TL;DR

EVM compatibility has been a long-running narrative since the last cycle, and SVM is now Solana's latest weapon in its infrastructure competition with Ethereum. While we previously thought the Layer 1 war had settled, today it appears the competition continues.

The Solana Virtual Machine (SVM) represents a significant technological advancement in blockchain architecture, positioning itself as a compelling alternative to traditional EVMs, particularly in terms of transaction processing efficiency and scalability.

In this article, we first delve into SVM itself and analyze the differences between SVM and EVM, highlighting SVM's advantages. We then explore the SVM landscape, separating projects into three categories: leading players, SVM-as-a-Service projects, and Specialized SVM implementations. Notably, each SVM project typically finds its counterpart in the Ethereum ecosystem, demonstrating how the Layer 1 blockchain competition remains fierce.

Despite impressive technical achievements, the SVM ecosystem's market traction is far from expection. Eclipse's metrics and Soon's early testnet phase indicate a gap between technical capability and practical adoption. The ecosystem's future success appears to depend on securing high-profile partnerships, developing compelling showcase projects, and strengthening developer engagement.

Introduction to the Solana Virtual Machine (SVM)

The Solana Virtual Machine (SVM) marks a pivotal advancement in blockchain architecture, representing a significant departure from traditional monolithic designs. While Solana's core architecture maintains its monolithic structure, the development of SVM by Anza (formerly Solana Labs) signals a strategic shift toward modularity, positioning the platform to compete effectively in the emerging modular blockchain landscape.

The Evolution of SVM

SVM's foundation rests on the Berkeley Packet Filter (BPF) technology, originally engineered for network packet filtering in Berkeley Software Distribution (BSD) Unix systems. This foundation has evolved into eBPF (Extended Berkeley Packet Filter), delivering a secure execution environment through meticulously restricted instruction sets. The technology's adaptation for blockchain use comes through rbpf, a Rust implementation initially created by Quentin Monnet and now maintained by Anza.

The ecosystem features two primary implementations: Solana rBPF, which operates under specific constraints defined by the SVM Instruction Set Architecture (ISA), and Firedancer, which offers a complete reimplementation while maintaining strict adherence to the SVM ISA. Both implementations support a diverse range of programming languages, including Rust, C, and C++, all compiling to BPF bytecode for execution.

The SVM's instruction set architecture provides a robust framework for smart contract execution, featuring a sophisticated system for instruction classification, operation control, register management, and memory access. This comprehensive technical foundation ensures both efficient and secure transaction processing while maintaining the flexibility required for diverse blockchain applications.

Core Innovations of SVM: The Execution Layer

The Solana Virtual Machine (SVM) represents a groundbreaking evolution in blockchain execution environments. While Solana was originally built on eight key innovations identified by co-founder Toly—spanning consensus mechanisms to data storage solutions—the decoupled SVM retains three crucial advantages that distinguish it from traditional EVMs.

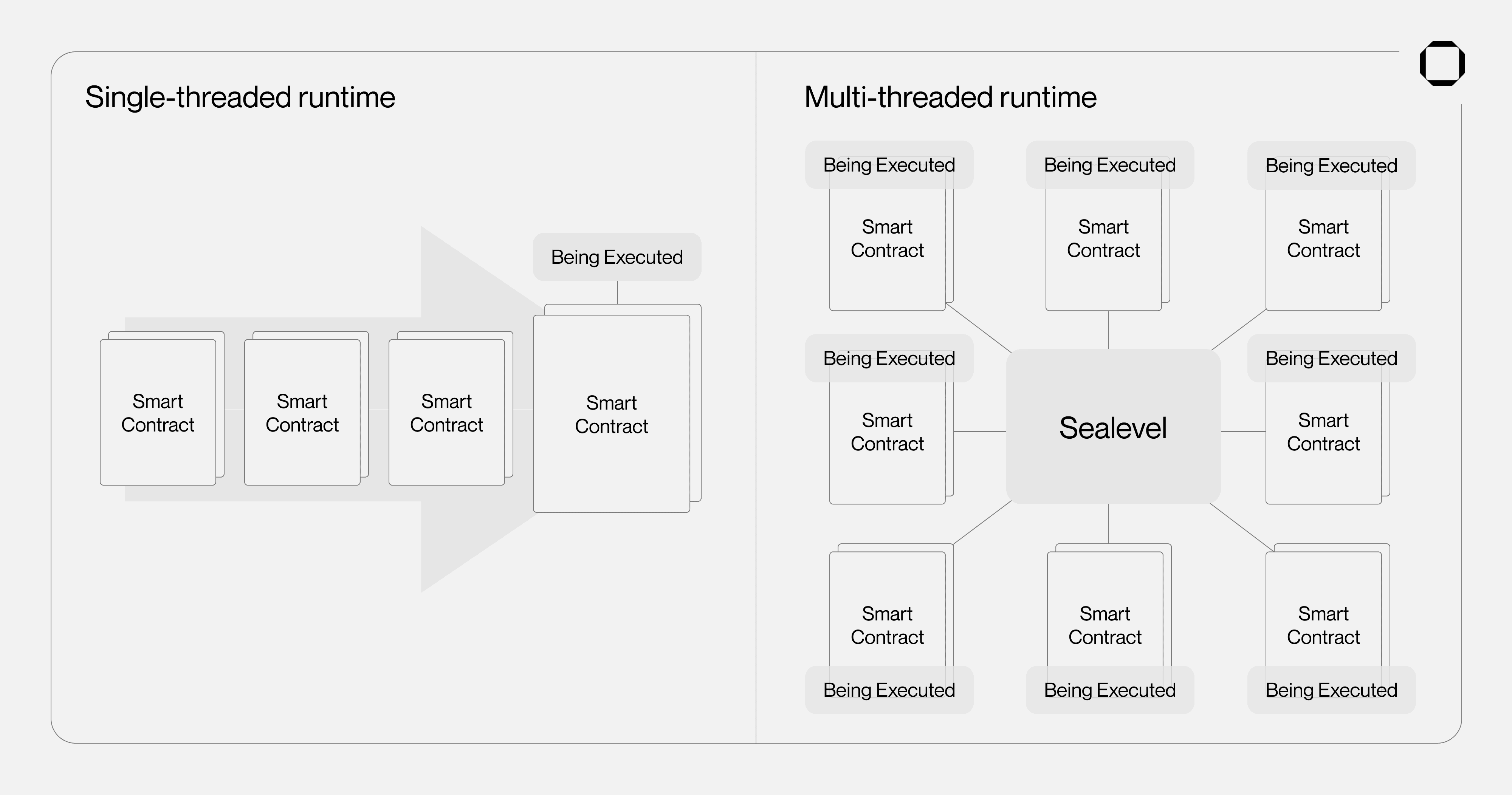

Parallel Execution Through Sealevel

At the heart of SVM's technological superiority lies the Sealevel parallelization engine, which fundamentally reimagines blockchain transaction processing. While traditional EVMs process transactions sequentially, Sealevel harnesses the power of multi-core hardware architecture to execute transactions in parallel. This innovative approach delivers natural scalability, automatically benefiting from hardware advancements as processors evolve to incorporate more cores at increasingly competitive costs.

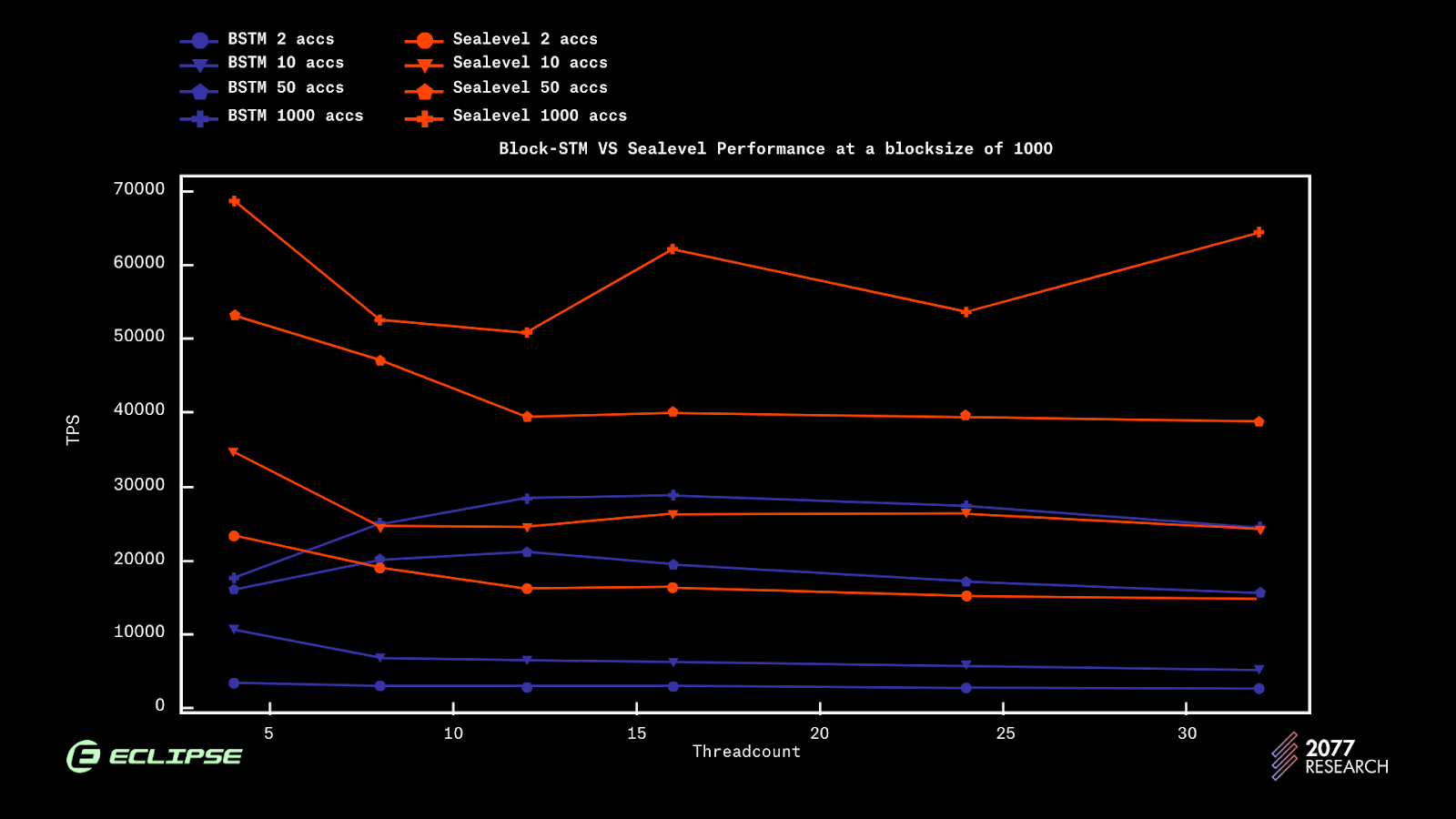

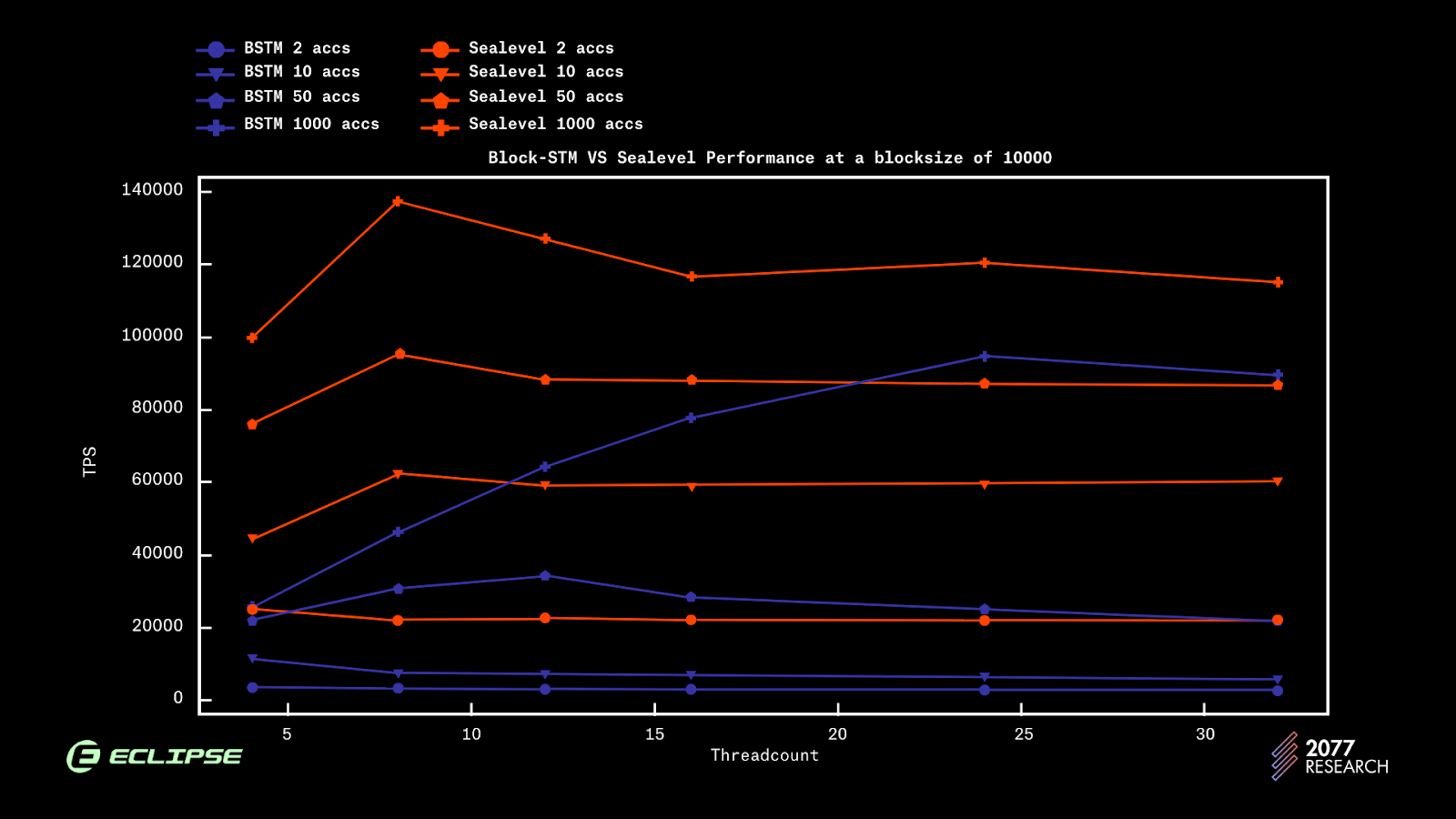

The key to Sealevel's efficiency is its preset dependency system. By requiring smart contracts to declare their state dependencies upfront, Sealevel can intelligently process non-conflicting transactions simultaneously. This contrasts sharply with solutions like Block-STM, which rely on transaction re-execution to identify conflicts. Stress testing demonstrates Sealevel's superior performance, particularly as block sizes increase, showing significantly better throughput across both small (1k) and large (10k) block sizes.

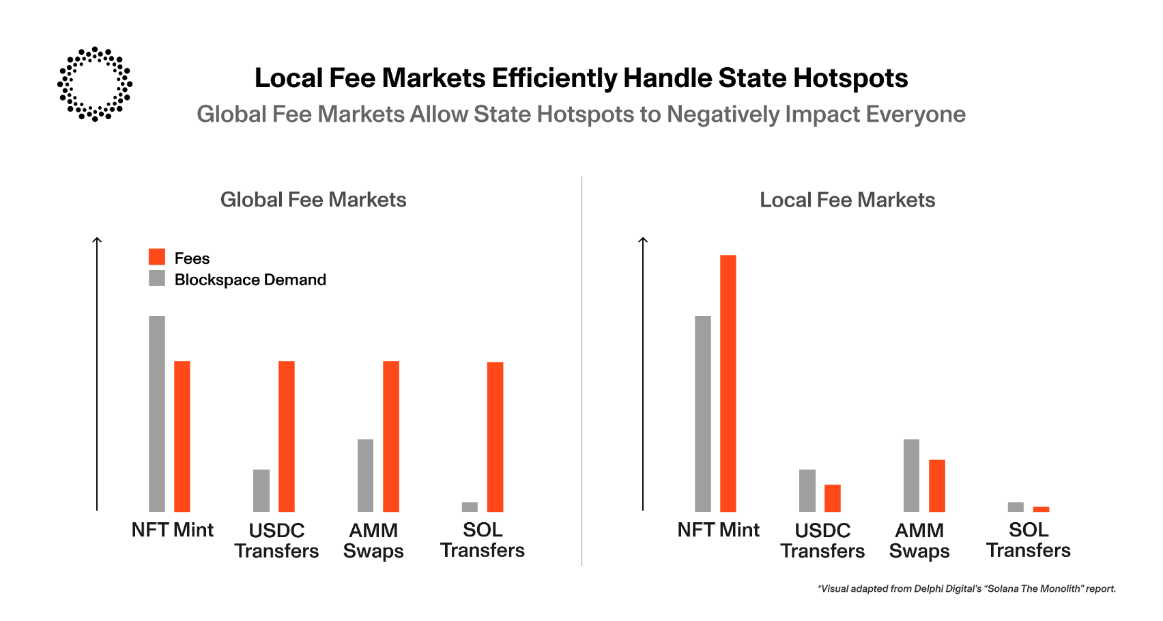

Innovative Fee Market Design

SVM implements a sophisticated local fee market that prioritizes efficiency. The system's scheduler identifies and prioritizes conflict-free transactions, allowing them to process with lower fees. This creates a more nuanced and efficient fee structure compared to traditional linear fee models, potentially reducing costs for users while maintaining system performance.

Advanced Account Architecture

Cloudbreak introduces a sophisticated account database system that fundamentally changes how blockchain state is managed. At its core, the system creates a direct mapping between public keys and their associated accounts, with each account maintaining both balance and data information. The architecture implements a clear ownership model where programs have specific control over their owned accounts while maintaining open access for certain operations. The System Program serves as a central authority for account management, handling ownership assignments and initial data allocation, with these assignments being permanent throughout an account's lifetime. This comprehensive approach creates a more efficient and secure way to manage state compared to traditional EVM architectures, while still providing the flexibility needed for complex applications.

The Battle Between EVM and SVM

The blockchain landscape is experiencing a significant shift in virtual machine adoption. Historically, discussions centered around EVM compatibility, but now an increasing number of projects are choosing SVM despite its higher operational costs.

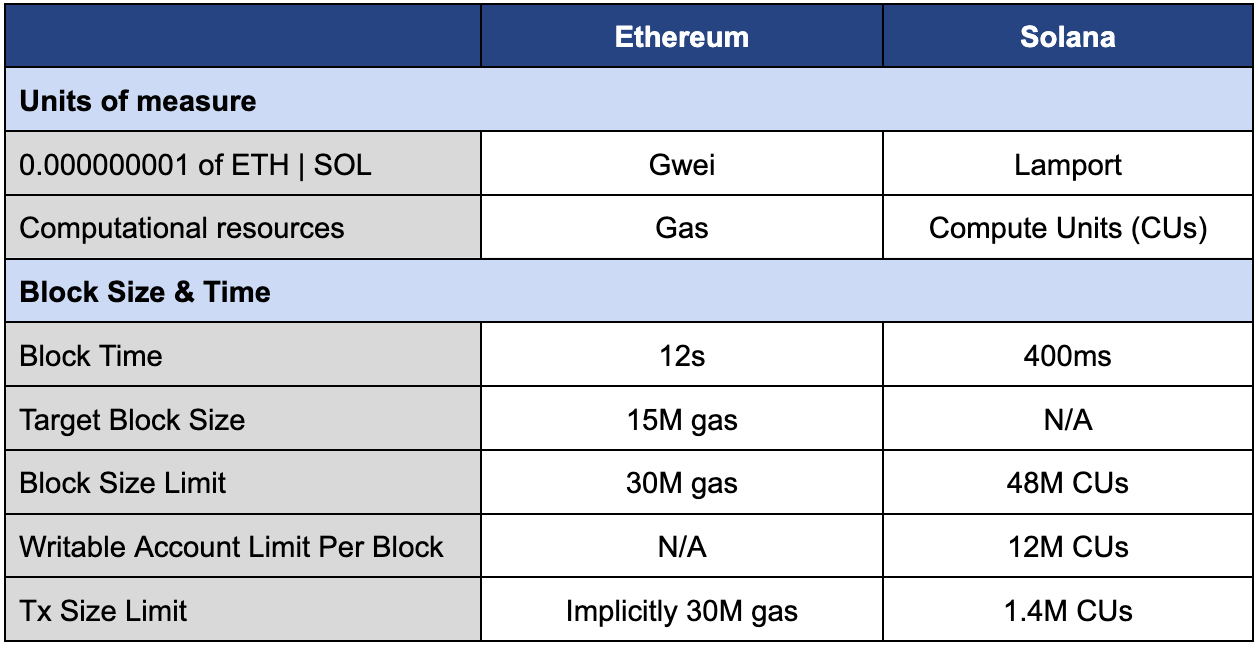

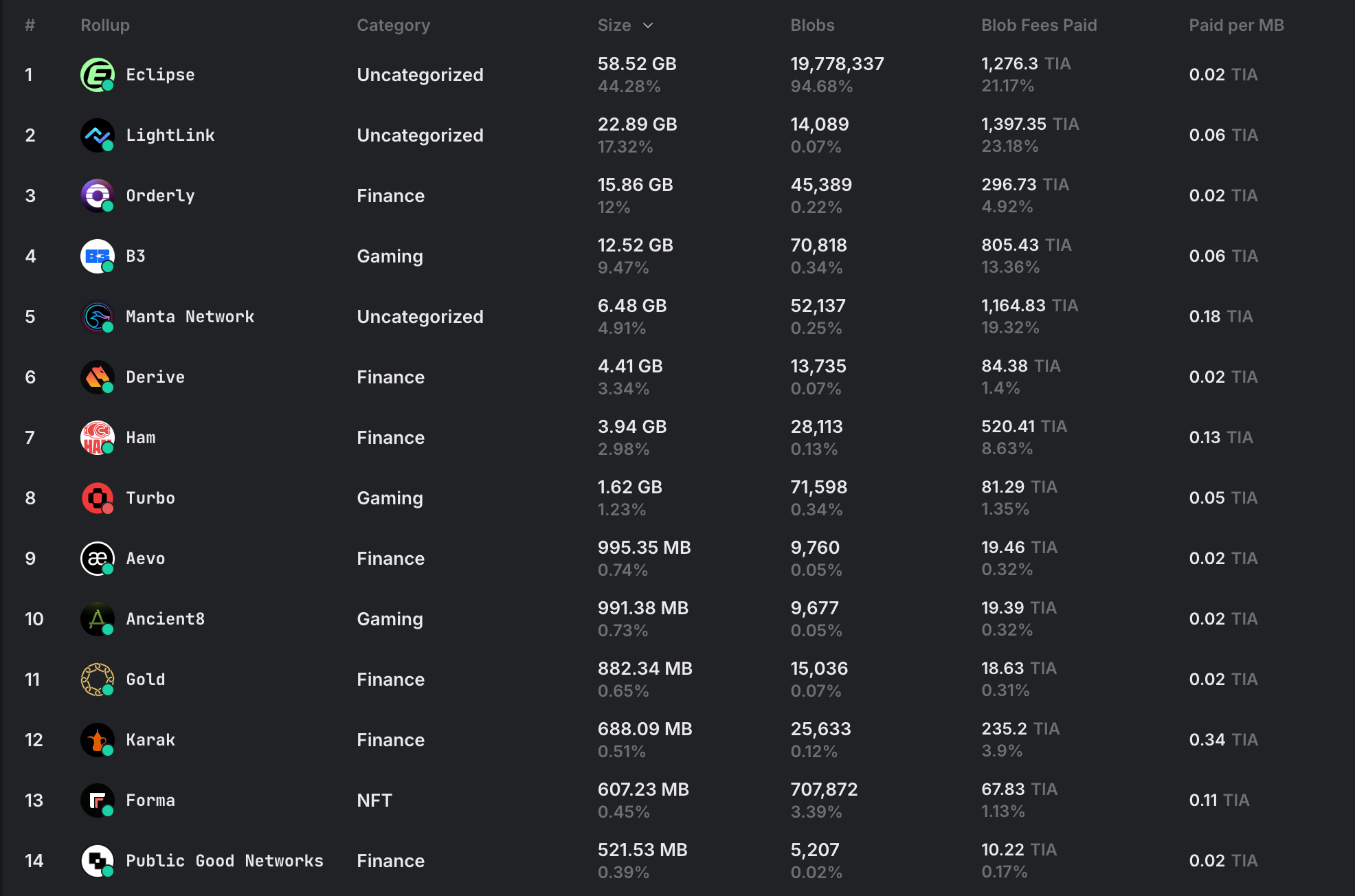

The technical differences between these systems are substantial. Their execution models differ dramatically. Solana processes blocks every 400ms compared to Ethereum's 12s, operating with a block size limit of 48M compute units versus Ethereum's 30M gas limit. Solana also implements specific constraints, limiting writable accounts to 12M CUs per block and individual transactions to 1.4M CUs.

The fee structures further highlight their distinct approaches. Ethereum employs a dynamic model through EIP-1559, adjusting fees every block to target 50% of maximum gas usage. Solana, meanwhile, maintains a fixed rate of 0.000005 SOL per signature (approximately $0.0005 at $100 SOL/USD). Their fee distribution models also differ significantly - Ethereum burns 100% of base fees while Solana splits fees 50/50 between burning and validator rewards.

This ongoing battle isn't just about technical specifications – it's about finding the right balance of performance, cost, and ecosystem support for specific project needs.

The Progress of SVM Development

The Solana Virtual Machine's development has been advancing at a remarkable pace, surpassing initial expectations. However, this technical progress has been met with mixed results in terms of ecosystem adoption and market impact.

At the forefront of this development is Anza (formerly Solana Labs), which is driving significant technical innovations. Their flagship project, Agave, represents a major step forward as one of five Solana clients under development. Set to launch on mainnet later this year, Agave demonstrates the technical maturity of the SVM ecosystem, having been forked from the original Solana Labs client.

Another significant development is the integration of the Move programming language into the SVM environment. This addition brings enhanced security features and improved interoperability to the platform. Move's static type system provides robust safety guarantees while maintaining the flexibility developers need for diverse use cases.

Leading SVM Players

In this section, we would go through the existing leading players in SVM ecosystem. Although they are all using SVM, their starting point, their vision, and even their SVM is not exactly same. And we could find the their positioning in the market according to their choice in modular layers.

Eclipse: The Pioneer of SVM Layer 2

Eclipse stands as the largest and on of the earliest SVM project to date, having raised an impressive $66M, though its journey since its pivot to SVM in September 2023 has been marked by both achievements and challenges. The project reached several significant milestones, including its testnet launch in December 2023 and mainnet launch in July 2024, along with notable leadership changes such as Vijay Chetty from Uniswap taking the CEO position.

Technical Innovation

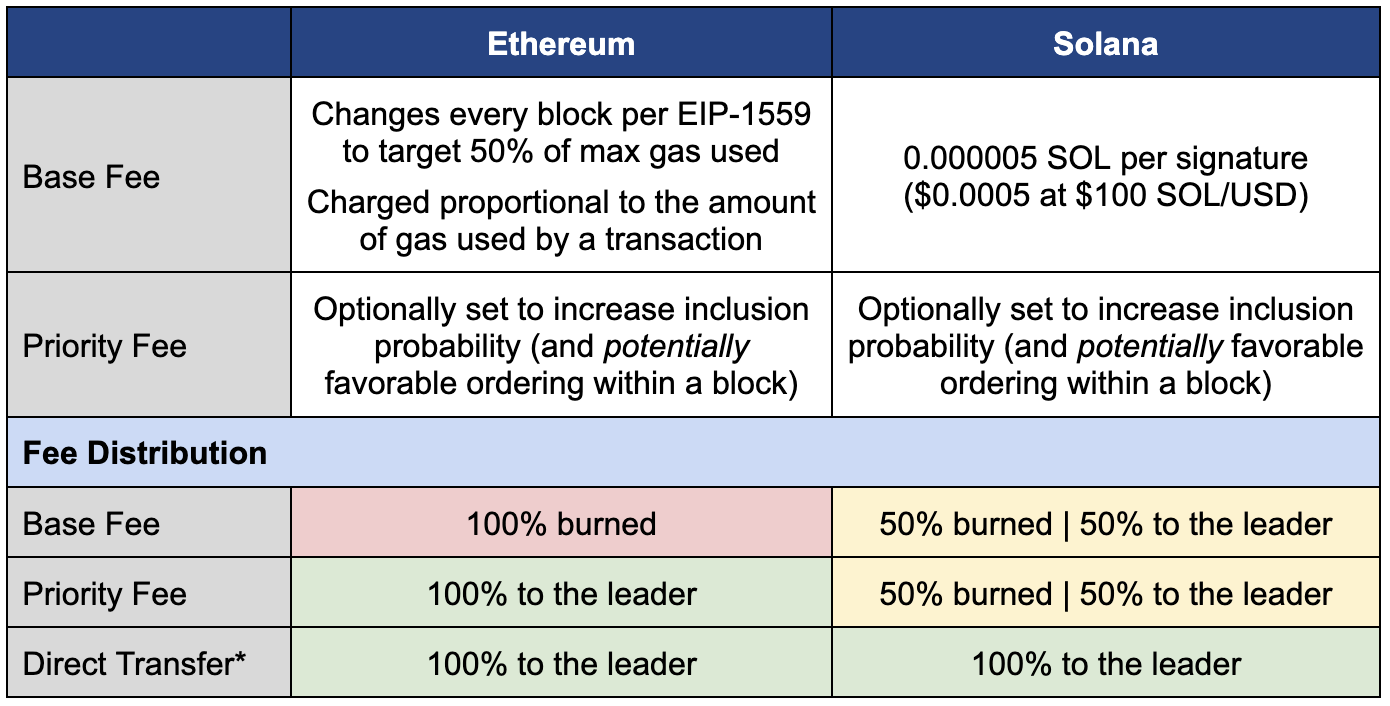

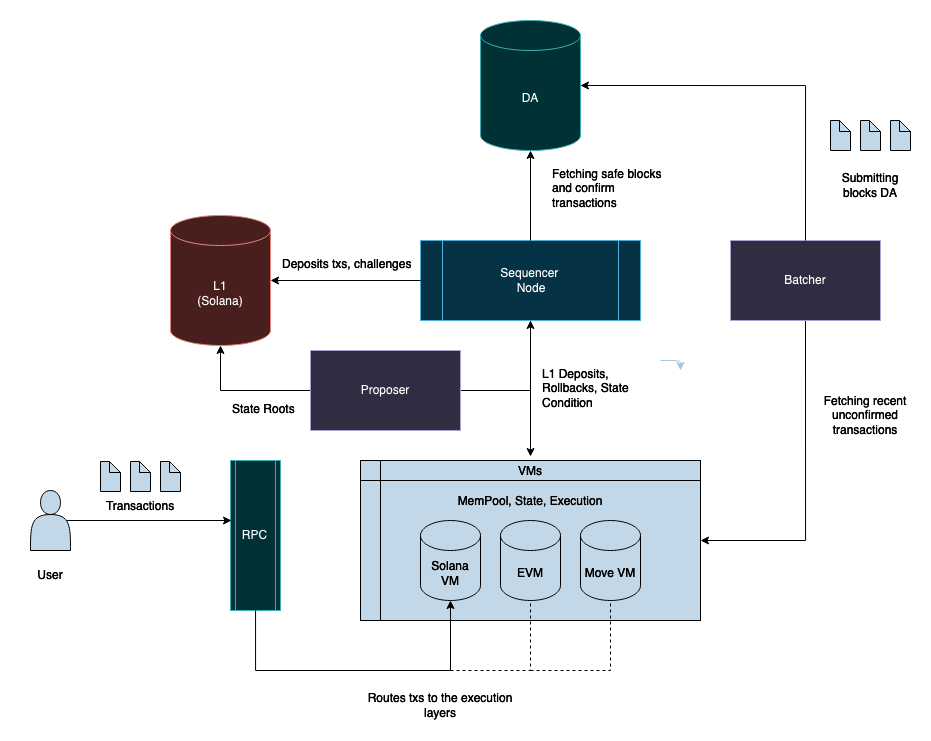

Eclipse's technical architecture is ambitious, combining Ethereum's settlement layer, SVM's execution capabilities, Celestia's data availability, and RISC Zero's proof system. Besides the general SVM, Eclipse's SVM maintains compatibility with Ethereum through EVM support, similar to Neon EVM's approach, allowing developers to deploy Ethereum-based programs. Additionally, their integration of the Turbo engine, a low-code 2D game development platform, makes SVM particularly attractive for blockchain gaming applications. These features, combined with SVM's core innovations, create a comprehensive environment capable of supporting diverse blockchain applications while maintaining efficiency and accessibility.

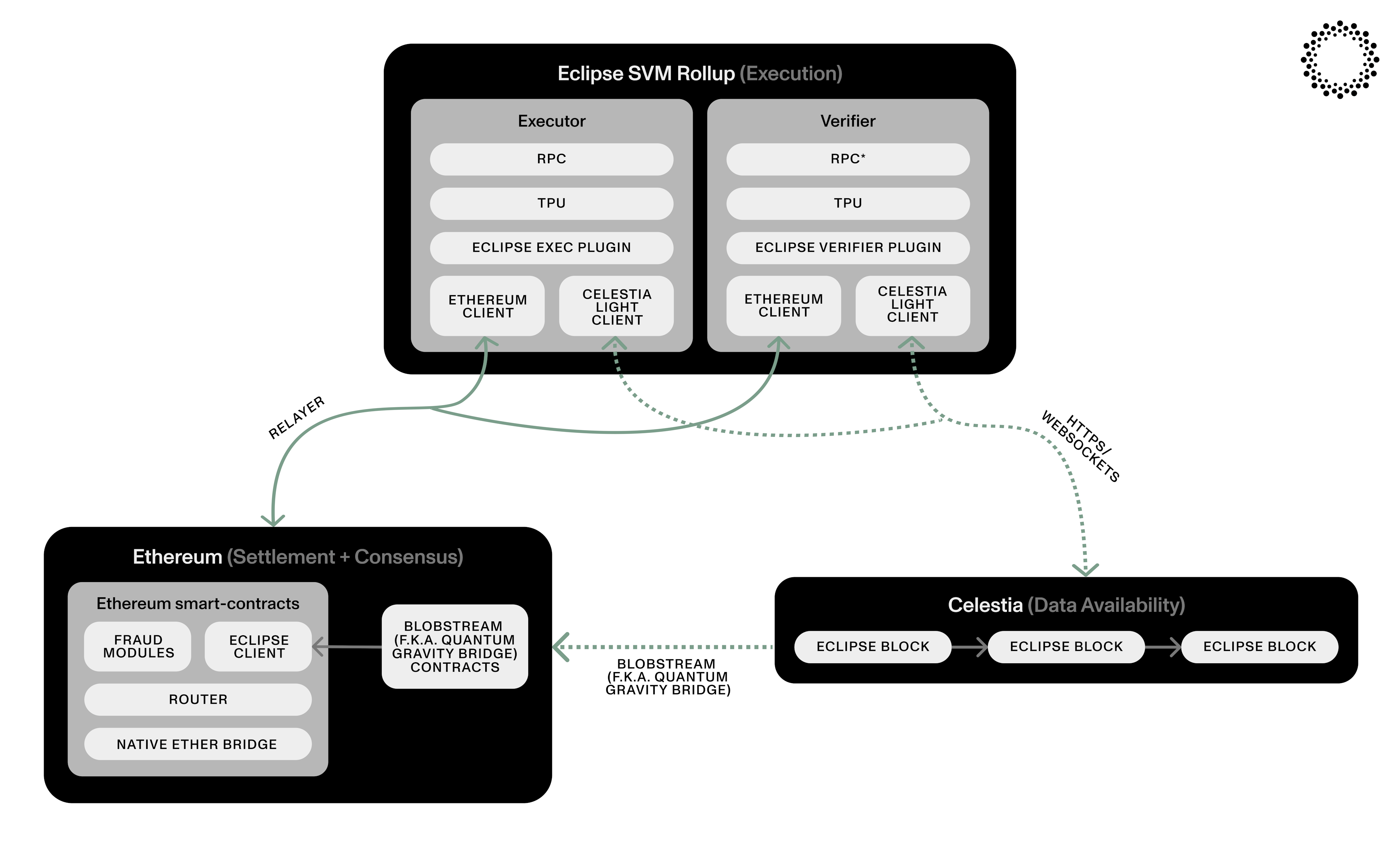

Besides SVM, Eclipse also modify the implementation of RISC Zero's proof system. Rather than maintaining a Merkle tree for state updates, which can create performance bottlenecks, the system focuses on detecting incorrect inputs and outputs through ZK proofs of fraud. This hybrid approach combines elements of both optimistic rollups and ZK systems, maintaining detailed records of transaction inputs and outputs, including account hashes and global state information. Each transaction's origin is tracked through indices, with data recorded on Celestia, enabling full nodes to independently verify state transitions by referencing their own data against Ethereum commitments. This innovative architecture moves away from conventional frameworks like OP Stack, prioritizing efficiency while maintaining security through a more streamlined verification process. Eclipse is already the top 1 rollup using Celestia, paid 1276 $TIA for 58.52GB.

Early Ecosystem Development

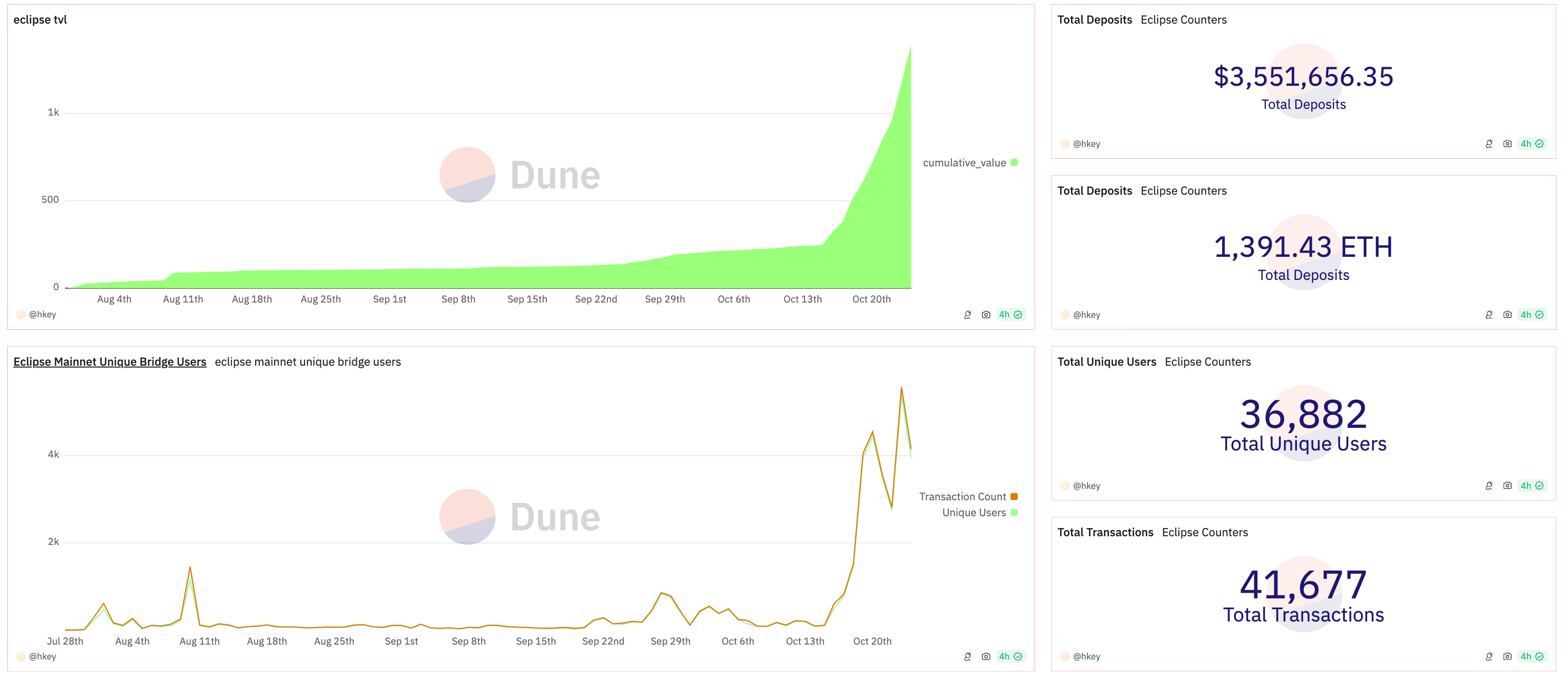

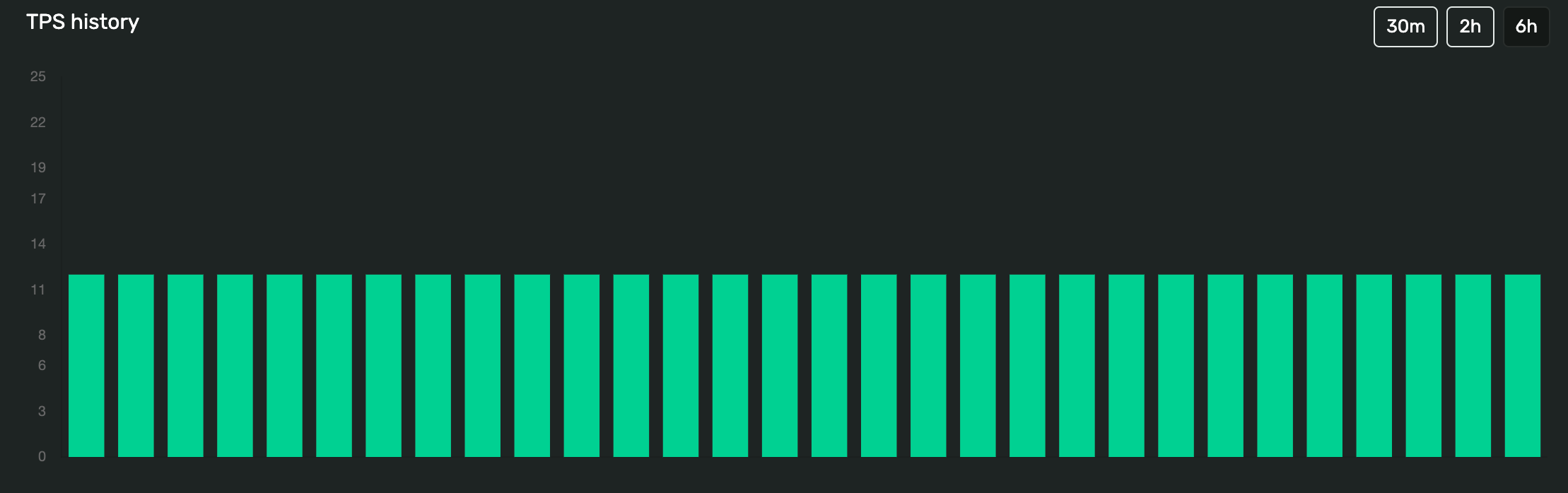

Current metrics suggest a disconnect between the project's substantial funding and its market traction. With approximately 1,400 ETH ($3.5M) bridged to the platform and an average of 11 TPS - mostly consisting of vote transactions - the usage statistics tell a story of early-stage adoption.

Eclipse's ecosystem is taking shape across multiple sectors. The infrastructure layer includes essential tools like similar blockchain explorers, developed by the same team behind Solana's explorer, and various bridge solutions. The bridging infrastructure currently supports ETH deposits through the official bridge (with approximately 2-minute processing times) and more extensive token support through Hyperlane, which enables transfers between Eclipse, Ethereum, and Solana.

The DeFi sector shows early signs of development, with several Solana-native projects migrating to Eclipse. These include AMM protocols like Lifinity (with around $100K in liquidity) and Invariant, prediction markets through Sharp Trade and Hedgehog, and an upcoming lending protocol ENSOFI. The ecosystem is further enriched by domain services through Alldomains and Eclipse Domains, though some services are still awaiting launch.

NFT infrastructure is beginning to emerge, with Scope marketplace leading the way. Their Path of Discovery NFT collection has achieved significant traction with 86,000 mints, operating with competitive fee structures (0.0008 ETH service fee and 0.00000015 ETH transaction fee). The social aspect of the ecosystem is represented by DSCVR, a forum platform originally from the Dfinity ecosystem, demonstrating Eclipse's ability to attract projects from various blockchain communities.

Strategy Positioning

Eclipse's strategic position is particularly interesting when viewed through the lens of ecosystem dynamics. While it operates as an Ethereum Layer 2, its adoption of SVM appears to be a calculated move to attract projects from the Solana ecosystem. This approach makes sense given Ethereum's larger asset base and established position, but it also presents unique challenges. The project essentially needs to bridge two distinct blockchain communities while building its own ecosystem.

Looking ahead, Eclipse faces the substantial task of ecosystem development. While it has laid strong technical foundations and attracted various projects, the path to significant adoption requires more active dApp deployment, greater liquidity, and stronger user engagement. The project's journey highlights both the potential and challenges of cross-ecosystem blockchain development, suggesting that while the technical infrastructure is in place, the real work of ecosystem building is still in its early stages.

Soon: Making SVM the End Game

Soon emerges as an ambitious project in the SVM ecosystem, founded by Joanna Zeng and Andrew Zhou with a clear mission to expand SVM's reach and compete directly with EVM. Launched in August 2024, the project has quickly garnered attention despite not disclosing its funding details.

Technical Innovation

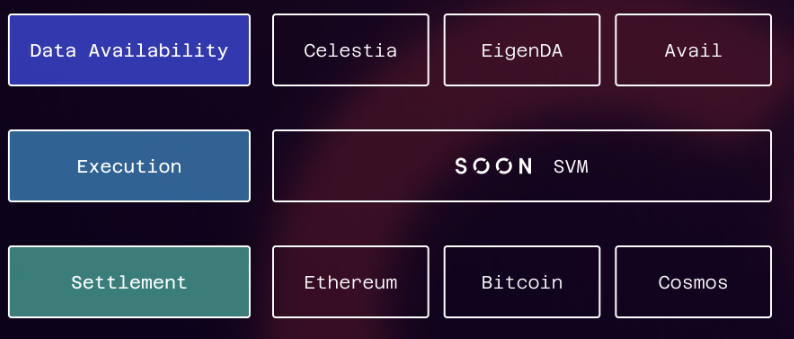

Soon's Super Adoption Stack (SAS) represents an ambitious evolution of traditional modular blockchain architecture.

SOON Stack builds upon and modifies the OP Stack framework, creating a more flexible and open system for blockchain deployment. This enhanced architecture serves as an intermediate layer between various Layer 1 blockchains and rollups, similar to the Superchain concept but with greater adaptability. The system allows chains to migrate freely between different Layer 1 networks, providing unprecedented flexibility in blockchain deployment.

Additionally, the InterSOON protocol facilitates seamless cross-chain communication, with the TON-Solana bridge serving as its first practical implementation. This comprehensive approach demonstrates Soon's vision of creating a more interconnected and adaptable blockchain ecosystem that transcends the limitations of traditional modular architectures.

While initially built on Ethereum using ETH as its gas token, the platform's settlement layer is designed to be blockchain-agnostic, enabling deployment on various Layer 1 networks including Ethereum, Bitcoin, and Cosmos chains.

Data availability in Soon's architecture demonstrates similar flexibility, supporting multiple providers including Celestia, EigenDA, and Avail. This multi-provider approach ensures robust data availability while allowing deployments to choose the most suitable solution for their specific needs.

The system's security is maintained through the implementation of OP Stack's decentralized fault proof mechanism, which enables any user to challenge the state of Soon Layer 2 chains through fault proofs submitted to the settlement layer.

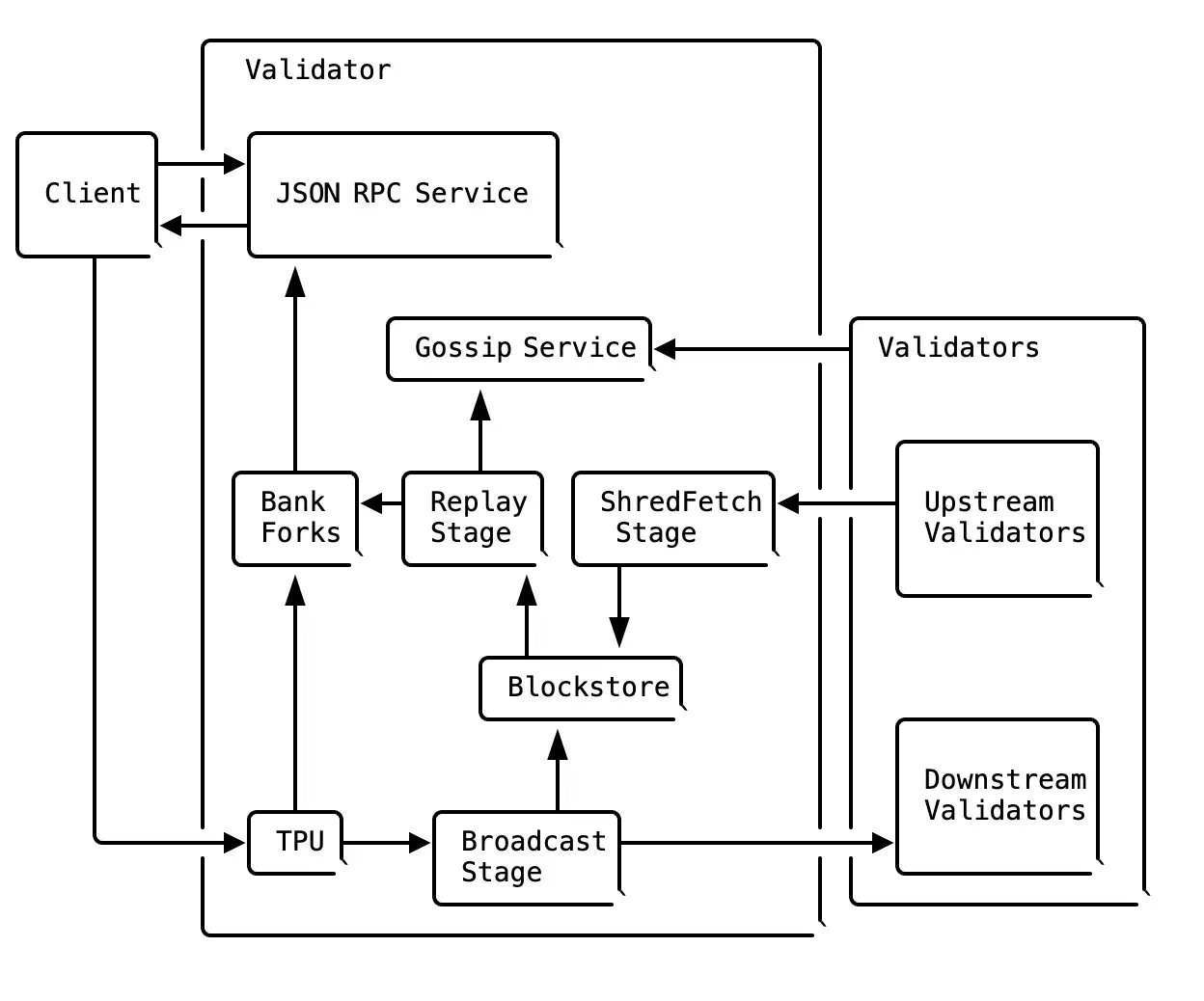

At its core, SOON SVM, innovation extends to its execution layer through a decoupled SVM implementation. This approach goes beyond simply removing the consensus layer – it fundamentally reconstruct the Solana Transaction Processing Unit (TPU) flow. Soon offers two distinct SVM implementations: a forked version that aligns with Anza's approach, maintaining the original client structure while optimizing parameters, and a fully decoupled version demonstrated through the Igloo project. The latter represents a more specialized implementation focused on rollup-specific requirements and efficient data availability usage.

The Decoupled SVM represents a more advanced implementation, offering comprehensive improvements across multiple dimensions. It features a decoupled Transaction Processing Unit (TPU), excludes unnecessary vote transactions, and is specifically optimized for Layer 2 operations with native fraud proof support. This version achieves higher data availability efficiency and delivers superior transaction throughput compared to Solana's base implementation. Importantly, it provides enhanced network security for Layer 2 deployments through its integrated fraud proof mechanisms.

In contrast, the Forked SVM takes a more conservative approach, maintaining closer alignment with Solana's original architecture. While it allows for parameter customization, it retains the original TPU structure and vote transaction system. This results in lower data availability efficiency and maintains the same TPS as Solana. The forked version also faces challenges in implementing fraud proofs due to the need to account for derivation, leading to relatively lower network security for Layer 2 deployments.

Early Ecosystem Development

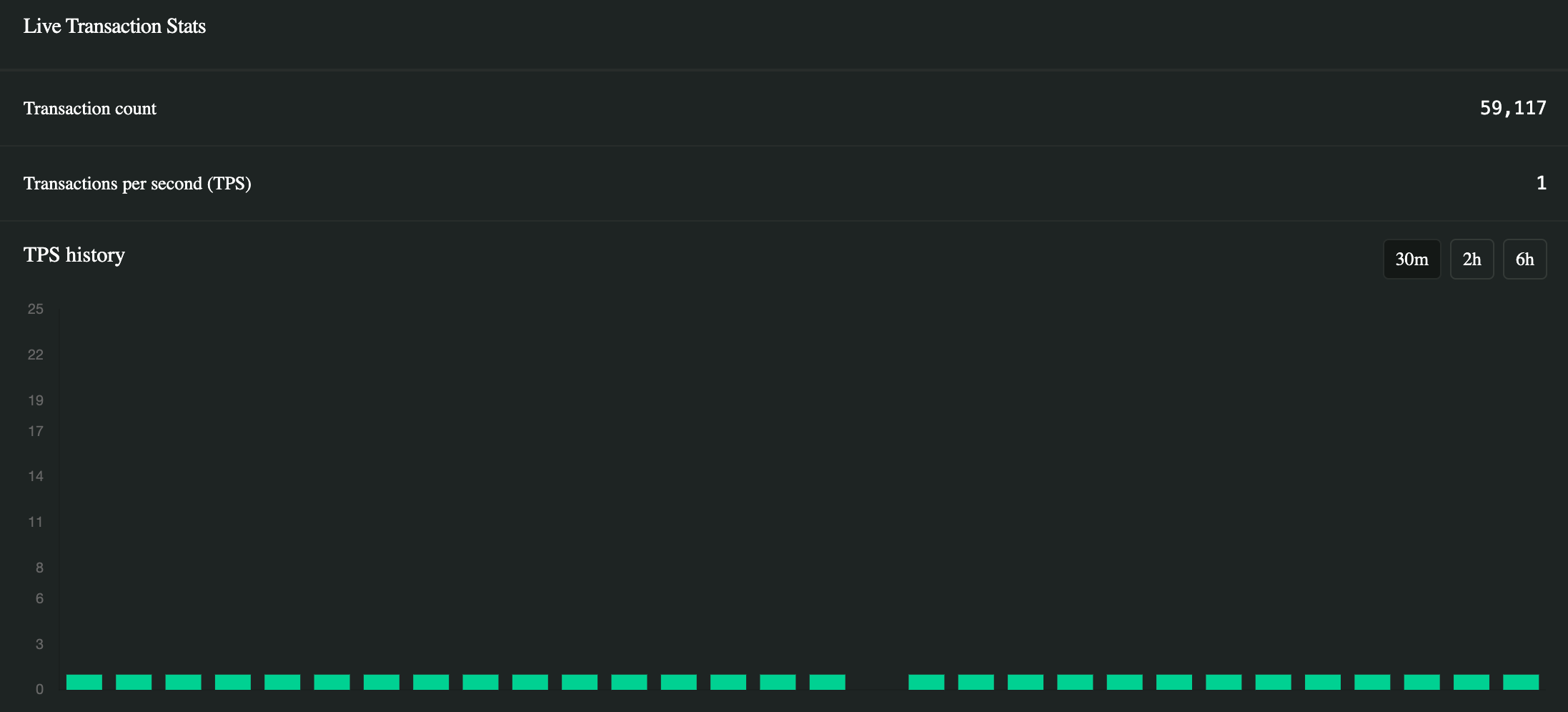

While Soon has rapidly formed partnerships and built infrastructure components, the stats shows it is still at early stage, Soon just opened up its public testnet, the total transaction count is merely 59,117, and approximately 1 TPS.

Soon's ecosystem is steadily developing its fundamental infrastructure components, with several key elements already in place. The platform's basic infrastructure includesintegration with the Apro oracle service. Cross-chain functionality is enabled through the official bridge, with a notable implementation being the TON-Solana bridge that operates with a fee structure of 0.008 SOL plus 0.1% of the transferred amount. The platform also addresses digital identity through ZEROBASE, a zkLogin framework, while the NFT sector is initiated with the SOON Badge NFT program. In the emerging DePin (Decentralized Physical Infrastructure) sector, SolanaSIM represents an early entry into this space. While these components demonstrate the foundation of a comprehensive ecosystem, they are currently operating primarily on testnet, indicating the early stage of Soon's ecosystem development.

Strategic Vision and Solana Alignment

Soon's approach to SVM implementation demonstrates a deep alignment with Solana's ecosystem while pushing for broader adoption. Their Super Adoption Stack (SAS) represents more than just another modular solution - it's a comprehensive framework designed to make SVM deployment more accessible across different Layer 1 blockchains.

The project's strong alignment with Solana manifests in two key ways. First, their technical infrastructure directly benefits Solana's ecosystem through innovations like the decoupled SVM implementation, which makes the execution layer more lightweight and efficient. Second, their development of tools and frameworks, such as the Igloo demo, shows a commitment to improving the broader Solana infrastructure.

The project's success appears to hinge on securing a high-profile partnership that could accelerate adoption and demonstrate the platform's capabilities. While the technical foundation and vision are solid, Soon faces the challenge of translating its resource-driven initiative into meaningful ecosystem growth. Their goal of "making SVM the end game" represents an ambitious vision that will require both technical excellence and successful market execution.

Sonic: Gaming-Focused SVM Innovation

Sonic emerges as a distinctive player in the SVM ecosystem, developed by Mirror World Labs under Chris Zhu's leadership. Having raised $16M with a fully diluted valuation of $100M, the project positions itself as a gaming-focused chain built on Solana, but also directly competing with Soon in the modular stack space while carving out its own niche in gaming applications.

Technical Architecture

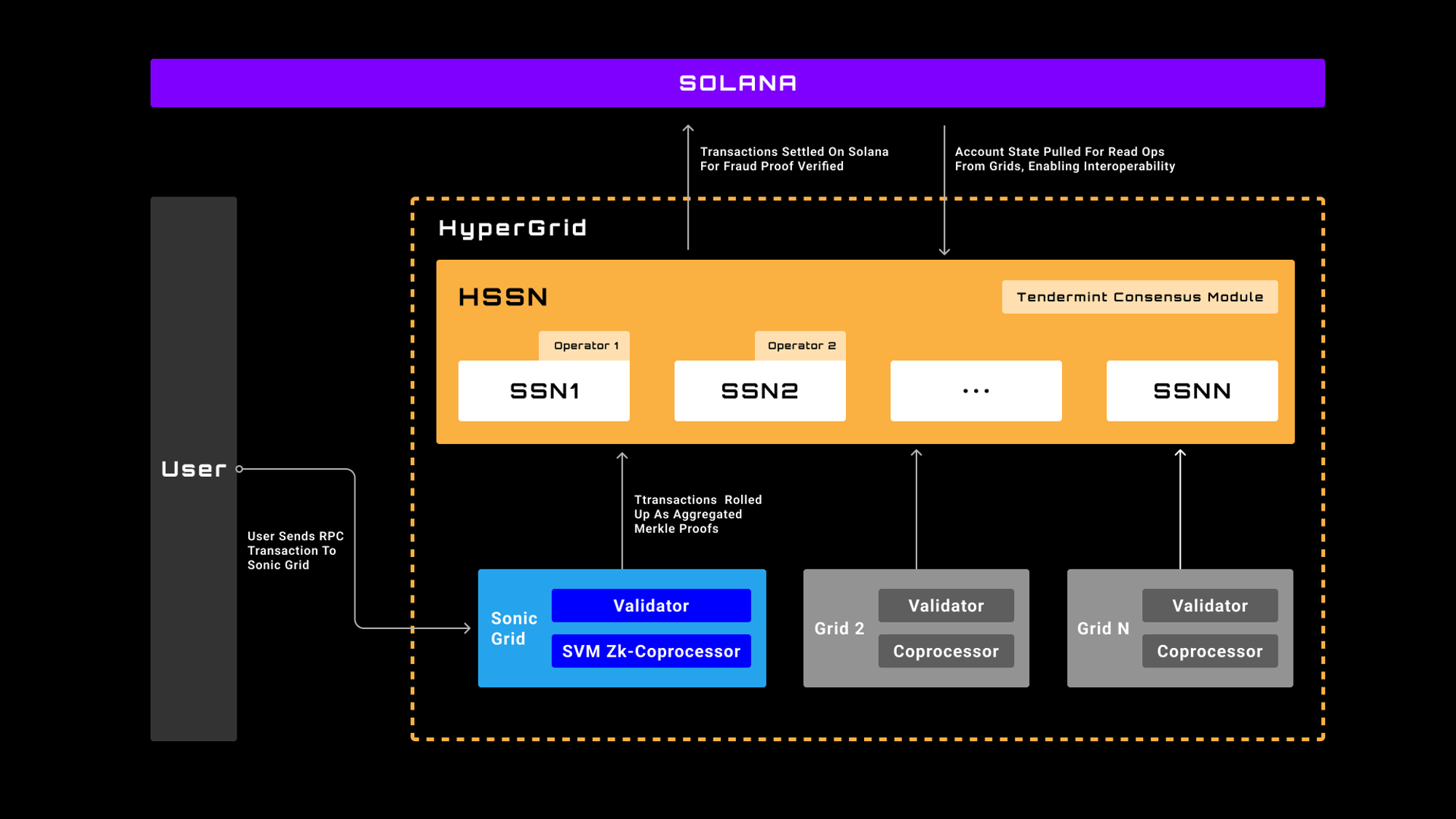

The platform's HyperGrid Shared State Network represents an innovative approach to blockchain gaming infrastructure. Built with the Cosmos framework, it combines Superchain architecture with Grid SVM execution, creating a flexible environment for game development. The system maintains periodic synchronization with Solana while utilizing the Op Stack for its proof system in the early stages.

Sonic introduces a distinctive architectural approach through its HyperGrid Shared State Network, combining elements from both Cosmos and Op Stack frameworks to create a specialized gaming infrastructure. The system implements a multi-layered settlement process where Grid nodes send state updates to HyperGrid, which then periodically synchronizes with Solana. This creates a hierarchical settlement structure that balances efficiency with security.

The platform's execution layer utilizes Grid SVM, while HyperGrid handles data availability. In its early stages, the system employs Op Stack's validity proof system, laying the groundwork for future security enhancements. This modular architecture creates a flexible foundation that can adapt to the specific demands of blockchain gaming.

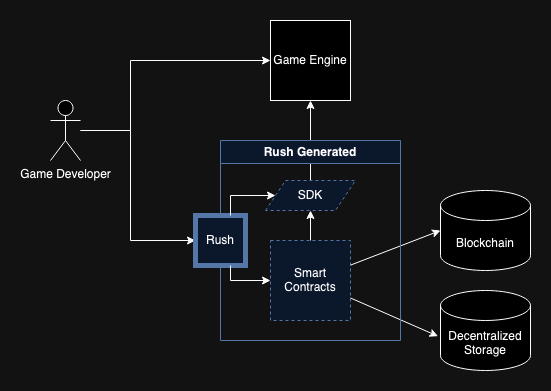

What sets Sonic apart is its integration of the Rush RCS Framework with its gaming engine, specifically designed for Full Onchain Games (FOCG) and Autonomous Worlds (AW). The Rush framework serves as a crucial bridge between the gaming engine and blockchain infrastructure, managing both smart contract interactions and storage layer connections. This integrated approach creates a comprehensive environment for blockchain game development, enabling developers to build complex gaming experiences while maintaining efficient blockchain interactions.

This architecture reflects Sonic's focused approach to gaming infrastructure, combining the performance benefits of SVM with specialized gaming tools and frameworks to create a purpose-built platform for blockchain gaming applications.

Early Adoption Metrics

Sonic's early statistics are notably impressive, with significant user engagement across different networks:

- Devnet has attracted 79M addresses

- Testnet has reached 1M addresses

- The Odyssey program has seen 6M passes minted

However, these numbers, while promising, require careful interpretation. The possibility of data manipulation exists, and the true test will come with mainnet launch when genuine user adoption becomes crucial for sustained success.

Strategic Position in Gaming and Future Challenges

Sonic's approach differs from other SVM implementations by specifically targeting app-specific rollups within the Solana ecosystem, with a particular focus on gaming applications.

Future Challenges

While Sonic has built a comprehensive technical foundation for gaming applications, it faces a critical challenge: the need for a flagship game to demonstrate its capabilities. Despite the impressive early statistics, the platform's long-term success will depend on attracting and retaining genuine users through compelling gaming experiences. The project's ability to secure and showcase a top-tier game will be crucial in validating its approach to blockchain gaming infrastructure.

The competition with Soon in the modular stack space, combined with the specific focus on gaming, positions Sonic at an interesting crossroads in the SVM ecosystem. Its success will ultimately depend on how effectively it can translate its technical innovations into practical gaming applications that attract and retain real users.

The Status of SVM-as-a-Service Platforms

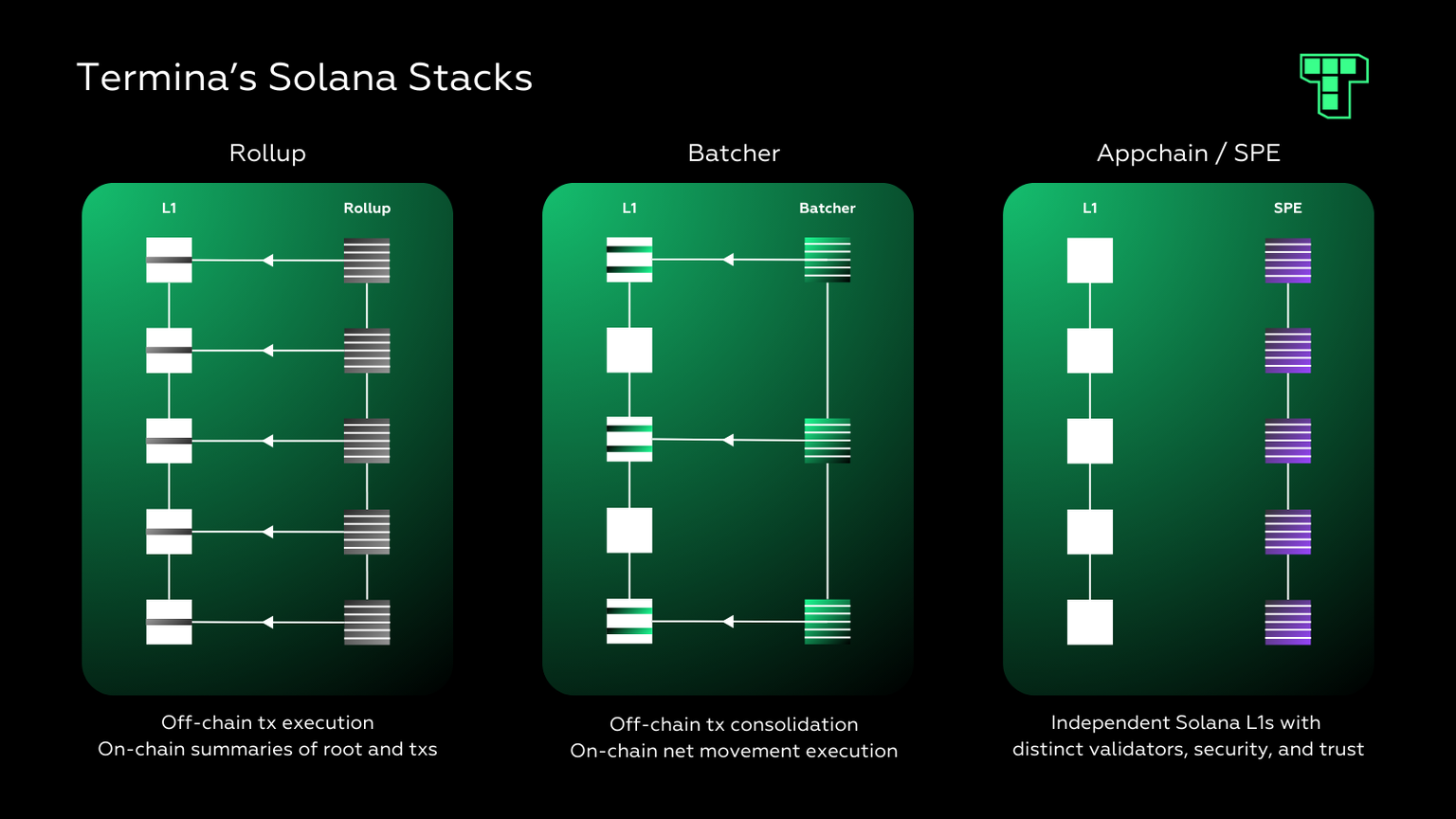

The emergence of SVM-as-a-Service platforms represents an interesting development in the blockchain infrastructure space, though one that faces significant challenges in the current market environment. Two notable players, Termina (previously NitroSVM) and Lumio (formerly Pontem), have emerged to offer customizable SVM deployment solutions.

Current Market Landscape

These platforms offer varying approaches to SVM implementation. Termina provides a range of solutions from full rollups to batchers and Solana Permissioned Environments (SPEs), targeting both public and enterprise use cases. Lumio takes a more comprehensive approach, supporting multiple virtual machines including SVM, EVM, and Aptos Move VM, with flexible settlement and data availability options.

However, the business model for these services faces fundamental challenges. Despite the impressive valuations in this space, as evidenced by Altlayer's $1 billion valuation, the core business proposition remains questionable. The absence of a clear need for tokenization in these services suggests that the current valuations might not reflect sustainable business models.

Maturity and Competition Challenges

The relative immaturity of SVM technology presents a significant hurdle for these service providers. While the technology shows promise, its early stage of development makes it difficult for these platforms to attract and retain clients who require stable, proven solutions for their blockchain deployments.

Furthermore, these dedicated SVM service providers face mounting competition from established Rollup-as-a-Service (RaaS) companies, like Altlayer. These existing players, with their established infrastructure and client bases, can relatively easily expand their offerings to include SVM support, potentially overwhelming specialized providers through their broader service offerings and existing market presence.

Market Adoption and Future Prospects

Current adoption metrics for these platforms remain modest. Termina has secured two gaming-related projects, Zypher Network and Murasaki, while Lumio positions itself against competitors like Sovereign and its projects ZETA and Bullet. However, these early partnerships have yet to demonstrate significant traction that would validate the SVM-as-a-Service model.

The future success of these platforms will likely depend on their ability to differentiate their offerings beyond basic SVM deployment services and demonstrate clear value propositions that justify their existence alongside established RaaS providers. This may require evolving beyond pure infrastructure plays to offer more specialized or value-added services that leverage SVM's unique characteristics.

Specialized SVM : Tailored Solutions for Specific Needs

The SVM ecosystem is witnessing the emergence of specialized rollup solutions, each designed for specific use cases and built on different base layers. Zeta Market, Grass, and Yona represent distinct approaches to implementing SVM technology, though all remain in pre-mainnet stages of development.

Diverse Approaches to Implementation

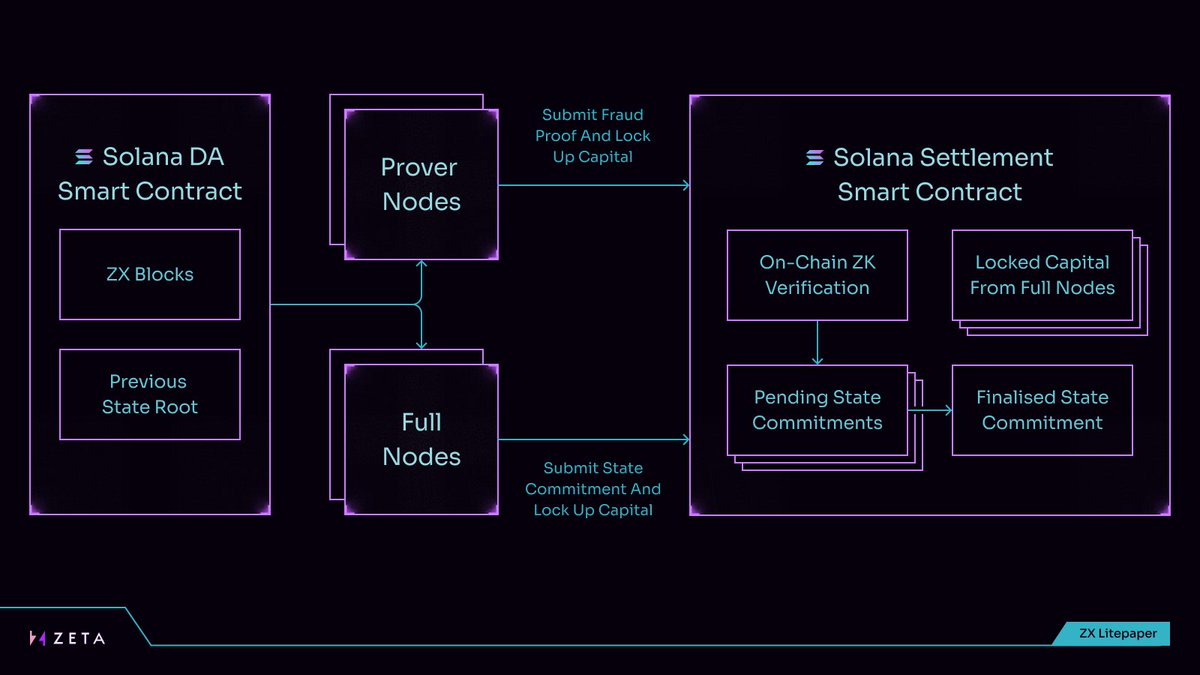

Each project demonstrates how SVM can be adapted for specific purposes while making different choices about their fundamental architecture. Zeta X positions itself as a DeFi-focused Layer 2 on Solana, utilizing ZK proofs and maintaining close integration with its base layer.

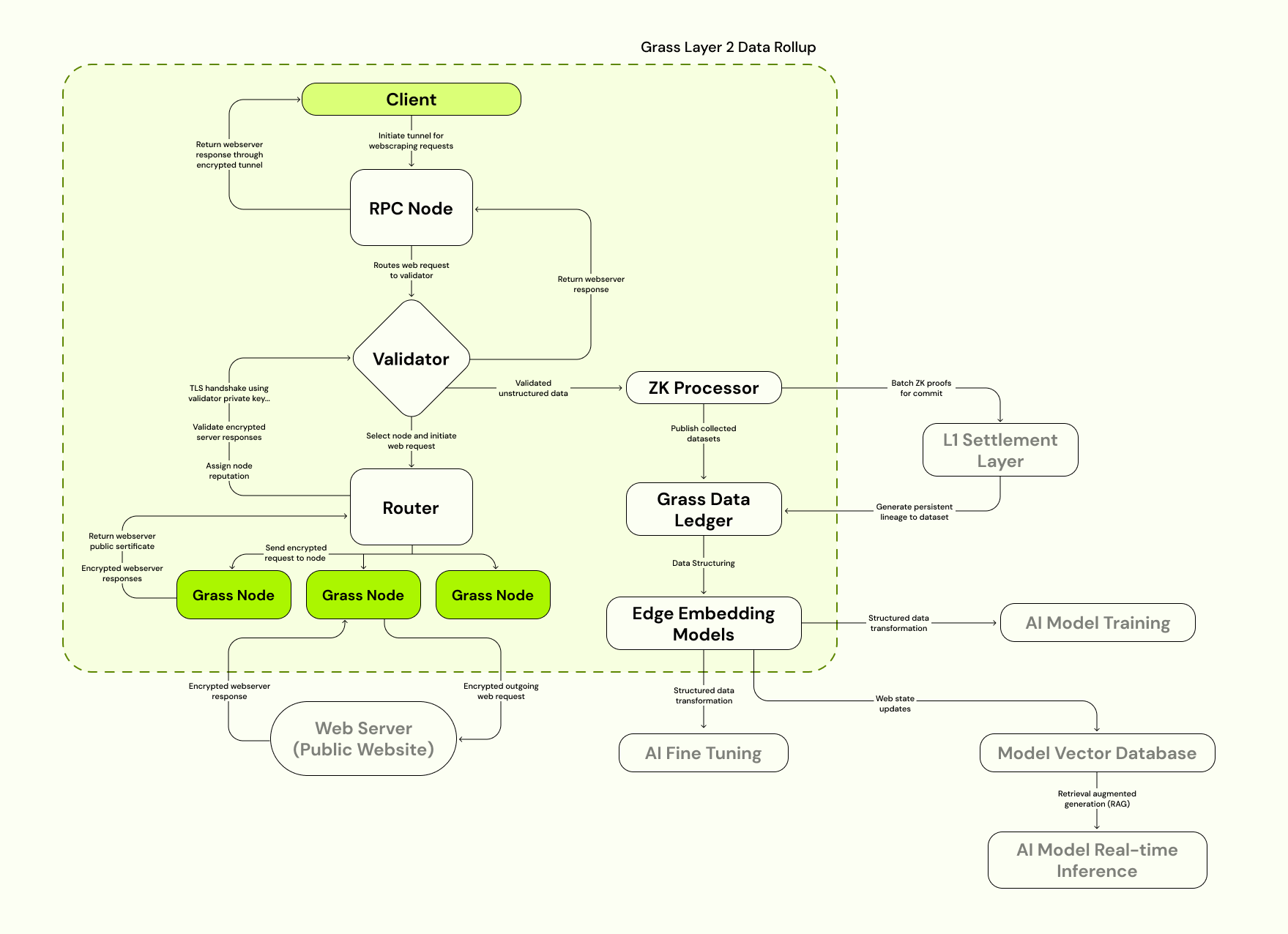

Grass takes a more independent approach as a sovereign data rollup, minimizing its reliance on Solana while hosting most functionality internally.

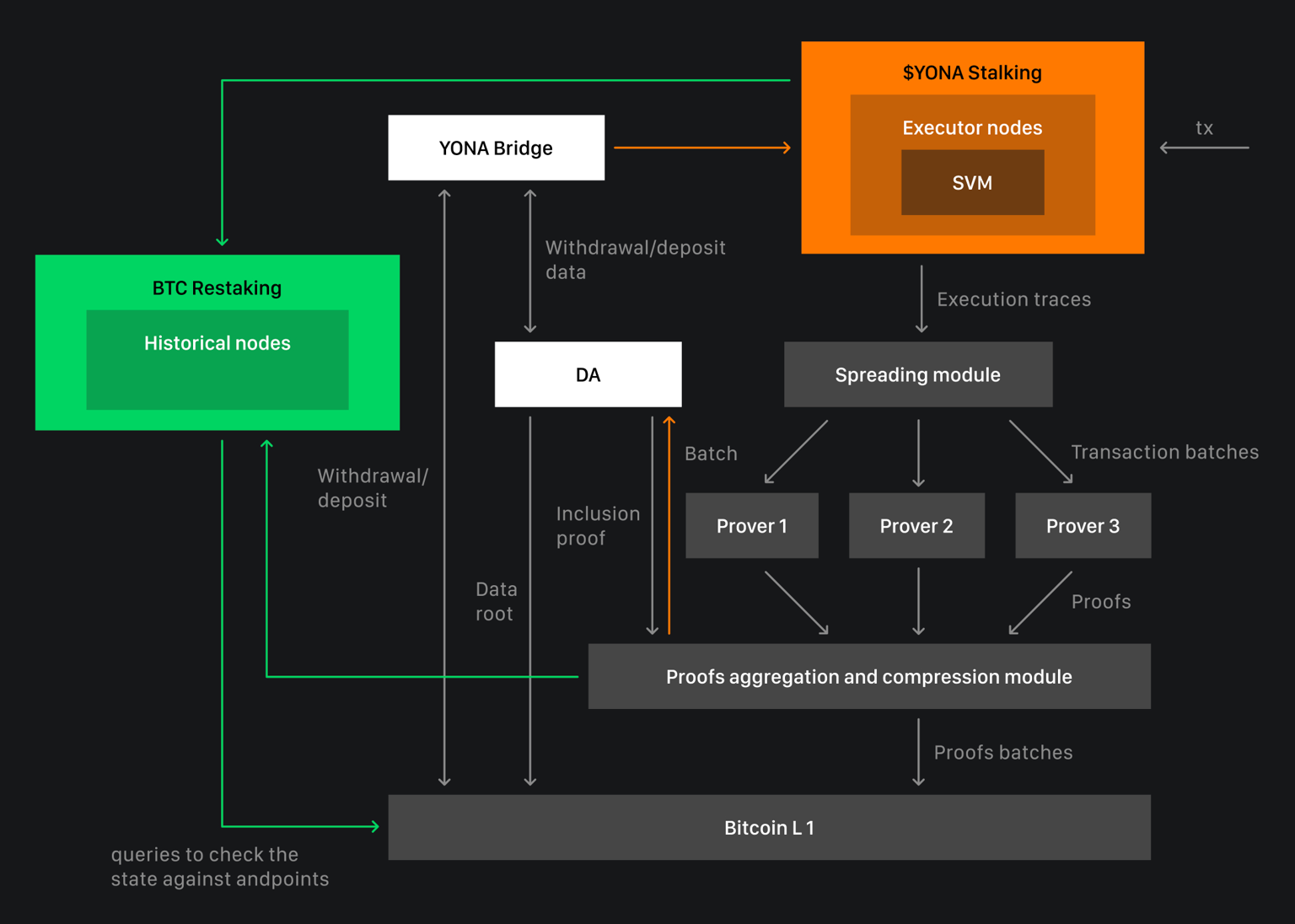

Yona breaks new ground by implementing SVM on Bitcoin, combining RISC Zero for proofs with Nubit for data availability.

However, with all these projects still in development and no mainnet launches yet, their business models and market potential remain theoretical. The true test will come when these platforms face real-world usage and market demands. Their success will largely depend on how well their specific implementations of SVM align with their chosen use cases and whether they can attract sufficient user adoption.

Role in the SVM Ecosystem

Despite the uncertainty surrounding their individual success, these specialized rollups play a crucial role in the broader SVM ecosystem. They serve as practical implementations that test different approaches to SVM deployment and help identify optimal use cases for the technology. Their diverse approaches to base layer selection and technical architecture provide valuable insights for the entire ecosystem.

The development of these specialized solutions suggests that SVM's future may lie not in one-size-fits-all solutions, but in targeted implementations that leverage the technology's strengths for specific use cases. As these projects move toward mainnet launches in 2025 and beyond, their experiences will help shape the evolution of the entire SVM ecosystem.

Reference

- The Solana eBPF Virtual Machine - Anza

- Speeding up the EVM (part 1) | Flashbots Writings

- What Is SVM - The Solana Virtual Machine - Squads Blog

- Sealevel — Parallel Processing Thousands of Smart Contracts | by Anatoly Yakovenko | Solana | Medium

- Cloudbreak — Solana’s Horizontally Scaled State Architecture | by Anatoly Yakovenko | Solana | Medium

- Getting Started | Eclipse Documentation

- Firedancer

- Rollup and Decoupled SVM: An In-Depth Analysis | by Soon SVM | Oct, 2024 | Medium