The Convergence of Web2 and Web3 Payments

Macro Backdrop: From Competition to Convergence

We have moved beyond the binary narrative of "Web3 replacing Web2" and entered a more profound phase of "Convergence." With the signing of the GENIUS Act in the U.S. and Stripe’s $1.1 billion acquisition of Bridge, stablecoins are being systematically modularized to address efficiency gaps in traditional banking rails.

Web2 giants are actively assimilating the technical advantages of Web3 (speed, programmability, openness), while Web3 protocols are diligently integrating the commercial necessities of Web2 (compliance, risk management, user experience).

Specifically, Web2 Card Networks and Payment Service Providers (PSPs) are transforming stablecoins into a "backend clearing layer." Visa has integrated USDC into its settlement network, supporting settlement across four public chains: Ethereum, Solana, Stellar, and Avalanche. End merchants may not even realize funds are moving via blockchain. For instance, when consumers use a Coinbase Card or Crypto.com Card, the Visa network handles the fiat-to-crypto conversion and clearing in the background. Similarly, Stripe, through Bridge's technology, allows merchants to accept cross-border payments in stablecoins that are automatically converted to local fiat currency, eliminating exchange rate volatility risk. This "overlay" strategy is prioritizing cross-border B2B and international payroll scenarios, where pain points are most acute and profit margins are highest.

Conversely, we see Circle launching programmable wallets and compliance engines to help enterprises meet KYC/AML requirements. Decentralized trading protocols like Uniswap are also exploring KYC verification via Hooks to satisfy institutional investors' compliance needs. This bi-directional integration makes stablecoins not just a technical protocol, but a complete commercial solution.

Inflection Point: From Gray Zone to Institutionalization

The GENIUS Act established the legal status of Payment Stablecoins, setting a benchmark for global regulatory frameworks. Before the GENIUS Act, large financial institutions (FIs) were hesitant to enter the stablecoin business, primarily due to reputational risk and legal uncertainty. Following the act's passage, the logic for institutional entry fundamentally shifted. Now, the trigger for adoption is no longer technical maturity, but the satisfaction of four compliance dimensions:

- Verifiable Reserves & Audits: The Act’s requirement for monthly audit reports provides legal endorsement.

- Clear Redemption Rights: The Act guarantees users the statutory right to redeem stablecoins at Par Value, allowing them to be treated as "cash equivalents" on balance sheets rather than high-risk investments.

- Defined Liability for Issuance & Distribution: The Act clarifies who can issue stablecoins (licensed non-bank issuers or depository institutions), resolving the liability question of "who to sue."

- Enforceable Sanctions/AML: By mandating the integration of on-chain analytics tools (e.g., Chainalysis, TRM Labs), institutions can ensure fund flows comply with OFAC sanctions requirements.

With the regulatory framework established, future market competition will no longer be a single-dimensional contest.

Web2 Value Chain

In the traditional payment ecosystem, profits are concentrated in several key nodes:

- Interchange & Scheme Fees: These are the primary revenue sources for Visa/Mastercard and Issuers. For every credit card transaction, merchants pay a 1.5% - 3% fee, the majority of which is distributed to the Issuer as an Interchange Fee.

- Cross-Border FX Spread: In cross-border payments, banks and remittance companies typically add a markup to the exchange rate. This hidden fee can be as high as 3% - 5%.

- Value-Added Services (VAS): Includes risk management (e.g., Stripe Radar), identity verification, reconciliation services, and merchant financing.

However, the era of pursuing growth purely via Total Payment Volume (TPV) has ended. Market valuation logic has shifted from "Scale" to "Quality"—specifically, the resilience of the Take Rate, the Float generated from retained funds, and the penetration rate of Value-Added Services (VAS).

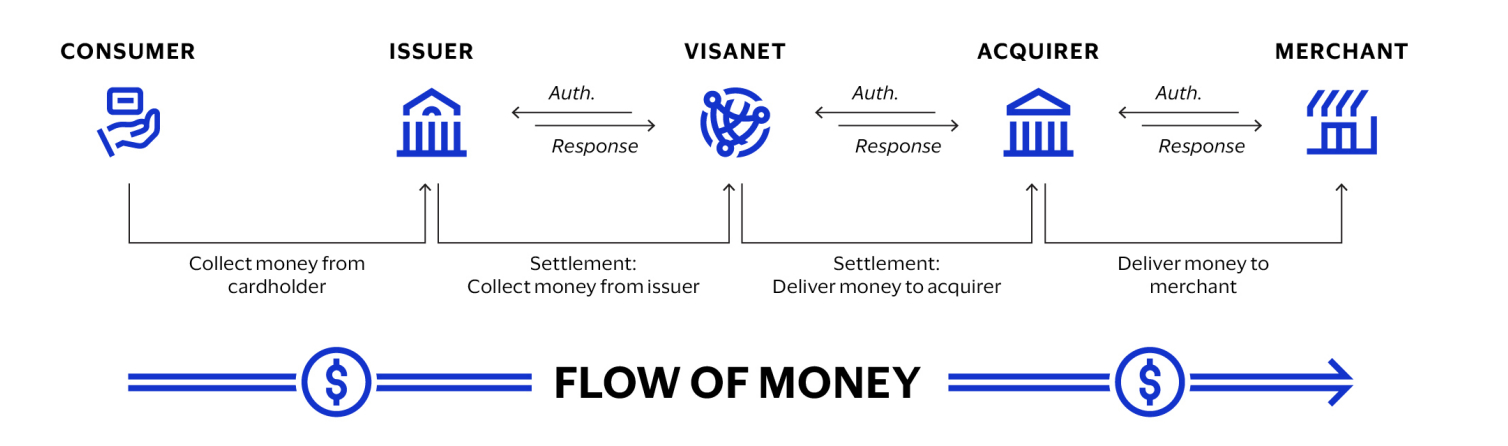

Card Networks & Legacy Rails & Messaging

Card Networks primarily act as network intermediaries in the global payment system, connecting Issuing Banks and Acquirers to process transactions. Revenue is primarily derived from transaction-driven fees—network service fees and processing fees charged as a percentage of transaction volume. These fees are typically a basis point (bps) cut of the transaction value, so TPV directly determines revenue scale. While Visa and Mastercard have expanded into Value-Added Services (VAS) like risk management, consulting, and data analytics, transaction fees remain dominant. Since Card Networks do not directly lend, interest spread drivers (like balance interest) do not apply to their business model.

Card Networks command exceptionally high profit margins and cash flow generation. Visa's FY2024 net revenue was $35.9 billion (+10% YoY). Mastercard's 2024 net revenue was approximately $28.2 billion (+12% YoY). Both networks far outstrip other payment companies in transaction volume. It is important to note that transaction mix impacts fee yields: cross-border transactions typically carry higher fee rates, so Visa and Mastercard closely monitor cross-border volume growth (Visa saw strong cross-border growth in FY2024; Mastercard's cross-border volume grew 20% YoY in Q4 2024). Generally, the Take Rate (Net Revenue/TPV) for both networks hovers in the 0.2%–0.3% range (Visa's $35.9B revenue on $13.2T volume implies ~0.27%).

Card Networks bear relatively little direct fraud or credit risk (most fraud losses are absorbed by Issuers and Acquirers); their operational risk lies primarily in network stability and compliance.

In the grand narrative of global payments, Swift is often misunderstood as a technological obstructionist. However, Swift itself is undergoing profound self-reinvention. Through Swift Go, Swift GPI, and the mandatory migration to ISO 20022 standards, Swift is redefining "speed" and "transparency" in cross-border payments.

In March 2023, SWIFT officially entered the MT / ISO 20022 coexistence period for cross-border payments and reporting (CBPR+). If Swift is the internet of the financial world, ISO 20022 is the new HTML5 standard. This is the most significant infrastructure upgrade for the global payments industry in decades.

- Rich Data Metadata: Legacy MT formats (like MT103) had limited, unstructured fields, causing compliance information (sender address, beneficiary details) to often be truncated or obscured. This directly led to high rates of "compliance blocks" and manual intervention in cross-border payments. ISO 20022 offers highly rich and structured data fields, carrying complete invoice information, tax codes, and ultimate beneficiary data.

- Cornerstone of Interoperability: As real-time payment systems globally (like Europe’s SEPA Instant, Australia’s NPP) adopt ISO 20022, Swift’s upgrade ensures cross-border payments can seamlessly settle into domestic real-time networks, eliminating data loss risks from format conversion.

November 22, 2025: The coexistence period ends. All cross-border payment instructions must be sent via FINplus using ISO 20022 (MX messages); legacy MT will no longer be accepted (with exceptions for some non-payment messages).

Swift Go is designed for small-value, high-frequency payments for SMEs and consumers, emphasizing pre-determined fees and processing times. Swift GPI is the backbone for high-value cross-border payments, offering end-to-end tracking, fee and status transparency, and pre-validation.

| Project | Positioning | Primary Coverage | Key Experience/Capabilities |

|---|---|---|---|

| ISO 20022 (CBPR+ Migration) | Message Standard + Industry Migration (MT → MX) | Cross-border FI-to-FI payment instructions on SWIFT network (CBPR+ in-scope) | Rich data (structured fields), higher potential for compliance/automation; requires end-to-end "ISO-native" adoption to fully benefit |

| Swift GPI | Cross-border Payment Experience Layer (Speed + Tracking + Transparency) | Broad cross-border payments (covers vast majority of SWIFT payment flow) | End-to-end tracking, status transparency, reduced inquiry costs; evolving towards "faster settlement" |

| Swift Go | Low-Value Cross-Border Product (Retail/SME focus, predictable fees/timing) | Low-value cross-border payments (typical threshold ≤$10,000 equivalent; varies by currency/market) | Tighter SLAs + Pre-validation + Fee transparency (reduces uncertainty of intermediary deductions) |

Modern Issuing & BaaS

Visa categorizes partners in the issuing space into roles such as BIN Sponsor, Issuer Processor, Program Manager, and End-to-End. The bottom three are core roles, with End-to-End providing full-stack services.

| Layer | Role | Primary Responsibility | Key Rights/Liabilities |

|---|---|---|---|

| License/Regulatory | Issuing Bank / BIN Sponsor | Holds BIN to access Card Network; holds/custodies cardholder funds; bears local regulatory/risk management duties; follows Network rules; often acts as settlement entity | Visa defines BIN sponsors as owning the BIN, holding funds, managing risk/regulations, following rules, and often acting as settlement agents. Bank is the issuer-of-record + regulatory liability holder. |

| Processing/System | Issuer Processor | System of record; card issuance & lifecycle management; transaction authorization; communication with clearing/settlement entities | Visa: Issuer processors are responsible for the system of record, managing issuance, authorization, and communicating with settlement entities. |

| Product/Ops | Program Manager / Fintech | Product, acquisition, merchant/user ops, pricing, customer service, risk strategy execution, profitability management (often manages KYB/KYC experience) | Visa: Program managers represent the issuer to manage the card program lifecycle, build key relationships, market, and support profitability. |

Modern Card Issuing is the engine of fintech innovation, decoupling the roles of Issuer, Processor, and Program Manager, making embedded finance possible.

| Model | Typical Combination | Pros | Implicit Costs/Risks |

|---|---|---|---|

| Bank Direct (Traditional) | Bank (Issuer) + In-house/Legacy Processor + Network | Clear regulatory boundaries, controlled costs (at scale) | Slow launch, slow API/product iteration |

| Sponsor Bank + Program + Processor (Most Common Modern Issuing) | BIN Sponsor (Bank) + Program Manager/Fintech + Issuer Processor | Fast launch, modular, replicable across markets | Fragmented liability; complex compliance trail & funds/clearing reconciliation; longer profit-sharing chain |

| End-to-End ("One-Stop") | Single provider integrates BIN sponsorship + processing + program mgmt | Developer-friendly, low integration cost | Vendor lock-in, weak pricing power; cross-region availability depends on provider coverage |

Marqeta is the Oracle of the enterprise market, essentially an Issuer Processor, often overlaid with Program Manager roles in client scenarios. In "managed solutions with Bank/BIN sponsor," it acts as Quasi-End-to-End (though the BIN sponsor is still a partner bank). Crypto co-branded cards are now the primary bridge connecting digital assets with physical consumption. Marqeta is the power behind this sector, supporting top projects like Coinbase, Shakepay, Fold, and Bakkt.

Lithic is the Stripe of the developer market. It has carved a niche in a red ocean through extreme developer experience and unique product positioning. Lithic’s "core" is Issuer Processor; choosing Processor-only falls into Model 2, while choosing its Program Management suite moves closer to Model 3.

Sponsor Banks are the invisible cash flow business, but as the "Banking-as-a-Service" (BaaS) model faces strict scrutiny from regulators (OCC, FDIC), sponsor banks are tightening audits of Fintech partners. Cross River Bank, through its proprietary Core Banking System (COS), achieves real-time compliance monitoring of transactions, establishing its leadership in the BaaS sector. Platforms like Marqeta and Lithic must be deeply integrated with it to ensure compliance.

Coinbase Card: Closer to "Program Manager/Brand (Commercial Lead)" + "Wallet/FX"

- Issuer / BIN Sponsor: Pathward, N.A. (Disclosed on Coinbase site as "issued by Pathward")

- Network: Visa

- Issuer Processor: Marqeta ("powered by Marqeta", and Marqeta is explicitly the issuer processor)

- Coinbase's Core Duty: Matches/executes user crypto asset sales and transfers fiat to Card Account to complete transactions (Essentially a "crypto→fiat real-time funding/FX engine + customer interface").

Thus, commercially and product-wise, Coinbase acts as the Program Manager (responsible for UX, funding source, and pricing), but the regulatory/licensing and clearing/settlement entity remains the Pathward + Visa/Marqeta combo.

Bitget Card: Bitget leans more towards "Wallet Entry/FX"; Formal Program Manager is a third party

- Program Manager (Terms): SaintPay S.R.L (Italy)

- Network: Visa ("issued… pursuant to a license granted by VISA")

- Bitget's Role: Terms clarify Bitget is the operator of Bitget Wallet, and upon transaction, clears/sells assets per Program instructions and transfers funds to complete the card transaction.

In the Bitget case, it is more accurate to classify Bitget as "Program Distribution Channel / Wallet Operator + Crypto FX & Liquidity Provider"; the "Program Manager" hat in legal texts is worn by SaintPay.

Bybit Card: Bybit leans towards "Wallet Entry/FX"; Formal Programme Manager is also a third party

- Programme Manager (Terms): UAB Onlychain Fintech Limited (Lithuania)

- Issuer (Varies by Region): EEA is Harmoniie SAS (French EMI), UK is Moorwand Ltd (UK EMI)

- Network: Mastercard

- Bybit's Role: Terms state Bybit is the operator of Bybit Wallet, and may charge separately for "crypto→fiat conversion."

Bybit here acts more as "Wallet/Distribution + Trading/FX Service Provider"; the formal programme manager and issuer are licensed/compliant entities.

Payment Service Provider (PSP)

This category includes companies providing payment processing and related services to merchants, such as Stripe, Adyen, Checkout.com, Worldpay, Fiserv (First Data), and Block's Square. These PSPs/Acquirers connect merchants to multiple payment methods via tech platforms, often offering Payment Orchestration (smart routing), risk management, anti-fraud, and value-added tools.

Stripe and Adyen are industry benchmarks. Stripe positions itself as a "financial infrastructure platform," entering the market with developer-friendly APIs. Core revenue comes from transaction-driven fees—a cut of the Gross Payment Volume (GPV/TPV). Typical SMEs on Stripe pay ~2.9% + $0.30 per transaction. Stripe retains a Net Take Rate after deducting network and bank costs (estimated net revenue is ~0.3% of TPV).

Adyen is an all-in-one Acquirer and Payment Platform, providing end-to-end solutions from processing and channel integration to issuing and banking services. Its revenue structure is dominated by Net Revenue from transaction fees: Adyen's reported "Net Revenue" excludes pass-through costs like interchange and scheme fees, equivalent to TPV multiplied by Net Take Rate. In 2024, Adyen processed €1.29 trillion (+33% YoY), with Net Revenue of €1.996 billion (+23% YoY), implying a net take rate of ~0.16%. Because it focuses on large enterprise merchants (e.g., Spotify, McDonald’s), leveraging scale for lower fees, its Take Rate is significantly lower than platforms like Stripe that primarily serve SMEs.

Wallet & Super Apps

These consumer-centric payment wallets have evolved into "Super App" payment gateways. They typically function as both payment tools and financial service platforms. PayPal is one of the world's largest independent digital payment wallets. About half its business is in the U.S., where fee rates are relatively stable; cross-border volume accounts for ~17%, carrying higher fees but also FX risk and compliance costs.

Alipay and WeChat Pay are China's two "Super Payment Gateways." Their model differs from Western wallets, resembling ecosystem platforms. They offer near-zero fees to consumers (transfers and payments are mostly free or very low cost) and charge low fees to merchants (typically 0.1%-0.6%, lower than card fees). Their core business model relies less on payment fees and more on generating revenue from financial services and value-added businesses derived from massive user fund flows: (1) Interest Spread Driver: Both platforms retain huge user balances (Yu'e Bao, Licaitong), used to issue consumer loans and wealth products, earning interest spreads and management fees. For example, Ant Group's Huabei/Jiebei and micro-loans contribute the bulk of interest income. (2) Value-Added Service Driver: Includes commissions from life service portals, advertising, payment installment fees, and tech service fees.

Ant Group's 2020 IPO prospectus revealed that digital payments and merchant services accounted for ~40% of revenue, while digital fintech services (lending, wealth management, insurance) accounted for nearly 60%.

Remittance

Companies here focus on cross-border payments, international remittances, and multi-currency fund transfers, serving individuals and cross-border e-commerce. Representatives include UK's Wise (formerly TransferWise), US's Remitly, and B2B platforms like Airwallex and Rapyd. Main revenue sources are remittance fees and FX spreads (typical model: small fixed fee + % FX markup).

Wise entered the market with "cheaper, faster cross-border transfers," leveraging its own FX trading and local settlement network to achieve low costs. Remitly is a US-based firm focused on personal international remittances, serving immigrant populations via a mobile-first digital approach, offering lower fees and better UX than traditional giants like Western Union/MoneyGram.

Airwallex and Rapyd, as B2B cross-border payment and embedded finance platforms, differ in model. Airwallex (HQ Australia/Hong Kong) offers corporate multi-currency accounts, collection, and FX conversion APIs, serving cross-border e-commerce and SaaS. Rapyd (HQ Israel) builds local payment networks (acquired ICCPay, etc.), offering Payment-as-a-Service to financial institutions and platforms.

BNPL (Buy Now Pay Later)

"Buy Now Pay Later" and related consumer credit models center on installment payments, embedding financial services into retail transaction scenarios.

Affirm is a leading US BNPL company, partnering with e-commerce merchants to offer installment options. Revenue comes from two parts: (1) Transaction Driven (Merchant Discount Rate): Merchants pay Affirm a percentage of the goods' price to increase conversion, allowing consumers 0% interest installments. For a $100 item, a merchant might pay Affirm ~5%. (2) Interest Spread Driven (Consumer Interest): For long-term or high-value installments, Affirm charges consumers interest. This includes interest paid by consumers and revenue from revolving credit products (like Affirm Debit Card). In FY2023, "Interest Income" accounted for 60%+ of revenue. Notably, Affirm is known for no late fees but covers risk via interest. (3) Other VAS: Interchange from virtual cards, Affirm card splits, and servicing fees from selling loans to banks. Overall, Affirm's model is built on matching consumer loans and managing credit risk.

Klarna, a global BNPL giant from Sweden, has a similar model but leans more heavily on short-term interest-free installments and a shopping app ecosystem. Its revenue bulk comes from merchant fees (~3%) and a portion from consumer interest and late fees.

Afterpay, a top Australian BNPL firm, was acquired by Block (formerly Square) for $29 billion in early 2022. Afterpay effectively became a traffic driver for Cash App—in 2024, ~3.5 million active Cash App users shopped via Afterpay, driving up Cash App's revenue per user. With Block rebranding Afterpay to "ClearPay" in late 2024 and integrating it more tightly, BNPL volume saw significant growth in the US holiday season.

Neobank

Digital banks (Neo-banks) born in the internet era focus on online account services. They typically offer zero-fee accounts, debit/credit cards, and rich App experiences. Core profitability relies on interest income and interchange splits.

Revolut is a leading UK fintech Super App, offering multi-currency accounts, payments, crypto trading, and stock trading. Revenue is diversified: (1) Transaction & Fee Driven: Includes Interchange revenue (Revolut gets ~0.2-0.3% cut from Visa/Mastercard when users spend) and FX spreads, small transfer fees. Given high user frequency, this accumulates significantly. In 2024, total payment volume was ~$125B. Nubank is the largest digital bank in LatAm, originating in Brazil. It rose via no-annual-fee credit cards and now offers a full suite of savings, loans, and investments.

Web3 Protocols

The introduction of Web3 technologies has created new value capture mechanisms while simultaneously posing a threat to legacy profit models:

- Issuance & Reserve Yield: This is currently the most lucrative part of the stablecoin business model. Since the GENIUS Act prohibits paying interest to retail users, stablecoin issuers can exclusively capture interest income from tens of billions in reserve assets (mainly T-bills). Tether realized a staggering $13 billion net profit in 2024, a figure surpassing many top global asset management firms. This explains why PayPal rushed to issue PYUSD—to get a slice of this "seigniorage" pie.

- Routing & Liquidity Services: With the formation of a multi-chain landscape (Ethereum, Solana, Base, Stellar, etc.), optimal path planning across chains and assets has become a necessity. Bridge and Uniswap are essentially acting as "routers" for fund flows, capturing value by offering best exchange rates and lowest gas fees.

- Compliance & Risk Middleware: Running compliant businesses on permissionless networks creates exponential demand for on-chain risk management. Providers of wallet screening, transaction monitoring, and identity verification (Web3 ID) will occupy critical ecological niches.

The implementation of the GENIUS Act and MiCA (Markets in Crypto-Assets) effectively marks the end of the "Wild West" era; compliance has become the ticket for protocol survival.

Although we still understand the value chain in layers, future Web3 infrastructure will gradually become "invisible."

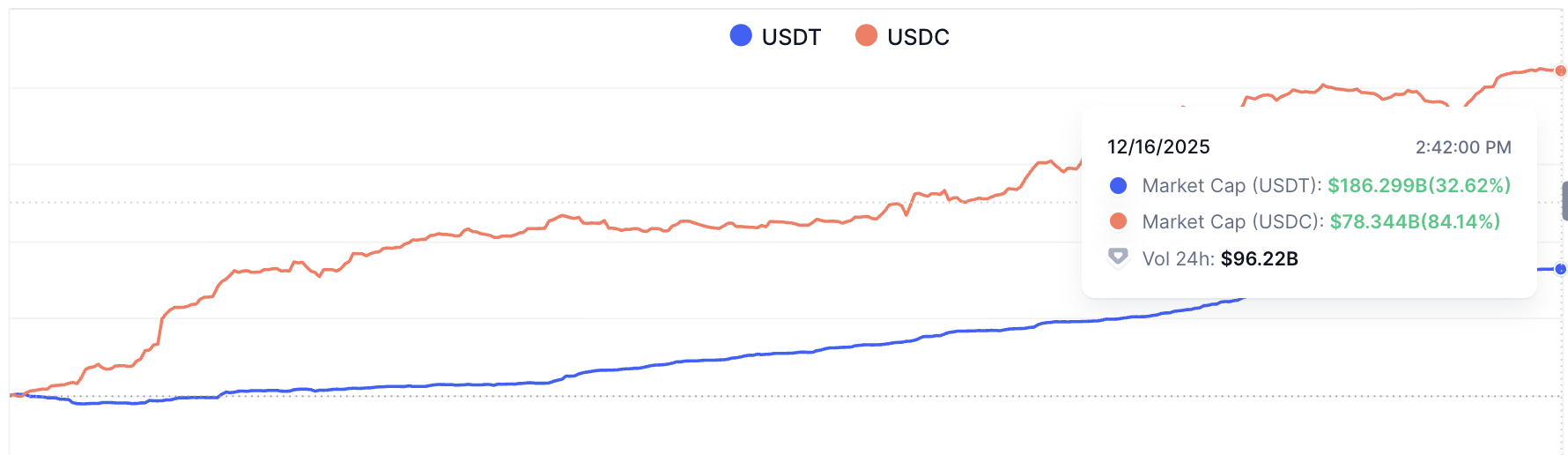

Stablecoin

Unlike Tether's aggressive growth, Circle chose an institutional path embracing regulation. In 2025, with the OCC's conditional approval of its national trust bank charter, Circle was formally integrated into the federal banking regulatory system. This milestone vastly increased institutional investor confidence in USDC, making it the preferred settlement tool for Wall Street entering the on-chain world.

| Metric | Tether (USDT) | Circle (USDC) |

|---|---|---|

| Circulation (2025 Q3) | ~$174.3 Billion | ~$73.7 Billion |

| Reserve Size | ~$181.2 Billion | ~$78.7 Billion |

| Primary Reserves | US Treasuries, Bitcoin, Gold, Secured Loans | Cash, Circle Reserve Fund (Managed by BlackRock) |

| Compliance Path | Offshore, emphasizes transparency reports | Seeking IPO, obtained OCC Bank Charter |

| Primary Revenue | Reserve interest, asset appreciation, investment gains | Reserve interest, transaction service fees |

PayPal's stablecoin PYUSD saw explosive growth in 2025, with market cap surging from $1.2 billion in 2024 to nearly $4 billion. This growth was driven by PayPal's massive two-sided network (merchants & consumers) and deep integration with the Solana blockchain. Leveraging Solana's low costs and high throughput, PYUSD successfully penetrated the micropayment and remittance markets, recently achieving adoption for creator payments on platforms like YouTube.

Ripple's RLUSD stablecoin targets the enterprise cross-border payment market. Launching less than a year ago, its market cap broke $1 billion, largely due to Ripple's long-standing layout in inter-bank settlement networks (RippleNet). RLUSD runs not only on XRP Ledger but also extends liquidity via Ethereum, bridging traditional banking systems with the DeFi world.

"Non-interest bearing + 1:1 cash/short-term debt reserve + licensed issuer" makes stablecoins with obvious DeFi/synthetic/yield structures harder to directly integrate into Bank/PSP/Merchant clearing systems.

Liquidity & Router

The liquidity and routing layer has arguably become the vascular system of Web3.

The first category is protocols supporting cross-chain operations from the token issuance level. Representative is Chainlink's Cross-Chain Interoperability Protocol (CCIP). CCIP's programmable token transfer function allows assets to carry instructions across chains (e.g., "deposit to Aave and borrow USDC"), laying the foundation for complex cross-chain DeFi operations. Through deep collaboration with Swift, CCIP successfully demonstrated how to transfer value between existing banking systems and blockchains. Coinbase also selected CCIP in late 2025 as the exclusive cross-chain infrastructure for its wrapped assets (like cbBTC, cbETH), further proving CCIP's dominance in high-value asset transmission. CCIP has processed approx. $11 B in volume to date.

Circle's CCTP is USDC's official cross-chain clearing rail (burn→attest→mint), aiming for native USDC cross-chain and stronger composability (V2's Fast Transfer, Hooks).

LayerZero (V2) and Wormhole both rely on off-chain observer networks for "cross-chain message validity" consensus. LayerZero V2's core improvement decouples "message verification" from "execution," introducing Decentralized Verifier Networks (DVNs), allowing developers to freely choose verifier combinations (e.g., Google Cloud + Polyhedra) to balance security and cost. Wormhole opts for a more "unified Guardian set signature (VAA)."

LayerZero's ecosystem construction is notably superior to Wormhole. USDT0 explicitly uses LayerZero OFT, managed/operated/developed by Everdawn Labs. The typical mechanism remains source chain lock/destination chain mint, or burn/mint on transfer, driven by LayerZero messaging. It can be said that USDT0 alone props up LayerZero's volume.

| DefiLlama Bridge | Monthly Volume |

|---|---|

| LayerZero | $3~16B |

| Tether USDT0 | $2~16B |

| Circle CCTP | $3~5B |

| Chainlink CCIP | $500M~2B |

| Wormhole | $1~2B |

The second category is common liquidity aggregators. Currently, Jupiter displays dominant performance, far exceeding aggregator protocols on Ethereum.

The third category is the upgraded version of cross-chain protocols. Despite technical progress, security incidents remain a shadow over the cross-chain field. Traditional bridges like Celer, Axelar, and Orbiter maintain monthly volumes around 50M. Thus, Intent-based cross-chain has gained popularity. Users simply express "I want 100 USDC on Chain B," and market makers (Solvers) resolve liquidity off-chain, settling on-chain at the end. This model drastically reduces the risk of assets being locked in bridge contracts.

Although specific implementations vary, a standard cross-chain intent lifecycle basically includes four key stages:

- Expression: User defines transaction parameters (source asset, destination asset, amount, recipient) on the frontend and signs. This signature is not put on-chain but serves as an off-chain authorization.

- Order Flow Auction (OFA): The intent is broadcast to a solver network. Solvers quote based on inventory, Gas costs, and expected profit. The protocol selects the optimal solution via specific auction mechanisms (e.g., Dutch auction, sealed-bid).

- Fulfillment: The winning solver executes the transaction on the destination chain, sending assets to the user. This step usually completes in seconds.

- Settlement: After verifying the solver correctly fulfilled the obligation, the protocol unlocks the user's funds on the source chain and transfers them to the solver. This process may lag on-chain, but only impacts the solver's capital recycling, not user experience.

Leader Across maintains average monthly volume around 1B. Veteran aggregator 1inch also launched its cross-chain aggregation solution Fusion+. Aggregator CowSwap, mainly based on its Intents foundation, integrates liquidity from Bungee and Socket. Bungee contributes ~500M monthly volume, and Socket ~250M.

| Project | Monthly Volume | Mechanism |

|---|---|---|

| Across | 700M~2B | Intents + Pre-funding Relayer + UMA Optimistic Verification |

| deBridge | 500M~1.5B | On-chain verifiable intent orders + Solver race-to-fill + Message unlock settlement |

| Mayan | 800M~1.2B | Auction + Competitive quoting/filling |

| Hashflow | 150M~800M | Off-chain quote, on-chain signature verification settlement |

| Near Intents | 100M~3.6B | Message Bus + On-chain Verify |

| 1inch Fusion+ | 30M~240M | Cross-chain swap protocol based on Escrow + Timeout recovery |

| CowSwap | <750M | Intent batch auction + Solvers bidding settlement |

Protocol Layer

x402 V1, as a proof-of-concept, successfully demonstrated the viability of HTTP-native payments but exposed issues like tight coupling, data redundancy, and HTTP semantic pollution in actual deployment. The V2 version, released on December 11, 2025, is a "bottom-up rewrite" based on six months of field experience and community feedback.

V2 thoroughly cleaned the HTTP header namespace, migrating all payment-related metadata to standardized headers, freeing the response body for application logic.

| Header Name | Direction | Data Format | Function & Technical Detail |

|---|---|---|---|

PAYMENT-REQUIRED |

Server |

Base64 encoded JSON | Payment Challenge: Contains list of payment schemes accepted by server. V2 supports declaring multiple networks (e.g., Base and Solana) and assets (e.g., USDC and ETH) in a single header, allowing clients to choose the optimal path based on wallet state. |

PAYMENT-SIGNATURE |

Client |

Base64 encoded JSON | Payment Proof: Contains PaymentPayload. This is the client's cryptographic signature of the payment intent (usually following EIP-712). V2 explicitly separates signature from request body, allowing clients to retry requests keeping the original Payload, attaching only this header. |

PAYMENT-RESPONSE |

Server |

Base64 encoded JSON | Settlement Confirmation: Contains on-chain transaction hash or Facilitator's verification receipt. This is the proof of service delivery, crucial for audit logs of AI agents. |

Another major update is the Extension System, which not only solves core pain points of V1 in high-frequency scenarios but paves the way for future upgrades. A key extension is SIWx. It introduces the "Session" concept:

- Initial Handshake: Client verifies identity via wallet signature and pays a "Session Fee" (e.g., buying 1000 calls or 1-hour access).

- Session Token: Server returns a lightweight Session Token.

- Subsequent Calls: Client only needs to carry this token in subsequent requests, without on-chain interaction, achieving millisecond-level response speeds. This makes x402 suitable not only for single high-value transactions but also for high-frequency micropayments.

Settlement Layer

Before Firedancer deployment, Solana mainnet's actual throughput hovered between 2,000 and 3,000 TPS. While far exceeding Ethereum, it was insufficient for a network aiming to carry Nasdaq-level volume. Firedancer demonstrated theoretical processing capacity exceeding 1 million TPS in test environments (based on pure transaction load in labs).

PayPal expanded its PYUSD issuance on Solana, utilizing Token Extensions for complex compliance controls. Visa also expanded its USDC settlement pilot to Solana, leveraging high throughput for merchant settlement.

Ripple consolidated its status as an "Inter-bank Settlement Layer" in 2025 through regulatory compliance and deep ties with traditional banking. The launch of RLUSD stablecoin marks a critical pivot from a single-asset (XRP) strategy to a dual-asset liquidity model. XRP continues as a volatility asset for fast bridging between fiat currencies (especially illiquid pairs). RLUSD serves as a stable store of value and collateral for on-chain RWA tokenization settlement.

Tether's Duo: Plasma runs in an EVM-compatible environment with a built-in "Paymaster" mechanism, enabling Zero Gas Fee USDT transfers. Stable uses USDT directly as the network's native Gas token, natively integrating the USDT0 standard. Performance-wise, StableBFT consensus (based on CometBFT Proof-of-Stake) designs throughput over 10,000 TPS with sub-second finality. However, in practice, the "Duo" has been underwhelming.

Arc and Tempo, yet to launch, are the last hope for payment-specific chains. Circle launched Arc's public testnet in October 2025, defining it as the "Internet's Economic Operating System." Arc's ambition is to move traditional capital market infrastructure on-chain. Arc employs a permissioned validator set in the startup phase, composed of renowned financial institutions meeting KYC/KYB standards. This ensures Deterministic Finality, eliminating fork risk, crucial for securities settlement. It is optimized specifically for RWA tokenization, supporting native identity wallets and compliant privacy transactions.

Tempo, incubated by Stripe and Paradigm, launched its testnet in December 2025. Its positioning is stark: Payments First, completely abandoning the single native token for Gas model. Users can pay network fees with any major stablecoin (USDC, USDT, KlarnaUSD). This "Gas Abstraction" means merchants don't need to handle ETH or SOL rate volatility for reconciliation, truly realizing a fiat-denominated on-chain experience.

| Feature | Solana (Firedancer) | Ripple (XRPL) | Plasma | Stable | Arc | Tempo |

|---|---|---|---|---|---|---|

| Primary Use Case | General PayFi / HFT | Cross-border / Bank Settlement | Retail Remittance / Gig Economy | Institutional Settlement / Treasury | Compliant DeFi / RWA | Fintech Payments / Merchant Settlement |

| Consensus | PoH + PoS (Tower BFT) | FBA (Federated Byzantine Agreement) | PlasmaBFT (Bitcoin anchored) | StableBFT (CometBFT) | Malachite (BFT) | Dedicated PoS |

| Real TPS | 3,000 | 30 | 1 | 0.1 | - | - |

| Theoretical Max | 1,000,000 | 1,000 | 2,000 | 10,000 | 3,000 | 100,000 |

| Finality | ~400ms | 3-5s | ~1s | < 1s | Sub-second (Deterministic) | ~0.6s |

| Gas Model | SOL (Low fee) | XRP | Zero Gas (USDT) | USDT (Native) | Stablecoin | Any Stablecoin |

| Backers | Foundation / Jump Crypto | Ripple Labs | Tether / Bitfinex / Thiel | Tether / Bitfinex | Circle | Stripe / Paradigm |

Future Winner Model: Stripe

Web3 Squeeze on Acquirer Rates: The greatest disruptive power of stablecoin payments lies in bypassing traditional card networks to achieve Peer-to-Peer (P2P) settlement. Theoretically, this can eliminate the 1.5% - 3% Interchange Fee. While card networks maintain position by integrating stablecoins, in the long term, with the spread of direct connection solutions like Solana Pay, merchants have strong incentives to steer users toward low-fee payment methods. Visa and Mastercard's defense strategy is transforming into "Value-Added Service Providers," compensating for potential fee declines via anti-fraud, dispute resolution, and cybersecurity services.

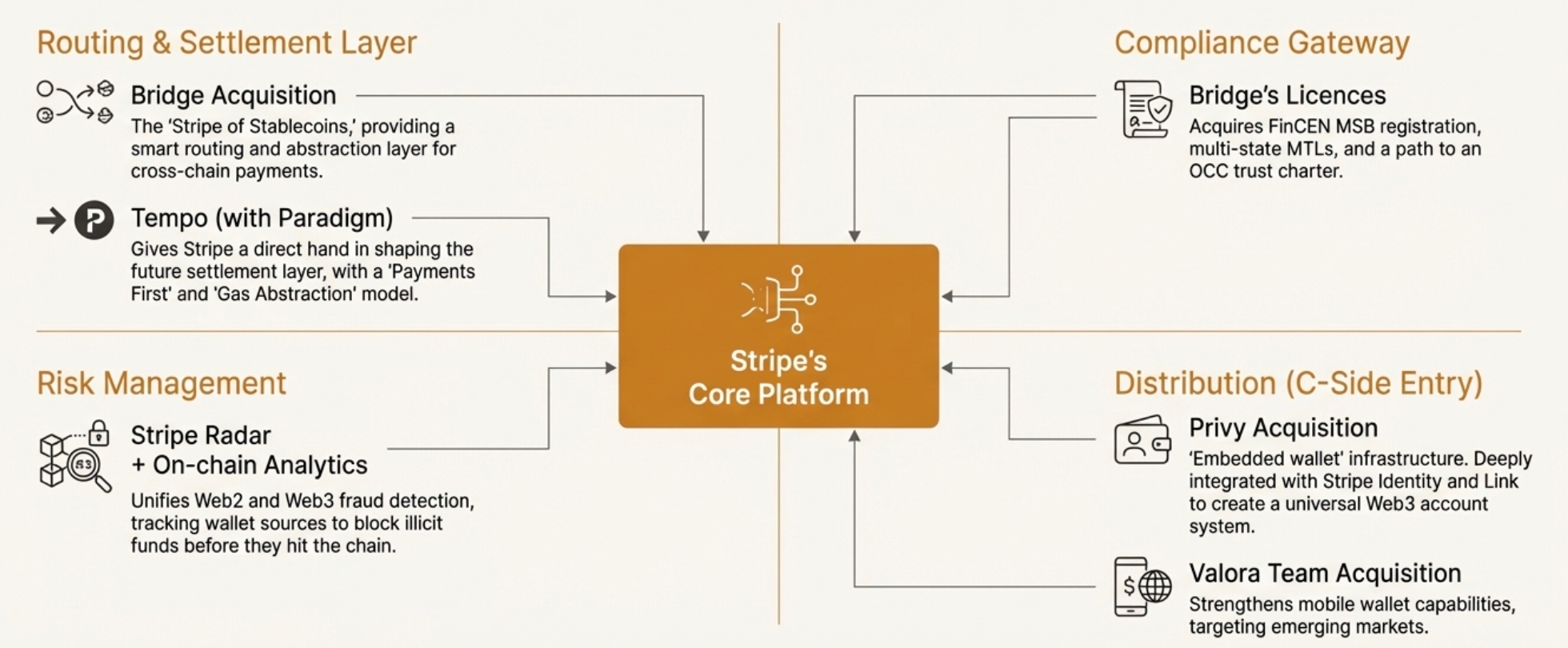

The Future Winner's Model: In the next 3-5 years, the "winner" in the payments industry will no longer be a simple channel provider, but a platform controlling four key nodes:

- Compliance Gateway (License/Regulatory Interface): Owning payment licenses in major jurisdictions (MTL, BitLicense) to legally handle fiat-crypto exchange.

- Distribution (Merchants/Devs/Wallets/Platforms): Having channels to directly reach end users. E.g., PayPal's 430M active accounts and Stripe's millions of connected merchants.

- Risk Management (Fraud/Sanctions/Identity): Unified risk capabilities across Web2 and Web3. Leveraging AI to analyze on-chain and off-chain data for precise fraud detection.

- Routing (Multi-rail Smart Selection): Intelligently switching between Card Networks, Bank Transfers (RTP/FedNow), and Stablecoin networks based on cost, speed, and success rate.

Visa, Circle, Stripe, and PayPal are likely to be the biggest winners in the future landscape. Among them, Visa, Circle, and PayPal are traditional giants, while Stripe, rising from a PSP, has become a pivotal industry player and a key model to study.

| Company | Compliance Gateway | Distribution | Risk Management | Routing |

|---|---|---|---|---|

| Stripe | SPC (has MSB/MTL attributes) | TPV $1.4T, Strong Merchant Penetration | Strong Merchant-side Productized Risk | Open Issuance / Stablecoin capability integrated into "Orchestratable Stack" |

| Visa | Via Network Rules & Partners | $15.7T, 233.8B txn Network Scale | Network-level Risk & Dispute Infrastructure | Stablecoin access leans more to "plugging new rails into old network" |

| PayPal | Stablecoin issued by Paxos; PayPal does distribution | 434M Accounts, TPV $1.68T | Strong Consumer-side Risk & Dispute Experience | Strong multi-funding paths, but weak control over stablecoin issuance/clearing |

| Circle | Strongest MiCA Compliance Narrative | Primarily USDC circulation & partner distribution | Strong in Reserve/Compliance, weak in merchant dispute ops | More like "Settlement Asset & Rail," not full-stack router |

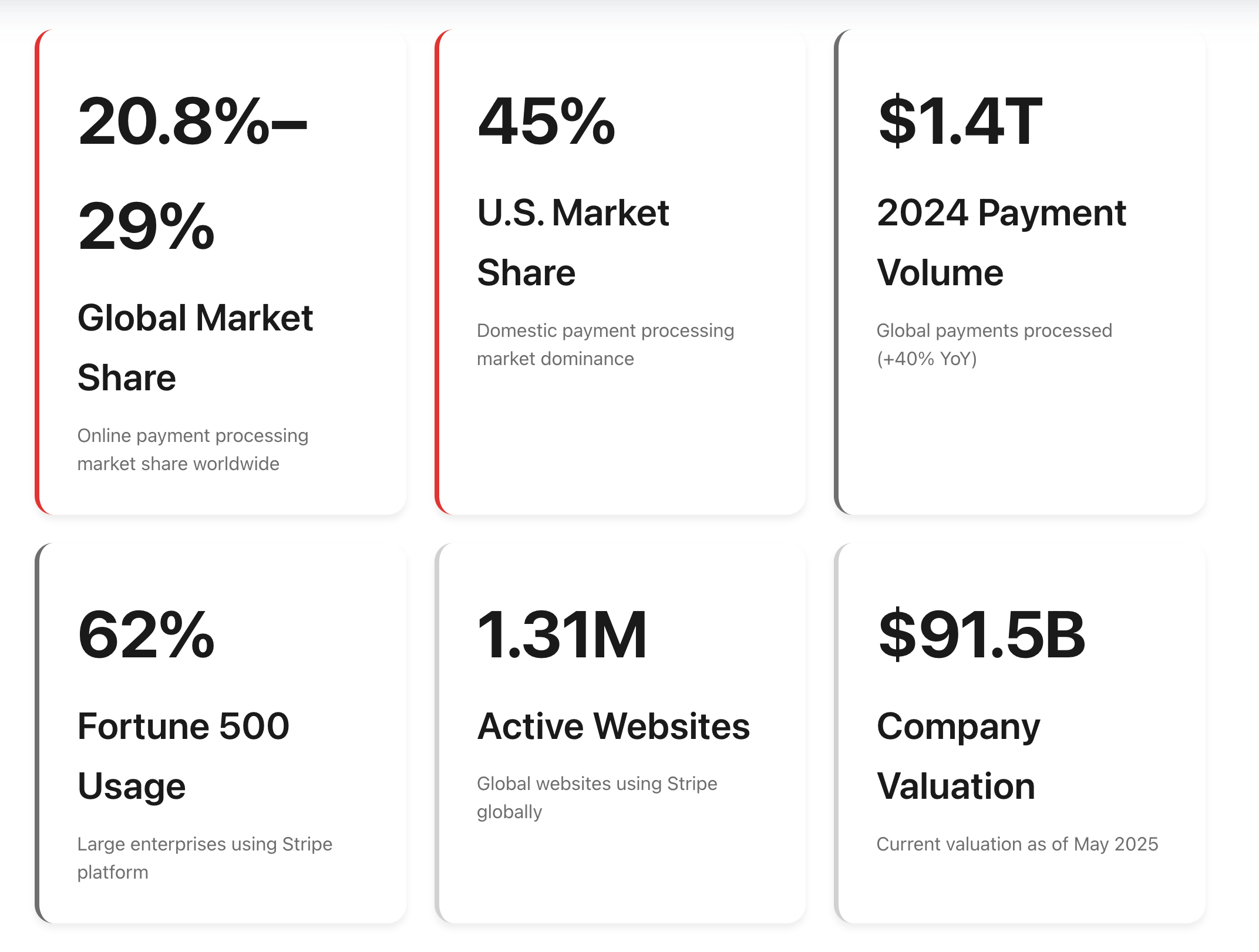

Stripe Inc. has evolved beyond a payment processor into the underlying financial infrastructure of the internet economy. Through a "Dual-Rail Strategy"—consolidating traditional fiat payments (GPTN) while aggressively building next-gen blockchain payment rails (Tempo & Stablecoins)—and leveraging the Agentic Commerce protocol, it is seizing the transaction entry point for the AI agent economy.

Its rise was not accidental but the result of precisely executing a "Bottom-up" penetration strategy, followed by a "Bottom-up meets Top-down" pincer movement. In 2010, accessing a payment gateway required weeks of approval, complex documentation, and legacy banking infrastructure. Stripe launched with the famous "7 lines of code," a minimalist API snippet allowing developers to accept credit cards in minutes.

| Funding round, Date | Valuation |

|---|---|

| Seed, March 2011 | $20 million |

| Series A, February 2012 | $100 million |

| Series B, July 2012 | $500 million |

| Series C, January 2014 | $1.75 billion |

| Series C – II, December 2014 | $3.5 billion |

| Series C – III, July 2015 | $5 billion |

| Series D, November 2016 | $9.2 billion |

| Series E, September 2018 | $19.8 billion |

| Series E – II, January 2019 | $22.4 billion |

| Series G, September 2019 | $35.25 billion |

| Series G – II, April 2020 | $36 billion |

| Series H, March 2021 | $94.4 billion |

| Series I, March 2023 | $50 billion |

| February 2024 | $65 billion |

| July 2024 | $70 billion |

| February 2025 | $91.5 billion |

Stripe's business model is ingenious: it builds a massive user base and data moat via low-margin payment operations, then monetizes through high-margin software and financial services. Revenue is split into Transaction Fees, Value-Added Services, and Interest Income.

Core Payments is Stripe's traffic entry, with a standard fee of roughly 2.9% + 30 cents. While margins are squeezed by card network fees, it provides the critical component for building upper-layer applications.

Stripe Connect is one of Stripe's most strategic products, allowing software platforms (like Shopify, Lightspeed) to embed payments and share revenue. Connect turns Stripe into "infrastructure for infrastructure." When platforms use Connect, they effectively become payment facilitators. Stripe profits by charging transaction splits or fixed fees (e.g., $0.25 + 0.25% per payout).

In Value-Added Services, Stripe Billing handles subscriptions. With the explosion of AI and SaaS, Billing now manages nearly 200 million active subscriptions, with an annual revenue run rate exceeding $500 million.

| Financial Metric | 2024 | YoY Growth | Strategic Implication & Analysis |

|---|---|---|---|

| Total Payment Volume (TPV) | $1.4 Trillion | +38% | Growth far exceeds global e-commerce average, showing strong market capture capability. |

| Gross Revenue | ~$18 Billion | ~12.5% | Estimated based on industry rates; reflects monetization capability of total flow. |

| Net Revenue | ~$5.1 Billion | +28% | Real revenue after pass-through costs; growth driven mainly by high-margin software services (SaaS). |

| Net Take Rate | ~0.36% - 0.40% | Stable | Actual profit retained per $100 transaction. Software VAS effectively buffers payment fee compression. |

| Free Cash Flow (FCF) | ~$2.2 Billion | N/A | Marks self-sustaining capability; no longer dependent on external financing for high R&D spend. |

| Valuation | $91.5 Billion | +30.7% | As of Feb 2025. Significant rebound from early 2024 ($65B), reflecting secondary market recognition of profitability. |

Stripe's concept of "Durable Profitability" does not mean cutting costs, but reinvesting all excess profits into R&D while maintaining profitability. This year, Stripe's crypto layout is no longer tentative but a full-scale strategic offensive, viewed as a component of this durable profitability.

Stripe's Crypto Evolution: Stripe’s relationship with cryptocurrency has followed a non-linear curve. In 2014, it was among the first to support Bitcoin payments, but ended support in 2018. The decision was based on a core judgment: Bitcoin's volatility, slow confirmation, and high fees made it "Digital Gold" for reserves rather than a tool for daily commerce.

However, in 2024, Stripe's return demonstrates a distinct strategic logic. The driver is the maturity of stablecoins as a technical architecture. Unlike Bitcoin, dollar-pegged stablecoins (like USDC) solve volatility; high-performance blockchains (Solana) and L2s (Base, Polygon) solve throughput and cost.

Stripe's key moat is its powerful Smart Routing, supercharged by the Bridge acquisition. Bridge acts as the "Stripe of Stablecoins," offering an abstraction layer for cross-chain interoperability. Post-integration, Stripe merchants can accept funds from any supported chain without managing multiple wallets or bridging. Bridge handles asset routing and conversion in the background. The partnership with Paradigm on Tempo will further give it initiative in the settlement layer.

Another driver for the Bridge deal is Compliance. Stripe provides services via regulated subsidiaries (US Stripe Payments Co as money transmitter/MSB; Ireland EMI for EEA; UK EMI). Bridge publicly discloses operating stablecoin issuance as "issuer-of-record," holding FinCEN MSB registration and multi-state MTLs, while applying for an OCC trust charter to bring issuance under federal supervision per the GENIUS Act.

The acquisition of Privy targets the C-side distribution entry. Privy focuses on "embedded wallet" infrastructure. Integrating Privy allows developers to generate wallets directly within apps, where users login via email/socials. Stripe has deeply bound Privy with its identity (Stripe Identity) and one-click payment (Link) products. Link stores payment info for hundreds of millions of users. Combined with Privy, Link evolves into a universal Web3 account system.

Furthermore, acquiring the Valora team (core Celo wallet) strengthens mobile wallet capabilities, specifically for emerging markets (LatAm, Africa) where fiat is unstable and demand for stablecoin wallets is rigid.

On Risk, Stripe Radar has introduced On-chain Analytics. Beyond traditional IP/device fingerprinting, Radar partners with data providers to track wallet sources. If an address is linked to hacks, mixers (Tornado Cash), or sanctioned entities, Radar blocks the transaction on the frontend before it hits the chain.

If execution holds, Stripe is poised to become the largest hub connecting the fiat and digital asset worlds. In the future, "Dollars" may no longer be distinguished between Fed ledger digits or blockchain Tokens—Stripe's API will have made them commercially equivalent and interoperable.