Technology Evolvement

Sei Giga: Next-Generation Architecture

Pre-Giga: Parallel EVM Execution

The Sei V2 launch in May 2024 successfully deployed the first parallelized EVM, leading to immediate ecosystem growth with TVL increasing 794% post-launch and daily EVM transactions growing 3,691%.

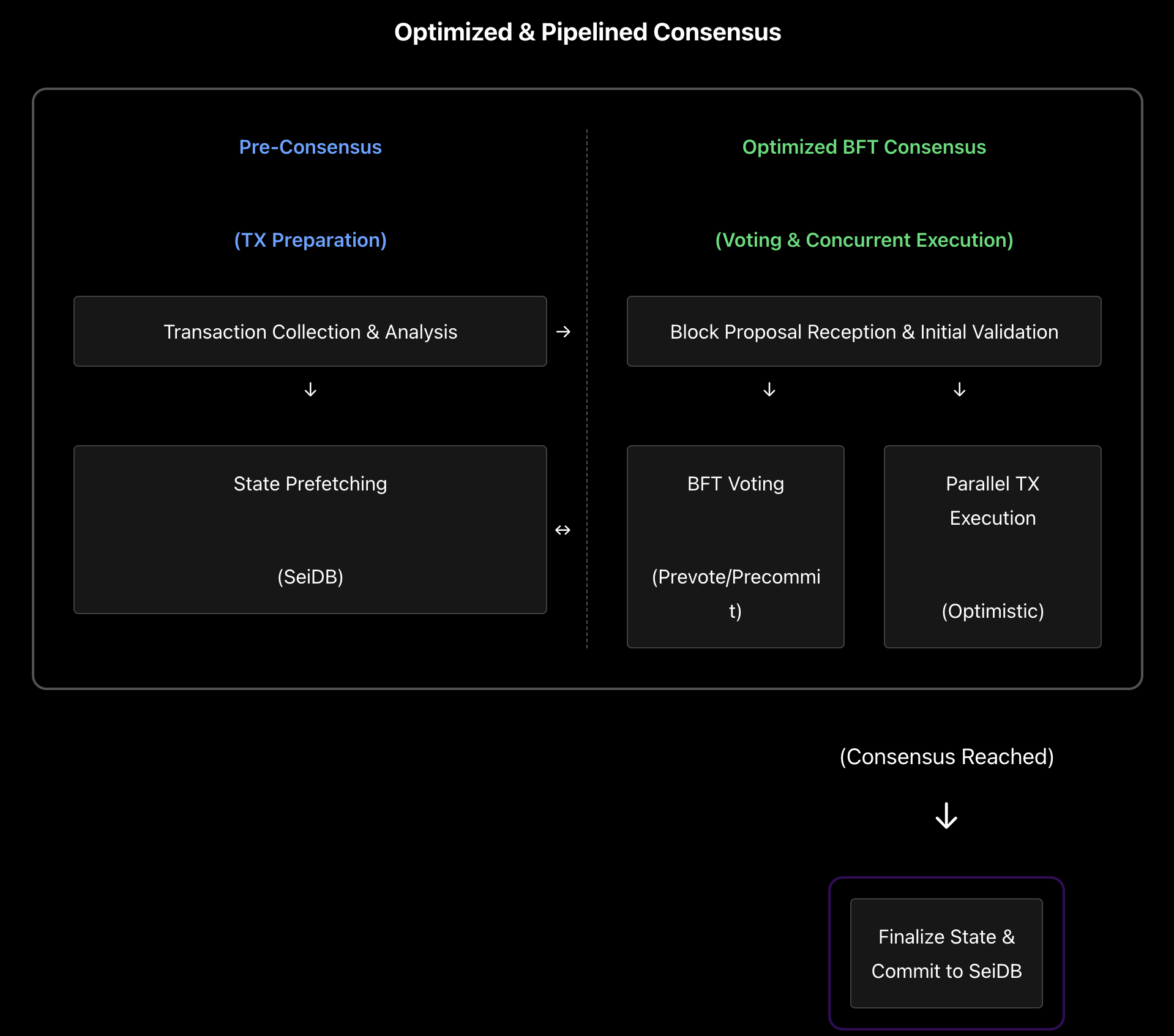

- Twin Turbo Consensus: The current consensus mechanism achieves ~400ms block times through aggressive optimization of the Tendermint BFT consensus engine. Key features include:

- Aggressive timeout configurations: reduces communication latency between validators

- Pipelined block processing: even before a block proposal is formally initiated, validators begin processing transactions intended for that block. “pre-consensus” preparation minimizes the work needed once the actual proposal for height

Harrives. - Optimistic transaction execution during consensus: “pre-consensus” preparation minimizes the work needed once the actual proposal for height

Harrives. - Parallel transaction decoding and validation: proceeds optimistically and concurrently using multiple worker goroutines

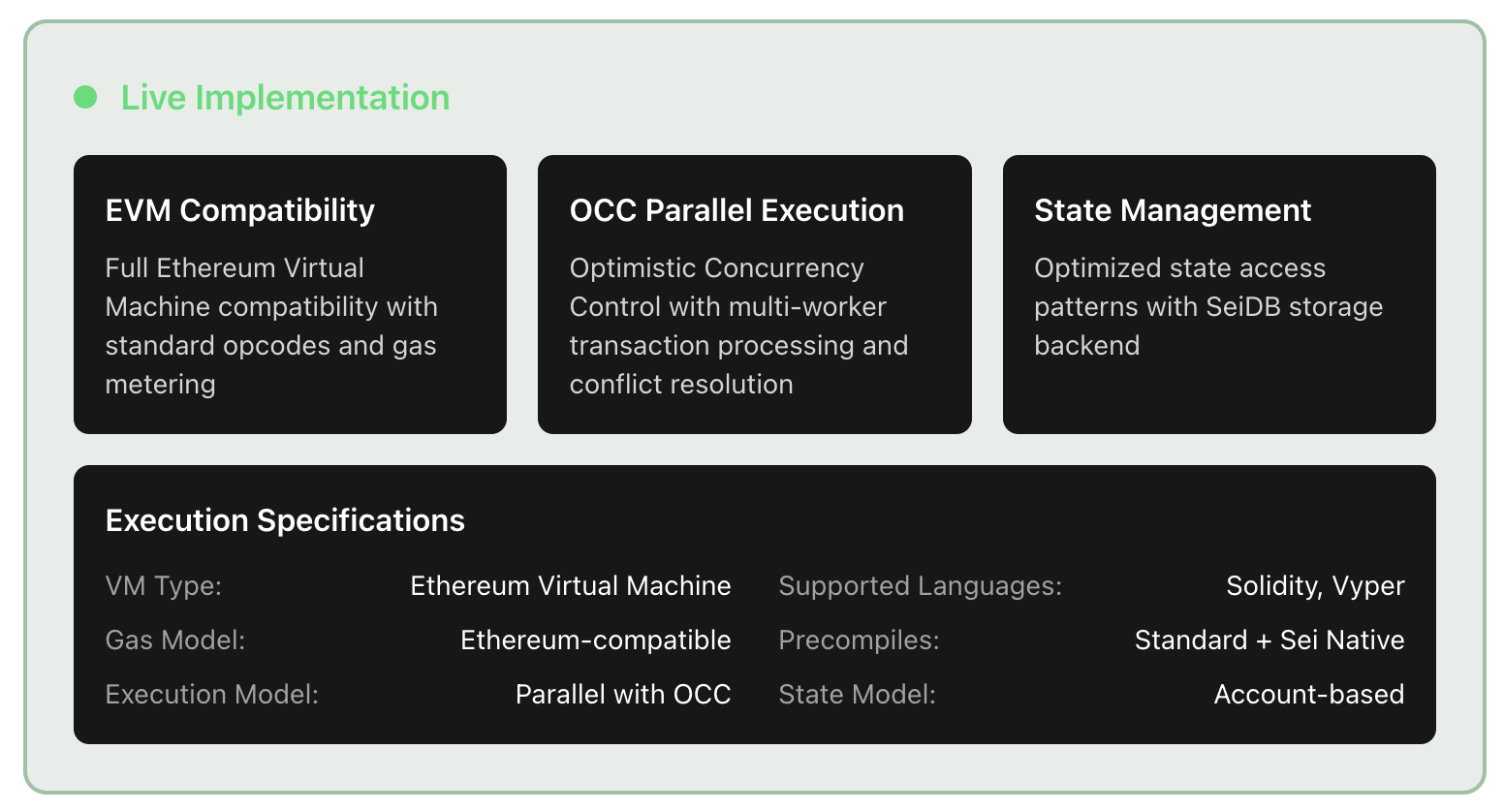

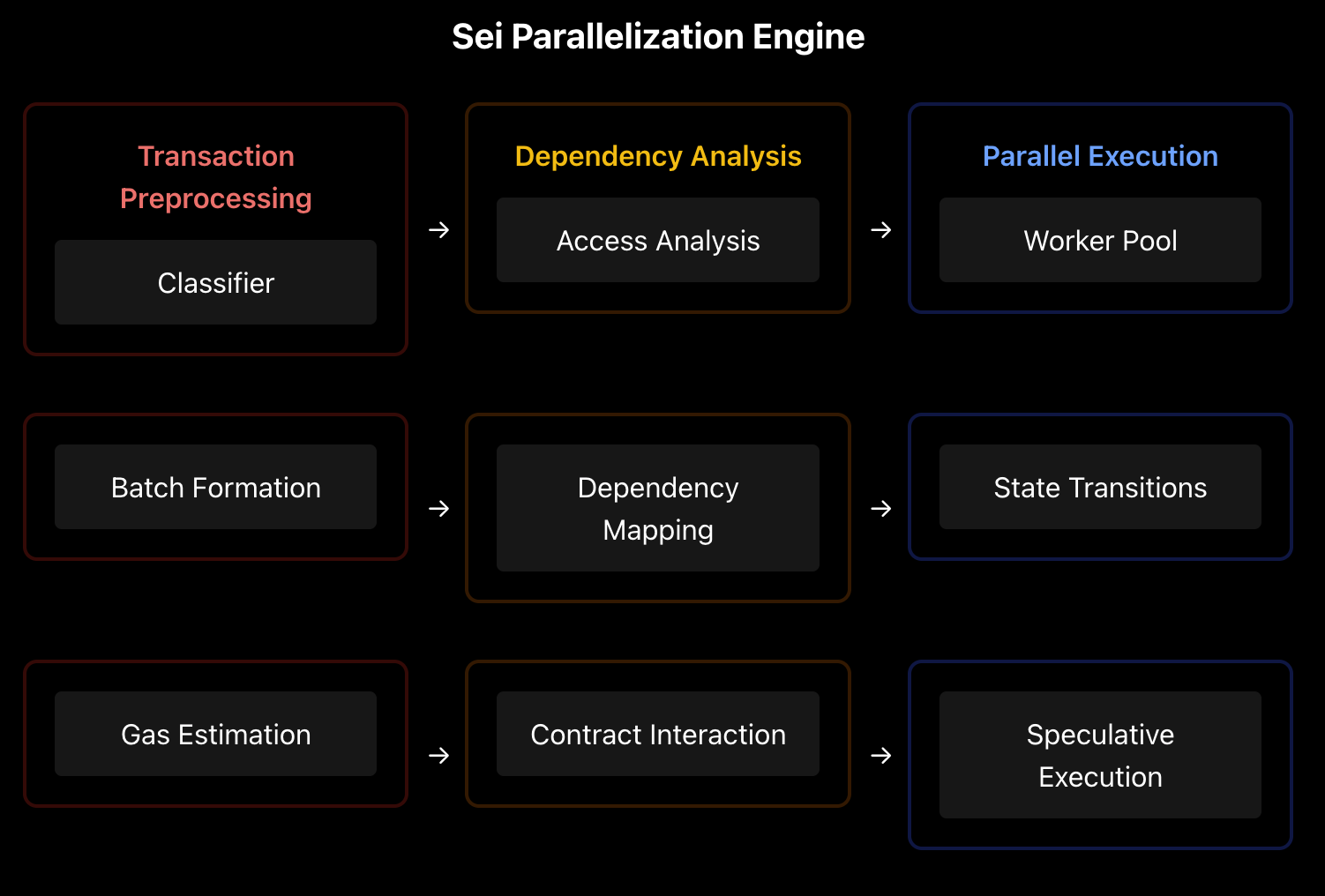

- Parallel Execution Engine: Sei implements Optimistic Concurrency Control (OCC) for parallel transaction execution, like Aptos

- Multiple CPU cores process non-conflicting transactions simultaneously

- Automatic conflict detection and resolution

- Maintains deterministic execution order

- It identifies the conflicting transactions as a group

- It removes their results from the temporary state buffer

- It re-executes the conflicting set in a deterministic, sequential order to ensure correctness

- Compatible with standard EVM semantics

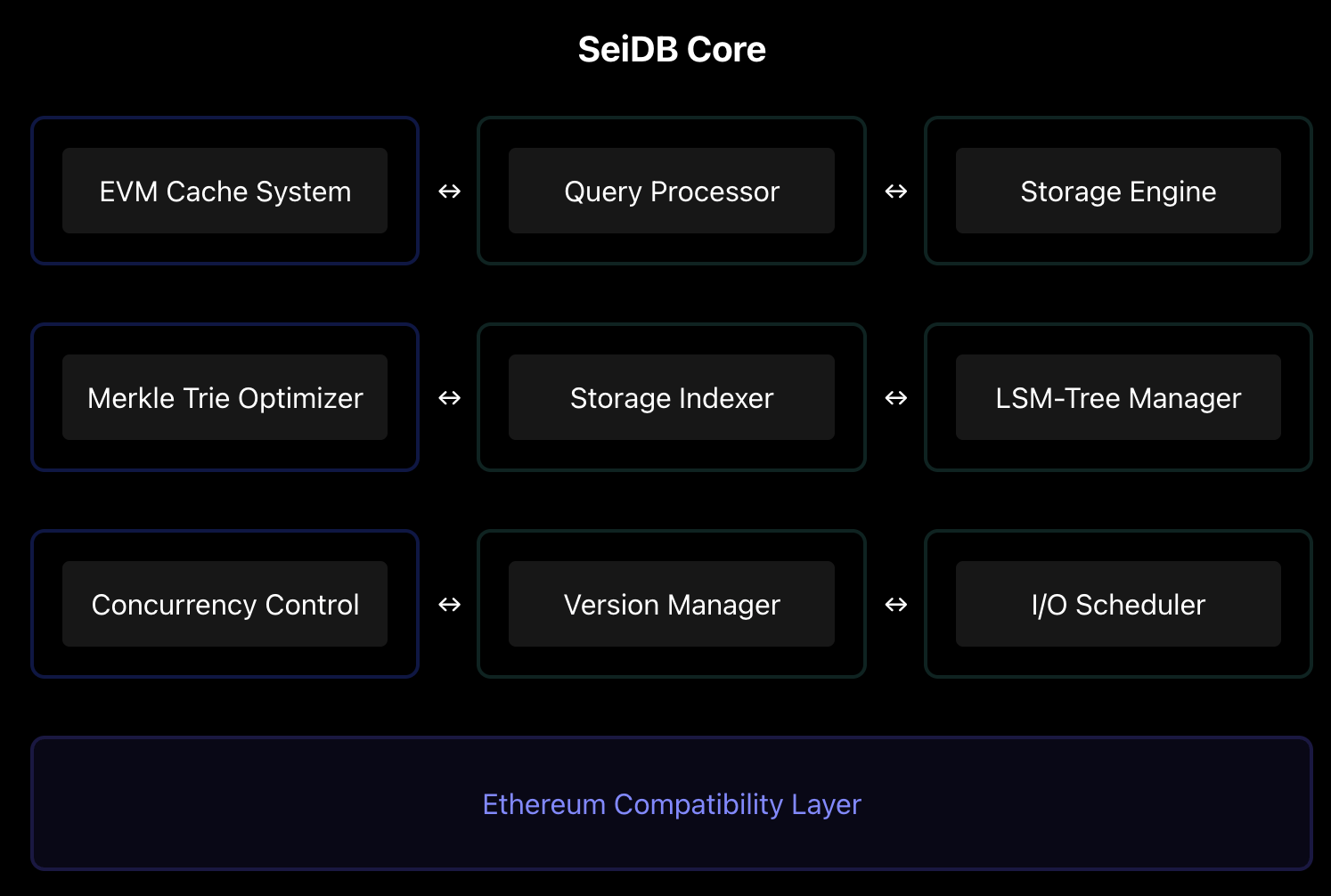

- SeiDB Storage System: a specialized database optimized for blockchain workloads, provides extremely low-latency read/write access needed for high transaction volume concurrent execution.

- Multi-level caching for hot state data

- Optimized Merkle Patricia Trie structure

- Concurrent state access controls

- Efficient state versioning and pruning

- Optimized rollback capabilities support the rapid discarding of speculative state changes

Current Parallelization Engine delivers significant performance improvements:

| Transaction Type | Sequential TPS | Parallel TPS | Improvement |

|---|---|---|---|

| Simple Transfers | 3,000 | 15,000+ | 5x |

| ERC-20 Transfers | 2,200 | 9,500+ | 4.3x |

| DEX Swaps | 800 | 2,800+ | 3.5x |

| Complex Contracts | 500 | 1,500+ | 3x |

Post-Giga

-

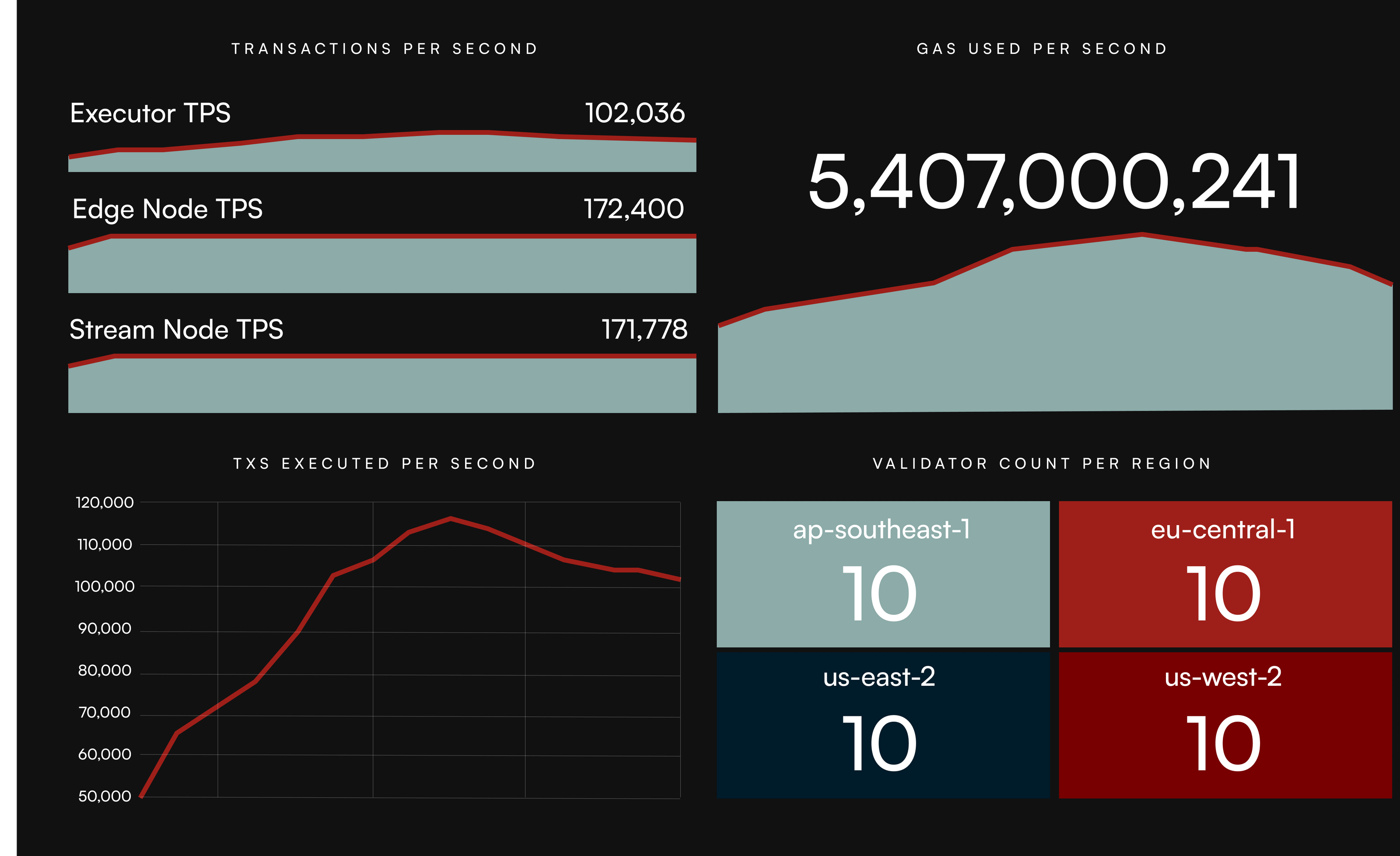

The upcoming Giga upgrade promises 50x performance improvements through the introduction of Autobahn consensus, a multi-proposer BFT protocol that enables multiple validators to propose blocks simultaneously. Early devnet results have achieved 5.4 gigagas per second (~115,000 TPS) with 700ms finality, targeting production deployment of 200,000+ TPS while maintaining Byzantine Fault Tolerance.

-

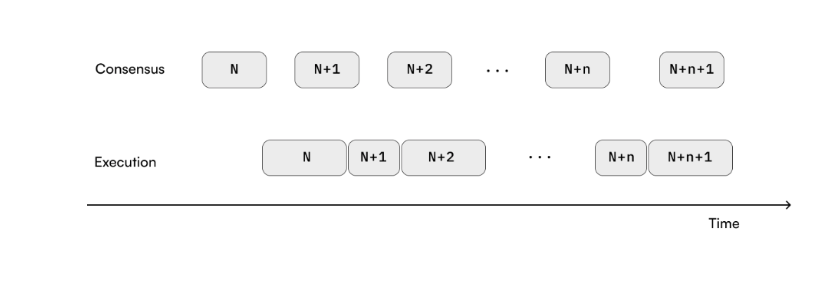

Asynchronous Execution Model

- Once there is consensus on the ordering of transactions, generating a state root is deterministic - a given ordering can only result in one state root via execution. As a result, finalization of a block does not wait for validators to execute transactions, allowing for higher throughput and reduced latency.

- Once there is consensus on the ordering of transactions, generating a state root is deterministic - a given ordering can only result in one state root via execution. As a result, finalization of a block does not wait for validators to execute transactions, allowing for higher throughput and reduced latency.

-

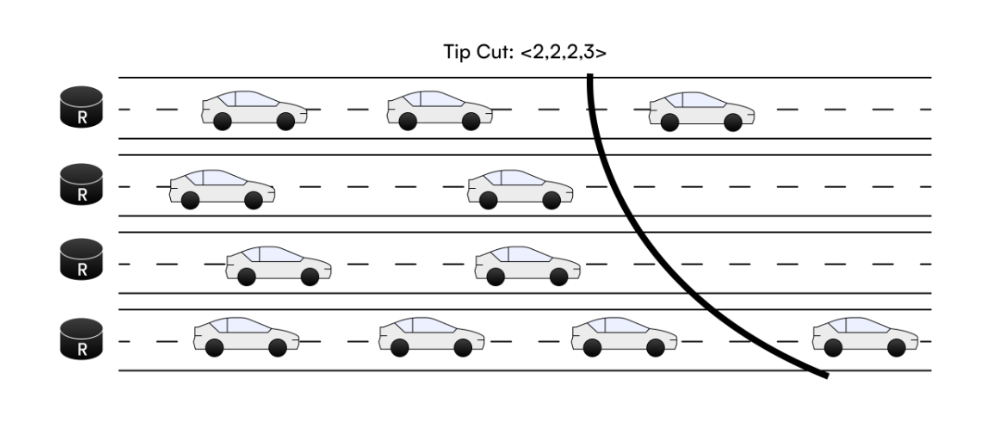

Autobahn Consensus Protocol

- Once enough votes are collected, they form a PrepareQC. After that, nodes send their commit votes, and once enough are collected, a CommitQC is formed, finalizing the blocks in N .

- While N is in its commit phase, the leader for tip cut N + 1 may start sending its proposal. In other words, even though each block goes through two distinct rounds, pipelining allows the next block’s proposal to start during the commit phase of the previous block, effectively reducing the overall latency to 1.5 rounds.

- introduce multiple concurrent proposers, eventually allowing any proposer in the validator network to propose transactions that are included in the current slot. This makes it much harder to censor transactions, and helps with overall network liveness, since one proposer going down will have a much lower impact on the overall network.

-

Advanced Parallel Execution

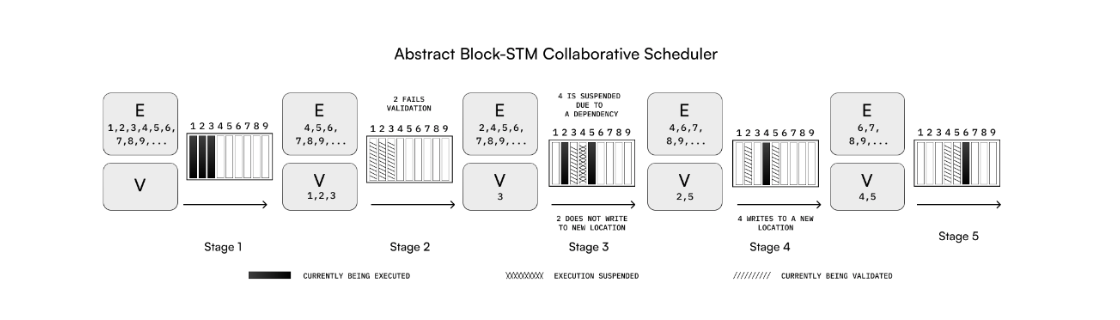

- In OCC, each node begins by executing all transactions in parallel, distributing them across multiple worker threads and assuming no conflicts will occ

- While executing, each transaction ti uses a private buffer to store changes to its write set Wi, rather than updating the globally visible EVM stat

-

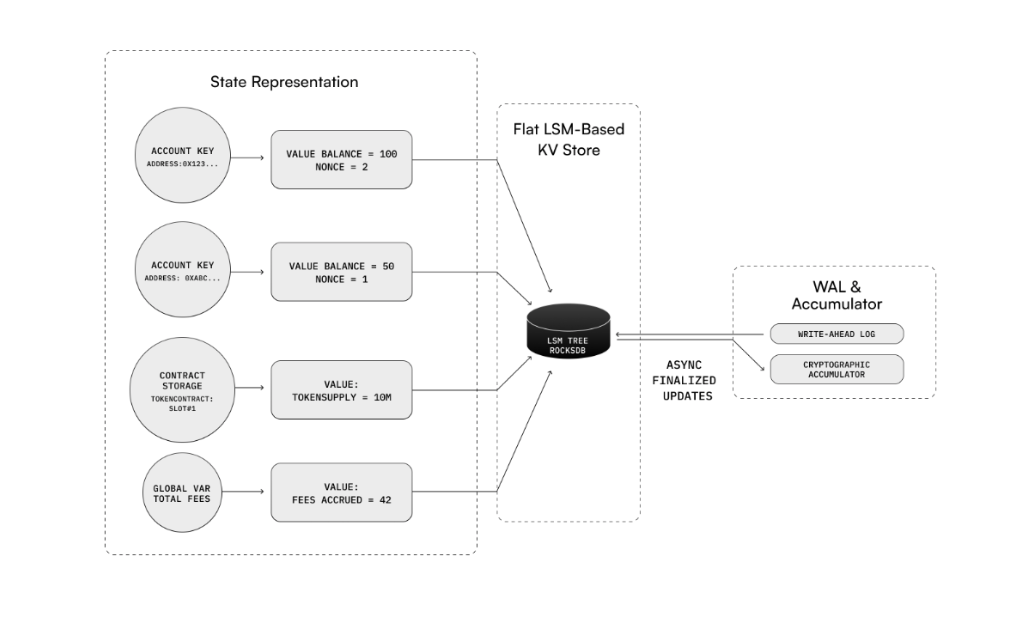

Advanced SeiDB

- By default the state of Sei Giga is stored in RAM. Instead of maintaining a Merkle tree for every update to global state, the chain uses a flat key-value model, where each account, contract storage slot, or globally accessible variable is mapped directly to a corresponding entry in a log-structured merge (LSM) tree. Storing ⟨k, v⟩ pairs in this manner is particularly effective for write-intensive environment

- By default the state of Sei Giga is stored in RAM. Instead of maintaining a Merkle tree for every update to global state, the chain uses a flat key-value model, where each account, contract storage slot, or globally accessible variable is mapped directly to a corresponding entry in a log-structured merge (LSM) tree. Storing ⟨k, v⟩ pairs in this manner is particularly effective for write-intensive environment

-

The Sei Labs team were able to get 5 gigagas throughput in a 40-node network distributed across 4 regions in an internal devnet.

<Solana’s Alpenglow: A Faster Consensus with New Trade-Offs>

Solana’s Alpenglow upgrade is a leap toward sub-second finality, simplified consensus, and reduced validator costs. By replacing Proof of History and Tower BFT with Votor and Rotor, Alpenglow achieves 100-150ms finality, enhances fault tolerance, and lowers barriers to decentralization.

However, concerns such as single-client dependency, geographic performance disparities, unspecified validator economics, MEV restructuring, RPC scalability, and unresolved questions about Multiple Concurrent Leaders highlight potential challenges. While Alpenglow’s design mitigates many of these issues, further research, community review, and testing are essential to address these concerns, refine economic mechanisms, and ensure a robust transition. The upgrade’s success will hinge on Solana’s ability to balance speed, security, and decentralization through rigorous development and ecosystem coordination.

SIP-3

| Feature | Sei EVM | Ethereum |

|---|---|---|

| Blocktime | 400 ms (500~800ms in production) | 12 s |

| Gas per Second | ~ 100 MegaGas/s | ~ 3 MegaGas/s |

| Finality | Instant | Various commitment levels (safe, latest, justified, finalized) |

| Parallelized Execution | Yes | No |

| EVM Tooling Compatibility | 100% | 100% |

| EVM Version | Cancun (w/o blobs) | Cancun |

| Gas Limit | 10 M | 45 M |

| Byte Size Limit | 21 MB | No byte-denominated limits |

| Execution Environment | EVM and Cosmos-SDK | EVM |

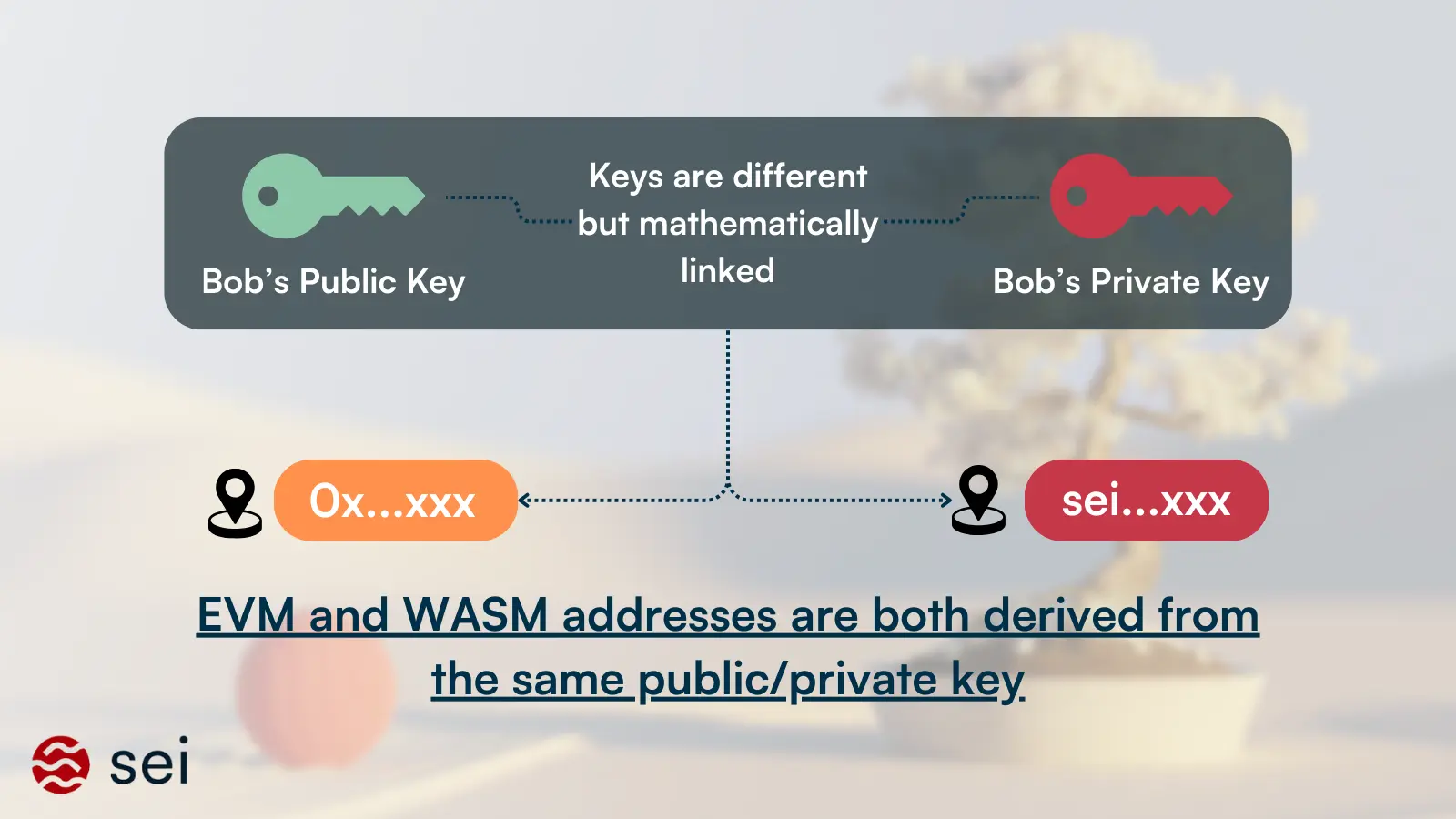

| Address Space | Dual ECDSA-derived addresses; Cosmos Bech32 (sei…) + EVM-compatible address (0x…) | ECDSA-derived address (0x…) |

| State Storage | AVL-tree (global root) | Merkle Patricia Trie (MPT) |

Dual-Execution Environment

- Non-EVM transactions can update EVM-accessible state. Account’s SEI balance can be affected by both Cosmos (bank send, wasm execute) transactions as well as EVM send transactions

- Sei assets can not only exist as EVM (i.e., ERC20/721/1155), but also as CW (i.e., CW20, CW721) or as “native” (Sei, IBC, Tokenfactory).

- User accounts on Sei have two addresses derived from the same public key (Cosmos Bech32 and EVM-compatible 0x…)

Post SIP-3

Implementing the SIP-3 proposal will transition the Sei network to an EVM-only architecture by deprecating CosmWasm and native Cosmos transactions. This streamlining aims to reduce complexity, improve developer experience, and position Sei more competitively within the broader EVM ecosystem while maintaining its performance advantages.

- Only EVM addresses will be allowed to initiate transactions on Sei.

- The network will support EVM-only transactions going forward.

- CosmWasm contracts and native Cosmos message handling will be deprecated and removed.

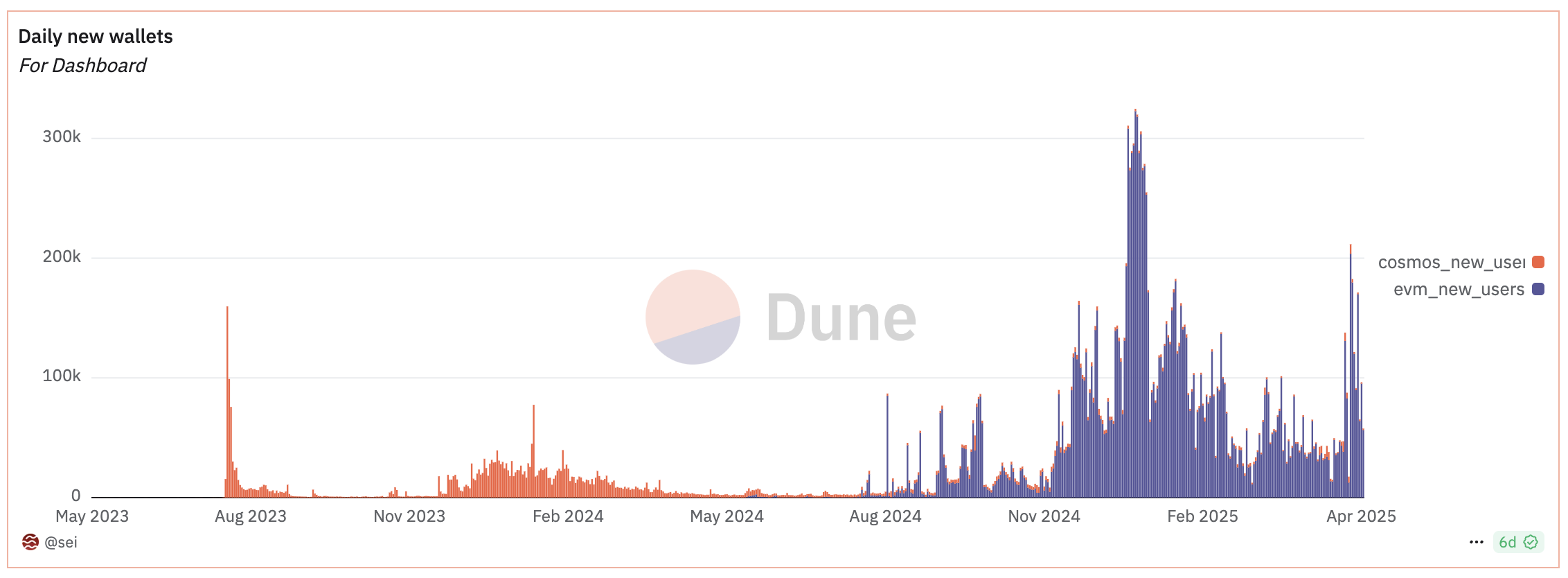

Since the introduction of Sei v2, EVM usage has rapidly grown to dominate network activity

- Cosmos Deprecation

- Sei Global Wallet is a cross-application embedded crypto wallet powered by Dynamic Global Wallets, built directly into web applications and allows users to authenticate using familiar methods like Google, Twitter, Telegram, or email—no downloads or crypto knowledge required.

- Connect Cosmos Wallet <> EVM Wallet

- EVM Wallets Integrations in progress: Metamask

Foundation Operation

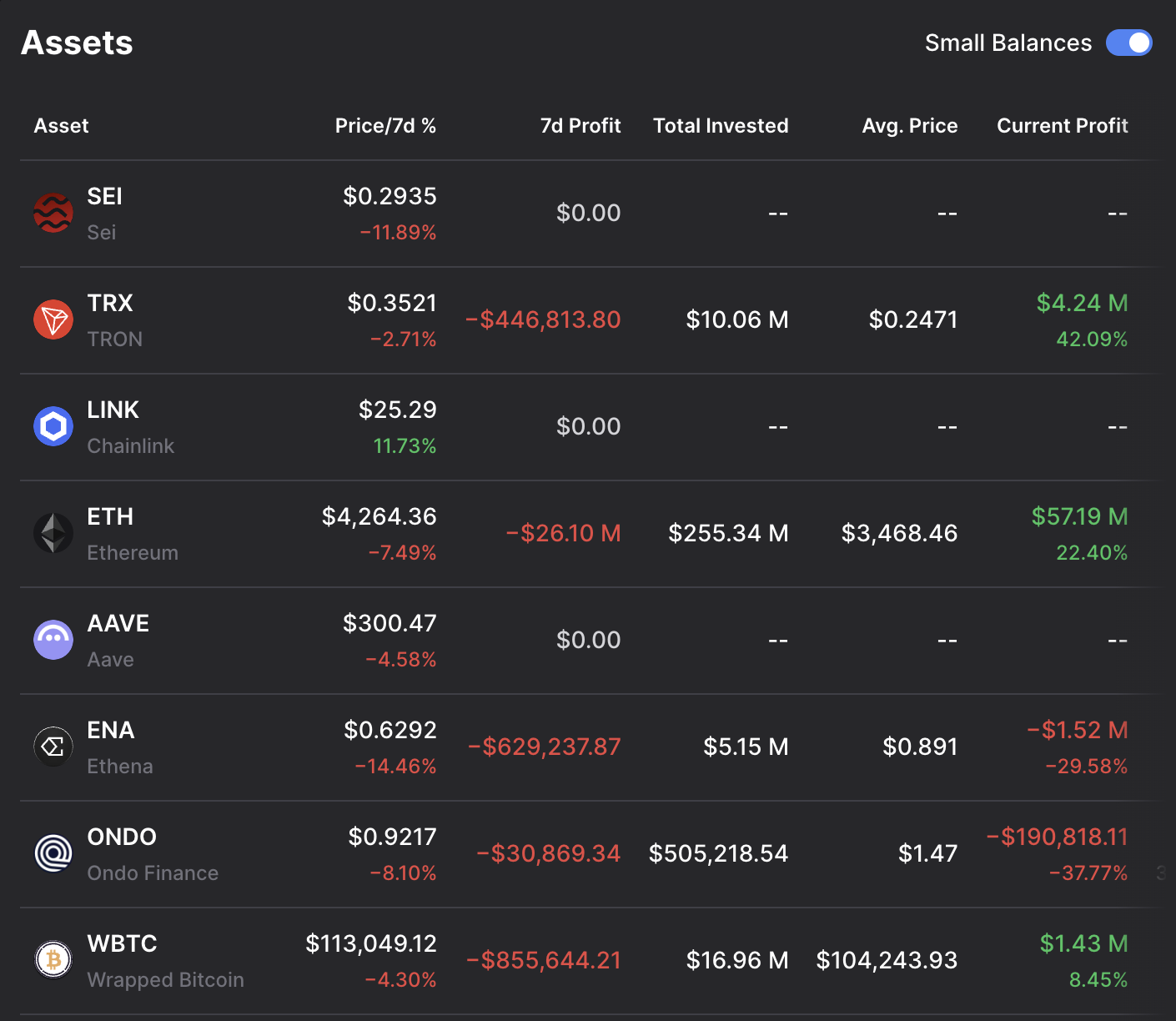

WIFL Investment

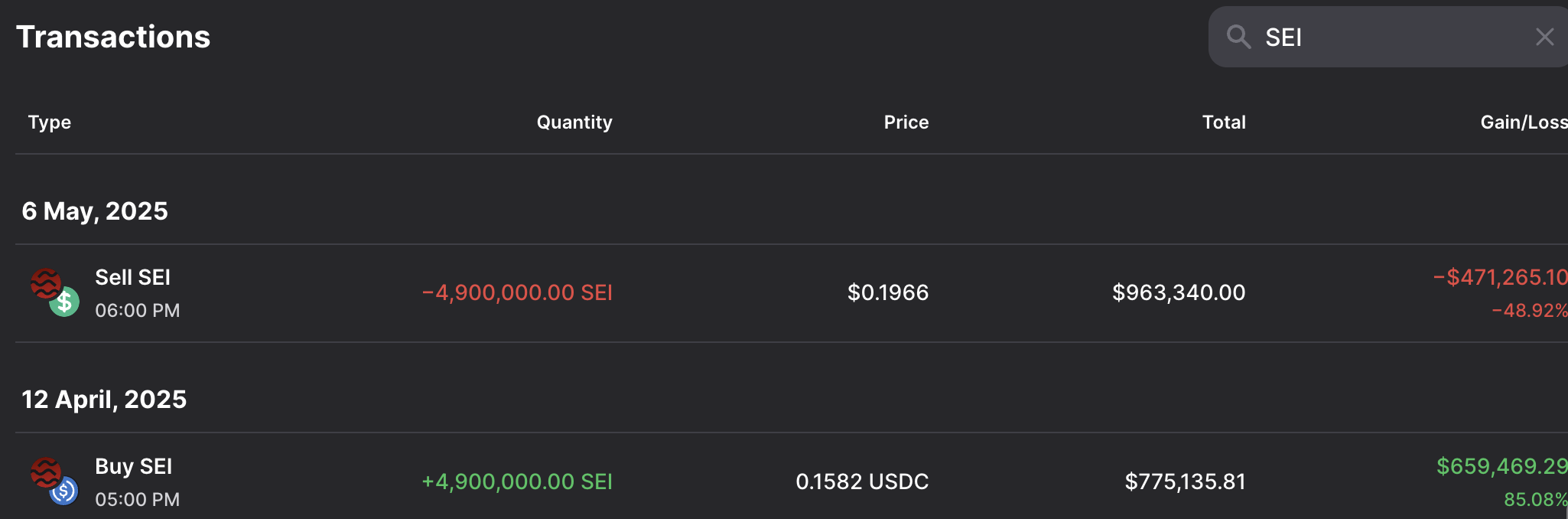

- February 20, 2025: WLFI made an initial purchase of approximately 547,990 SEI tokens for $125,000 (average price ~$0.23 per token).

- March 14, 2025: WLFI added another 541,242 SEI tokens for $100,000 (average price ~$0.185 per token), bringing their total to around 1.1 million SEI at an average entry price of $0.21.

- April 12-14, 2025: WLFI executed its largest SEI buy to date, acquiring 4.89 million tokens for $775,000 in USDC (average price ~$0.158 per token). This move expanded their holdings to approximately 5.98-6 million SEI tokens overall, valued at around $1 million at the time but likely appreciating since.

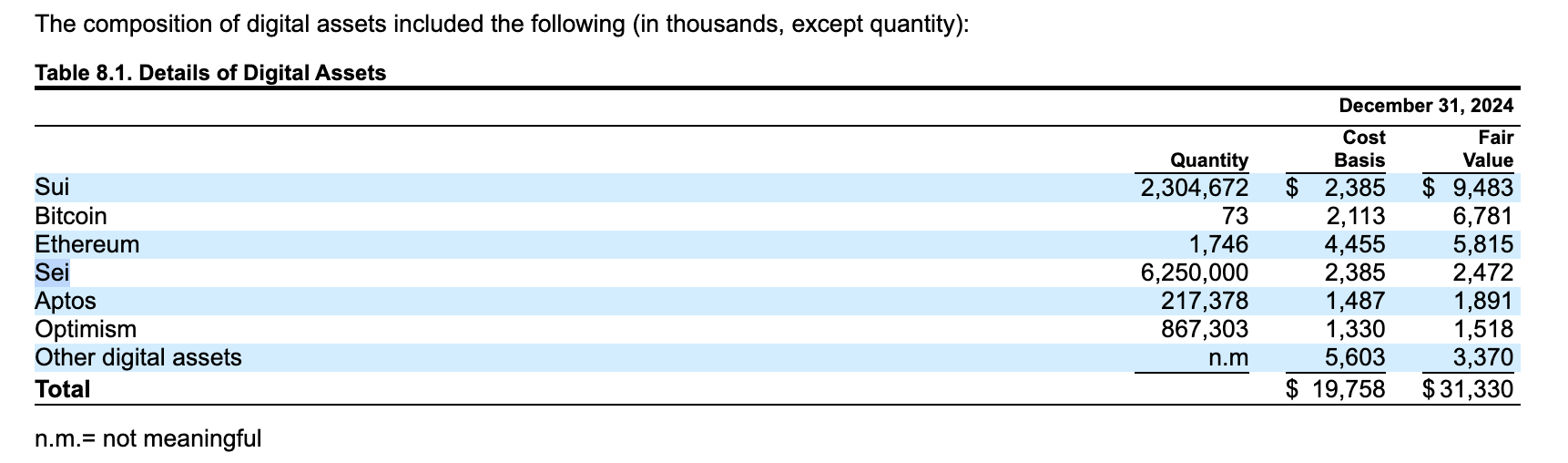

Circle Holdings

Based on available information from Circle's IPO filing, the company holds 6.25 million SEI tokens, which had a fair market value of $2.47 billion as of December 31, 202

Canary ETF in Progress

- Structure and Objective: The ETF operates as a Commodity-Based Trust Shares product under Cboe BZX Rule 14.11(e)(4). It will hold spot SEI tokens, cash, or cash equivalents in a Delaware statutory trust (formed April 23, 2025). The primary goal is to track the performance of SEI's price, as measured by the CoinDesk SEI Price Index (a benchmark calculated every 15 seconds based on real-time prices from major platforms). Shares represent fractional ownership in the trust's net assets and will trade on the Cboe BZX Exchange.

- Staking Mechanism: A portion (or all) of the trust's SEI holdings may be staked through trusted third-party staking providers on the Sei Network, which uses a delegated proof-of-stake consensus. Staking rewards (earned by validating transactions and securing the network) will be treated as trust income and distributed to shareholders, potentially providing yield on top of SEI price appreciation. Airdrops, forks, or other non-staking events are excluded from the net asset value (NAV).

- Progress Timeline:

- April 23-24, 2025: Canary registers the Staked SEI ETF Trust in Delaware.

- April 30, 2025: Canary files Form S-1 registration statement with the SEC, outlining the ETF's structure and seeking approval to offer shares publicly. This is the initial registration step for securities offerings.

- May 2025: Industry commentary highlights the filing as a push for SEC clarity on crypto staking, amid broader altcoin ETF momentum (e.g., Canary also filed for Sui and others).

- August 18, 2025: Cboe BZX submits Form 19b-4 to the SEC, proposing rules to list and trade the ETF shares. This initiates the formal SEC review process, placing SEI in the same category as ETH and SOL for staked ETFs.

SALT

- Participation and Representation: Sei Labs' General Counsel, Gerald, is actively on-site at the SALT Conference. He is engaging with high-profile figures, including U.S. Senator Cynthia Lummis, a vocal advocate for pro-crypto legislation. This aligns with the event's emphasis on bridging institutions, policymakers, and blockchain developers to shape digital asset frameworks.

- Contextual Significance: The conference coincides with the Federal Reserve's Jackson Hole meeting, creating a "pivotal week for crypto." Discussions include a DeFi-friendly stance from the Fed, Wyoming's launch of a landmark stablecoin initiative, and collaborative efforts on regulation. SEI positions itself as "high-performance infrastructure for this new era of digital markets," emphasizing its Layer 1 blockchain's speed and suitability for institutional adoption.

DAT

- Not announced yet

- In Progress

Network Status

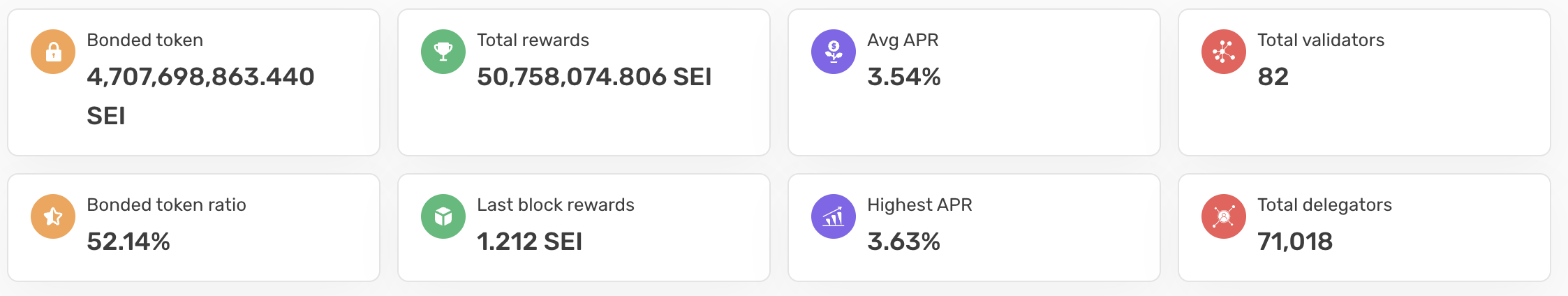

- Validators

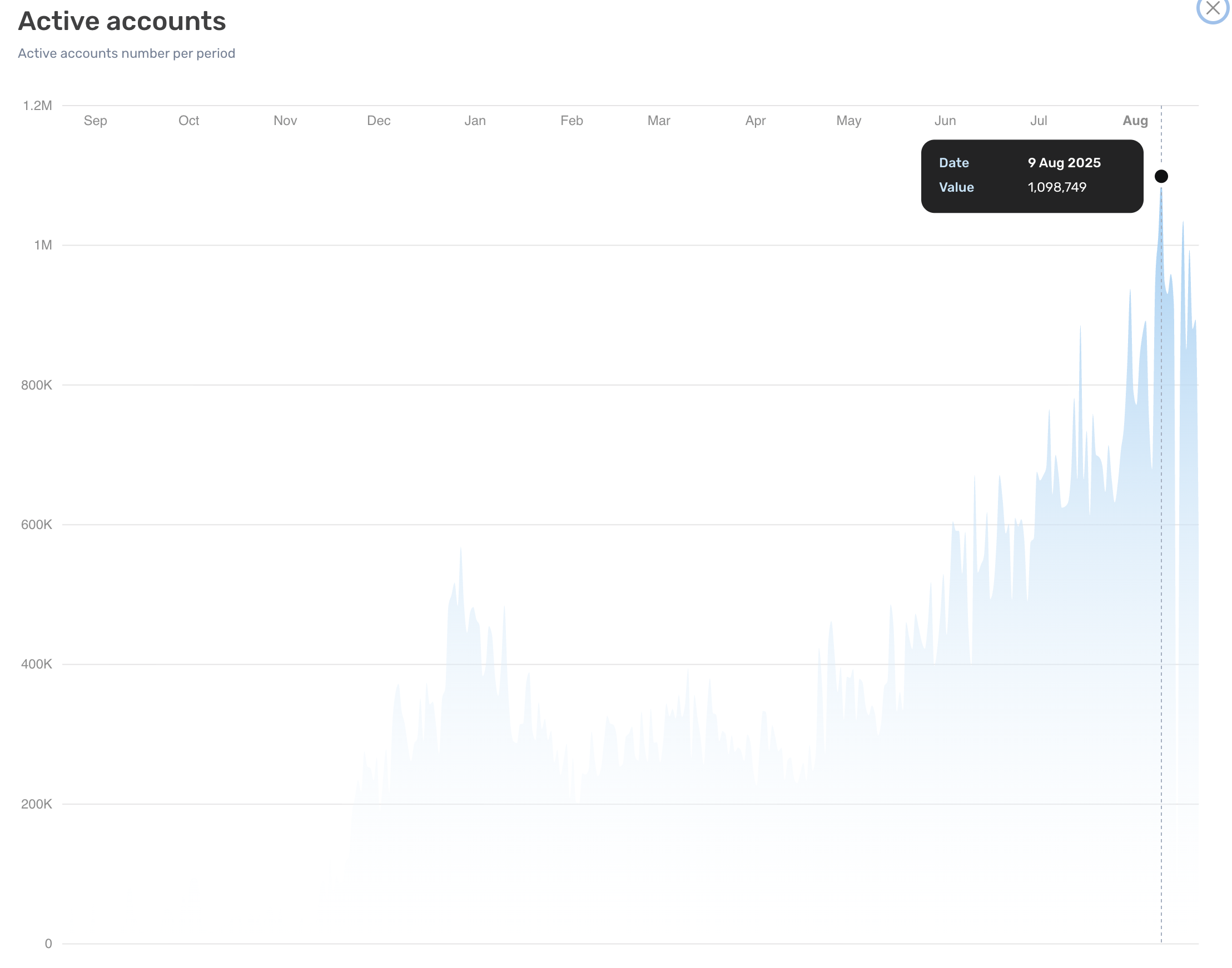

- Active Address

- Real Address: 10~100K

- ATH: nearly 1M

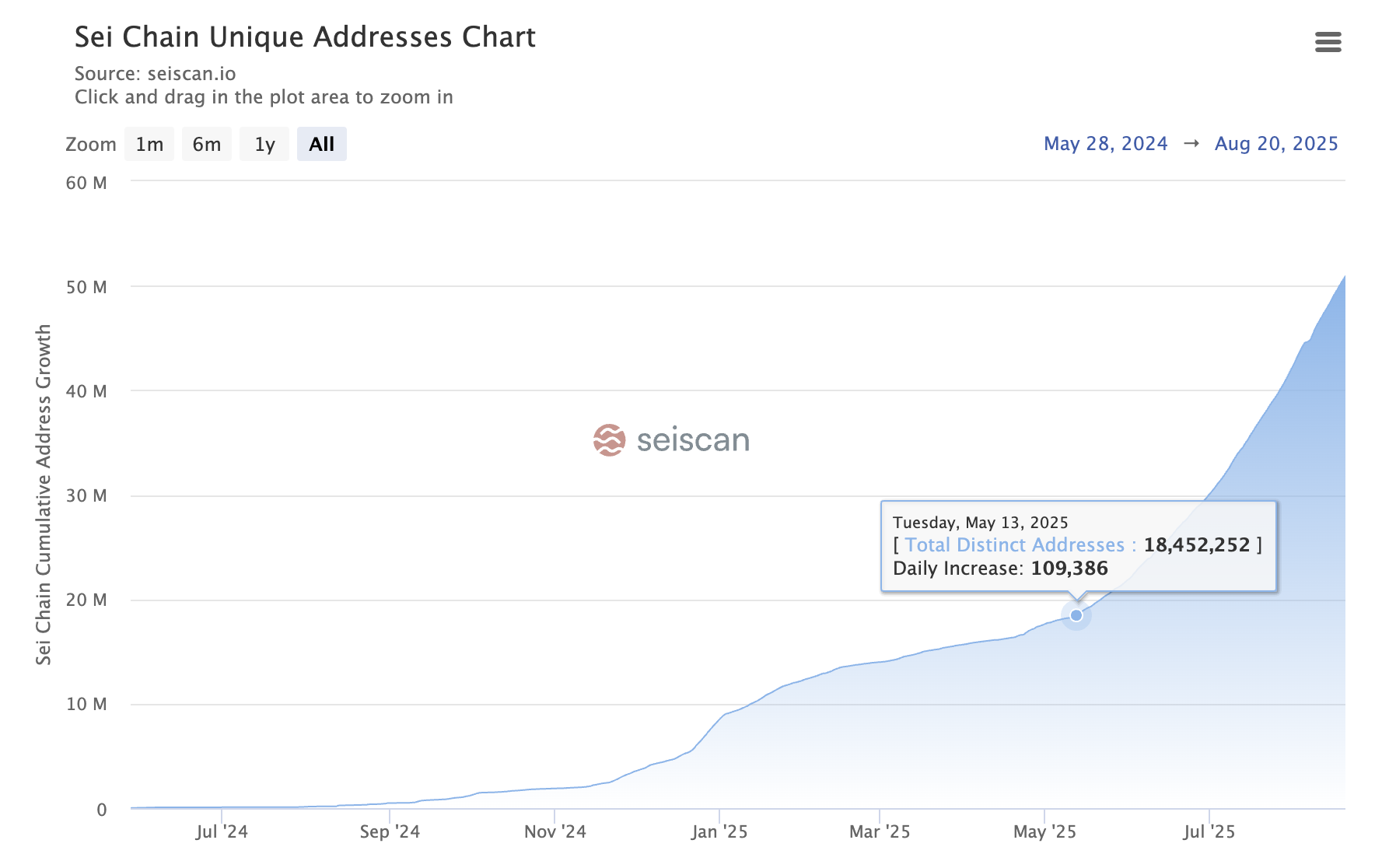

- User Growth

- Daily increase over 100K address since mid of May

- Main users comes from GameFi application, like Starknet before

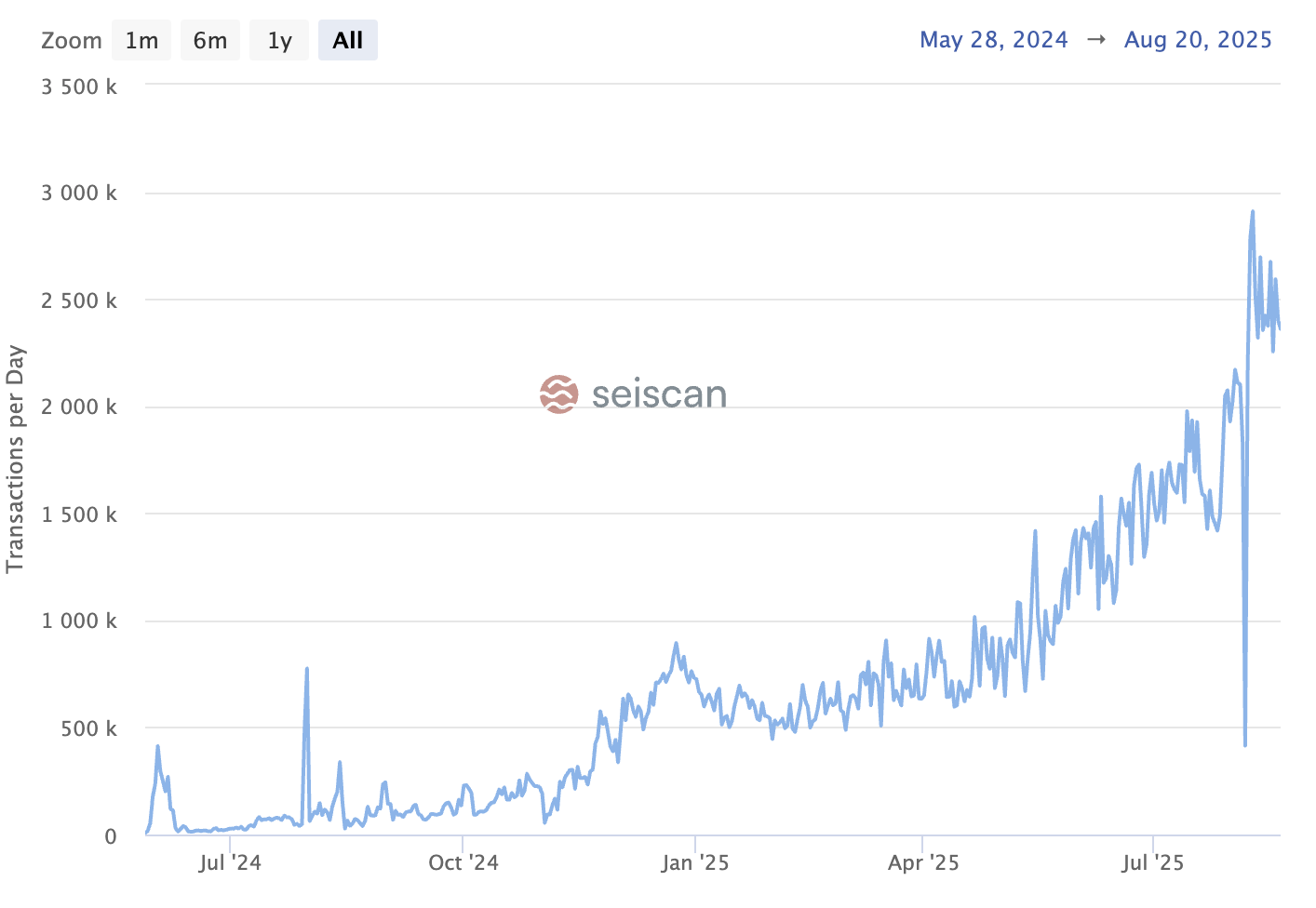

- Daily Transactions

- Approaching 30 TPS now

- Approaching 30 TPS now

Ecosystem Building an Positioning in the Market

- High-Speed EVM L1, to serve all possible applications.

- Not rely on single sector, in case stuck in the sector and hard to pivot to other sector. Like MEME for Solana, GameFi for Ronin.

Lending

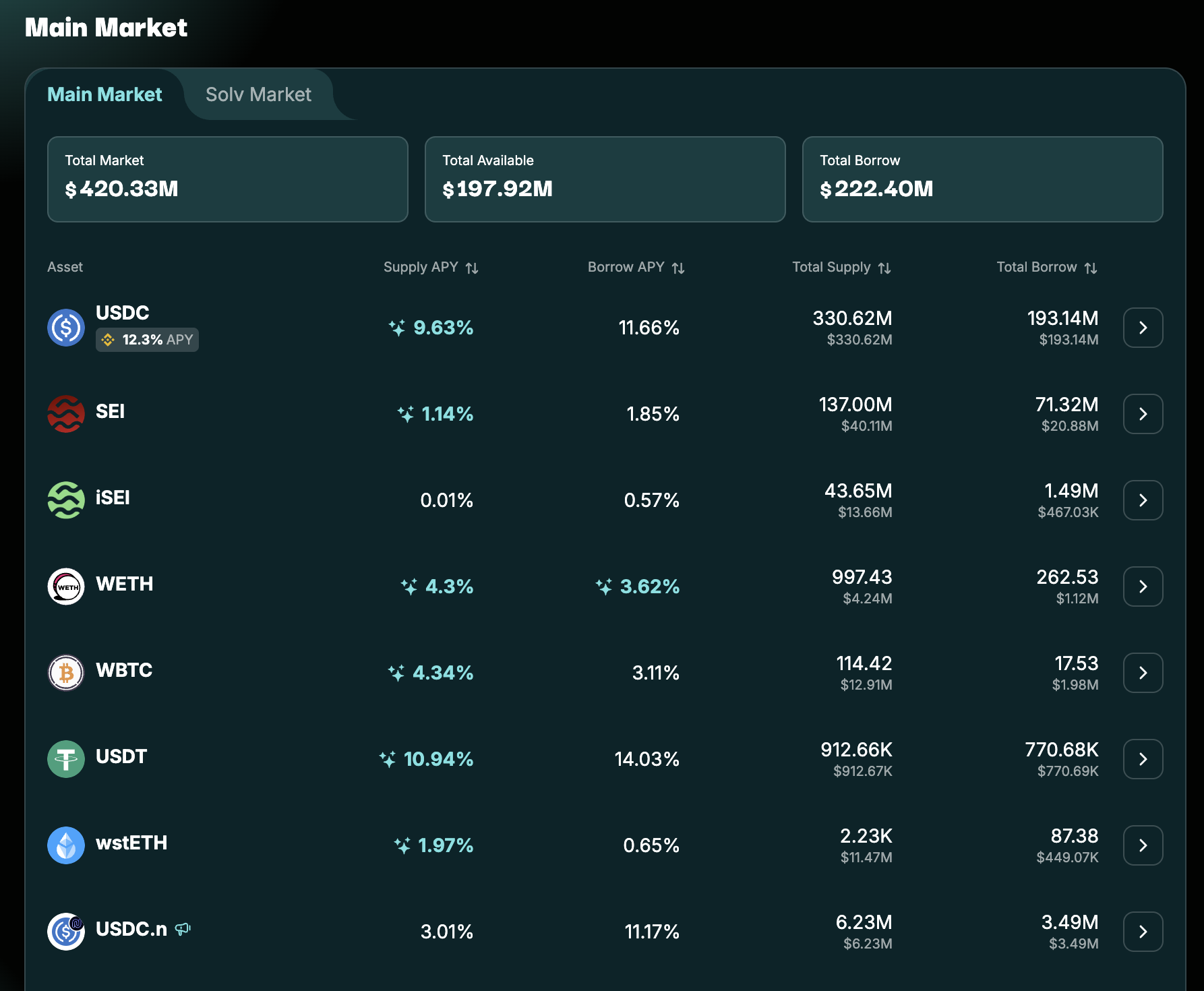

YEI Finance

- Taiwan team

- USDC: 12.4% APY

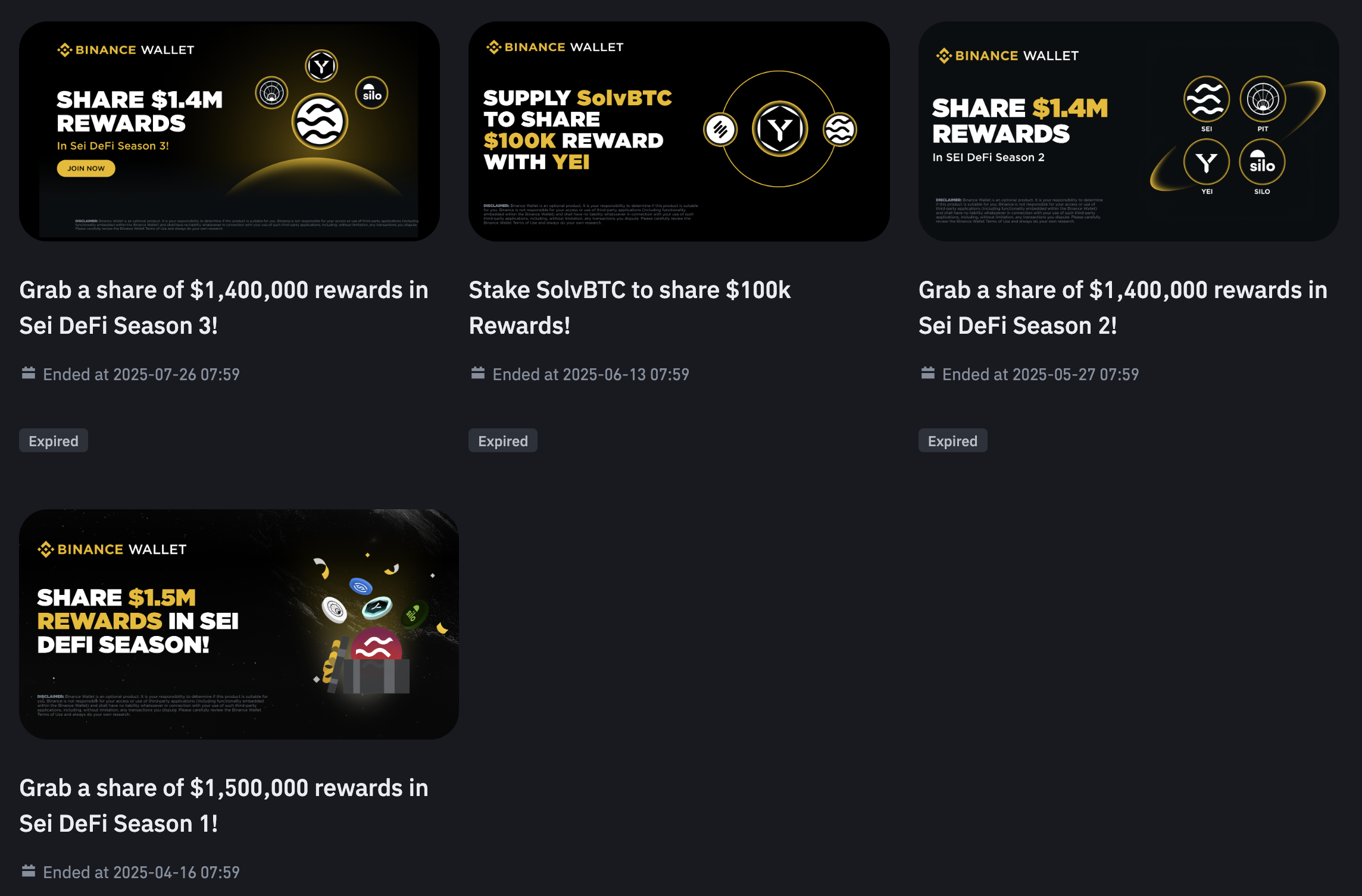

- Binance Wallet: 1.4M, 2 months campaign

- 8.4M, 12.4% APY, 70M Supply comes from Binance Wallet

- Sei DeFi Seasons with Binance Wallets

- 700K Sei, 8.4M

- 8.4M

- SolvBTC

- Campaign close at end of July

- Still over 1,000 BTC, over 100M TVL

- When the subsidy of 0.84% WSEI ends

- 1M

- TGE in 1~2 months, Points Leaderboard

- May follow the strategy of Sui

- Previous cooperation with OKX

- 5 months

- 300~400M

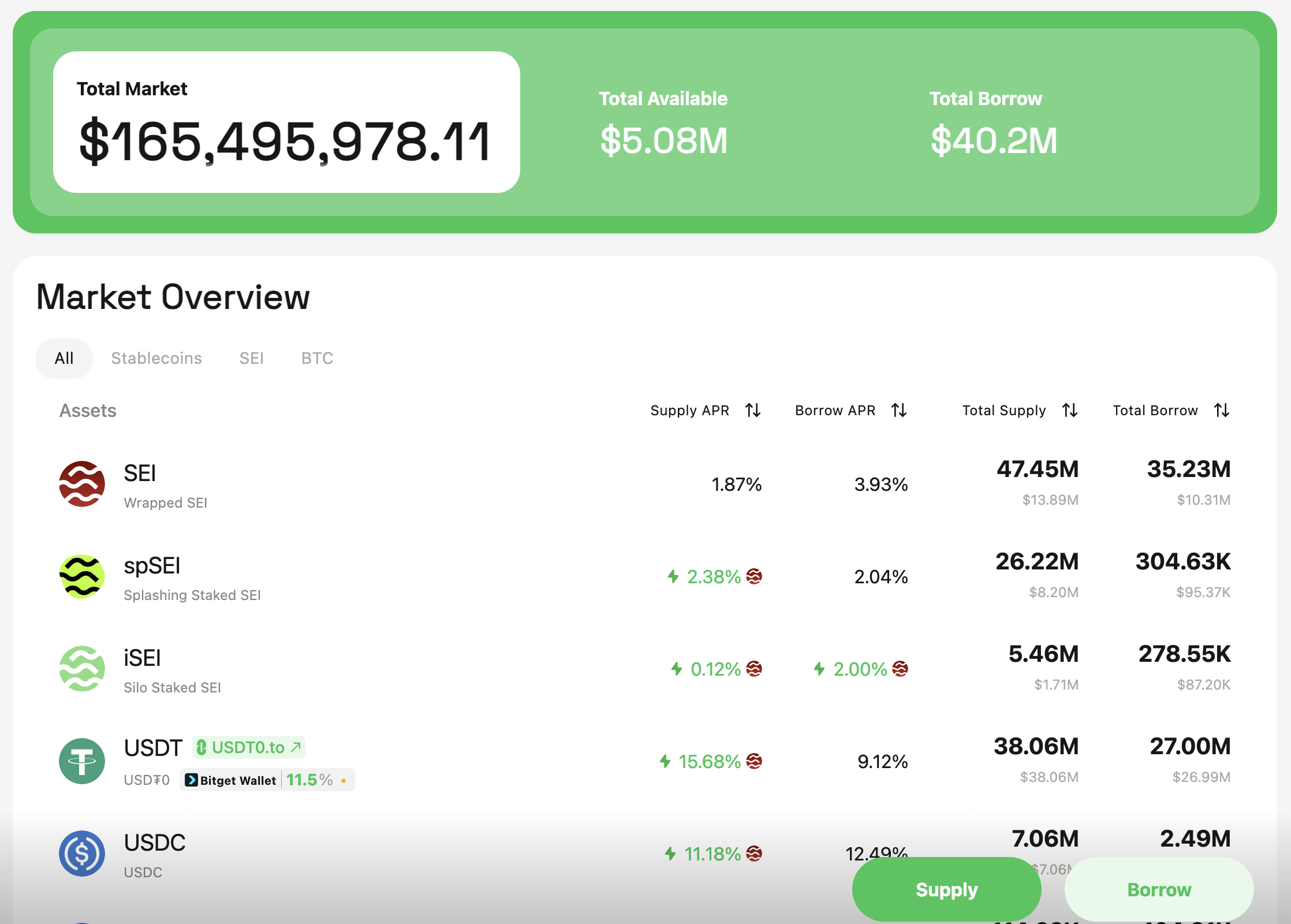

Takara Lending

- Half comes from stake Assets

- Half comes from Bitget wallet compaign

- USDT, 15% APY

- 1M for 6months, 2M per year, 12% APY subsid

- USDT TVL from Bitget is 16.6M

- Small users, 21K in 12 hours

- TGE soon. No Leaderboard, Opportunity

Dex

Monaco

Monaco is a Central Limit Order Book (CLOB) that delivers institutional performance with decentralized principles, built as a shared liquidity layer on the Sei blockchain. It's designed to become the default trading infrastructure for the expanding onchain economy.

- The Market Opportunity: The article highlights a massive shift toward tokenization, with estimates putting the tokenized market at $30T by 2034, growing more than 45% a year. Industry leaders including Treasury Secretary Scott Bessent, BlackRock CEO Larry Fink, and Standard Chartered are backing this transformation.

- Key Innovations:

- Shared Liquidity: Applications can instantly access deep institutional liquidity without building their own order books from scratch

- PitPass Revenue Sharing: Applications can integrate Monaco's liquidity in minutes and automatically earn fees from the trades they facilitate, democratizing order flow revenue that traditionally only benefits large institutions

- Network Effects: More applications using Monaco leads to deeper liquidity and tighter spreads, creating a virtuous cycle

- Vision: Monaco positions itself as the infrastructure layer for "Decentralized Wall Street" - enabling 24/7 trading, instant settlement, and democratized access to institutional-grade trading infrastructure while maintaining decentralized principles.

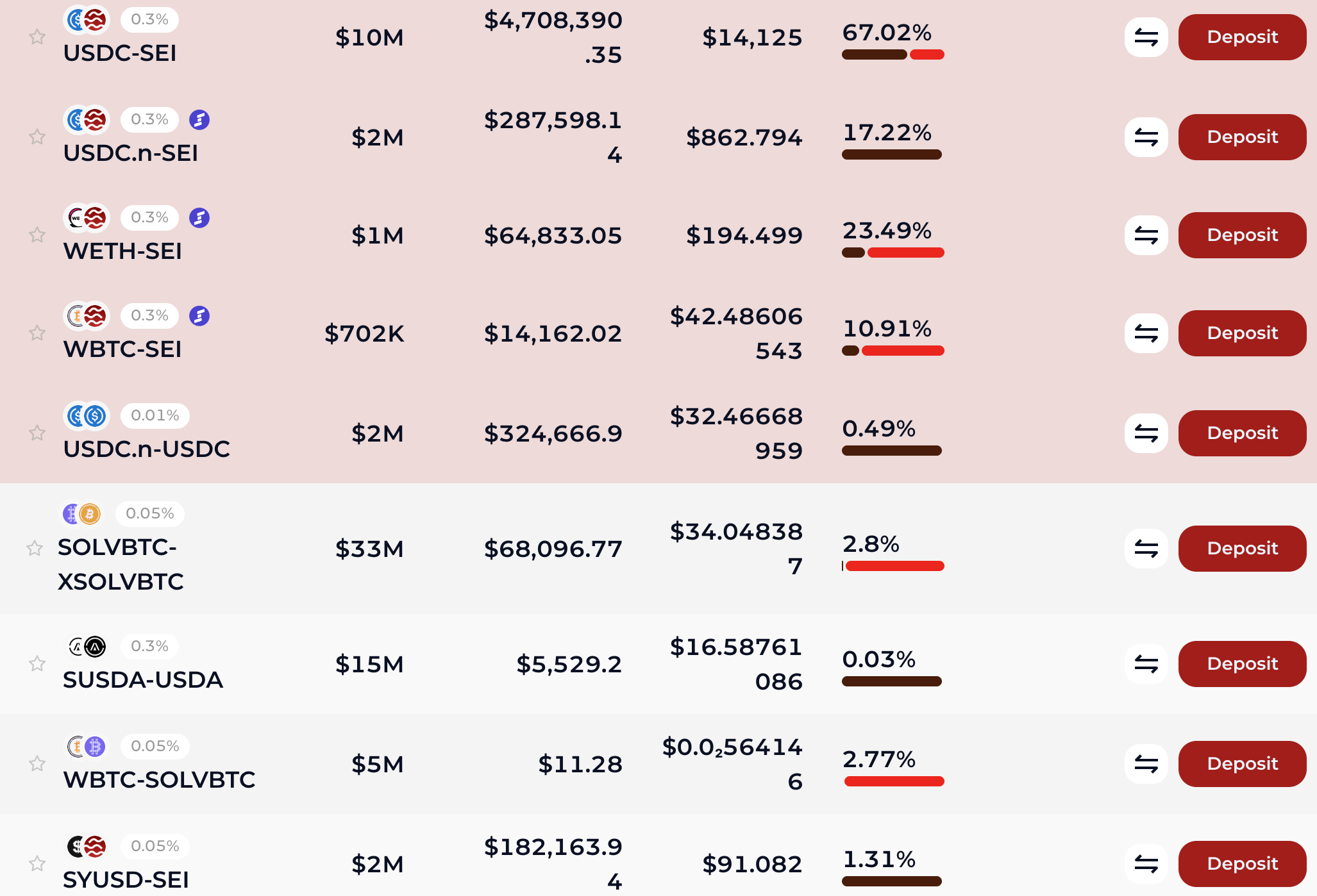

Sailor

- Singapore Team

- 70M TVL

- 33M form SolvBTC/xSolvBTC

- Launchpad in the future

Dragon Swap

- Already TGE

- First DEX

- Market Cap: 50M +

Symphony

- Aggregator & MEME Lanuchpad

- Hard to compete with Monaco in aggregator

- MEME is not the focus so far

Stablecoin

USDC

- Now provides full support for native USDC on Sei, offering institutional-grade access to USDC liquidity through Sei’s high performance infrastructure.

- Total Supply:

- Native USDC: 176M

- Bridged USDC: 27M

USDY

- Tokenized note backed by short-term US Treasuries and bank deposits

- Announced Jul 17, 2025

- Not launched yet

USDT0

- USDT0 on Sei Mainnet is backed 1:1 by locked assets on Ethereum and ensures seamless interoperability across blockchain networks via the LayerZero protocol.

- Total Supply: 23M

syUSD

- CDP is still under building

- Locked around 14M SEI

fastUSD

- Backed by deUSD from Elixir

- Total Supply: 5.3M

Other Potential Stablecoins

- USDT: in progress

- Wyoming Stable Token Commission targets

- Sei network was selected for Wyoming's state-backed stablecoin pilot project, validating its regulatory-friendly approach and institutional-grade performance capabilities.

- Aptos、Arbitrum、Avalanche、Base、Ethereum、Optimism、Polygon、Sei、Solana、Stellar and Sui

AI

Sei Model Context Protocol

- Sei MCP server provides blockchain services for Sei blockchain. This server enables AI assistants and agents to interact via unified interface.

- Reading blockchain state (balances, transactions, blocks, etc.)

- Interacting with smart contracts

- Transferring tokens (native, ERC20, ERC721, ERC1155)

- Querying token metadata and balances

- GitHub

Cambrian Agent Kit

- A developer SDK for building powerful, autonomous AI agents and agentic chatbots on the SEI blockchain.

- Token Operations: Complete SEI ERC-20 and ERC-721 token management

- DeFi Protocol Integration: Seamless interaction with SEI’s DeFi ecosystem

- Swap Functionality: Token swapping through Symphony aggregator

- Liquidity Management: Add and remove liquidity with DragonSwap

- Lending & Borrowing: Interact with Takara protocol for lending operations

- Staking Operations: Stake and unstake SEI tokens with Silo

- LangChain Integration: Build AI agents with LangChain and LangGraph

- Team: add new Head of AI

Raiinmaker

- A mobile application enabling users to upload, capture and annotate videos, earning COIIN tokens convertible to $RAIIN for trading and staking. It transforms smartphones into validator nodes, ensuring GDPR-compliant data creation.

Oracle

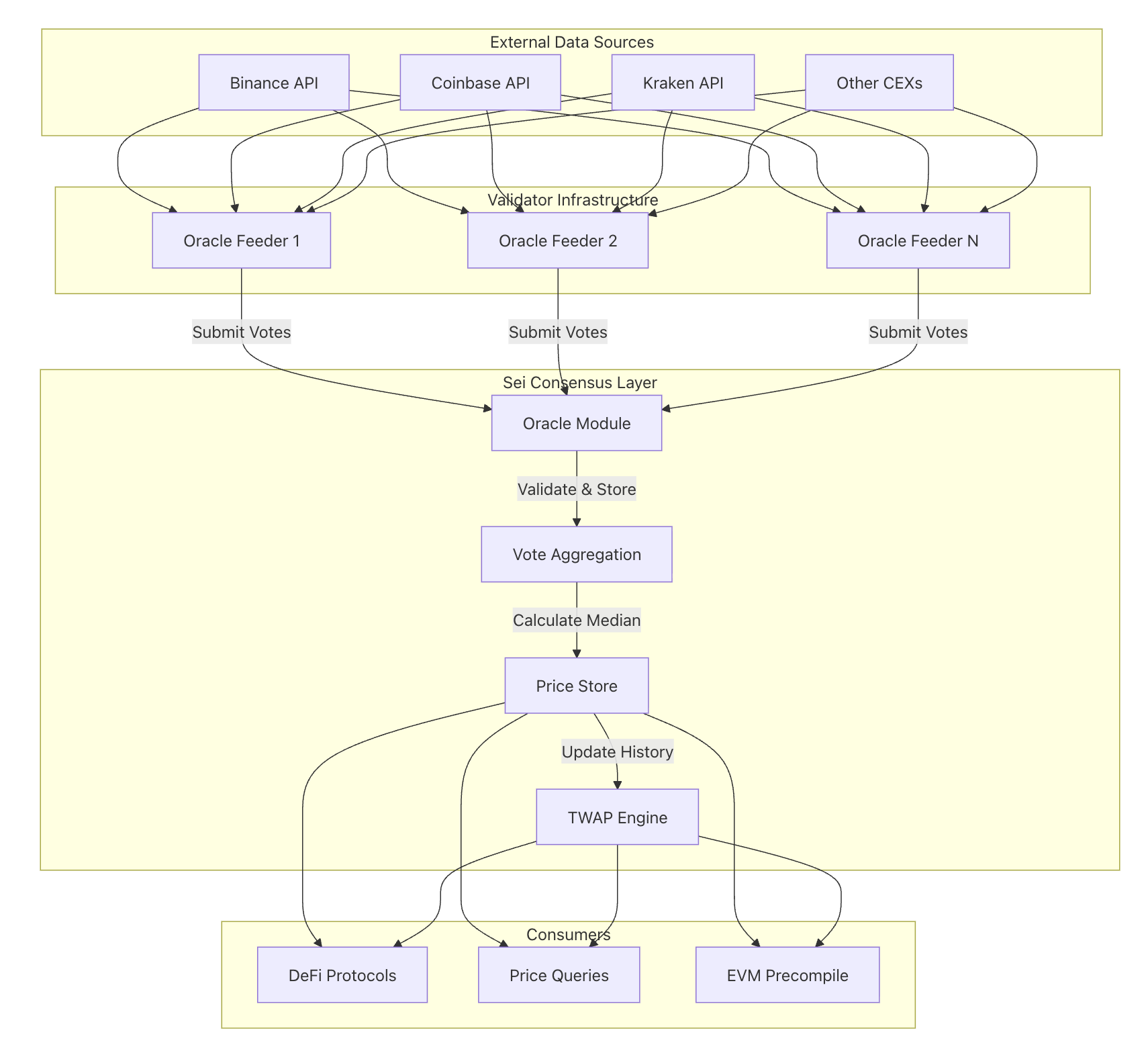

-

Native oracle module provides a decentralized, secure, and efficient mechanism for bringing off-chain price data on-chain. Unlike third-party oracle solutions, Sei’s native oracle is deeply integrated into the consensus layer, making it a critical component of the network’s infrastructure.

- Validator Participation: All validators are expected to participate in price voting as part of their duties

- High Frequency Updates: Price updates occur every block through an efficient voting mechanism

- Weighted Aggregation: Uses stake-weighted median calculations to resist manipulation

- Time-Weighted Averages: Built-in TWAP support for DeFi protocols requiring smoothed prices

- Spam Resistance: Multiple security layers prevent vote manipulation and overflow attacks

-

Oracle Feeders are off-chain services run by validators that fetch prices from multiple exchanges, aggregate them locally, and submit votes to the chain. Each validator typically runs their own feeder with custom logic.

-

Vote Submission occurs through

MsgAggregateExchangeRateVotetransactions. Validators must submit votes for all whitelisted denoms each voting period or face penalties. -

Vote Aggregation happens at the end of each voting period (typically every block). The module calculates a stake-weighted median of all valid votes to determine the final exchange rate.

-

Price Store maintains the current exchange rates and historical data needed for TWAP calculations. Prices are stored with block height timestamps for auditability.

-

TWAP Engine calculates time-weighted average prices over configurable lookback periods. This provides smoothed prices that are resistant to short-term manipulation.

-

Ecosystem Oracles

- Pyth

- RedStone

- Api3

- Orochi Network

- SEDA

RWA

Picasso Markets

Others

- DeSci

- 65M Fund

- 23andMe

- DePin

- Not involved yet

- LSD

- Silo

- TVL 26.5M

- APR 3.82%

- Silo

- Payments

- Sept