc. launched support). For remittance companies, RLUSD can serve as an intermediate token to bridge payouts in different countries (especially useful if XRP’s volatility is a concern – they can use RLUSD for a fully stable path). Even centralized crypto platforms like lending desks or OTC desks can use RLUSD as a dollar balance for clients, knowing it’s redeemable and regulated.

- Bridging Traditional Finance and DeFi: RLUSD also exists on Ethereum, which means it can be used in Ethereum’s DeFi protocols (though its adoption there is still nascent compared to USDT/USDC). Ripple integrated Chainlink price feeds for RLUSD on Ethereum to ensure reliable oracle data, a step toward making RLUSD usable as collateral in lending protocols or other DeFi apps on Ethereum. Additionally, Ripple’s partnerships like the one with BDACS (a Korean custody provider) to custody RLUSD indicates that institutions in various regions are preparing to handle RLUSD for clients, possibly in trading or payments.

Stats

- By end of Q1 2025, RLUSD reached a $244.2 million market cap combined across XRPL and Ethereum, with about $44.2 million on XRPL

- By end of Q2 2025, RLUSD reached a $428.2 million market cap combined across XRPL and Ethereum, with about $65.0 million on XRPL

For CEX adoption now mainly on Kraken, and Bitget. No matter is holdings or daily volume.

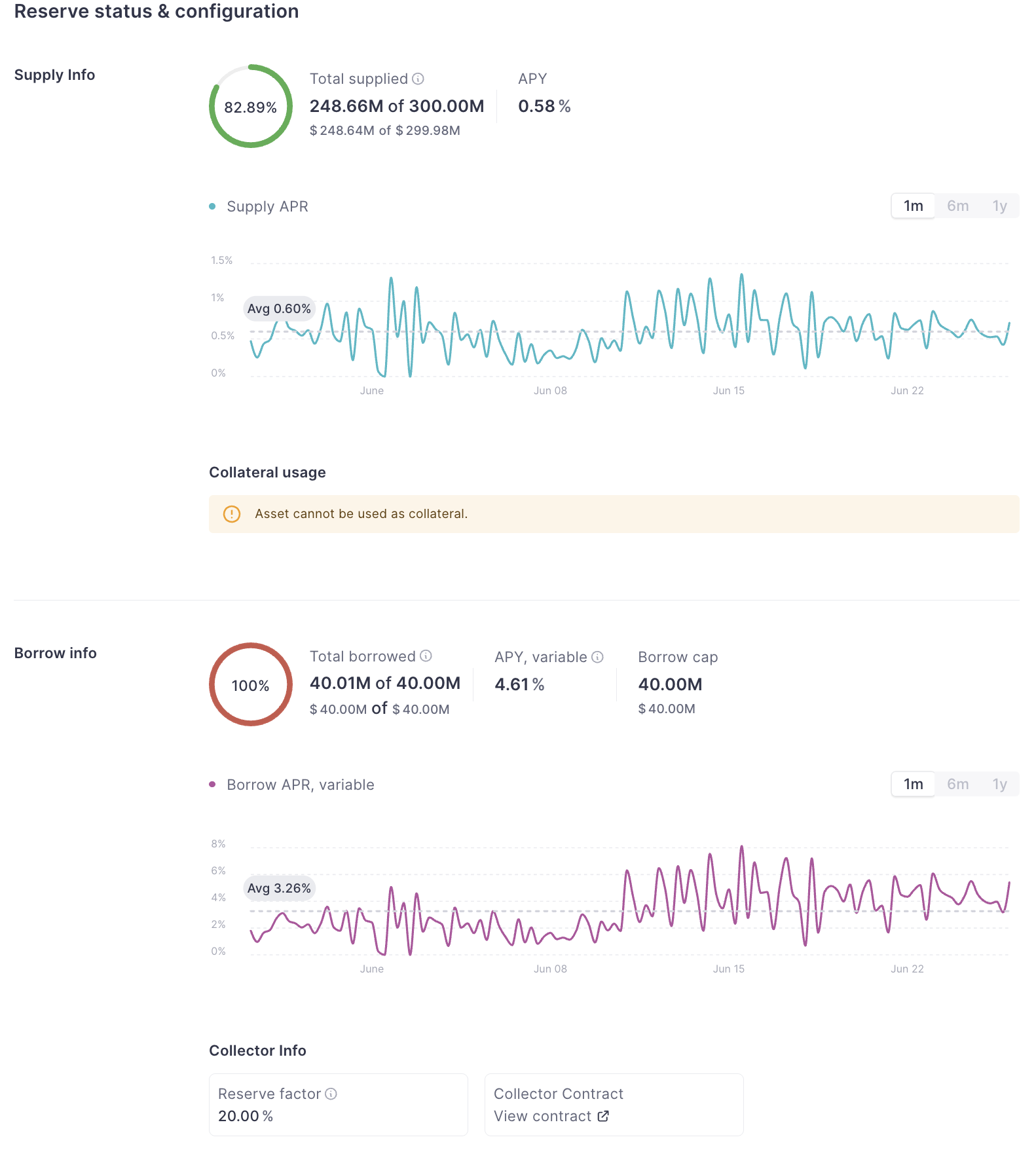

For the 362.2M RLUSD on Ethereum, over half of them are in AAVE.

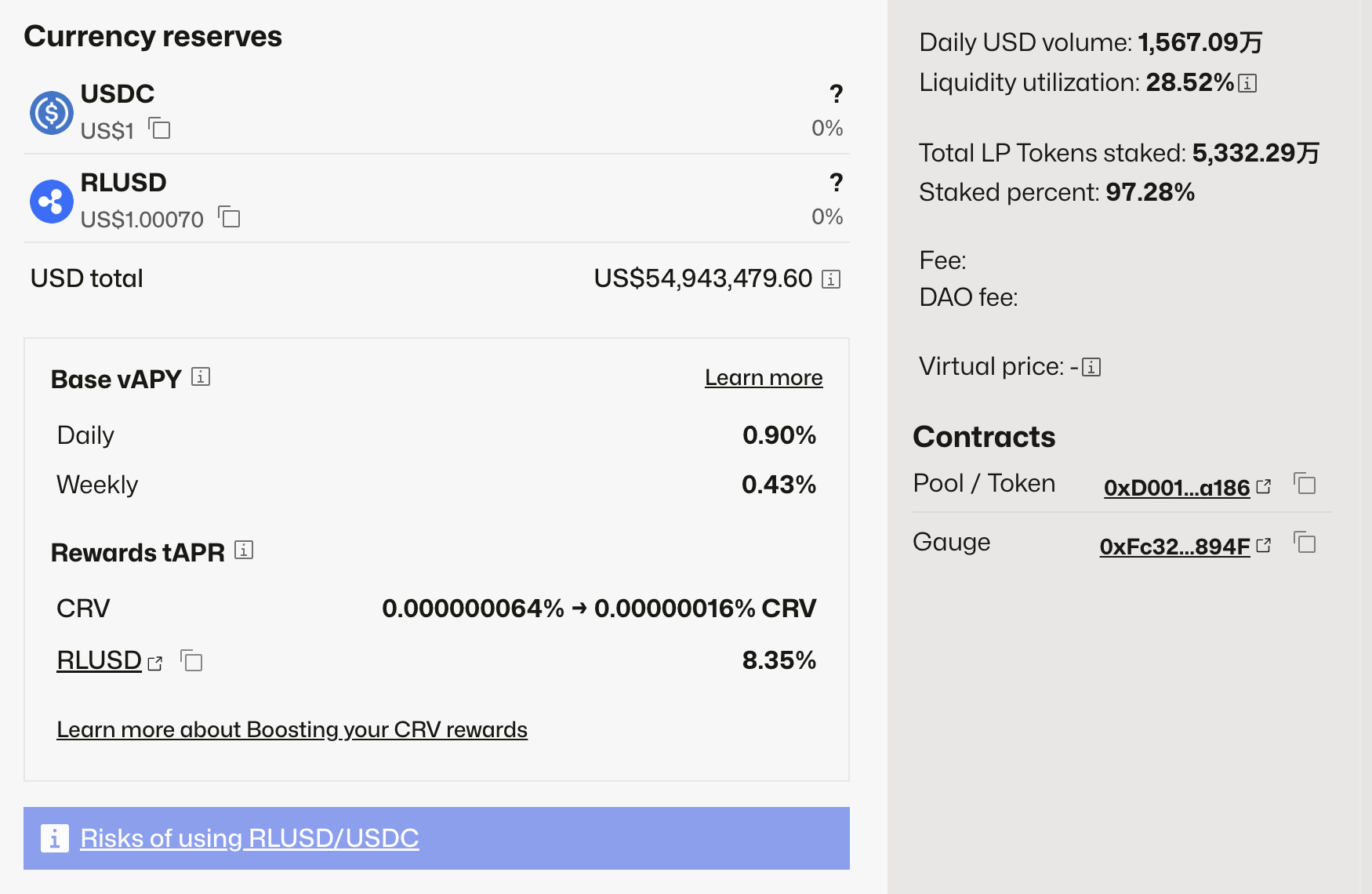

Another 17M is provided liquidity with USDC on Curve, TVL 53M , and daily volume is also concentrated on Curve, Uniswap only occupy 40% of Curve.

For the 65M on XRP Ledger: XRPL Explorer

XRPFi - The Ecosystem

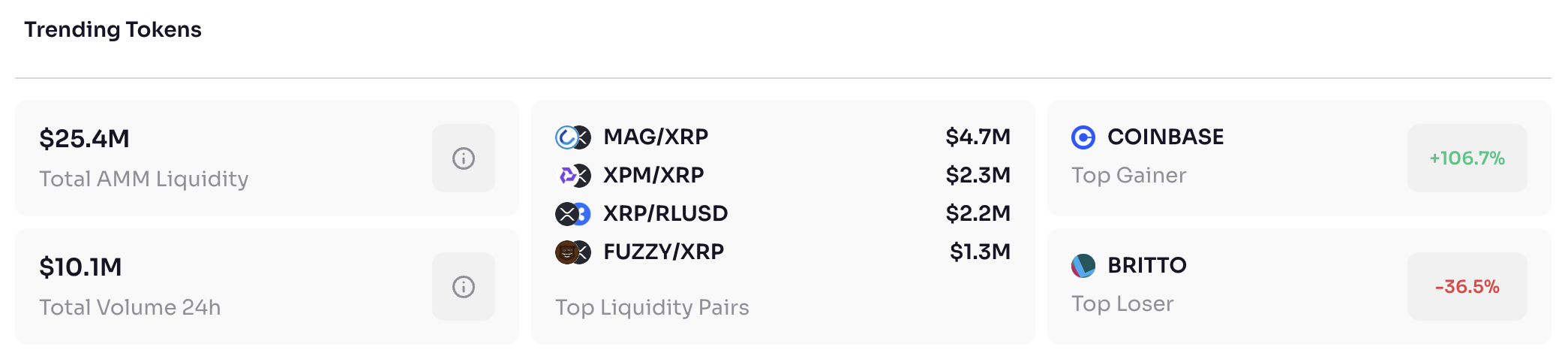

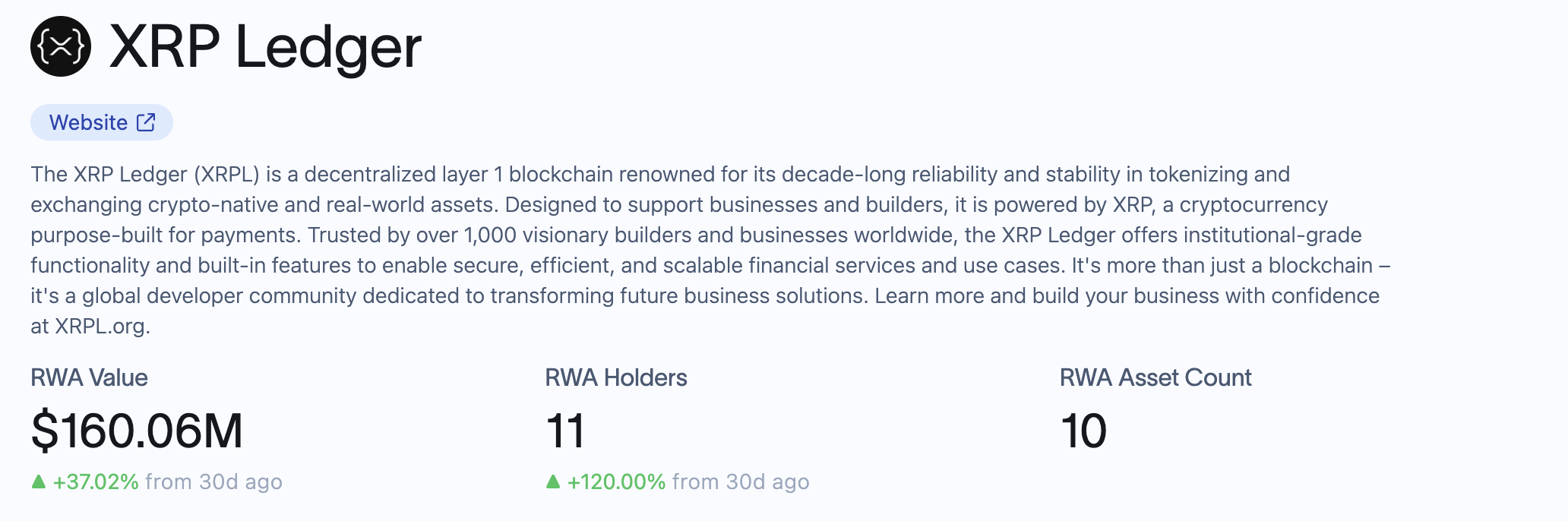

XRPFi is currently focused around XRL Ledger, may expand to future EVM sidechain. And the on-chain stats shows TVL is only 57M, not including RWA stats like Ondo Finance, etc.

XRPL DEX

AMM pools for the XRP Ledger Blockchain, Finds all AMM pools on XRPL, checks their reserves, calculates TVL (in XRP) for each pool and sums them up

-

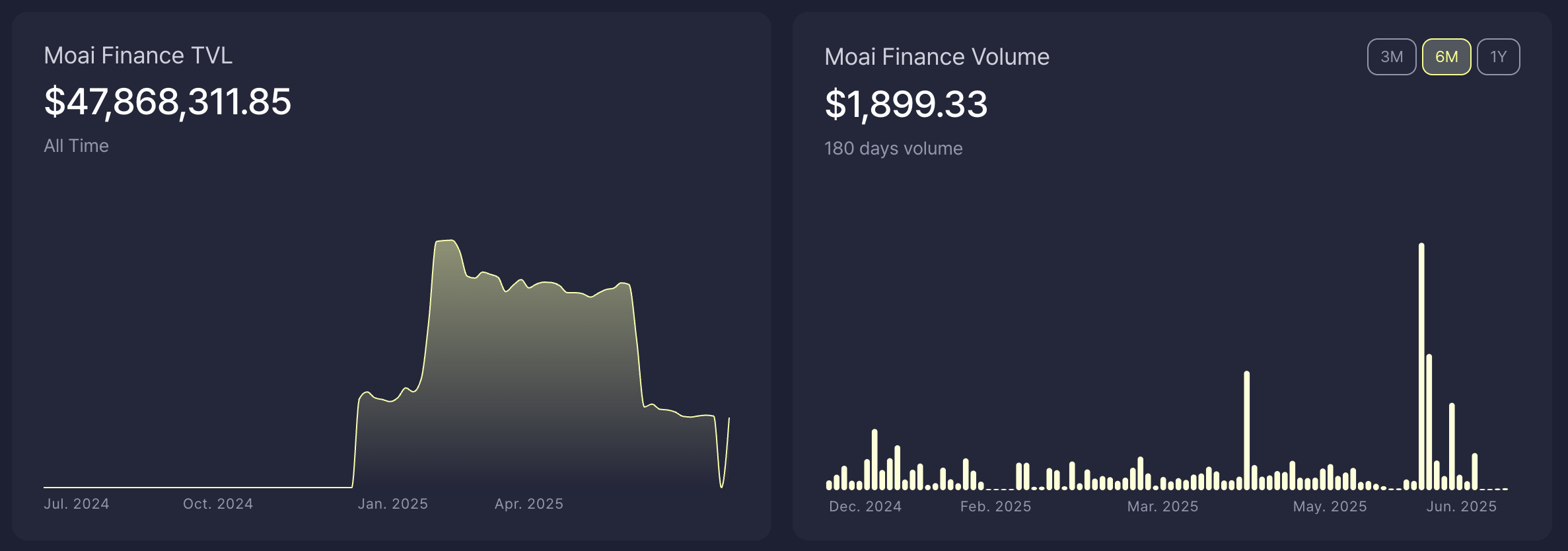

Moai Finance: TVL 47M

-

XPMarket: 25.4M

-

Sologenic DEX

- DEX

- NFT

- Fiat Ramps

- Crypto Card

-

Orchestra Finance: largest pool, 36k

-

First Ledger Bot: trading tool

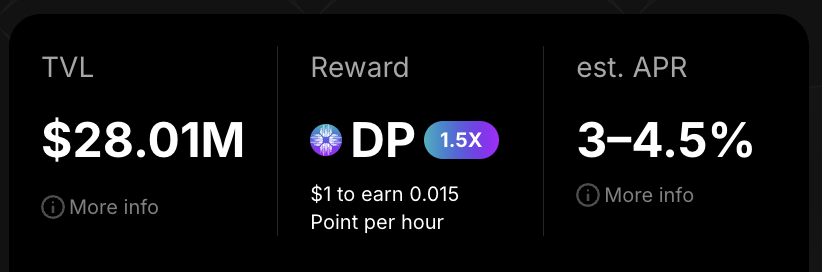

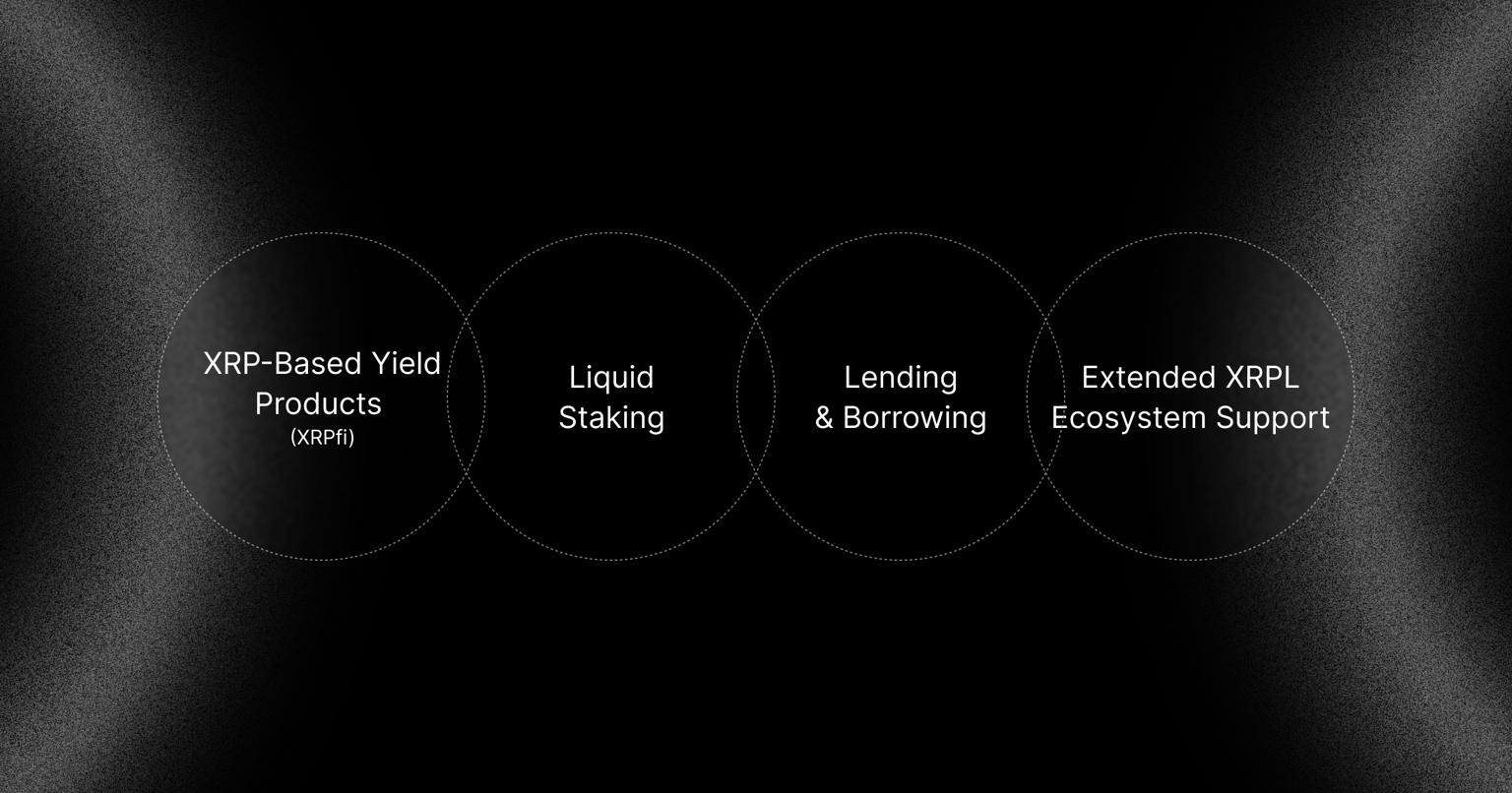

Doppler Finance

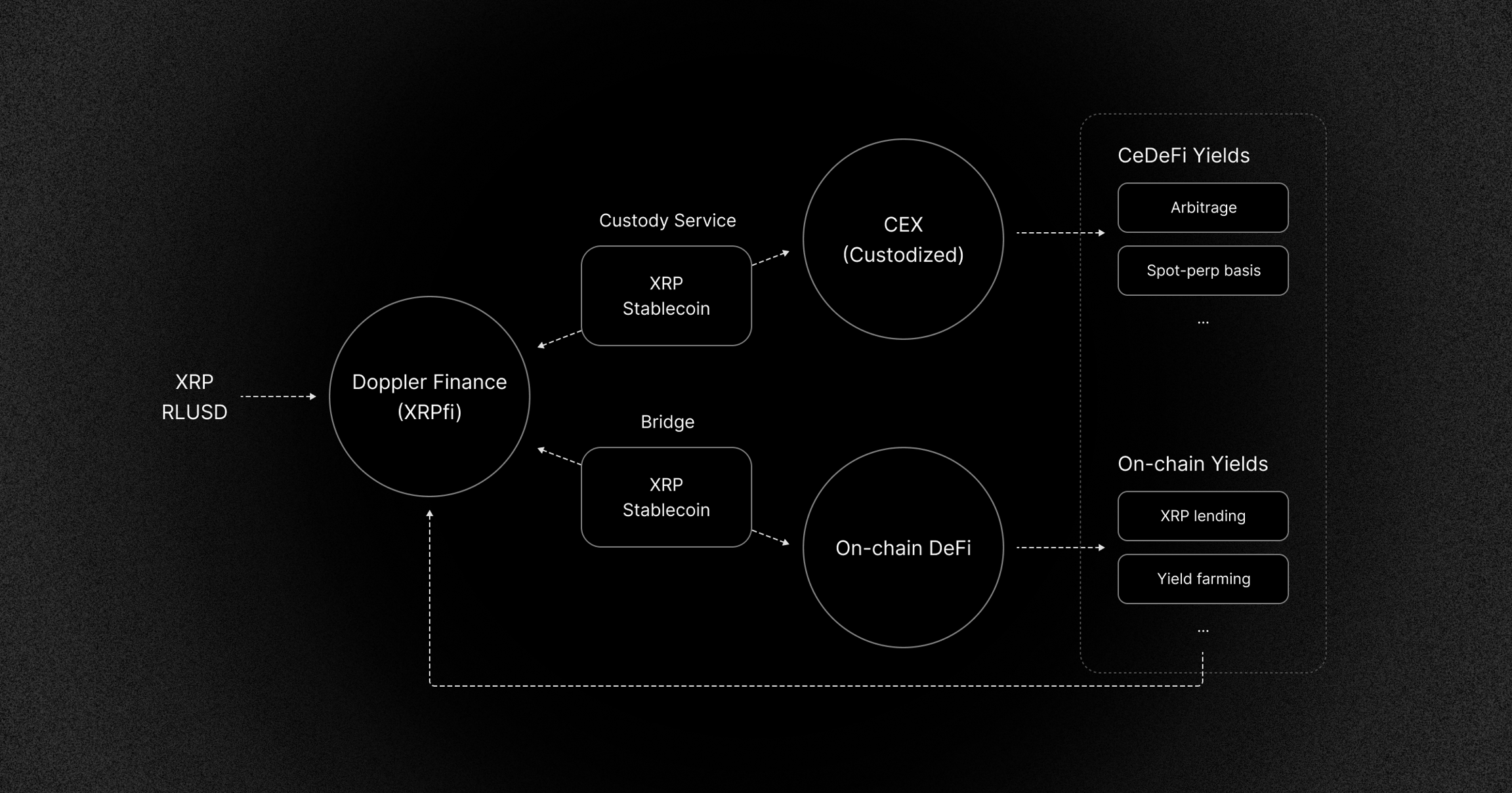

The only projects has highlighted XRPFi. XRPfi refers to a set of on-chain DeFi activities built around XRP. Copy paste BTCFi.

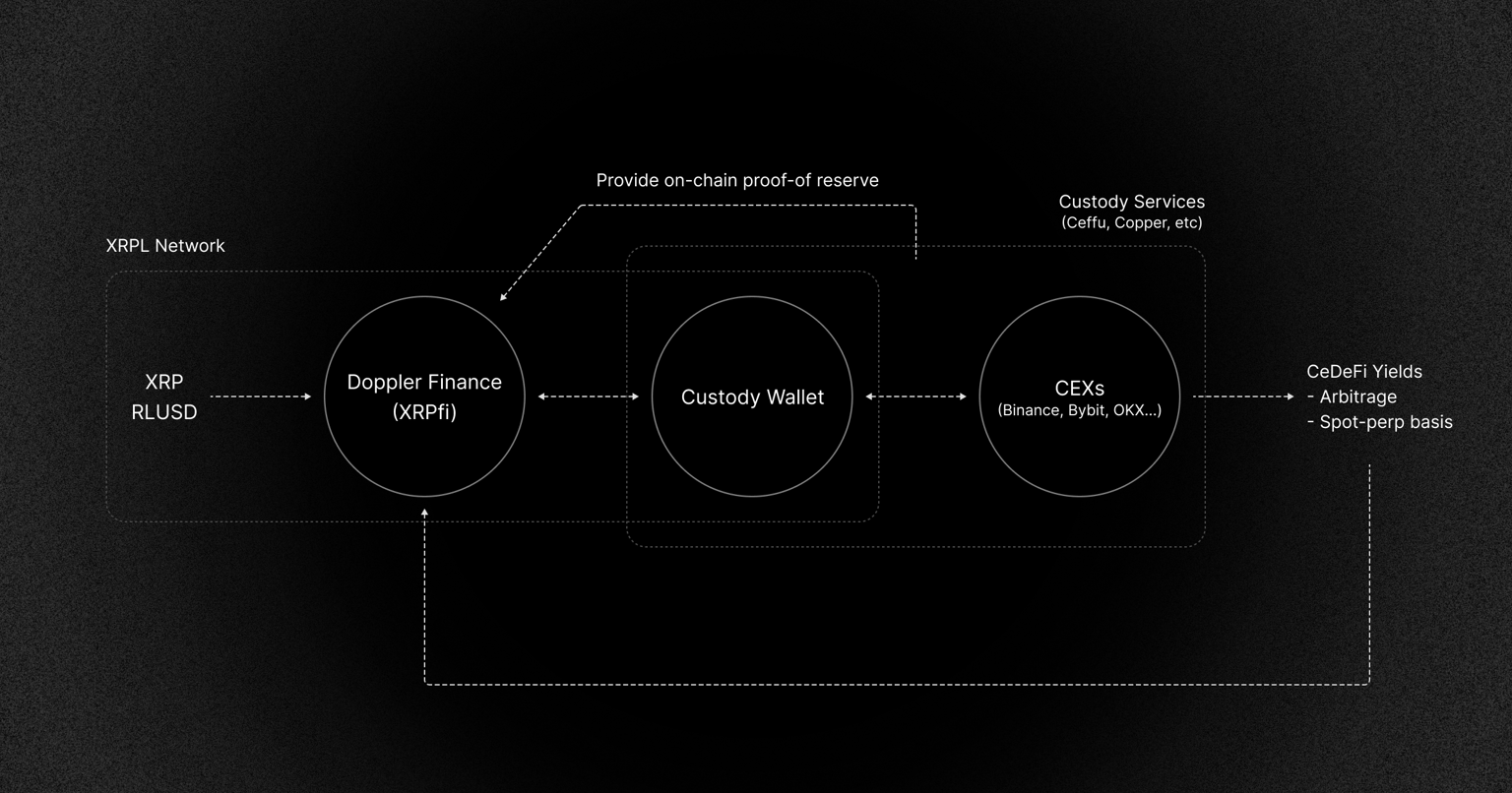

CeDeFi Product, Yield Platform for XRPL Ecosystem. Accepts XRP deposits on the XRPL network, securely storing them in a trusted custody wallet. Future CeDeFi yield opportunities will enable users to earn rewards safely and conveniently. Currently, only accept XRP, but would enable RLUSD in the future, the frontend is ready, not enabled.

Yield Opportunities:

- CeDeFi Yield: integrating institutional-grade custody solutions(Fireblocks, Ceffu, Bitgo not live yet), Doppler Finance’s XRPfi offers a secure revenue for XRP holders to participate in institutional-level yield strategies in secure ways.

- XRP-Neutral Arbitrage: designed to accumulate more XRP, short-lived price inefficiencies rather than broad market trends, it remains inherently more stable—even in volatile conditions

- Spot–Perpetual Arbitrage: perpetual market funding rates to generate yield.

- On-chain Yield: Taking advantage of EVM-compatible sidechains and a rapidly evolving XRPL ecosystem, Doppler Finance provides direct access to on-chain DeFi opportunities. These on-chain strategies enable users to generate yield on XRP in a decentralized environment. To do this, Doppler Finance is pioneering the on-chain adoption of XRP throughout the Web3 DeFi ecosystem.

RWA

Fund

Treasury Fund

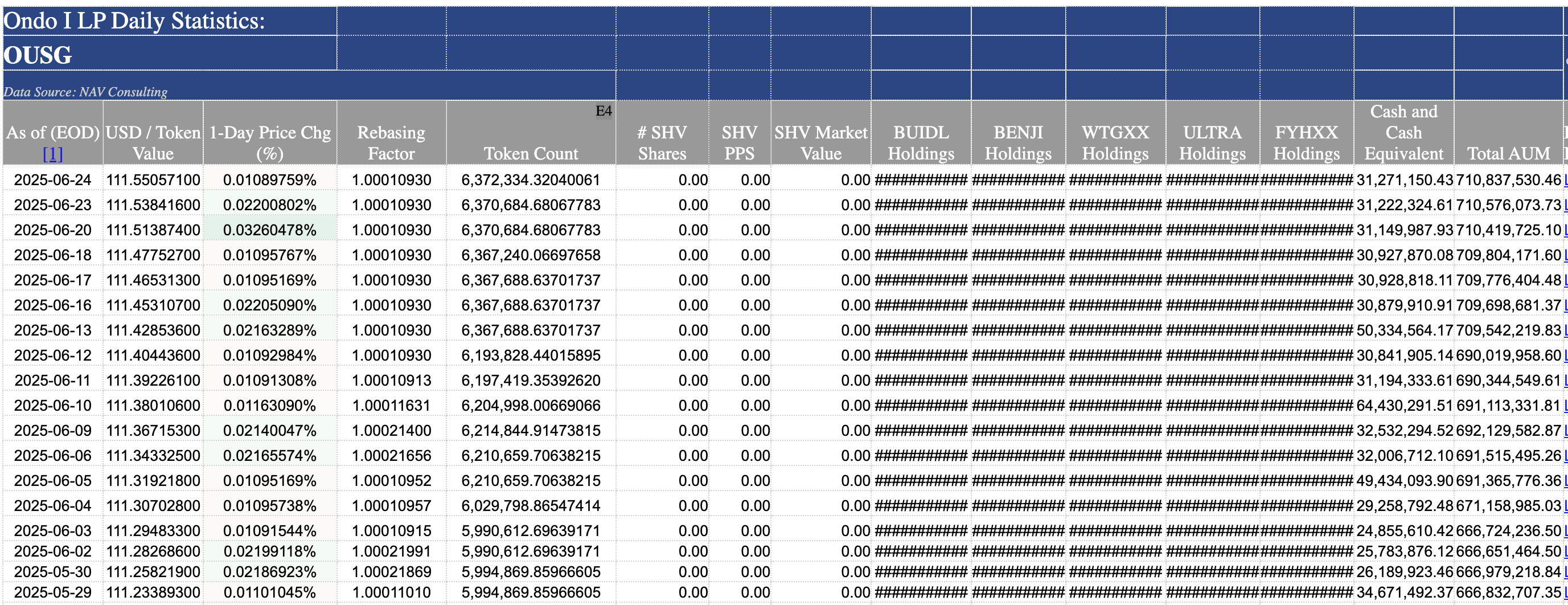

Ondo Finance(30M) deployed its flagship tokenized U.S. Treasuries fund (OUSG) on the XRP Ledger. OUSG was one of the first tokenized money-market instruments, originally on Ethereum and Polygon – by adding XRPL as an issuance chain, Ondo can offer faster, cheaper transactions and use Ripple’s RLUSD stablecoin for 24/7 fund subscriptions/redemptions. OUSG

Qualified Purchasers and institutions can convert in and out of OUSG using RLUSD, making use of a settlement and liquidity model tailored for capital efficiency. OUSG total TVL is around 710M, 50% of Ondo Finance. OUSD on XRP Ledger is around 30M, 4% of total OUSG

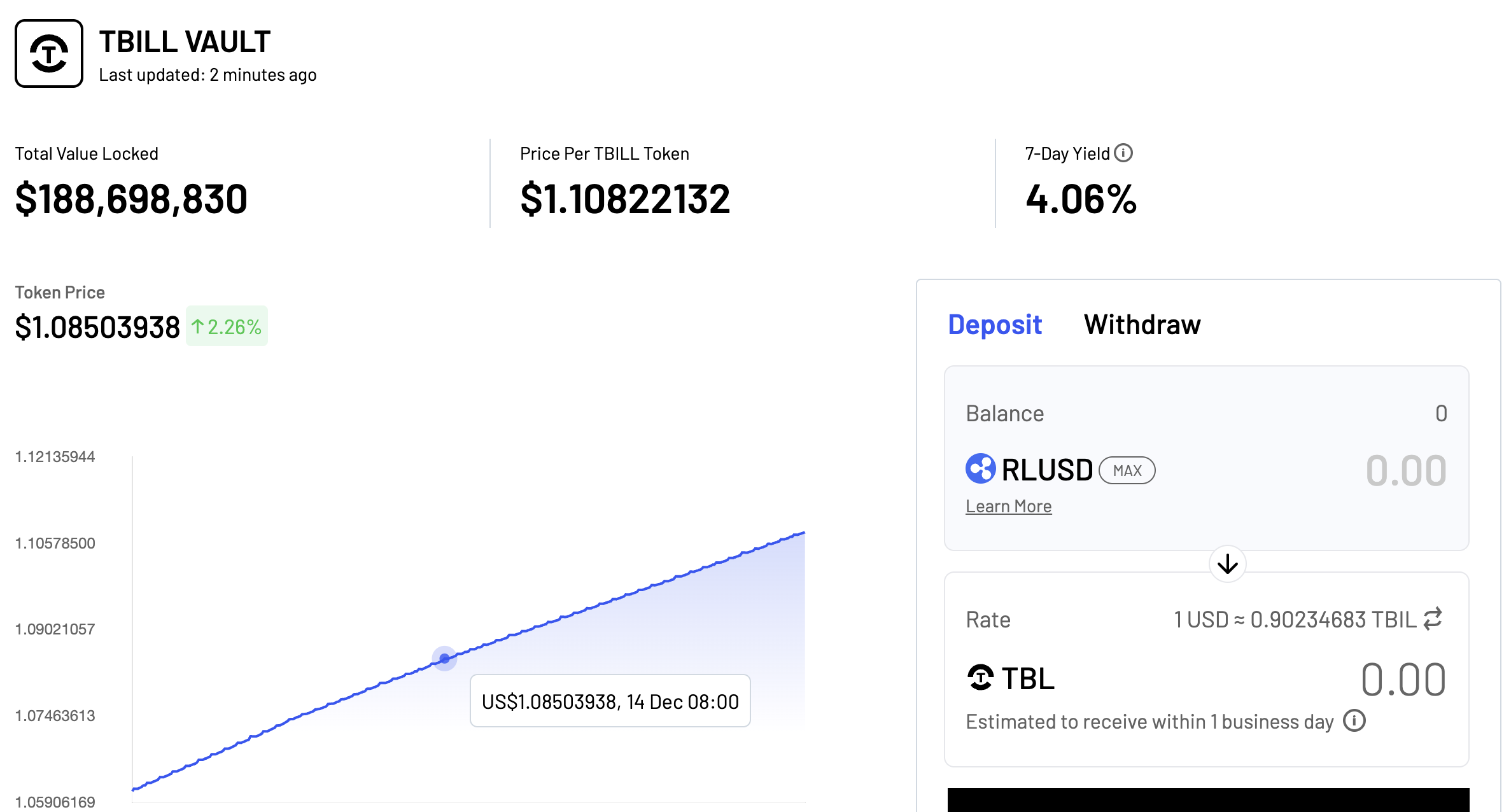

OpenEden(5M), TBILL Tokens are issued by Treasury Bills Institutional Liquidity Limited, a BVIFSC regulated professional fund (“TBILL Fund”) and are only available to Professional Investors as defined under the BVI Securities and Investment Business Act. TBILL Tokens are only available to eligible customers

Size on Ripple is only 5M, and the average APY is around 4%

Money Market Fund

In 2024, Ripple extended a partnership with Archax(55M), a London-based digital securities exchange regulated by the FCA, to bring “hundreds of millions of dollars” of real-world assets onto XRPL. At the XRPL Apex summit in June 2024, Ripple and Archax announced the first ever tokenized money market fund on the XRP Ledger – providing access to Abrdn’s $3.8 billion USD Liquidity Fund in tokenized form. Ripple itself allocated $5 million to seed this fund on-ledger, signaling its commitment to bootstrap RWA liquidity on XRPL.

Private Equity/Debt Fund

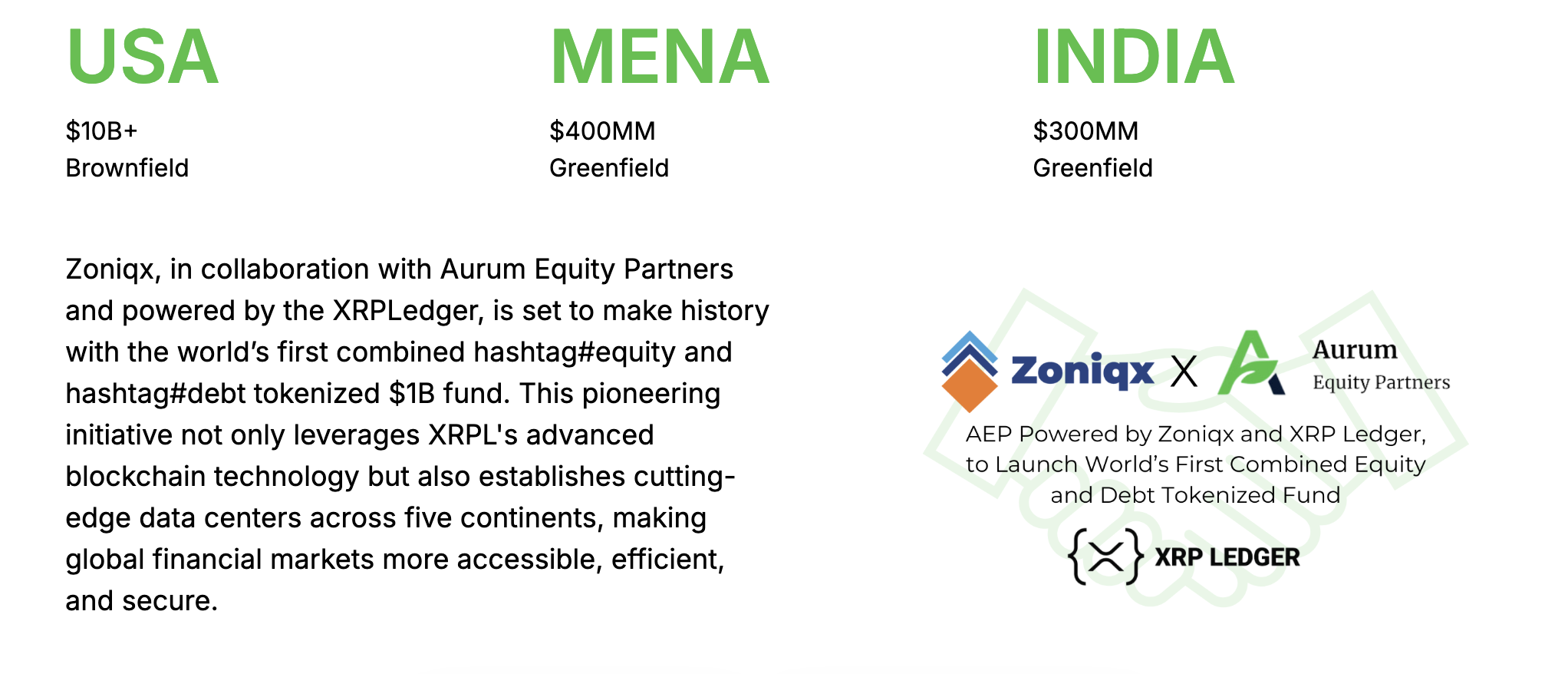

Zoniqx, a fintech platform specializing in compliant security tokens, worked with Aurum Equity Partners to launch a $1 billion tokenized fund on XRPL that combines equity and debt assets This fund is used to finance data center projects across multiple countries, and its tokens live on the XRPL. By using Zoniqx’s tokenization lifecycle tools and XRPL’s features, the project enables investors to buy into private equity/debt with greater liquidity and transparency

Stocks

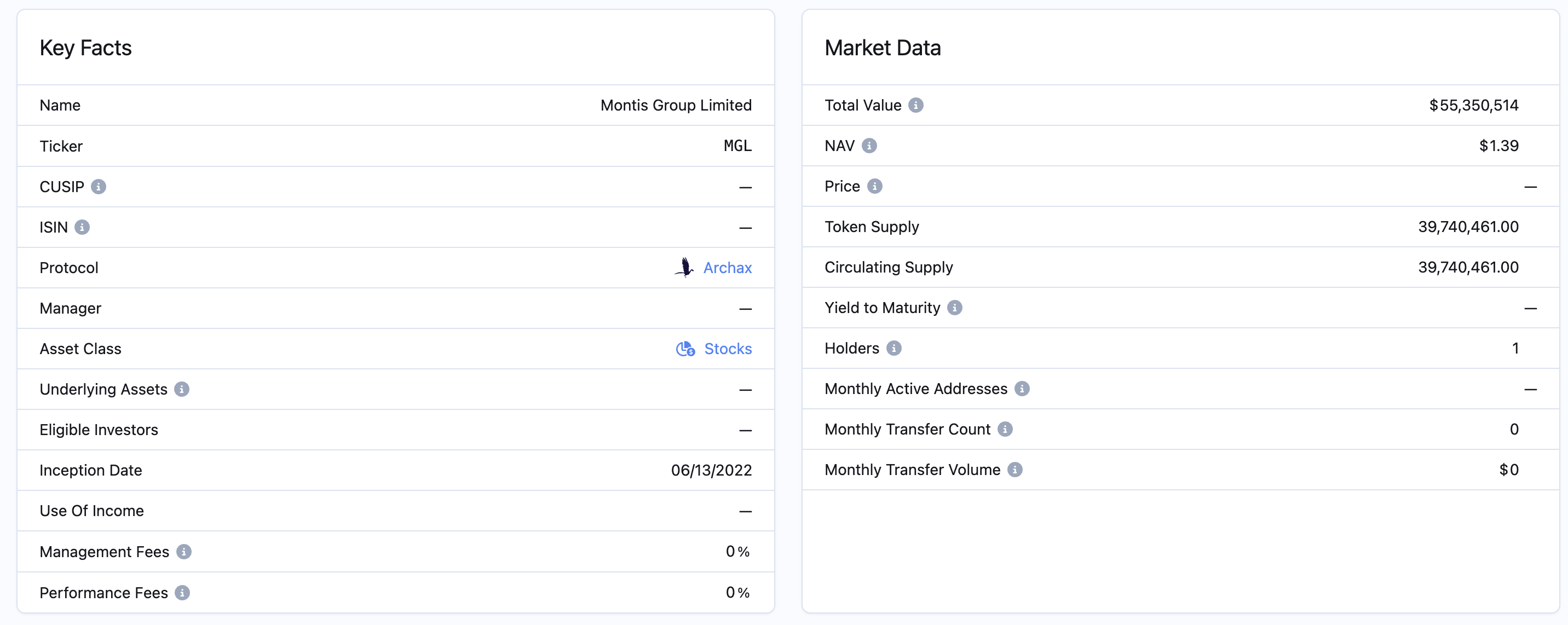

Montis Group Limited(55M) is a market infrastructure service provider developing innovative post-trade solutions leveraging DLT, such as Montis Digital SA, a digitally native Central Securities Depository in Luxembourg. Also build upon Archax

Commercial Paper

Guggenheim Partners(10M) in 2025 launched digital commercial paper (DCP) on XRPL as a way to streamline short-term debt markets. Guggenheim had tested issuing commercial paper tokens on Ethereum, but migrated to XRP Ledger for its enterprise-grade throughput and real-time settlement, which are better suited for high-volume financial instruments. Ripple invest in DCP as part of its commitment.

DCP is fully backed by maturity-matched U.S. Treasury securities and is offered daily at custom maturities of up to 397 days. DCP is currently available exclusively to Qualified Institutional Buyers (QIBs) and Qualified Purchasers (QPs).

Gold

Meld Gold, an Australia-based company that partnered with Ripple to issue tokens backed by physical gold and silver on the XRP Ledger. Slated for launch in Q3 2024, each gold token (AUS) represents 1 gram of gold stored in vaults, bringing the stability of a precious metal to the XRPL network.

Carbon Credits

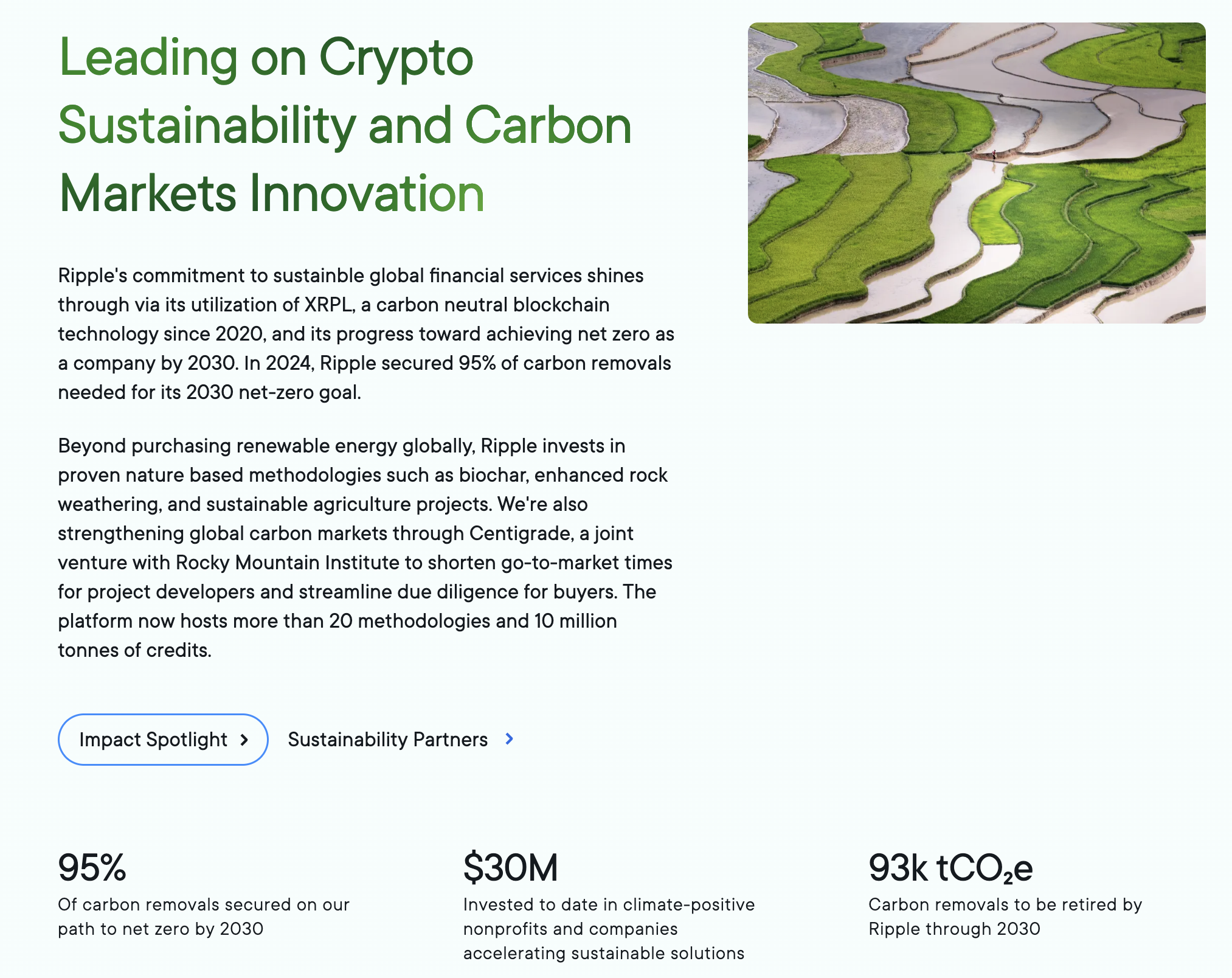

Over 1 million tokenized carbon credits were issued on XRP Ledger, as part of sustainability initiatives. Carbon credit marketplaces built on XRPL (with partners like Xange and Carbonland Trust) allow companies to trade tokenized carbon offsets with traceability and integrity, illustrating another real-world asset domain being enhanced by XRPL’s transparency. Ripple Annual Impact Report | Ripple

XRP ETFs and XRP Treasury

ETFs

- Franklin Templeton filed an S-1 for a spot XRP ETF in the U.S.

- CME announced the expansion of its crypto derivatives suite with the launch of XRP futures, and Volatility Shares submitted applications for three XRP ETFs.

- Brazil’s Comissão de Valores Mobiliários approved a dedicated XRP ETF, expanding access in Latin America, while Teucrium's 2x Long Daily XRP ETF debuted with $5M in trading volume, ranking it among the top 5% of new ETF launches

XRP Treasury

TDTH

Singapore-based Web3 services firm, announced on June 12, 2025 that it would raise up to $500 million to create a corporate treasury of the cryptocurrency XRP.

- Size & Structure: $500M crypto buy would dwarf the company’s equity value, and that Trident was already under a Nasdaq notice for low share price and market-cap in May 2025

- Timeline: Initial XRP purchases and deployment planned for late 2025 (second half), pending legal/regulatory approvals

- Funding Sources: Will raise funds through stock offerings, strategic placements and other instruments

- Advisors & Partners: Appointed Chaince Securities (USA) as strategic advisor; collaborating with Ripple-network infrastructure projects. Ongoing discussions with “crypto foundations and institutional partners” are intended to ensure liquidity, favorable pricing and supporting infrastructure

Webus

- Size & Structure

- Target reserve: up to US $300 million in XRP, set as the authorized mandate cap in the Delegated Digital-Asset Management Agreement.

- Framework: Samara Alpha will custody and manage the tokens; the mandate only activates once Webus actually transfers assets—no XRP has been bought yet. the plan is phased and subject to financing, with no fixed purchase timeline yet.

- Timeline

- 29 May 2025, Financing plan announced

- 2 Jun 2025, Management agreement signed

- 4 Jun 2025, Form 6-K filed with SEC, confirms intent; stresses funding via loans / credit lines.

- Funding Sources

- Non-equity instruments: available cash, bank loans, shareholder guarantees and third-party institutional credit facilities; explicitly “loans and credit lines rather than new share issuance.

- Advisors & Partners

- Samara Alpha Management LLC – exclusive delegated digital-asset manager (SEC-registered RIA).

- Tongcheng Travel Holdings – renewed nationwide mobility partnership that will test XRP-settled ride payments.

- RippleNet / XRP Ledger (planned) – Webus plans to integrate Ripple’s network to enable instant cross-border chauffeur payouts and refunds.

VivoPower International(VVPR)

Size & Structure

- Target reserve: up to US $121 million of XRP, funded by a private placement priced at US $6.05 per share.

- Initial purchase mandate: VivoPower will acquire US $100 million in XRP via BitGo’s OTC desk, then deploy the same amount on Flare to generate yield; additional tranches may follow as the placement is completed.

- Treasury model: Hold XRP long-term as a reserve asset while staking/yield-farming on Flare and using Ripple’s forthcoming RLUSD stable-coin for cash-equivalent liquidity.

Timeline

| Date | Milestone | Key details |

|---|---|---|

| 28 May 2025 | Strategy announced | XRP-focused treasury plan + US $121 M private placement unveiled. |

| 2 Jun 2025 | BitGo partnership | BitGo named exclusive OTC trader & custodian for the first US $100 M XRP buy. |

| 11 Jun 2025 | Flare partnership | Definitive deal to deploy US $100 M XRP on Flare and adopt RLUSD for operations. |

| 20 Jun 2025 | Phase-1 closing | First US $60.5 M of the placement funded; second half pending shareholder vote. |

| H2 2025 (target) | Initial XRP transfer | Company indicates first on-chain purchases will occur after placement fully closes and regulatory clearances are obtained. |

Funding Sources

- Private equity placement: US $121 M Regulation S share issue led by HRH Prince Abdulaziz bin Turki Al Saud and other institutional crypto investors.

- Use of proceeds: Primary allocation to XRP accumulation and XRPL/DeFi build-out; smaller portions for debt reduction and working capital.

Advisors & Partners

- Adam Traidman – ex-Ripple board member; joins as Chairman, Board of Advisors and investor.

- BitGo – exclusive OTC trading desk and institutional-grade custodian for XRP holdings.

- Flare Network – yield-generation partner; VivoPower to deploy XRP via Flare’s FAssets system.

- Ripple (RLUSD) – VivoPower will integrate Ripple’s RLUSD stablecoin for cash management within its treasury stack.

- Chardan – sole placement agent for the US $121 M financing.