De-SPACs 2025 H1

Overview

| SPAC Symbol | SPAC Name | SPAC Sponsor | Underwriter | Additional Funding | SPAC Size | Pub(SPAC). Shares | Redmp. % | Symbol | Company | Exchange | Industry | Sector | Post IPO Raised |

Closing Date | Latest Price | IPO Rtrn. | List. Mkt Cap | Mkt Cap | ATH | ATL | Avg. Trading Volume | 1st Week Volume | 1st Month Volume | 1st Quarter Volume | Float Shares | Total Shares |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| CLBR | Colombier Acquisition Corp. II | Farvahar Capital LLC | BTIG | 5M(Warrants) | 170M | 17.00M | 0.03% | PEW | GrabAGun Digital Holdings | NYSE | Firearms Retail | Consumer Discretionary | No | 07/15/2025 | $10.01 | 0.10% | 315M | 316M | 21.4 | 9.24 | 2.02M | 4.5M | 4.5M | 4.5M | 11.9M | 31.25M |

| BNIX | Bannix Acquisition Corp. | Bannix Management LLP | I-Bankers | 3M(Debt Deferral Agreements) | 69M | 115k | 76.6% | VWAV | VisionWave Technologies | NASDAQ | Defense Technology, AI Analytics | Industrials | No | 07/14/2025 | $2.44 | -71.00% | 46.5M | 34.75 | 3.86 | 2.37 | 651K | 3.25M | 6.51M | 6.51M | 3.03M | 14.23M |

| NVAC | NorthView Acquisition Corp | NorthView Sponsor I, LLC | I-Bankers | 10M (PIPE) | 192M | 101.78K | 99.47% | PFSA | Profusa, Inc. | NASDAQ | Biotech, Medical Devices | Healthcare | $9M (Secured Convertible Note) | 07/11/2025 | $1.10 | -89.00% | 332M | 36.48M | 5.5 | 0.85 | 2.23M | 5.91M | 15.4M | 15.4M | 20.64M | 33M |

| DIST | Distoken Acquisition Corporation | Xiaosen Sponsor LLC | I-Bankers | 27M(PIPE) | 69M | 640k | 90.72% | YOUL | Youlife Group Inc. | NASDAQ | Human Resource & Employment Services | Industrials | No | 07/09/2025 | $2.57 | -71.70% | 215M | 195M | 5.5 | 2.5 | 965k | 6.2M | 6.2M | 6.2M | 54.31M | 76.05M |

| JVSA | JVSPAC Acquisition Corp. | Winky Investments Limited | Maxim Group | 2.4M(Warrants) | 57.5M | 108.65K | 98.11% | HBNB | Hotel101 Global Holdings Co. | NASDAQ | Hospitality, Real Estate | Consumer Discretionary | No | 06/30/2025 | $2.17 | -78.30% | 487.7M | 508M | 4.17 | 2.02 | 472K | 18M | 25M | 25M | 28.96M | 234.5M |

| FNVTF | Finnovate Acquisition Corp. | Finnovate Sponsor L.P. | EarlyBirdCapital | 7.9M(Warrants), 1.5M (Woking Capital Loan), 3M (promissory note) |

176M | 99.08K | 99.44% | SCAG | Scage Future | NASDAQ | Automotive, Commercial Automobiles, Transportation | Industrials | No | 06/27/2025 | $5.34 | -48.90% | 361.1M | 384M | 24.7 | 2.91 | 854k | 22.42M | 119M | 119M | 14.95M | 71.94M |

| RCFAF | Perception Capital Corp. IV | RCF VII Sponsor LLC | Citi | 2M(Convertible promissory note), 700k(PIPE) | 235M | 25.19K | 99.89% | BGL | Blue Gold Limited | NASDAQ | Gold Mining | Materials | No | 06/25/2025 | $19.83 | 66.40% | 455M | 606M | 166.5 | 14.5 | 15.1M | 107M | 257M | 257M | 16.62M | 30.57M |

| SUAC | ShoulderUP Technology Acquisition | ShoulderUp Technology Sponsor LLC | Citi | 12M(PIPE) | 306M | 2.24K | 99.99% | DAIC | CID HoldCo, Inc. | NASDAQ | Supply Chain IoT | Information Technology | No | 06/20/2025 | $5.63 | -43.70% | 135M | 156M | 75 | 4.16 | 22.83M | 22.43M | 622M | 622M | 4.79m | 24.83M |

| BHAC | Focus Impact BH3 Acquisition Corp | Crixus BH3 Sponsor LLC | Guggenheim Securities | 1.2M(Working Capital Loan), 2.5M(Promissory Note), 7M(Promissory Note), 100M(PIPE, Convertible Promissory Note) | 232M | 3.7K | 99.99% | SAFX | XCF Global Capital | NASDAQ | Sustainable Aviation Fuels | Energy | No | 06/06/2025 | $1.66 | -83.40% | 227M | 251M | 45.9 | 1.42 | 28.75M | 20.29M | 714M | 735M | 30.73M | 149M |

| HCVI | Hennessy Capital Investment Corp. | Hennessy Capital Partners VI LLC | Citi | 60M(PIPE) | 341M | 107.47K | 99.68% | NAMH | Namib Minerals | NASDAQ | Metals & Mining | Materials | No | 06/05/2025 | $8.60 | -14.00% | 537M | 462M | 55 | 6.65 | 5.7M | 40.7M | 63M | 178M | 1.39M | 54.4M |

| BSII | Black Spade Acquisition II Co | Black Spade Sponsor LLC II | Clear Street | 5.5M(Warrants) | 153M | 2.18M | 85.76% | TGE | The Generation Essentials | NYSE | Media and Entertainment | Communication Services | 5.56M(Warrants) | 06/04/2025 | $5.89 | -40.00% | 324M | 323M | 37 | 5.6 | 3.55M | 66.57M | 109M | 121M | 13.79M | 54.8M |

| GLST | Global Star Acquisition, Inc. | Global Star Acquisition 1 LLC | EF Hutton | 4.41M(PIPE, Convertible Note), 15M(PIPE, Convertible Note) | 94.3M | 40.04K | 99.58% | KWM | K Wave Media Ltd. | NASDAQ | Entertainment | Communication Services | No | 05/13/2025 | $4.22 | -57.80% | 271M | 267M | 10.5 | 1.52 | 18.85M | 7.9M | 11.3M | 905M | 29.5M | 63.25M |

| BUJA | Bukit Jalil Global Acquisition 1 Ltd. | Bukit Jalil Global Investment Ltd. | A.G.P. | No | 50M | 112.64K | 97.75% | GIBO | GIBO Holdings Limited | NASDAQ | Media | Information Technology | No | 05/08/2025 | $0.04 | -99.60% | 7.95B | 7.04M | 11.18 | 0.0286 | 3.73M | 13.28M | 29.59M | 194M | 668M | 725M |

| IRAA | Iris Acquisition Corp. | Tribe Arrow Holdings I LLC | Cantor | 25M(PIPE) | 276M | 114.63K | 99.58% | LIMN | Liminatus Pharma, Inc. | NASDAQ | Biopharma | Healthcare | No | 04/30/2025 | $5.42 | -45.80% | 143M | 136M | 33.66 | 4.4 | 5.87M | 6.72M | 9.2M | 329M | 5.97M | 26.01M |

| SKGR | SK Growth Opportunities Corporation | Auxo Capital Managers LLC | Deutsche Bank | 9.9M(Sponsor Warrant Purchase) + 5M (Sponsor Loan) | 215M | 913.09K | 95.75% | BULL | Webull Corporation | NASDAQ | Fintech, Investment App | Financials | No | 04/10/2025 | $16.89 | 68.90% | 5.63B | 8.19B | 79.56 | 10.18 | 191M | 3.09B | 4.13B | 9.38B | 22.95M | 485M |

| GATE | Marblegate Acquisition Corp. | Marblegate Acquisition LLC | Cantor | 485K(promissory note) | 302M | 46.60K | 99.85% | MGTE | Marblegate Capital Corporation | OTC | Taxi Medallions | Industrials | No | 04/07/2025 | 1.92 | -80.8% | - | - | 15 | 0.61 | 106K | 185K | 6.25M | 7.9M | - | - |

| BFACF | Battery Future Acquisition Corp. | Battery Future Sponsor LLC | Cantor | 7.5M(Warrants), 250k (Extension Loans), 3.23M (PIPE) |

352M | 168.36K | 99.52% | KIDZ | Classover Holdings, Inc. | NASDAQ | EdTech | Information Technology | No | 04/04/2025 | $3.05 | -69.50% | 258M | 72.57M | 10.3 | 1.03 | 35M | 4.49M | 71.23M | 2.6B | 19.4M | 23.79M |

| IPXX | Inflection Point Acquisition Corp. II | Inflection Point Holdings II LLC | Cantor | 6M(Warrants), 2.5M(Loans and Extension Funding), 43M(PIPE) | 250M | 2.08M | 91.69% | USAR | USA Rare Earth | NASDAQ | Rare Earth Mining | Materials | No | 03/13/2025 | $14.62 | 46.20% | 1.08B | 1.41B | 20 | 5.56 | 18.8M | 26.3M | 53M | 1.7B | 62.3M | 94.7M |

| PWUP | PowerUp Acquisition Corp. | PowerUp Sponsor LLC | Citi | 0.5M(Bridge Loan) | 295M | 70.01K | 99.76% | ASBP | Aspire Biopharma Holdings | NASDAQ | Biopharma | Healthcare | No | 02/19/2025 | $0.36 | -96.40% | 520M | 17.73M | 10.5 | 0.21 | 4.68M | 3.87M | 10.8M | 450M | 35.35M | 49.53M |

| WAVS | Western Acquisition Ventures Corp | Western Acquisition Ventures Sponsor LLC | A.G.P. | 5M(PIPE), 3M(FPA), 3.33M(Convertible Bridge Notes) | 116M | 78.98K | 99.32% | CYCU | Cycurion, Inc. | NASDAQ | Cybersecurity | Information Technology | 60M(Committed Equity Facility) | 02/14/2025 | $0.38 | -96.20% | 509M | 12.02M | 16.2 | 0.26 | 4.94M | 163M | 188M | 368M | 252.6M | 31.44M |

| FLDD | FTAC Emerald Acquisition Corp. | Emerald ESG Sponsor, LLC | Goldman Sachs | 20M(Convertible Note), 550K(Working Capital Loan) | 251M | 1.34M | 93.90% | FLD | Fold Holdings, Inc. | NASDAQ | Bitcoin, Crypto, Personal Finance | Financials | 46.3M(senior secured convertible note), 250M(equity financing facility) | 02/14/2025 | $4.36 | -56.40% | 501M | 204M | 14 | 2.51 | 1.66M | 16M | 48.6M | 101M | 10M | 46.4M |

| BLAC | Bellevue Life Sciences Acquisition | Bellevue Global Life Sciences Investors LLC, | Chardan | 25M(FPA), 800k(Convertible Bridge Note), | 70.21M | 61.93K | 99.12% | OSRH | OSR Holdings, Inc. | NASDAQ | Biomedical Research, Healthcare | Healthcare | 78.9M(equity facility) | 02/14/2025 | $1.06 | -89.40% | 74.9M | 20.43M | 10 | 1 | 10.5M | 466M | 475M | 1.14B | 34.5K | 19.28M |

| RFAC | RF Acquisition Corp. | RF Dynamic LLC | EarlyBirdCapital | 20M(Convertible Note ) | 116M | 51.40K | 99.56% | GCL | GCL Global Holdings Ltd | NASDAQ | Gaming, Digital Entertainment | Consumer Discretionary | 2.9M(Senior unsecured convertible note) | 02/13/2025 | $3.54 | -64.60% | 1.01B | 447M | 9.89 | 1.76 | 5.23M | 451M | 483M | 516M | 37.69M | 126M |

| GODN | Golden Star Acquisition Corp | G-Star Management Corporation | Ladenburg Thalmann | 500K(Promissory note) | 69M | 95.98K | 98.61% | GMHS | Gamehaus Holdings Inc. | NASDAQ | Gaming | Communication Services, Information Technology | No | 01/24/2025 | $1.44 | -85.60% | 436M | 77.14M | 8.14 | 0.96 | 7.4M | 15.8M | 23M | 17.76M | 53.57M | |

| LATG | Chenghe Acquisition I Co. | LatAmGrowth Sponsor LLC | BofA Securities | 30M(FPA) | 133M | 1.78M | 86.58% | KBSX | FST Corp. | NASDAQ | Manufacturing, Golf | Consumer Discretionary | No | 01/15/2025 | $1.69 | -83.10% | 468M | 75.57M | 15.48 | 1.26 | 2.9M | 1.53M | 29.96M | 300M | 19.08M | 44.7M |

| BRKH | BurTech Acquisition Corp. | BurTech LP LLC | EF Hutton | 110.7M(Convertible Note), 15.4M(PIPE) | 292M | 3.17M | 89.15% | BZAI | Blaize Holdings, Inc. | NASDAQ | AI Hardware, High-Performance Computing | Information Technology | No | 01/13/2025 | $4.81 | -51.90% | 995M | 489M | 19.25 | 1.7 | 6.2M | 31.67M | 50.42M | 199M | 43.35M | 102M |

| MARX | Mars Acquisition Corp. | Mars Capital Holding Corporation | Maxim Group | 15M(FPA), 1.25M(Bridge Financing) | 70.38M | 646.81K | 90.81% | STAI | ScanTech AI Systems Inc. | NASDAQ | Security Technology, AI | Information Technology | 2.85M(unsecured loan), 1.5M( promissory note) | 01/02/2025 | $0.70 | -93.00% | 437M | 17.90M | 9.07 | 0.62 | 10.14M | 46.5M | 236M | 1.33B | 29.34M | 48.26M |

- Total Deals: 27

- Date Range: 2025-01-02 to 2025-07-15

- Exchanges: 3 (NYSE, NASDAQ, OTC)

- Underwriters: 15

- Sectors: 8

- Industries: 26

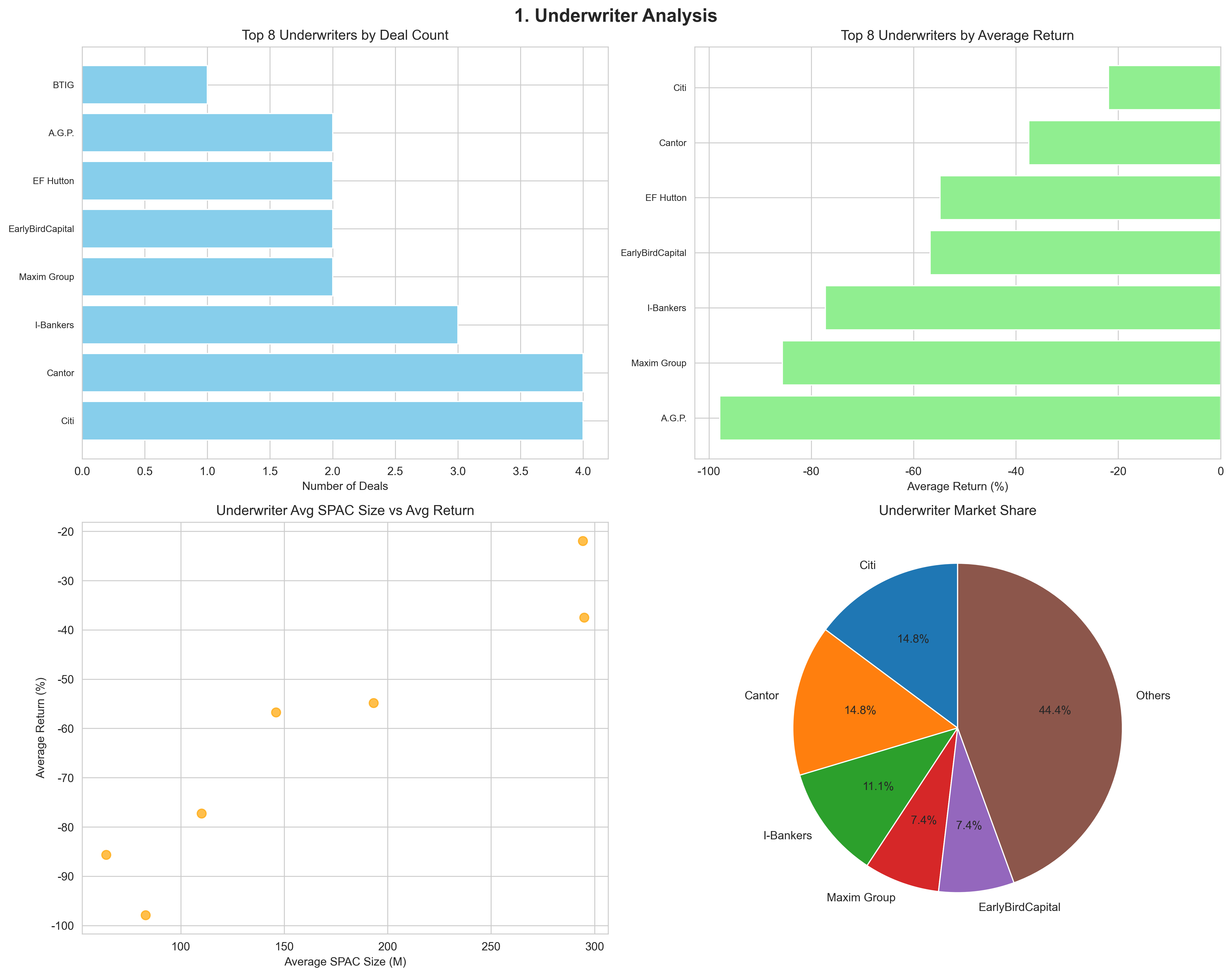

Underwriters

- Total Underwriters: 15

- Top 5 Underwriters:

• Cantor: 4 deals

• Citi: 4 deals

• I-Bankers: 3 deals

• EarlyBirdCapital: 2 deals

• Maxim Group: 2 deals

Pre-Merge Funding Analysis

-

Pre-Merge Funding Rate: 26/27

-

Average Funding/SPAC Size Ratio: 13.8%

-

Average Funding Amount: 24.0M

-

Median Funding Amount: 13.7M

-

Funded Deals Average Return: -51.1%

-

Unfunded Deals Average Return: -99.6%

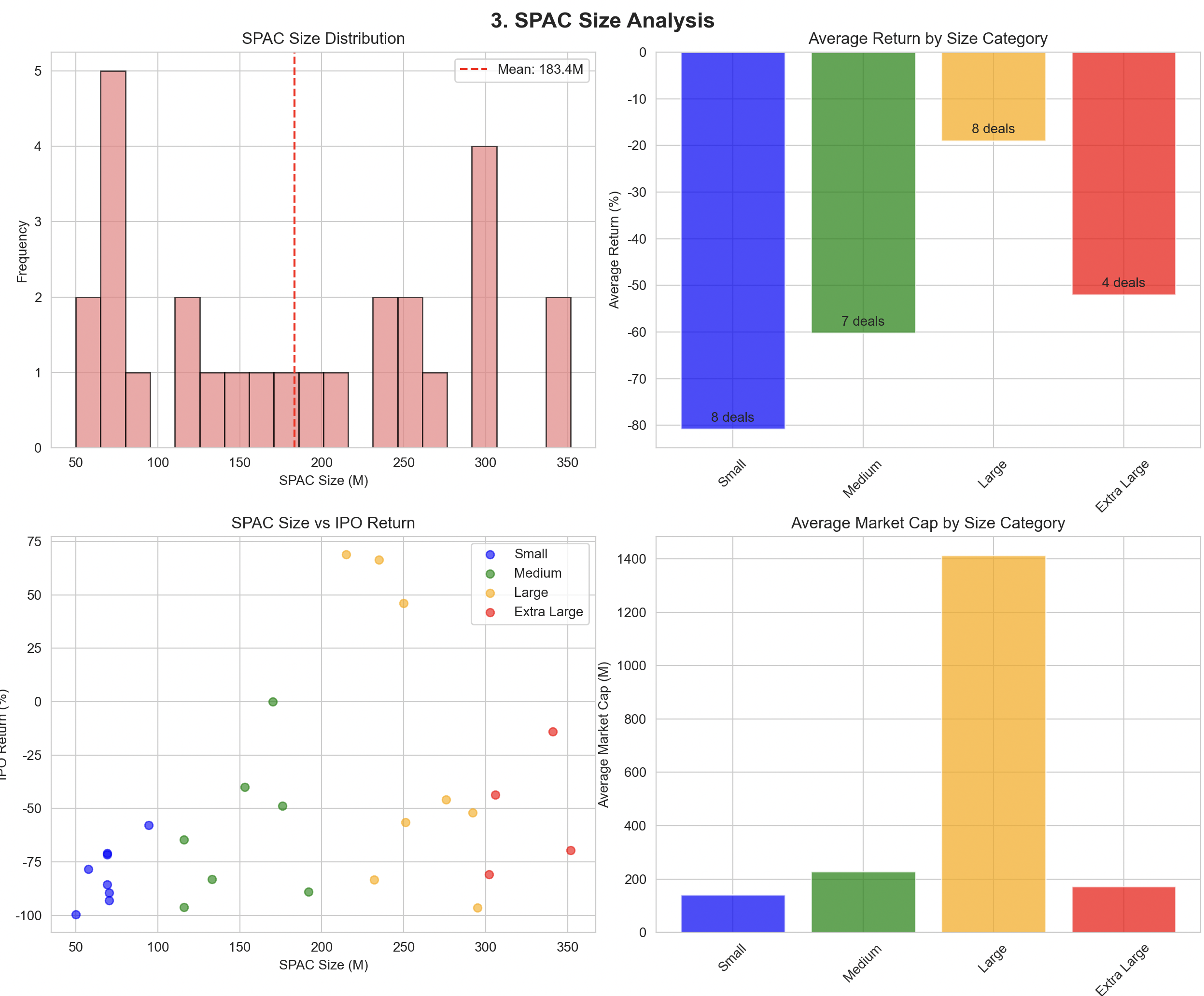

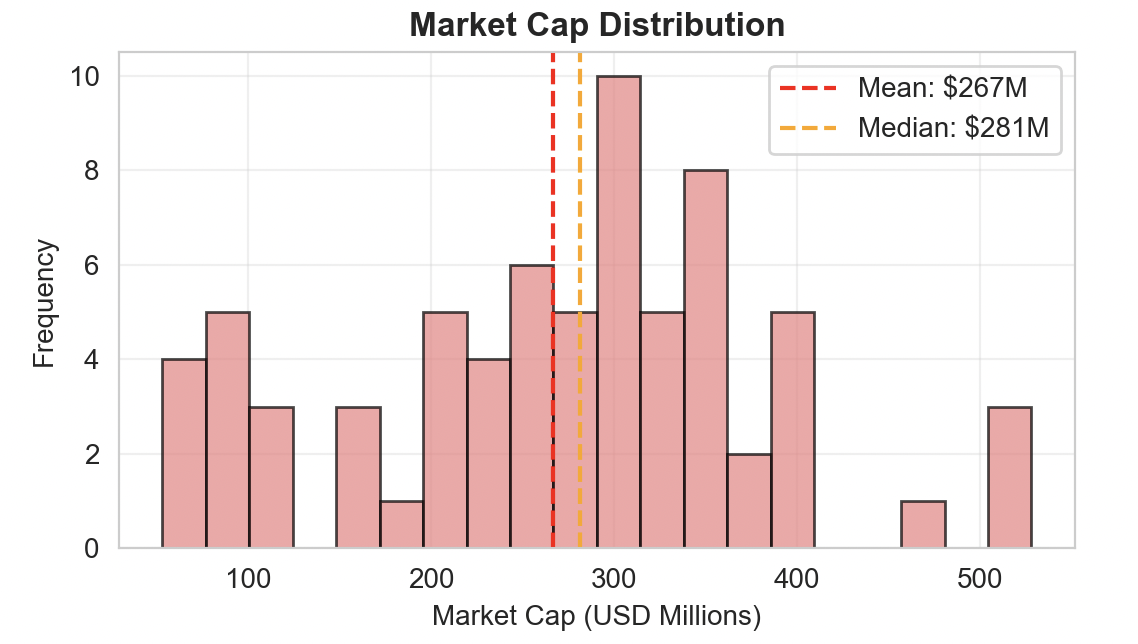

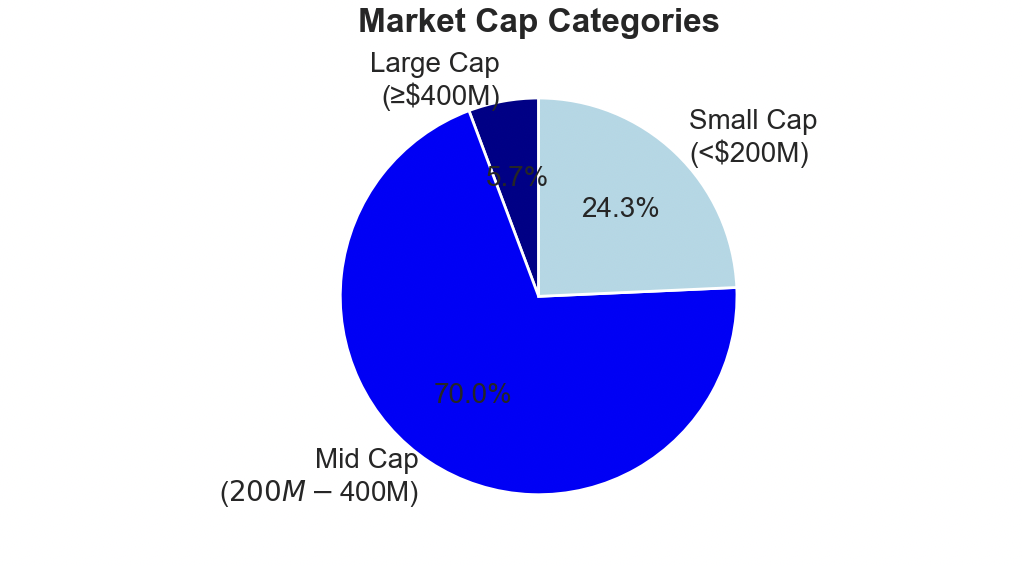

SPAC Size

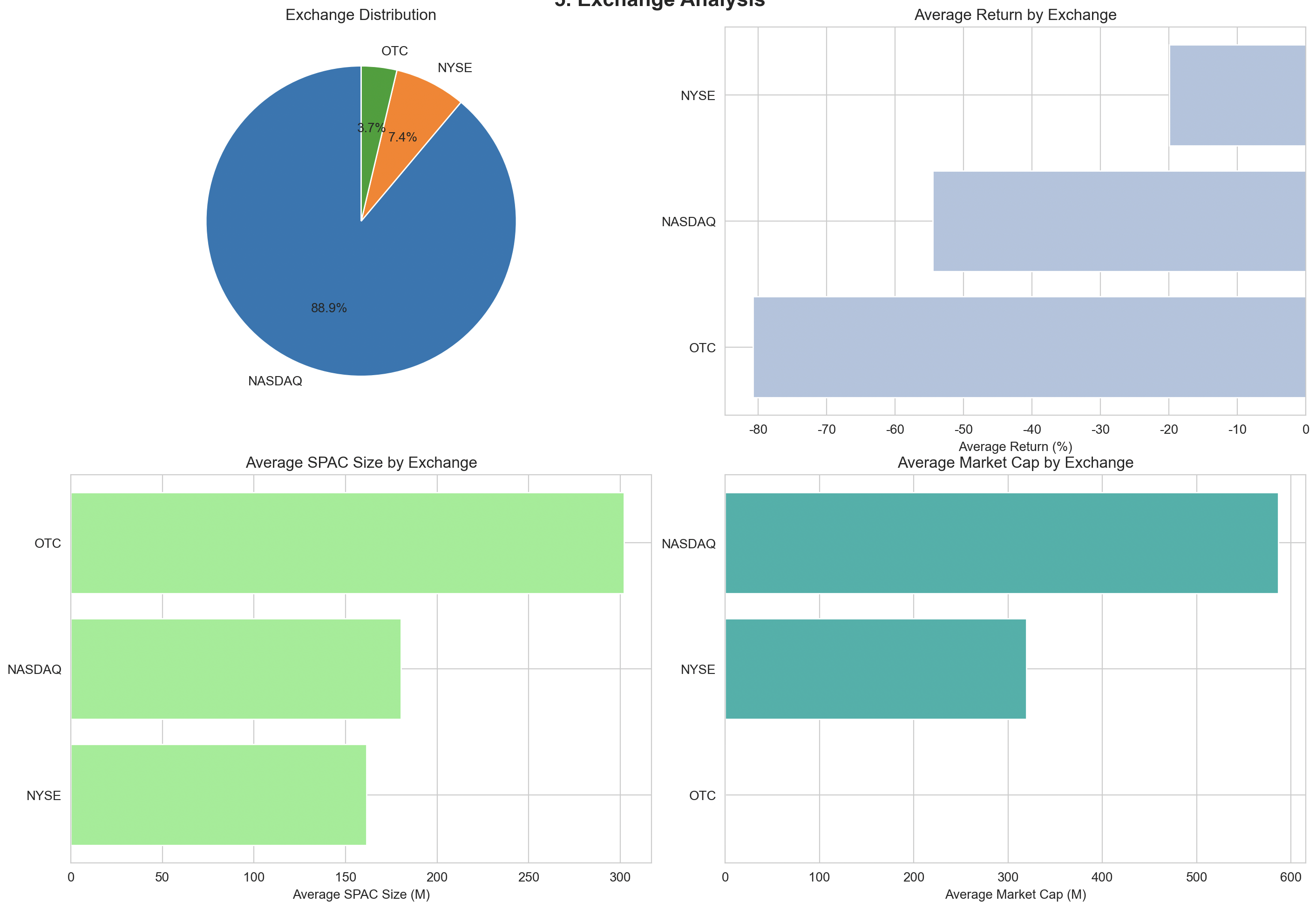

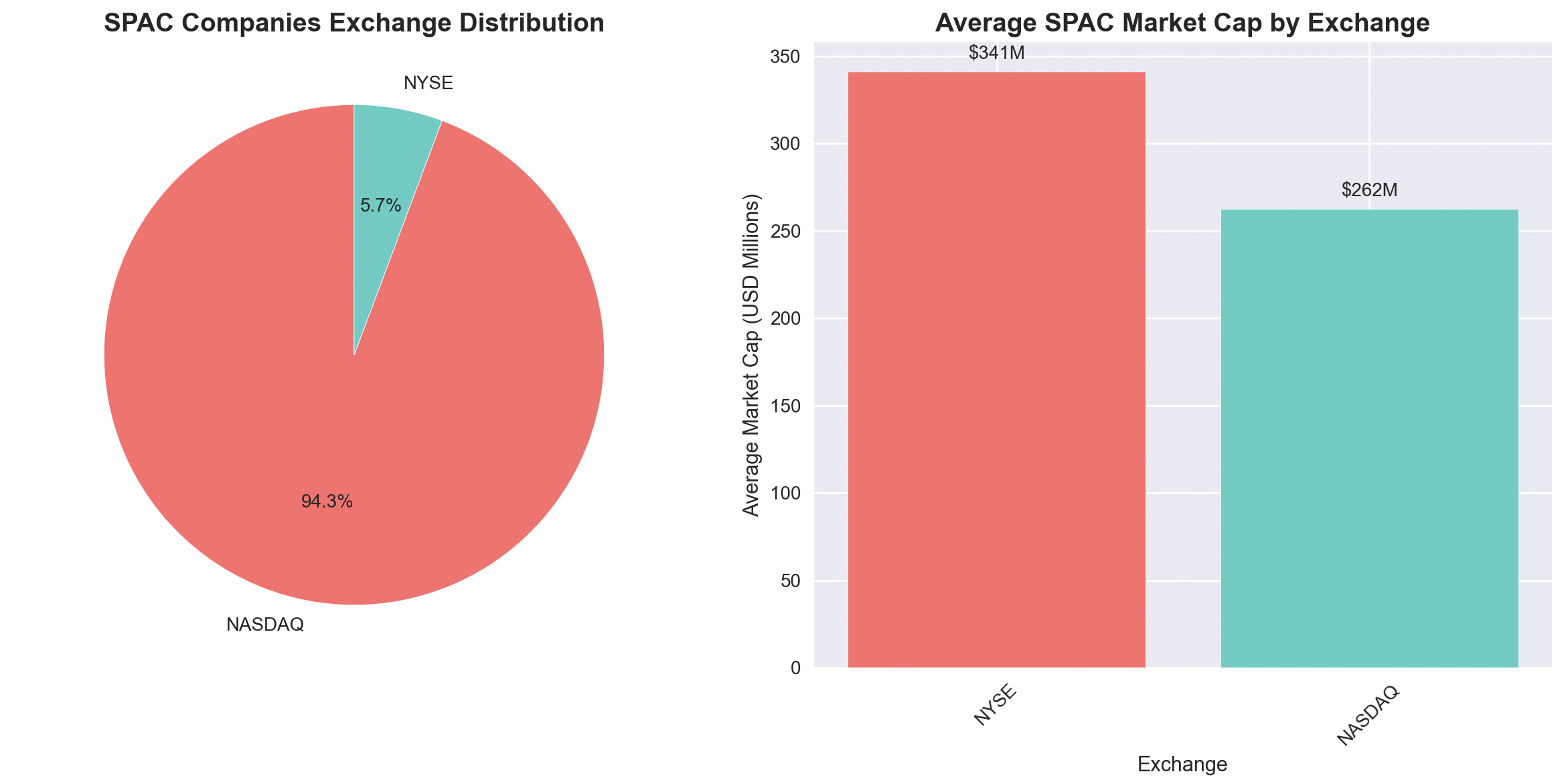

Exchange Distribution

- NASDAQ: 24 deals (88.9%)

- NYSE: 2 deals (7.4%)

- OTC: 1 deals (3.7%)

Industry

- Total Industries: 26

- Top 10 Industries:

• Biopharma: 2 deals (7.4%)

• Defense Technology AI Analytics: 1 deals (3.7%)

• AI Hardware High-Performance Computing: 1 deals (3.7%)

• Manufacturing Golf: 1 deals (3.7%)

• Gaming: 1 deals (3.7%)

• Gaming Digital Entertainment: 1 deals (3.7%)

• Biomedical Research Healthcare: 1 deals (3.7%)

• Bitcoin Crypto Personal Finance: 1 deals (3.7%)

• Cybersecurity: 1 deals (3.7%)

• Rare Earth Mining: 1 deals (3.7%)

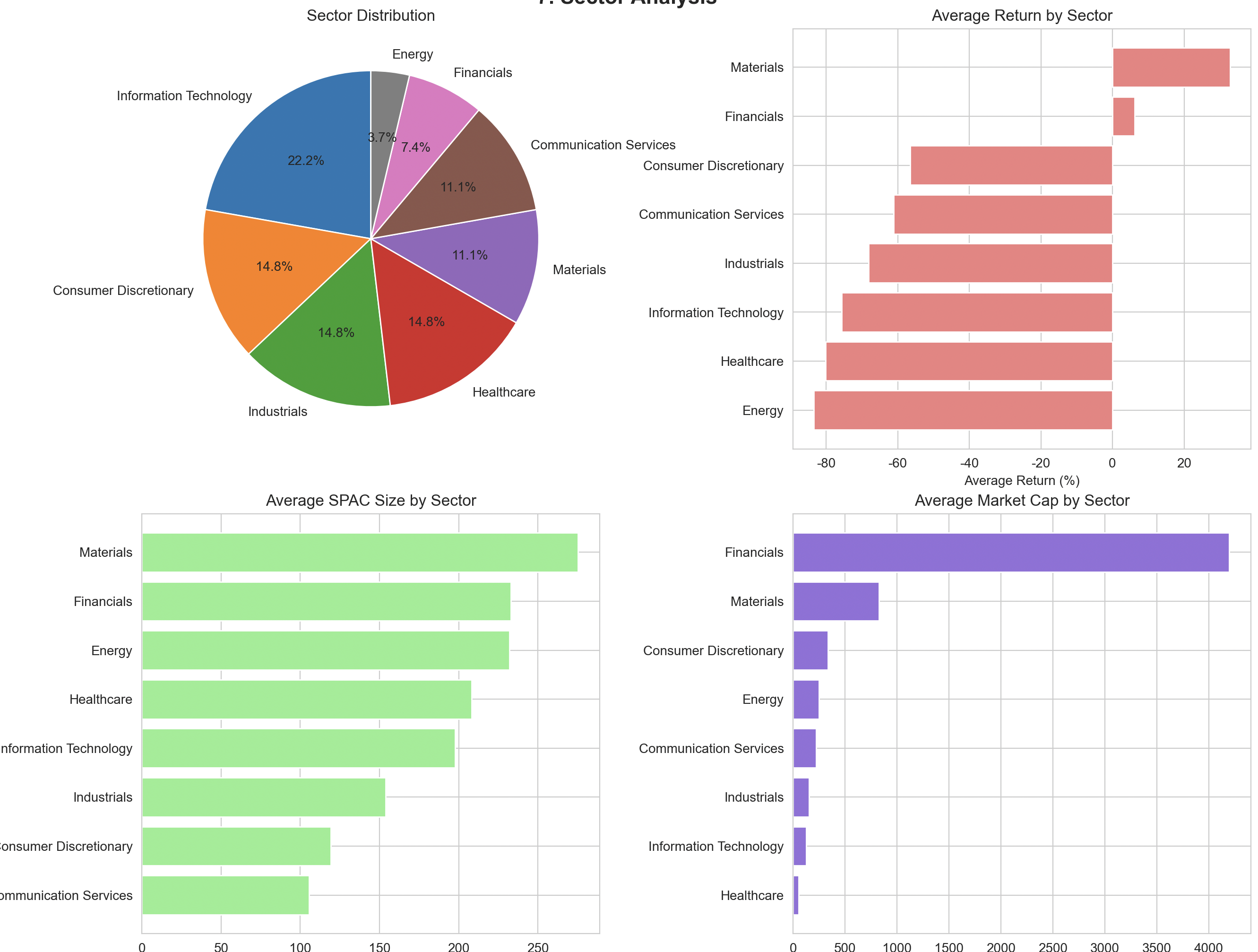

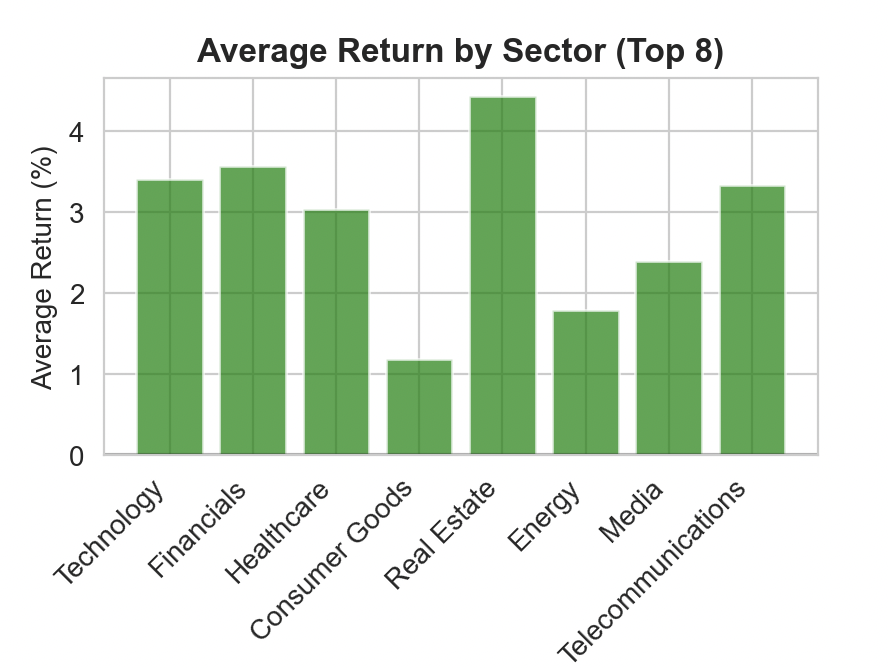

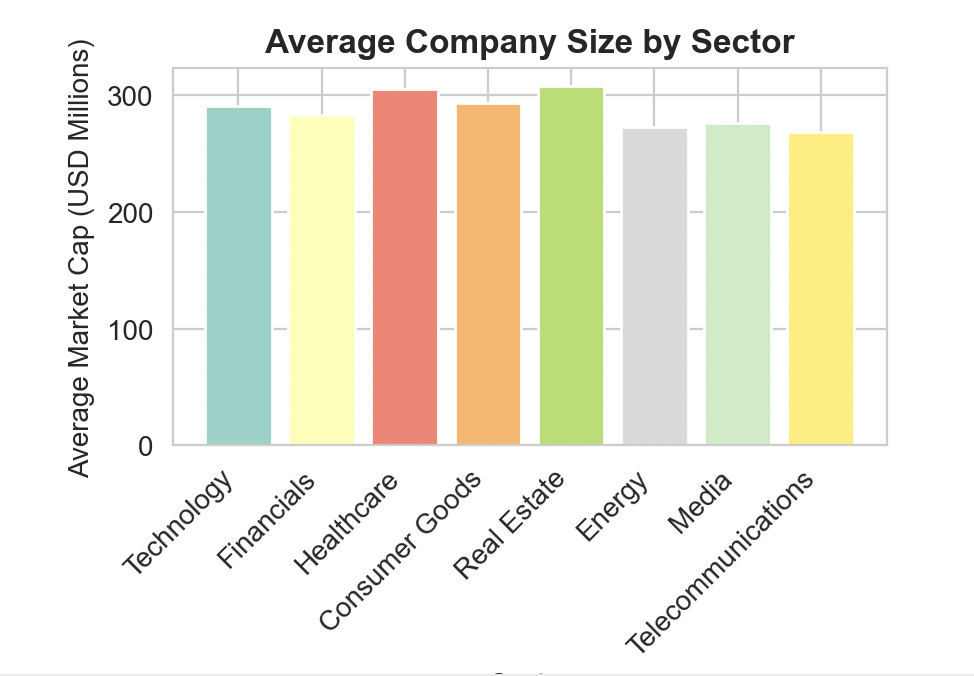

Sector

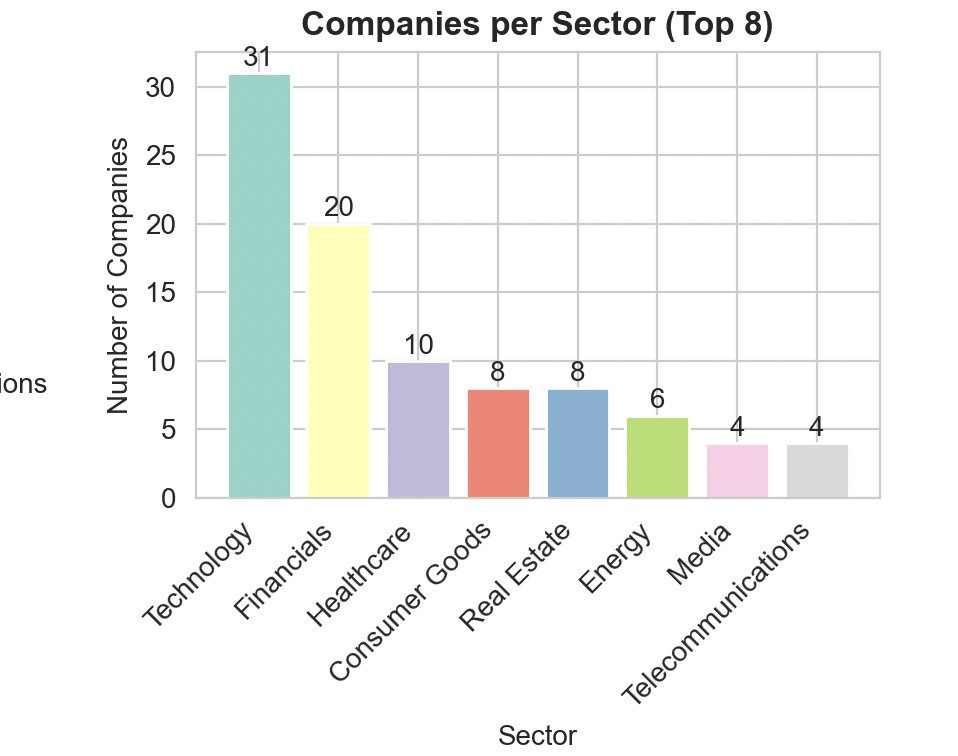

- Total Sectors: 8

- Sector Distribution:

• Information Technology: 6 deals (22.2%)

• Consumer Discretionary: 4 deals (14.8%)

• Industrials: 4 deals (14.8%)

• Healthcare: 4 deals (14.8%)

• Materials: 3 deals (11.1%)

• Communication Services: 3 deals (11.1%)

• Financials: 2 deals (7.4%)

• Energy: 1 deals (3.7%)

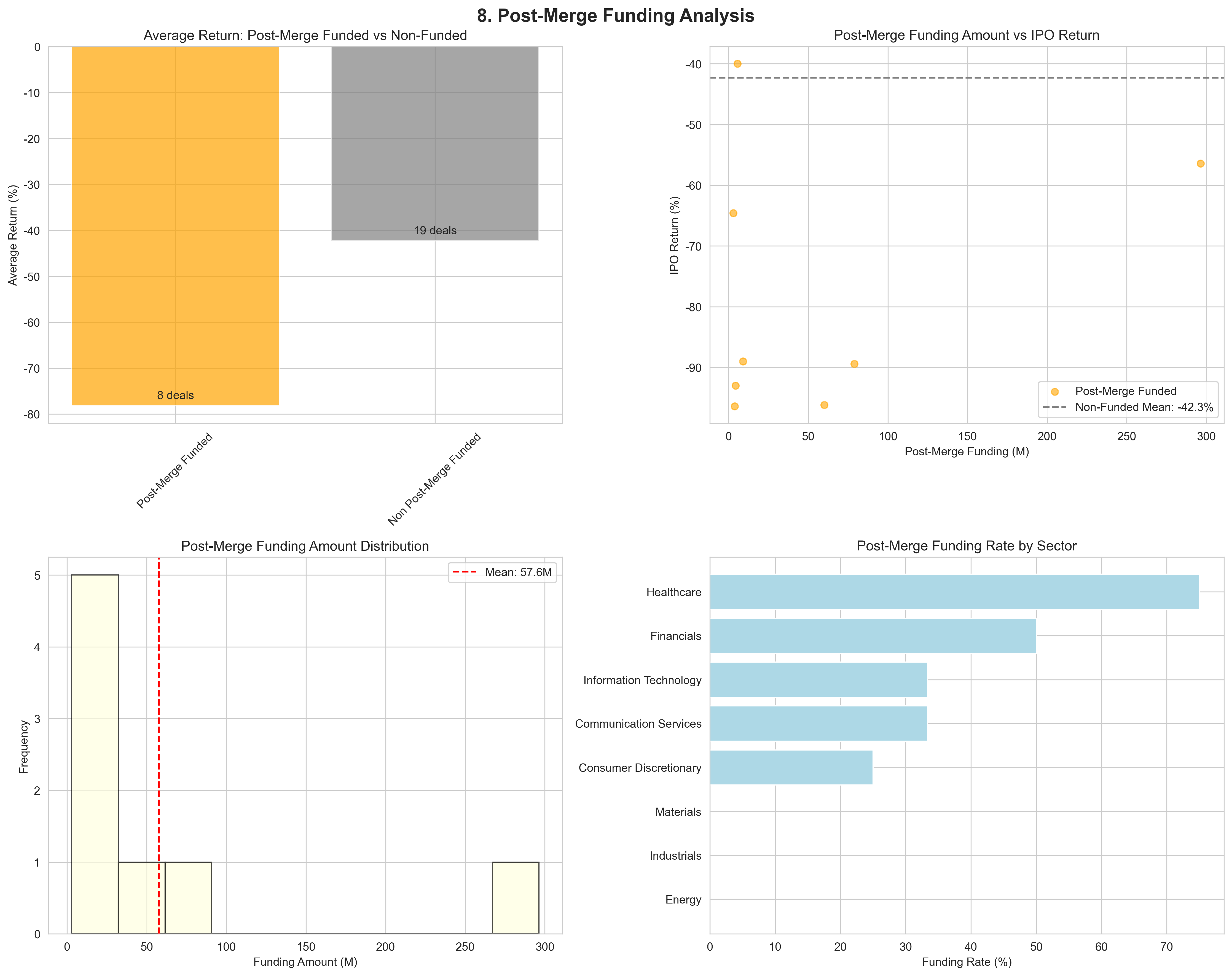

Post-Merge Funding Analysis

-

Post-Merge Funding Rate: 16/27

-

Average Funding Amount: 57.6M

-

Median Funding Amount: 7.3M

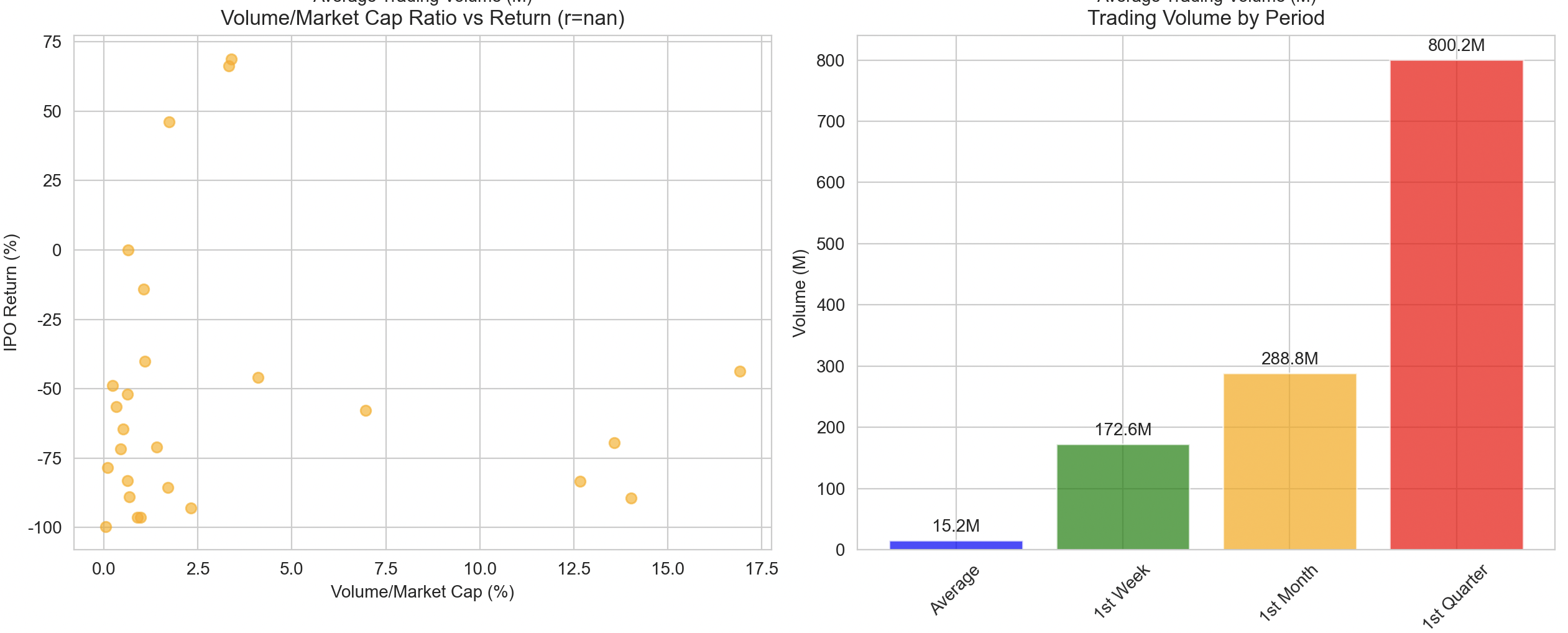

Trading Volume

Average Daily Volume:

- Average: 60.7M

- Median: 6.2M

1st Week Daily Volume:

- Average: 65.2M

- Median: 18.0M

1st Month Daily Volume:

- Average: 136.0M

- Median: 48.6M

1st Quarter Daily Volume:

- Average: 202.7M

- Median: 119.0M

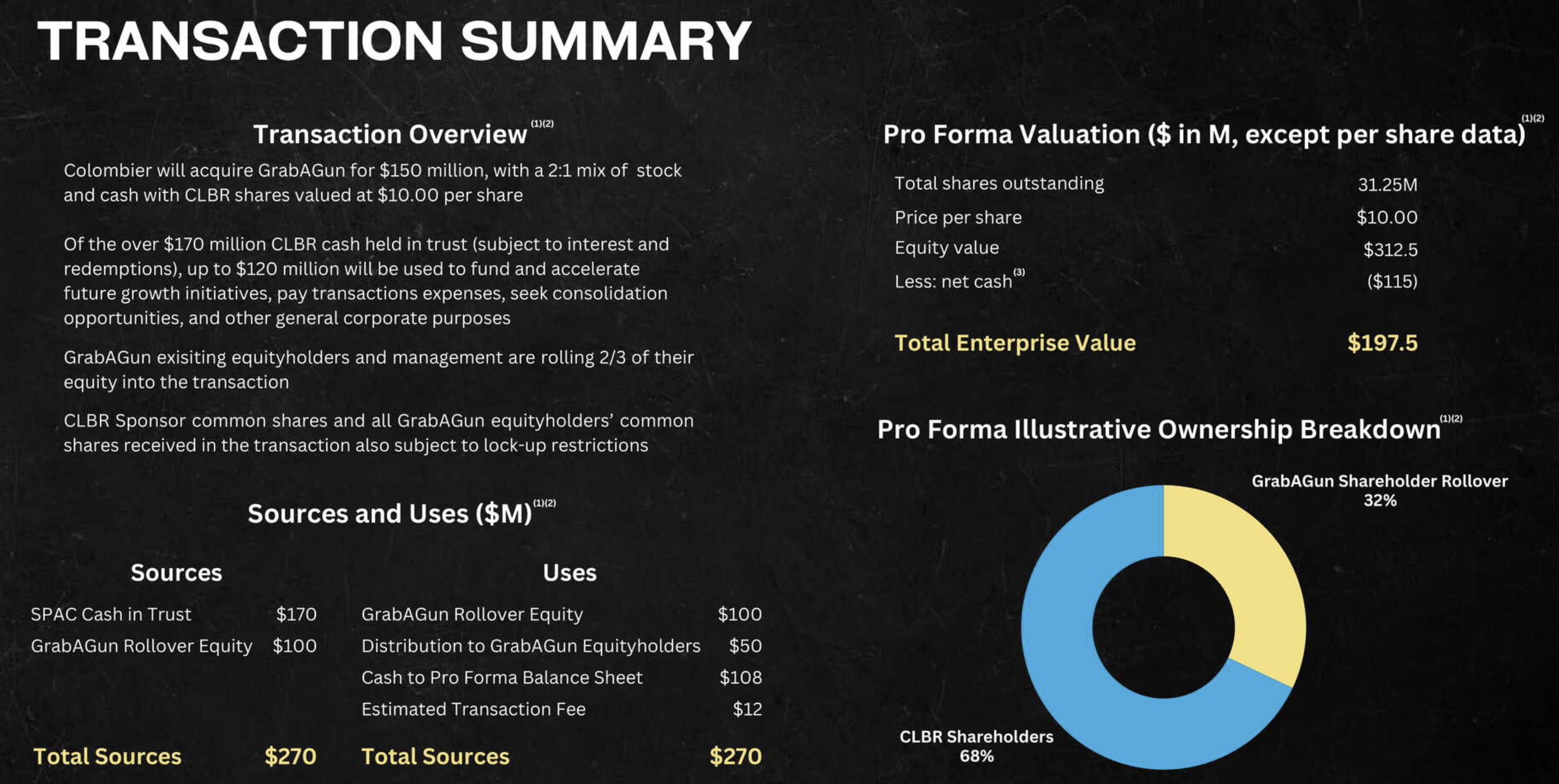

GrabAGun Digital Holdings

Company Info

- GrabAGun Digital Holdings operates as an online retailer of firearms, ammunition, and related accessories, founded in 2007 and headquartered in Coppell, Texas

- Donald Trump Jr. joined the Board of Directors

Price Chart

Shareholders

- Shares: 31.25M

- Sponsor: 4.25M

- Public SPAC Shareholders: 17M

- GrabAGun Shareholders: 10M

Merge Details

- Target Valuation: 150M

- 100M in Equity: 10M Shares, 10USD/Share

- 50M Cash

- Post-Merge

- 150M Equity

- 120M Cash

VisionWave Technologies

Company Info

- VisionWave technologies is a provider of cloud business management software

Price Chart

Shareholders

- Total Shares: 14.23M

- VisionWave Side

- VisionWave original shareholders receive 11,000,000 shares total

- Target stockholders: 8,979,427 shares

- Target non-affiliated public shareholders: 2,020,573 shares

- VisionWave original shareholders receive 11,000,000 shares total

- Bannix Side (Maximum Redemption Scenario)

- Public SPAC stockholders: 690,000 shares (from 6,900,000 Public Rights converted at 1:10 ratio)

- Sponsor and other insiders: 2,041,600 shares

- Representative shares: 393,000 shares

- Former officers and directors: 130,000 shares

Merge Details

- VisionWave receives 77.2% ownership (11M ÷ 14.25M)

- If combined company market cap ~$22.86M, then VisionWave implied valuation ~$17.6M

- Bannix remaining value ~$5.3M

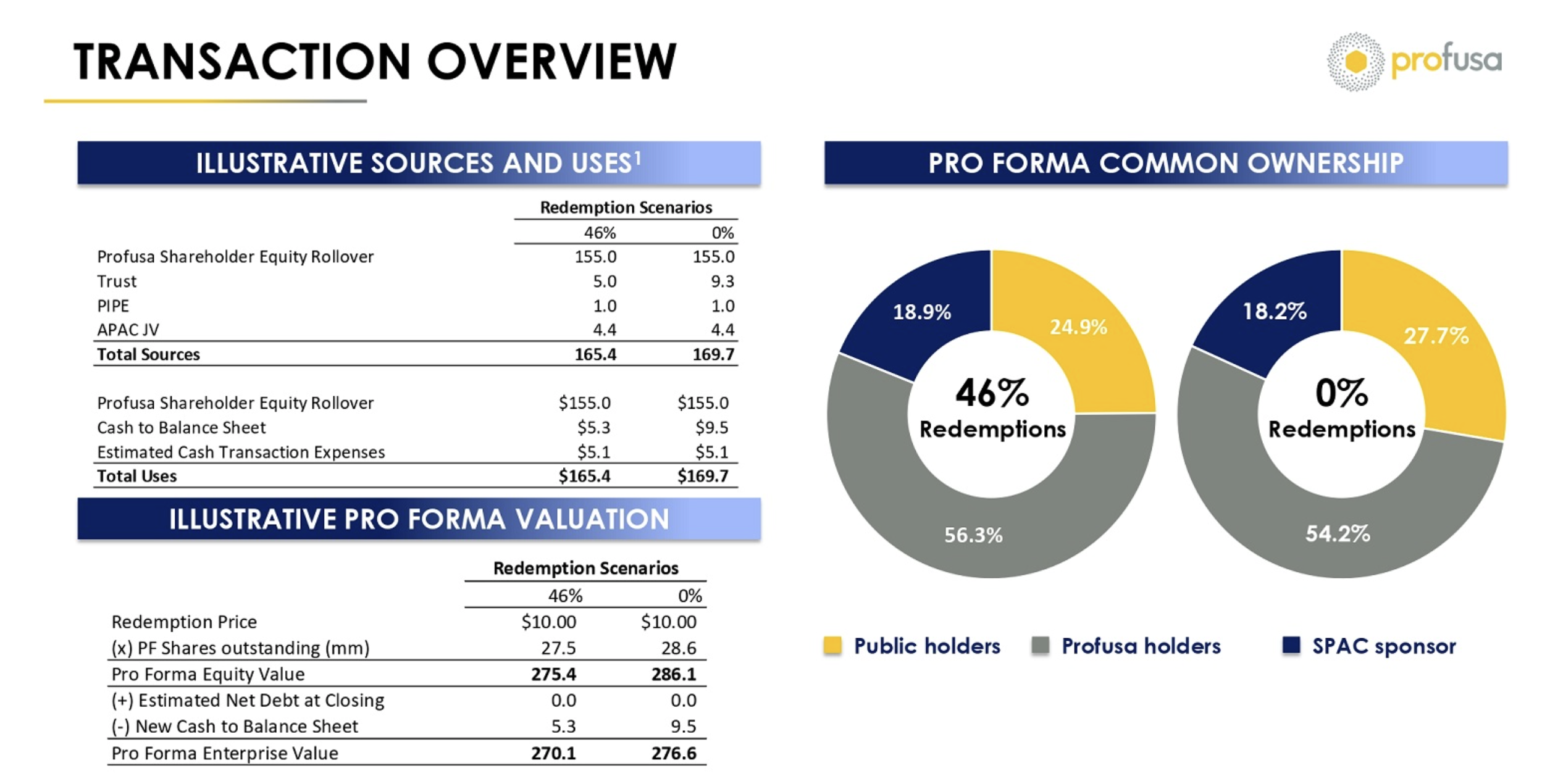

Profusa, Inc.

Company Info

Commercial-stage digital health company pioneering the next generation of continuous biochemical monitoring technology. Based in the San Francisco Bay Area (Emeryville, California), the company has invested nearly $100 million over the past decade developing revolutionary bio-engineered sensors that enable real-time monitoring of body chemistry.

Price Chart

Shareholders

- Total Shares: 33M

- NAVC SPAC Public Shareholders: 1.99M

- Sponsor: 4.48M

- PIPE: 1M

- Profusa: 15.5M

- Senior secured convertible note: 4.6M

- Profusa bridge notes: 4.2M

- Additional Earnout: 3.9M

Merge Details

- Massive shareholder redemptions had reduced the trust fund from $193 million to just $9 million

- PIPE: No public disclosure found identifying the specific investor(s) in the $1 million PIPE.

- Previous Debt

- Senior Secured Convertible Note, $26.6M

- Junior Convertible Notes, $19.6M

- Profusa bridge notes: unknown

- Pre-Merge

- PIPE: 10M

- Post-Merge

- Senior secured convertible note: 10M

- principal amount of $10 million, for which Profusa received $9 million after a 10% original issue discount.

- a 10% annual interest rate, escalating to 24% upon an event of default

- Senior secured convertible note: 10M

- Target Valuation: 155M

Youlife Group Inc.

Company Info

- Youlife is a leading platform in China dedicated to lifetime services for blue‑collar workers, spanning vocational training, job placement, employee management, and market services—catering to workers at every stage of their career

Shareholders

Shareholders

- Total shares: 76M

- Public SPAC Holders: 640K

- Sponsors: 2.54M

- Founder Share: 1.72M

- Private Shares: 0.54M

- Representative Shares: 0.27M

- Youlife shareholders: 70M

- PIPE Investor: 2.7M

Merge Details

- Target Valuation: 700M

- All-Stock Merger: DIST shareholders received one Youlife Group Inc. ADS for each DIST share they held (1:1 exchange).

- No Cash Consideration: Except for those holders who elected to redeem, no cash was paid; all non-redeemed DIST shares converted into new ADS.

- Class A Common Stock (ADS): 64,887,792 shares outstanding.

- Class B Common Stock: 11,160,808 shares outstanding.

- Redemptions: 601,118 DIST shares were redeemed pre-closing at $11.86 per share, funded from the SPAC trust.

- Founders, sponsors and PIPE investors are subject to lock-ups ranging from 180 days to 12 months, with potential early release upon sustained share price performance.

Hotel101 Global Holdings Co.

Company Info

Hotel101 Global Holdings Co. operates a standardized "condotel" model, where individual hotel units are sold to investors and managed by Hotel101 under long-term contracts. This generates:

- Upfront sales revenue from unit sales, and

- Recurring management fees from hotel operations

Price Chart

Shareholders

- Total Shares: 234.5M

- Public SPAC Shareholders: 108k

- Sponsors: 1.73M

- HBNB: 230M

- DDPC, Hotel101 Worldwide and DoubleDragon: 195.5M

- Key Executives: 34.5M

- Merdeka Corporate Finance Limited(Financial advisor for HBNB): 600k

- Maxim(Underwriter): 285K

- Additional Earnout: 500k

- For Directors, executives, managers, advisors and employees

Merge Details

-

Warrantd: 2.4M from sponsor

-

Loan: 350K from sponsor

-

Extension loan: 2M

-

Target Valuation: 2.3B

-

All-Stock Deal – No Cash Paid to Shareholders

- The merger implies a $2.3 billion equity value, using a HBNB share price of $10.00 at closing

- JVSPAC shareholders received 1 share of HBNB for each Class A or Class B ordinary share they held.

-

Two simultaneous steps

- Singapore Amalgamation: Hotel101 Global merged with Merger Sub 1 in Singapore—Hotel101 Global emerged as a wholly owned subsidiary of the new public holding company (“PubCo”).

- BVI SPAC Merger: Merger Sub 2 merged into JVSPAC (a BVI company), with JVSPAC surviving as a subsidiary of PubCo.

Scage Future

Company Info

- Headquartered in Nanjing, China, and focuses on the design, production, and testing of zero‑emission heavy‑duty commercial vehicles, including hydrogen fuel‑cell, plug‑in hybrid trucks, and proprietary e‑fuel technologies

Price Chart

Shareholders

- Total Shares: 71.94M

- Public SPAC Holders: 99k

- Sponsors: 6.4M

- Scage Future | KVAC Holders: 62.5M

- Potential Warrants: 2.94M

Merge Details

-

Pre-Merge

- Oct–Nov 2021: Finnovate IPO (15,000,000 units) raises $150 M; sponsor purchases 7.9 M private warrants for $7.9 M[

- By mid-2022: Sponsor has loaned ~$449,765 as working‐capital loans to Finnovate

- May 8, 2023: Sunorange Investment closes. Sponsor deposits $300k into trust and cancels the working-capital loan Sponsor begins committing $100k/mo (or $0.033/share) thereafter

- Jan 26, 2024: Finnovate issues up-to-$1.5M promissory note to Scage (0% interest, repayable at closing)

- Aug 23 & Oct 20, 2024: Scage sells 3.442 million shares to an investor for $20M total. effectively a PIPE for the target).

-

Target Valuation: 625M

-

Two-step merger via First & Second Merger Subs

- Step 1 (First Merger):: Merger Sub I_ merged into Scage International, which continued as a wholly owned subsidiary of Pubco (Scage Future). All Scage International equity was converted into Pubco securities

- Step 2 (Second Merger): On June 27, 2025, Merger Sub II merged into Finnovate, making Finnovate a wholly owned subsidiary of Pubco. All Finnovate securities (shares, warrants, units) were converted to equivalent Pubco securities

-

Finnovate shares 1:1; warrants split 2-to-1

-

Lock-ups: ~28M shares locked for 6–36 months

Blue Gold Limited

Company Info

- Incorporated in the Cayman Islands (headquartered in Grand Cayman) and operates in Ghana's Ashanti Gold Belt, one of West Africa’s historic gold mining regions, centered on the Bogoso‑Prestea mine—a key 5.1 million ounce gold resource acquired in 2024 as part of a value-driven growth strategy

Price Chart

Shareholders

- Total Shares: 30.57M

- Public SPAC Shareholders: 25.19K

- Sponsor: 4.47M

- BGHL shareholders: 11.45M

- Blue Capital(Convertible promissory note): 2M

- BCMP Services Limited (Preferred Stock): 12.05M

- Bonaventura Industries Inc (Advisor): 160K

- Cibreo Partners LLC(Second Advisor): 432K

Merge Details

- Pre-Merge

- Convertible Promissory Note: 2M

- Preferred Stock: 700k

- Target Valuation: 114.5M

- Two‑step merger via First & Second Merger Subs

- Step 1 (First Merger): Blue Gold formed a Cayman “Blue Merger Sub,” which merged with and into Blue Gold Holdings Limited (BGHL). BGHL survived as a wholly owned subsidiary of the SPAC vehicle, holding the entire gold‑mine business.

- Step 2 (Second Merger): The SPAC formed a second Cayman “Merger Sub,” which merged with and into Perception Capital Corp. IV. Merger Sub survived and was immediately re‑named as the combined public entity (trading as BGL), with all BGHL assets now under it.

- Share Exchange: Each outstanding Perception Class A share and Unit was converted 1 for 1 into BGL ordinary shares; public and private warrants converted into BGL warrants on substantially equivalent terms.

CID HoldCo, Inc.

Company Info

- Provides asset tracking and workflow management solutions for operations intensive enterprises. Its solutions offer safety and assurance for enterprise processes. The company is based in Bethesda, Maryland.

Price Chart

Shareholders

- Total Shares: 24.83M

- Public SPAC Stockholders: 2.24K

- Sponsor:

- Class A: 1.35M

- Class B: 10.45M

- Former See ID Stockholders(DAIC): 8.8M

- Conversion of See ID SAFE Notes: 2.1M

- Earnout: 2.01M

Merge Details

-

Pre-Merge

- PIPE (committed): 12M

- PIPE/ELOC (planned): 7M

- See ID SAFE: Unknown

-

Target Valuation: 130M

-

Two‑step merger via First & Second Merger Subs

- Step 1 (Company Merger):

- A Delaware “SEI Merger Sub” (a subsidiary of CID HoldCo) merged into SEE ID, Inc. (Dot Ai). SEE ID survived as a wholly-owned subsidiary of the SPAC vehicle

- Step 2 (SPAC Merger):

- Another sub, “ShoulderUp Merger Sub,” merged into the SPAC (ShoulderUp Technology Acquisition Corp. – SUAC). SUAC survived, renamed itself CID HoldCo, Inc., and began trading on Nasdaq under DAIC (equity) and DAICW (warrants) on around June 23, 2025

- Step 1 (Company Merger):

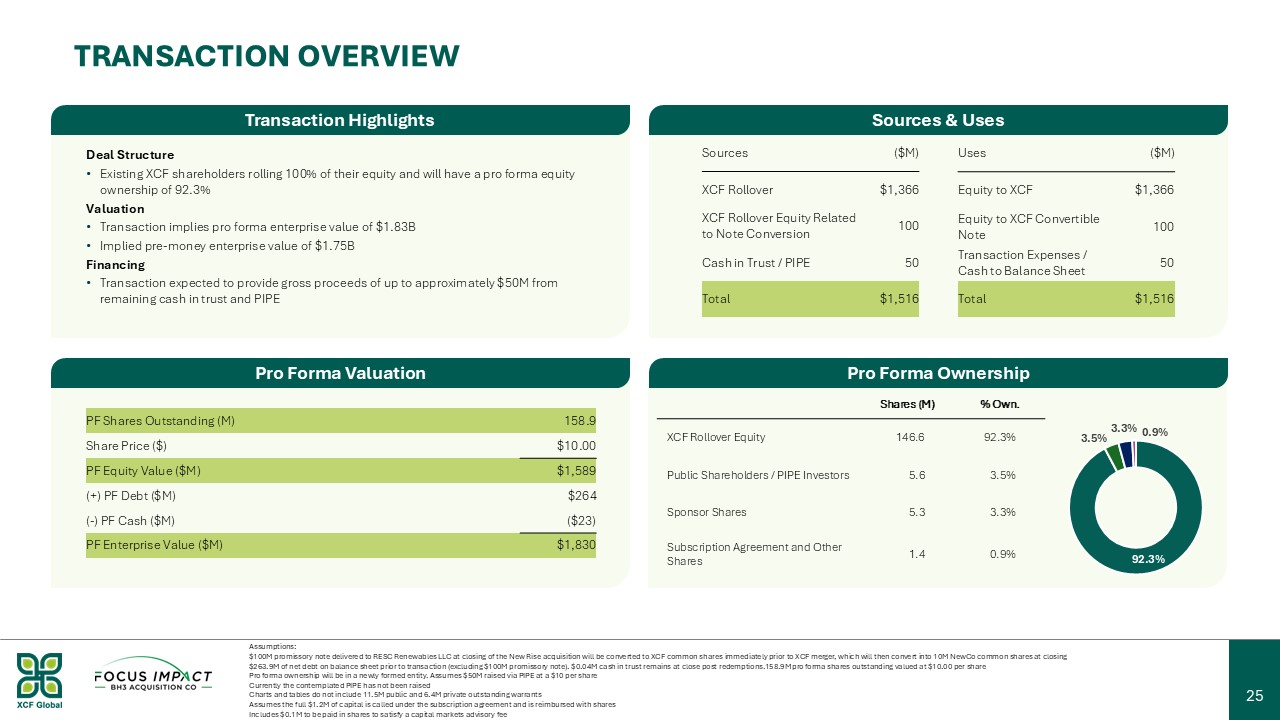

XCF Global Capital

Company Info

- XCF Global, Inc. produces renewable diesel and sustainable aviation fuels in North America.

- It develops and operates clean fuel SAF production facilities to reduce the global carbon footprint through production of clean-burning, sustainable biofuels, and Sustainable Aviation Fuel (SAF).

Price Chart

Shareholders

- Total Shares: 149M

- SPAC Public holders: 3.7K

- Sponsors: 4.6M

- Current: 3.3M

- Former: 1.3M

- XCF Equityholders: 147M

- Includes the conversion of 20,795,833 shares of XCF stock held by Sky MD, LLC

- Indeed, not 147M

- BTIG Fee: 100K

Merge Details

- Pre-Merge

- Promissory Notes Financing(Working-capital loan): 1.2M from Capital Support from Polar Multi-Strategy Master Fund

- Promissory Notes: GL SPV Part I LLC, 2.5M,

- Multiple Entity Promissory Notes, Innovativ Media Group, Inc., Narrow Road Capital, Ltd., Gregory Segars Cribb, and other entities, 7M

- Convertible Promissory Note, RESC Renewables Holdings, LLC, 100M

- PIPE: 50M, *Probably Not Executed *

- Post-Merge

- ELOC(Equity Line of Credit): Planned, 1B

- Target Valuation: 1.49B

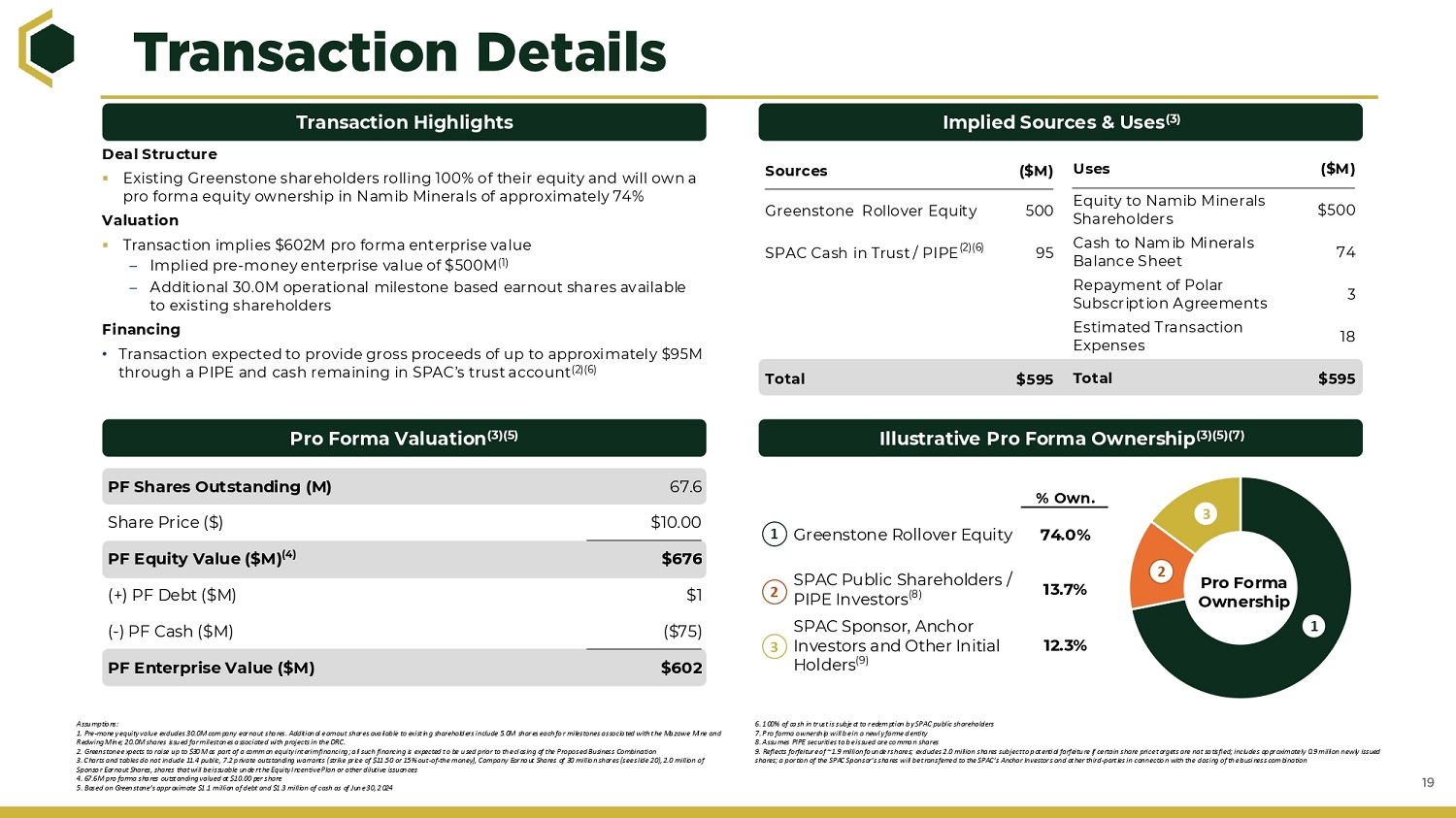

Namib Minerals

Company Info

- Namib Minerals engages in the production, development, and exploration of gold and critical green metals.

- Operates an underground mine in Zimbabwe, with additional exploration assets in Zimbabwe and the Democratic Republic of Congo.

Price Chart

Shareholders

- Total Shares: 54.42M

- SPAC Public Holders: 107K

- Sponsors: 10.19M

-

- Another 125K: 125,000 PubCo Ordinary Shares issuable in exchange for 125,000 shares of SPAC Class B Common Stock held by the current and former independent directors of HCVI.

- 9,318,318 PubCo Ordinary Shares issuable in exchange for the Sponsor’s outstanding shares of SPAC Class B Common Stock

- 880,000 PubCo Ordinary Shares issuable to Polar pursuant to the Polar Subscription Agreements

-

- NAMM Company Shareholders: 50.02M

- PIPE Investors: 6M

- Notes: Actual outstanding shares after merger, excluding

- Unconverted Sponsor Class B

- PIPE shares that weren’t funded yet

Merge Details

- Target Valuation: 500M

- Two‑step merger via First & Second Merger Sub

- Step 1 (Company Merger):

- Cayman “Company Merger Sub” (a PubCo subsidiary) merged into Greenstone Corporation (Namib’s operating entity). Greenstone survived as a wholly owned subsidiary of PubCo

- Step 2 (SPAC Merger):

- Delaware “SPAC Merger Sub” (also a PubCo subsidiary) merged into the SPAC (HCVI), with the SPAC surviving as a PubCo subsidiary. The combined entity was renamed Namib Minerals, and began trading on Nasdaq under NAMM (equity) & NAMMW (warrants) around June 6, 2025

- Step 1 (Company Merger):

- NAMM ordinary shares:

Issued 1-for-1 to Namib shareholders per the Business Combination Agreement, reflecting the $500 M valuation formula - SPAC public shares & warrants:

Each HCVI Class A share/unit converted 1-for-1 into Namib ordinary shares; HCVI warrants converted into NAMM warrants on equivalent terms

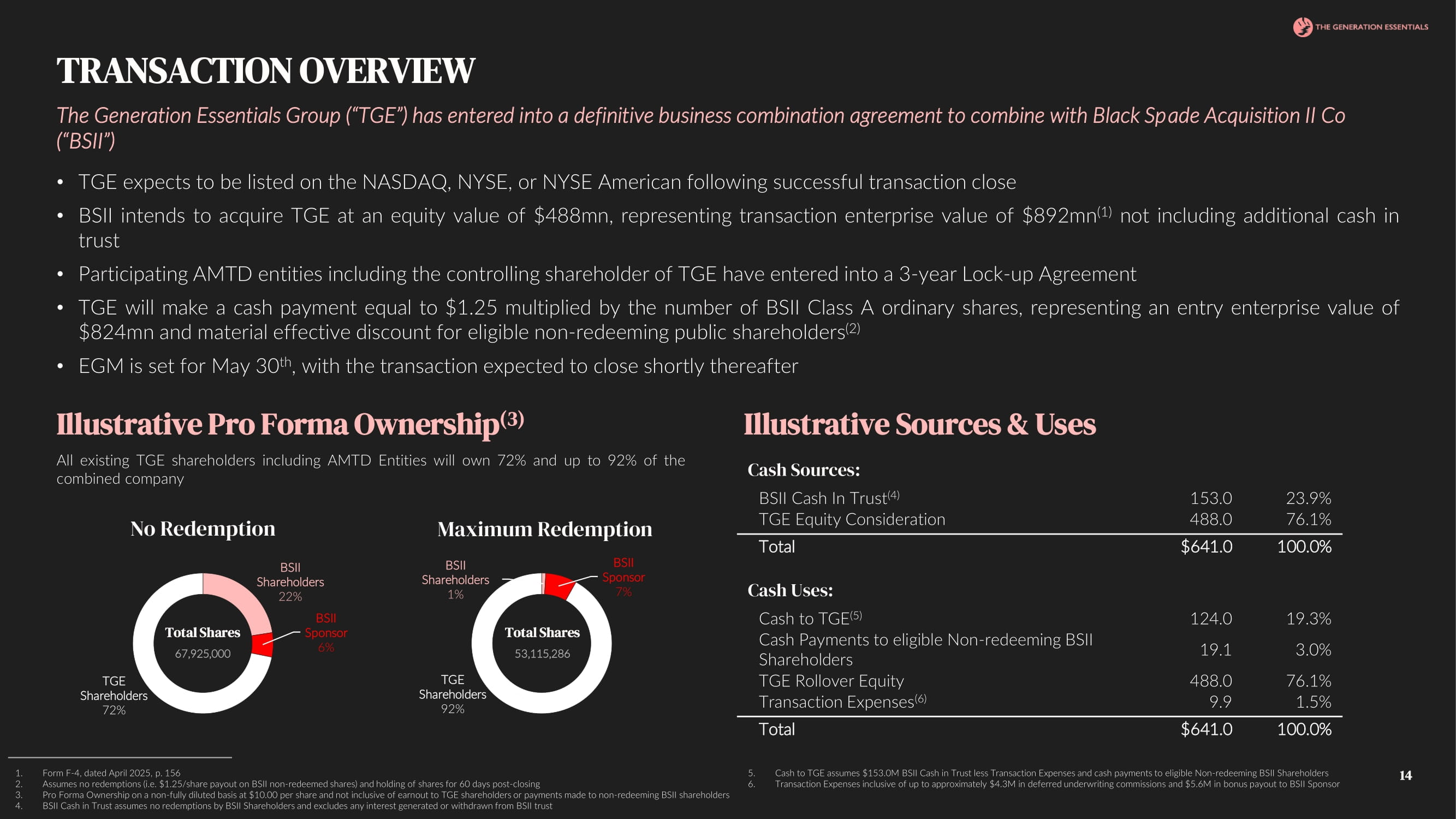

The Generation Essentials

Company Info

- A media and entertainment company, engages in fashion, arts, lifestyle, cultural, entertainment, as well as F&B businesses worldwide.

- It publishes print publications and digital contents, including L’Officiel, The Art Newspaper, and DigFin.

- The company also produces and invests in movies; holds premium building properties; and provides hospitality services in Hong Kong and Singapore, as well as operates IP extended business in the areas of F&B.

Price Chart

Shareholders

- Total Shares: 54.8M

- SPAC Public Holders: 2.18M

- Sponsors: 3.82M

- TGE Shareholders: 49.24M

- Class A Shareholders: 23.7M

- Class B Shareholders: 19.2M

- Preferred Shareholders: 6.34M

Merge Details

- Pre-Merge

- PIPE: 5.5M, BSII Sponsor Support

- Post-Merge

- PIPE: $5.56M from Black Spade Sponsor LLC II via pre-funded warrants

- Target Valuation: 488M

- Step 1 (Recapitalization): TGE redesignates its shares into Class A, Class B, and preferred, then consolidates to a $10 basis per share

- Step 2 (Merger): TGE’s Cayman subsidiary merges into BSII; BSII survives as a subsidiary. Combined entity is TGE, listing under the TGE name.

- Result: TGE (Cayman-inc.) is the public parent; BSII is a private subsidiary. The combined company retains the name The Generation Essentials Group.

K Wave Media Ltd.

Company Info

- Engages in the entertainment content and IP creation, merchandising, and entertainment investment business. The company is based in Grand Cayman, Cayman Islands.

Price Chart

Shareholders

- Total Shares: 63.25M

- SPAC Public Holders: 40.04K

- Sponsors: 2.94M

- KWM: 59.16M

- Representative Shares(Underwriter): 115K

- Other Dilutions

Merge Details

- Pre-Merge:

- Convertible Note PIPE: 4.41M, five accredited investors

- Convertible Notes PIPE: 15 M initial; up to $500 M total, Anson Funds

- Post-Merge:

- Standby Equity Purchase Agreement (SEPA): 500M, Bitcoin Strategic Reserve (BSR) committing up to $500 M in equity funding for its Bitcoin treasury strategy

- Target Valuation: 592M

- Two-step merger via newly formed Delaware and Cayman entities

- Step 1 – Reincorporation Merger: Global Star Acquisition (Delaware SPAC) “Parent” merged into a newly formed Cayman Islands subsidiary (“Purchaser”, K Wave Media Ltd.). Global Star ceased to exist, and K Wave (Cayman) survived as the publicly traded company. All of Global Star’s charter and outstanding securities (common stock, warrants, rights, units) were converted into equivalent K Wave shares and securities under Cayman law K Wave’s name (K Wave Media Ltd.) and governance replaced Global Star’s.

- Step 2 – Acquisition Merger:** On closing, a Delaware subsidiary of K Wave (“GLST Merger Sub”) merged into K Enter Holdings (Delaware). K Enter (the target) survived this merger as a wholly owned subsidiary of K Wave. The effect is that K Wave (Cayman) became the ultimate parent, and K Enter (with its business in Korean entertainment assets) became a fully owned operating unit. (Merger Sub’s only purpose was to facilitate this reverse-triangular merger.)

GIBO Holdings Limited

Company Info

- GIBO Holdings Limited operates as an AI-driven animation streaming company.

- It provides AIGC animation streaming platform with extensive functionalities provided to both viewers and creators that serves to young people community.

- The company is based in Kwai Chung, Hong Kong.

Price Chart

Shareholders

- Total Shares: 725M

- SPAC Public Holders: 112.64k

- Sponsors: 1.94M

- Underwriter: 179K

- Representative Shares: 150k

- Advisory fee: 29K

- GIBO Shareholders: 756M

- Class A: 552M

- Class B: 204M

- Notes: Actual outstanding shares after merger, excluding

- Unconverted Shares

Merge Details

- Pre-Merge

- PIPE: Undisclosed, transparency issues

- BUJA Sponsor Support: Standard SPAC structure, founders hold ~20% equity

- Post-Merge

- PIPE: Trust account funds used to support merger, specific usage insufficiently disclosed

- Target Valuation: $8.3B

- Step 1 (Recapitalization): GIBO Share Restructuring

- Global IBO Group restructured into dual-class share structure

- Class A Common Stock: 1 vote per share (public shareholders)

- Class B Common Stock: 20 votes per share (founder shareholders)

- Base price: $10 per share

- Step 2 (Merger): Two-step merger mechanism

- Step 1: Merger Sub I merges with Global IBO Group; Global IBO survives as GIBO Holdings subsidiary

- Step 2: Merger Sub II merges with BUJA; BUJA survives as GIBO Holdings subsidiary

- Combined entity lists on NASDAQ under ticker GIBO

- Result: GIBO Holdings Limited (Cayman Islands) is the public parent company

- GIBO Holdings Limited (public parent - Cayman Islands)

- Global IBO Group Ltd. (wholly-owned subsidiary)

- Bukit Jalil Global Acquisition 1 Ltd. (wholly-owned subsidiary)

- Final company name: GIBO Holdings Limited, ticker GIBO

- Step 1 (Recapitalization): GIBO Share Restructuring

Liminatus Pharma, Inc.

Company Info

- Operates as a pre-clinical stage biopharmaceutical company that develops novel cancer therapies.

- It is developing CD47, a high affinity humanized anti CD47 antibody that has the potential to translate into clinic for CD47 SIRPα blocking and restoring the anti-tumor function of innate immune cells without inducing hemagglutination or hemolysis.

- The company was founded in 2018 is based in LA Palma, California.

Price Chart

Shareholders

- Total Shares: 26.01M

- SPAC Publice Holders: 114K

- Sponsors: 6.9M

- Liminatus Members: 17.5M

- Deferred underwriting commissions: 700K

- PIPE: 2.5M

Merge Details

- Pre-Merge

- PIPE: 25M

- Originally planned $15M PIPE financing (common stock at $10/share) + $25M convertible notes (conversion price $11.50), both terminated during execution; replaced with $25M equity subscription agreement (2.5M shares × $10)

- Target Valuation: 175M

- Equity Value: Liminatus shareholders received 17.5M shares valued at $175M (at $10/share)

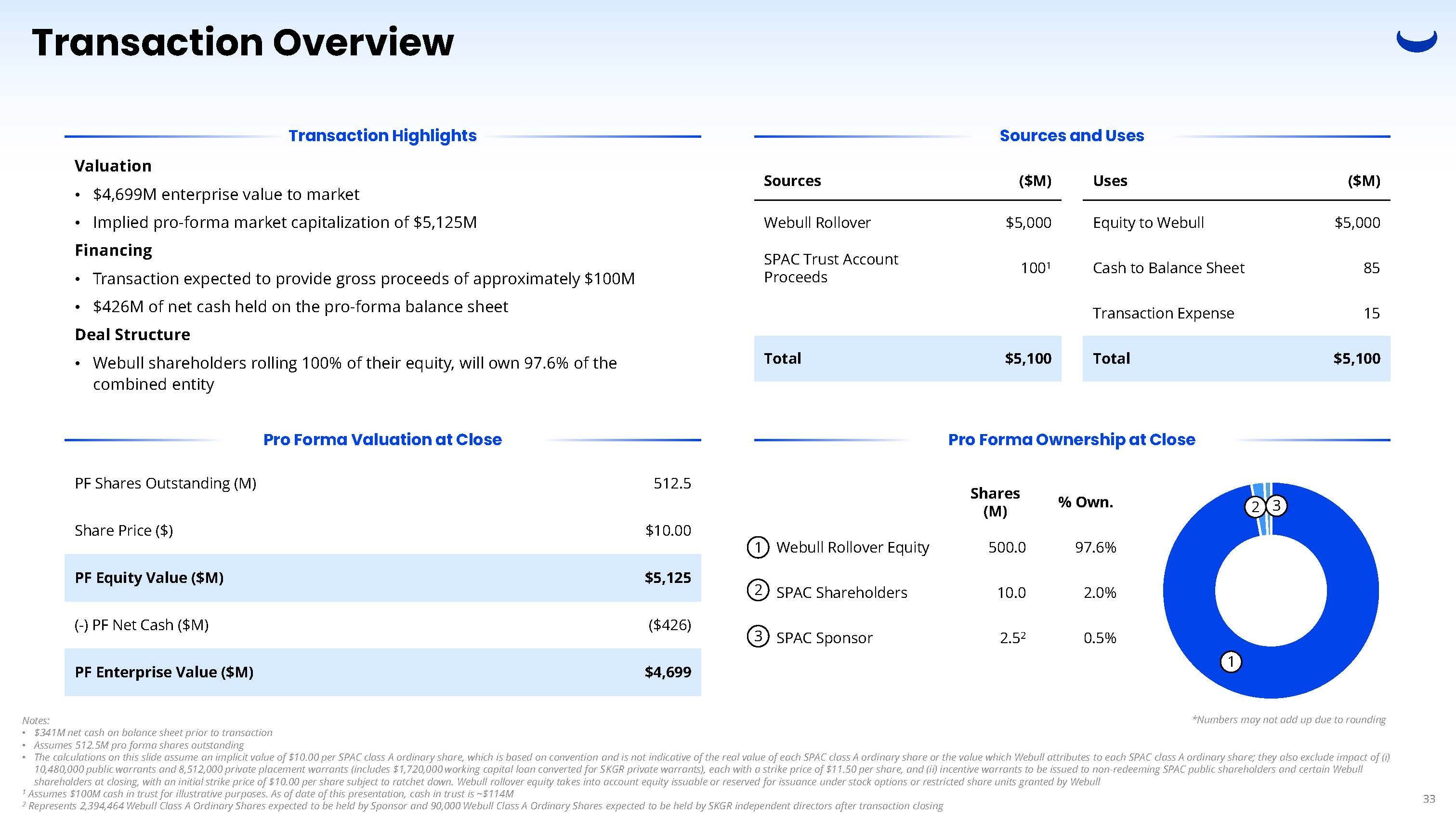

Webull Corporation

Company Info

Webull is a commission-free online brokerage platform offering trading in stocks, ETFs, options, and cryptocurrencies. It was founded in 2017 and has rapidly grown in popularity among retail investors, especially in the U.S. and Asia. The company provides mobile-first, tech-driven investing tools targeting younger, active traders.

Price Chart

Shareholders

- Total Shares: 485M

- SPAC Public Holders: 913K

- Sponsors (SK Growth Founders & PIPE):

- ~2.4M founder shares

- ~6.6M private placement warrants

- Webull Existing Shareholders:

- 455M shares

- 20M warrants

Merge Details

Pre-Merge

- Sponsor Warrant Purchase: $9.9M

- 6.6M private warrants at ~$1.50 each

- Sponsor Overfunding Loan:

- $5M (increased to $5.75M after over-allotment), used to ensure $10.25 per share in trust

- Target Valuation: 5B

Marblegate Capital Corporation

Company Info

- Marblegate Capital Corporation (MCC) is a vertically integrated specialty finance lender and full-service fleet operator focused on the New York City taxi medallion industry

Price Chart

Shareholders

- Total Shares: ~74.6 M

- SPAC Public Holders: 46.6K

- Sponsors: 7.8M

- PIPE: 610K

- DePalma (Target) Shareholders: 63.4M

- Anchor Founder: 2.47M

Merge Details

- Pre-Merge:

- $0.485 M promissory note: Sponsor

- Target Valuation: 750M

- Step 1 (Reorganization): Prior to merger, New MAC (a Delaware corporation renamed Marblegate Capital Corp) was formed, and the two DePalma entities were reorganized into wholly-owned subsidiaries of New MAC .

- Step 2 (Merger): A New MAC subsidiary (“MAC Merger Sub”) merged into Marblegate Acquisition Corp. (MAC), with MAC surviving as a wholly-owned sub of New MAC . The SPAC’s stockholders exchanged their shares for shares of New MAC (now MCC).

- Result: Marblegate Capital Corporation (MCC), a Delaware-incorporated operating company, became the public parent. Marblegate Acquisition Corp. ceased to exist as an independent public entity and continues as an operating subsidiary of MCC . The combined company retains the Marblegate name and mission, and its common stock and warrants began trading on April 10, 2025, on OTCQX under “MGTE” and “MGTEW”, respectively

Classover Holdings, Inc.

Company Info

- Classover Holdings, Inc. is a New York-based educational technology platform offering live online classes for K–12 students. It connects children in over 30 countries with qualified U.S.-based instructors for real-time interactive courses . The company provides a diverse curriculum across subjects – from creativity-focused programs to competitive test prep – delivered via personalized instruction and AI-driven learning tools . Founded in 2020, Classover’s mission is to make high-quality, accessible online learning available globally, leveraging innovative curriculum design and technology to engage students and improve outcomes .

Price Chart

Shareholders

- Total Shares: 23.79M

- SPAC Public Holders: 163K

- Sponsors: 8.62M

- Classover Holders: 12.5M

- Advisors: 975K

- PIPE: 500K

- Other Dilutions

Merge Details

- Pre-Merge

- warrants: Sponsor 7.5 million

- Extension Loans: 250K

- PIPE: 3.23M Jumpstart NYC LLC

- Target Valuation: 125M

- Step 1 (Recapitalization): Classover establishes a dual-class share structure under a new Delaware holding company (“Pubco”), issuing Class A (super voting), Class B (1 vote), and Series A Preferred shares.

- Step 2 (Double Merger): BFAC Merger Sub 1 merges with Class Over Inc. (operating company), and BFAC Merger Sub 2 merges with BFAC (SPAC). Both become wholly-owned subsidiaries of the new Pubco entity.

- Result: Classover Holdings, Inc. (Delaware-inc.) becomes the public parent, listed on Nasdaq under ticker KIDZ. BFAC ceases to exist as a standalone public entity. The combined company retains the name Classover Holdings, Inc..

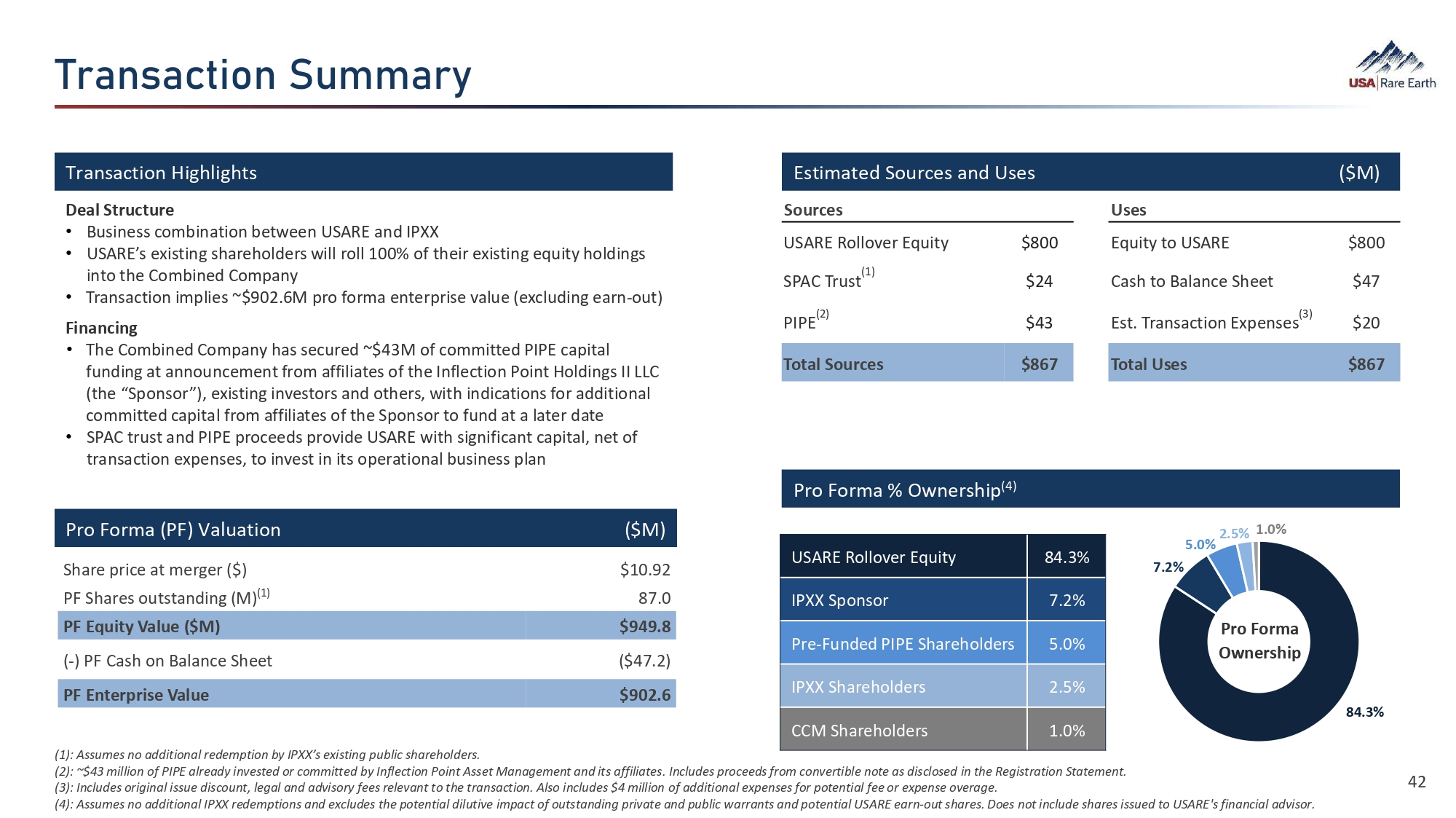

USA Rare Earth

Company Info

- USA Rare Earth, Inc. engages in mining, processing, and supplying rare earths and other critical minerals in the United States.

- It explores for neodymium, dysprosium, terbium, gallium, beryllium, lithium, and other critical minerals.

- The company holds interests in the Round Top Mountain located near Sierra Blanca, Texas. USA Rare Earth, Inc. was founded in 2019 and is based in Stillwater, Oklahoma.

Price Chart

Shareholders

- Total Shares: 94.7M

- SPAC Public Holders: 2.08M

- Sponsors: 6.25M

- USAR: 77.5M

- USARE shareholders/members: 73.2M

- Series A Cumulative Convertible Preferred shareholders: 4.3M

- Advisors: 877K

- Other Dilutions

Merge Details

- Pre-Merge

- Sponsor Warrants: 6M

- Sponsor Loans and Extension Funding: 2.5M

- PIPE: 43M

- Target Valuation: 800M

Aspire Biopharma Holdings

Company Info

- An early-stage biopharmaceutical company, develops and markets disruptive technology for novel sublingual delivery mechanisms in the United States.

- It offers Instaprin, a sublingual aspirin product that is a soluble, PH neutral, and fast acting aspirin, which addresses cardiology emergencies and pain management.

- The company is also developing formulations for sublingually administered products, including a melatonin sleep-aid product; vitamins D, E, and K; testosterone; and semaglutide product.

- In addition, it is developing formulations for anti-nausea products, anti-psychotic products, ED drugs, seizure medication, and other classes of drugs through sublingual administration; and caffeine products, such as a formula for a single dose sublingual pre-workout supplement.

The company was founded in 2021 and is headquartered in Estero, Florida.

Price Chart

Shareholders

- Total Shares: 49.5M

- SPAC Public Holders: 70K

- Sponsors: 7.1M

- Original: 2.87M

- Current: 4.31M

- Working Capital Loan Shares: 3.75M

- Sponsor: 2M

- Investors: 1.75M

- Aspire: 35M

- Other Dilutions

Merge Details

- Pre-Merge

- Bridge Loan: up to $0.5 million provided by Blackstone Capital Advisors (20% original issue discount, 10% annual interest) .

- The SPAC sponsor, Srirama Associates LLC, agreed to transfer 3 SPAC shares for each $1 loaned as an incentive to the lender .

- Bridge Loan: up to $0.5 million provided by Blackstone Capital Advisors (20% original issue discount, 10% annual interest) .

- Post-Merge

- Senior Secured Convertible Debentures: $3.75 million aggregate principal issued at a 20% original issue discount (company received $3.0 million net) .

- Convertible at 92.5% of the lowest 5-day VWAP prior to conversion (with a $4.00 per share floor price) .

- If an event of default occurs, interest increases to 2% per annum and investors can demand repayment of 125% of outstanding principal plus interest .

- Investors received 2,106,527 shares as a commitment fee, subject to leak-out resale restrictions .

- Investors: The debentures were purchased by Cobra Alternative Capital (controlled by Aspire’s former IR director Lance Friedman) and Target Capital X LLC .

- Senior Secured Convertible Debentures: $3.75 million aggregate principal issued at a 20% original issue discount (company received $3.0 million net) .

- Target Valuation: 316M

- Step 1 (Domestication): PowerUp (incorporated in Cayman) and Aspire (incorporated in Puerto Rico) each converted into Delaware corporations on the closing date (February 17, 2025) , in preparation for the U.S.-based merger structure.

- Step 2 (Merger): PowerUp’s wholly-owned Merger Sub merged with and into Aspire on Feb 17, 2025, with Aspire surviving as a wholly-owned subsidiary of the public entity . The merger was approved by PowerUp’s stockholders on Jan 31, 2025 .

- Result: PowerUp Acquisition Corp. renamed itself Aspire Biopharma Holdings, Inc., which became the publicly traded parent company on Nasdaq (ticker: ASBP; warrants: ASBPW) beginning Feb 20, 2025 . All remaining PowerUp public shares and warrants were converted into Aspire Biopharma common stock and warrants .

- Post-Merger Ownership: Aspire’s existing shareholders rolled 100% of their equity and retained a majority ownership of the combined company after closing .

- Sponsor/Insider Lock-up: The SPAC sponsor and certain Aspire insiders agreed to lock up their shares post-merger (subject to customary exceptions) to provide stability for the combined company

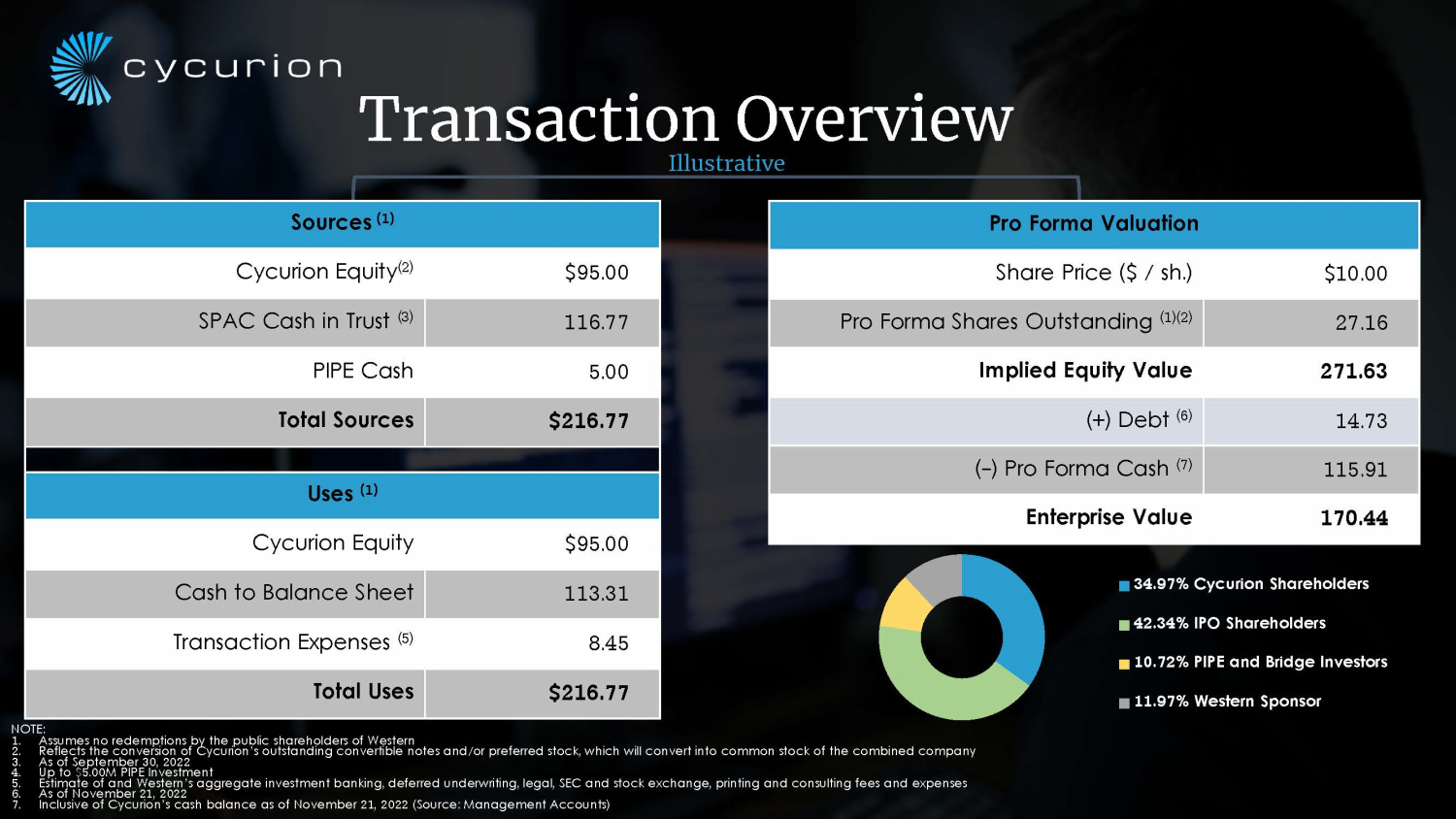

Cycurion, Inc.

Company Info

- Cycurion, Inc. provides information technology security solutions.

- The company provides consulting and advisory services, such as security control assessments, security architecture and engineering, risk management and compliance audits, staff augmentation, cybersecurity awareness and training, cloud security, virtual CISO support, and digital modernization.

- It also offers managed IT services, which include project and license management, network infrastructure, systems engineering and administration, voice and data infrastructure engineering and management, application development, IT help desk support, and staff augmentation.

- In addition, the company provides managed security services including managed detection and response, external attack surface management, threat hunting and threat intelligence, end point detection and response, firewall management, threat and vulnerability management, vulnerability and penetration testing, 24/7/365 security monitoring, and digital forensic and incident response.

- Further, it offers ARx platform, a turnkey web application protection and managed security solution that combines all the essential cybersecurity layers.

Price Chart

Shareholders

- Total Shares: 31.44M

- SAPC Public Holders: 78.98K

- Sponsors: 4.08M

- CYCU: 16M

- Sellers: 15M

- Sellers of common shares issued with Series D Preferred stock: 472K

- Conversion of Series B Preferred: 710K

- Acquisition of SLG Innovation(Another Company): 609K

- Other Dilutions

Merge Details

- Pre-Merge

- PIPE: Up to $5 million PIPE commitment from institutional investors.

- Forward Purchase Agreement (FPA): PIPE Variants

- Alpha Capital Anstalt agreed to purchase up to 300,000 shares post-merger at a fixed price, providing up to $3 million in proceeds.

- Extension Financing:

- Sponsor deposited $10,000/month to extend merger deadline, for up to 6 month

- Convertible Bridge Notes: $3.33 million bridge financing raised via convertible notes.

- Converted into 6,666,667 Series D Convertible Preferred Shares at closing, at $0.50/share.

- Issued alongside 7,272,728 warrants exercisable for common stock.

- Post-Merge

- Equity Line (Committed Equity Facility):

- Agreement with Yield Point NY LLC to purchase up to $60 million of common stock over time, post-merger.

- Equity Line (Committed Equity Facility):

- Target Valuation: $120M(Pre-Money Equity Value)

- Merger Structure

- Step 1 (Merger)

- WAVS formed a wholly owned Merger Sub that merged with Cycurion, with Cycurion surviving as a wholly owned subsidiary.

- Step 2 (Listing Transition)

- No new holding company was formed.

- WAVS remained the public entity but was renamed Cycurion, Inc.

- Single-class common stock post-merger.

- Step 1 (Merger)

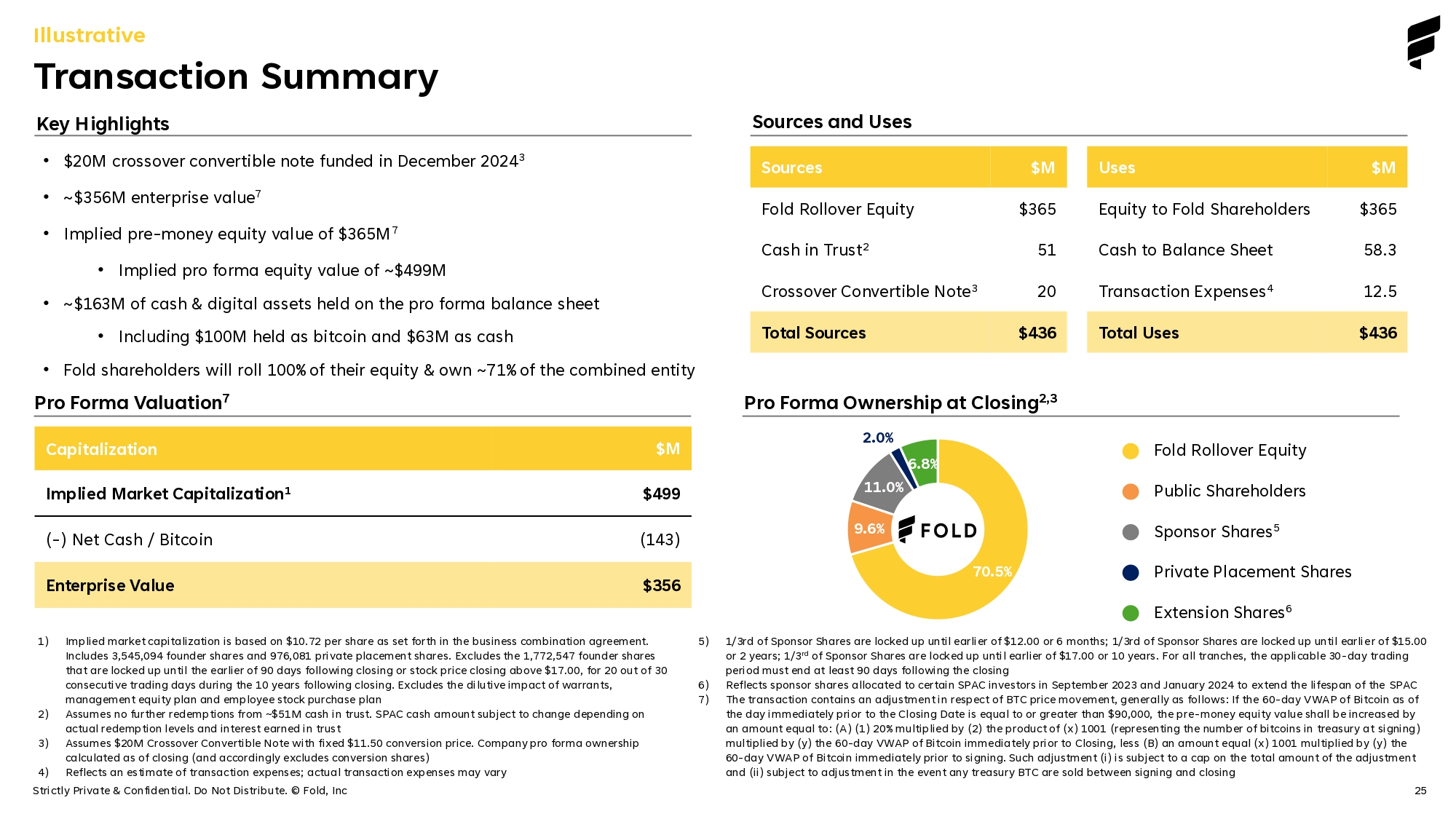

Fold Holdings, Inc.

Company Info

- Fold Holdings, Inc., a bitcoin financial services company, provides access to bitcoin through a suite of consumer financial products in the United States.

- Its financial services platform allows consumers to accumulate, save, and use bitcoin to accomplish financial goals.

- It offers consumers an FDIC insured checking account, a Visa prepaid debit card, bill payments, and an extensive catalog of merchant reward offers, as well as partners with third-party service providers that offer bitcoin exchange and custody services.

- The company also invests in and accumulates bitcoin for treasury. The company offers its products and services through the Fold mobile app.

- Fold Holdings, Inc. was founded in 2019 and is headquartered in Phoenix, Arizona.

Price Chart

Shareholders

- Total Shares: 46.43M

- SPAC Public Holders: 1.34M

- Sponsors: 6.29M

- Fold Shareholders: 34.5M

- Other: 3.29M

Merge Details

- Pre-Merge

- Convertible Note (PIPE Alternative): Closed a $20 million secured convertible note financing with ATW Partners in Dec 2024, with an additional $10 million second tranche available at mutual discretion upon closing . The note matures 3 years post-merger and is convertible into common stock at a fixed $11.50/share (a premium to the deal valuation), and ATW received warrants exercisable at $12.50/share as part of the financing

- Extension Financing (Working Capital Loan): Polar Multi-Strategy Master Fund also committed up to $550,000 to fund SPAC extension and working capital needs . This bridge funding is non-interest-bearing and repayable at closing (in cash or stock, at Polar’s election), and in return the SPAC agreed to issue Polar one common share per $1 funded (up to ~550,000 shares) with no lock-up

- Post-Merge

- SATS Convertible Note (Post-Closing): In March 2025, Fold Holdings raised approximately $46.3 million via a senior secured convertible note issued to SATS Credit Fund LP . The note is backed by 500 Bitcoin as collateral and carries a 7% annual interest rate (paid quarterly in stock); it matures in March 2030 and is convertible at $12.50/share at the holder’s option

- The SATS note agreement included the issuance of 750,000 shares of common stock to the investor at closing, plus a warrant to purchase 925,590 shares at a $15.00 exercise price . The note features automatic conversion tranches that trigger if Fold’s stock trades above specified price thresholds (with full mandatory conversion if the stock exceeds $40) .

- Equity Purchase Facility: In June 2025, Fold secured a committed equity financing facility of up to $250 million with an institutional investor . This facility gives Fold the discretionary right to periodically issue and sell new common shares (via private placement) over time, primarily to raise capital for expanding its Bitcoin treasury holdings . Fold is not obligated to draw on the facility, and any sales can occur only after an SEC-effective registration, ensuring flexibility in post-merger fundraising.

- SATS Convertible Note (Post-Closing): In March 2025, Fold Holdings raised approximately $46.3 million via a senior secured convertible note issued to SATS Credit Fund LP . The note is backed by 500 Bitcoin as collateral and carries a 7% annual interest rate (paid quarterly in stock); it matures in March 2030 and is convertible at $12.50/share at the holder’s option

- Target Valuation: $365 million in the merger agreement (with an additional ~$7 million of contingent value tied to Bitcoin price adjustments) . This valuation underpinned the exchange ratio for Fold shareholders.

- Merger Structure

- Step 1 (Merger): FTAC Emerald formed a wholly-owned merger subsidiary that merged with and into Fold, with Fold surviving as a wholly-owned subsidiary of FTAC Emerald . In conjunction, all of Fold’s preferred stock converted into Fold common stock, and then Fold’s common stock was exchanged for FTAC Emerald common stock at the agreed ratio (Fold’s SAFEs also converted into equity immediately before closing) .

- Step 2 (Listing & Company Name): No new holding company was created – FTAC Emerald remained the public entity and was renamed “Fold Holdings, Inc.” upon closing . The combined company continued the Nasdaq listing, with its common stock and warrants trading under new ticker symbols “FLD” and “FLDDW” respectively . All Class A public shares and Class B sponsor shares converted into a single class of Fold Holdings common stock at closing, simplifying the capital structure.

- Governance and Founder Shares: The SPAC’s sponsor agreed to forfeit all sponsor warrants and subject a portion of its founder shares (~5.3 million shares) to post-merger lock-up and earnout conditions (staged release based on time and share-price targets) . If total capital raised from signing through two years post-close was under $50 million, a longer lock-up applied and up to 1 million of the sponsor’s shares would be forfeited; in fact, due to modest capital raised by closing, the sponsor’s earnout shares remained restricted for an extended period . The overall merger did not utilize any additional new holding company, and post-transaction Fold Holdings operates with a single class of common stock (one share one vote).

OSR Holdings, Inc.

Company Info

- OSR Holdings, Inc., a healthcare holding company, develops a portfolio of therapies and healthcare solutions in the United States, Switzerland, and South Korea.

- The company develops immunotherapy products, including VXM01, an immuno-oncology candidate for glioblastoma that is in phase 2 clinical trial, as well as preclinical stage products, such as VXM04 to treat mesothelin; VXM06 for the treatment of Wilms Tumor Protein (WT1); VXM08 for Carcinoembryonic antigen (CEA); and VXM10 for PD-L1.

- It is also developing design-augmented (DA) biologics comprising DRT-102, a clinical-stage asset for spinal fusion; and DRT-101, a pre-clinical stage asset for osteoarthritis.

- In addition, the company distributes neurovascular intervention medical device and systems. OSR Holdings, Inc. is based in Bellevue, Washington.

Price Chart

Shareholders

- Total Shares: 19.28M

- SPAC Public Holders: 61.93K

- Sponsors: 2.16M

- OSR Shareholders: 14.6M

- Duksung Co., Ltd(Convertible Promissory Note Holder): 98K

- Chardan Capital Markets, LLC(Underwriter): 34K

- Other Dilutions

Merge Details

- Pre-Merge

- PIPE: A $20 million PIPE investment was initially committed by Toonon Partners Co., Ltd., involving 222,222 shares of Series A Preferred Stock at $90/share (equivalent to $9/common share). However, the PIPE was ultimately cancelled before closing due to unfavorable macroeconomic factors in Korea.

- Forward Purchase Agreement (FPA): OSR SPAC Opportunities I, LP (affiliate of the sponsor) subscribed for 1,000,000 units in BLAC’s IPO and agreed not to redeem or vote against the merger. It also committed to invest up to $25 million total (including the $10 million IPO portion) by purchasing BLAC units at $10/share at closing to offset redemptions.

- Extension Financing: The sponsor funded two deadline extensions

- November 2023: $180,000 initial deposit to extend to February 14, 2024, plus $60,000/month for two months thereafter.

- May 2024: Commitment to deposit $50,000/month into the trust through the new deadline of November 14, 2024.

- Convertible Bridge Note: In October 2024, OSR issued an $800,000 unsecured promissory note to Duksung Co., Ltd., bearing 5% interest (or 7% if not converted). If a qualified PIPE occurred by March 31, 2025, the note would automatically convert into common stock at $8.00/share. Since no qualifying PIPE was completed, the note became repayable in cash or stock at OSR’s discretion.

- Post-Merge

- Equity Purchase Facility: On February 25, 2025, OSR Holdings, Inc. entered into a $78.9 million committed equity facility with White Lion Capital / GBM Innovation Fund. Under this facility, OSR may periodically issue and sell up to 9.5 million shares (not to exceed 20% of post-merger equity) at market-based discounts, providing flexible capital over time. The agreement remains active through December 31, 2026.

- Target Valuation: 147M

- Merger Structure

- Step 1 (Merger): BLAC remained the surviving public entity. OSR shareholders exchanged their equity for BLAC shares. At closing, BLAC acquired approximately 67% of OSR, with the remaining ~22% retained by legacy shareholders subject to put/call rights for future acquisition.

- Step 2 (Listing & Company Name): No new holding company was created. BLAC was renamed OSR Holdings, Inc. post-close. Nasdaq ticker symbols changed to “OSRH” for common stock and “OSRHW” for warrants, effective February 18, 2025.

- Governance and Capital Structure: All shares converted into a single class of common stock. No dual-class structure exists. The originally planned PIPE Preferred Stock was never issued, and all public and sponsor shares were converted into OSRH common shares on a 1:1 basis.

GCL Global Holdings Ltd

Company Info

- GCL Global Holdings Ltd. unites people through games and entertainment experiences, enabling creators to deliver engaging content and fun gameplay experiences to gaming communities worldwide with focus on the Asian gaming market.

- The company leverages its portfolio of digital and physical content to bridge cultures and audiences by introducing Asian-developed IP to a global audience across consoles, PCs, and streaming platforms.

- GCL Global Holdings Ltd. is based in Singapore.

Price Chart

Shareholders

- Total Shares: 126M

- SPAC Public Holders: 51.4k

- Sponsors: 4.875M

- GCL: 120M

- EBC(Private Warrant Investor): 200K

Merge Details

- Pre-Merge

- Convertible Note (PIPE Alternative): In lieu of a traditional PIPE, RF Acquisition Corp. raised $20 million through a convertible note financing in late 2024 to support the merger with GCL . The notes were issued by a GCL subsidiary (Epicsoft Asia Pte. Ltd.) and are convertible into ordinary shares of the combined company at the closing of the business combination . Notably, investors received “Bonus Shares” to be held in escrow for three years post-conversion, entitling them to additional shares or a cash payout depending on post-merger share price performance . The funding agreement required a minimum $20 million to be raised and that the merger close by March 28, 2025; it also provided downside protection such that if the merger share exchange ratio equated to below $10.00 per share, investors would receive 110% of their note principal back . This structured convertible note served as a PIPE substitute, ensuring the deal met its cash funding needs.

- Post-Merge

- Convertible Note Facility (Post-Closing): In May 2025, shortly after the merger, GCL (the combined company) secured a new convertible financing facility with ATW Partners to fund its growth. Under a Securities Purchase Agreement, GCL issued an initial $2.9 million senior unsecured convertible note (3-year maturity, 6% annual interest) for a purchase price of $2.61 million . Importantly, GCL has the right to require the investor to buy additional notes of up to $42.6 million principal (for $38.34 million in funding) over time, subject to certain conditions being met . Interest on the notes is payable monthly in either cash or (if conditions are met) in GCL ordinary shares . This committed facility – totaling up to $45.5 million – effectively provides GCL with flexible, discretionary growth capital post-merger, without obligating the company to draw more than it needs. Any future tranches under the facility can be issued at GCL’s discretion (once an SEC registration is effective for the underlying shares), giving GCL the ability to raise equity-linked funding progressively as it pursues expansion initiatives .

- Target Valuation: $1.2 billion pre-transaction equity value .

- Merger Structure

- Step 1 (Merger): The transaction was structured with a newly-formed Cayman Islands holding company – GCL Global Holdings Ltd (“PubCo”) – as the top-level public entity. First, a wholly-owned merger subsidiary of PubCo merged with and into GCL (Grand Centrex Limited, the target operating company), with GCL surviving as a wholly-owned subsidiary of PubCo . At this “Initial Merger” effective time, all of GCL’s outstanding shares (and any interim convertible securities like SAFEs) were exchanged for equivalent ordinary shares of PubCo at the agreed exchange ratio . In other words, GCL’s pre-merger shareholders surrendered their private GCL shares and received PubCo shares (valued at $10 each per the merger terms) in return, resulting in GCL becoming a wholly-owned unit of the new holding company. This step was preceded by an internal reorganization of the GCL group to ensure the merger mechanics (GCL was reorganized under a BVI entity as needed) and was a non-cash, share-for-share exchange.

- Step 2 (Listing & Company Name): Next, a second merger subsidiary of PubCo merged with and into RF Acquisition Corp., with RFAC surviving that merger as another wholly-owned subsidiary of PubCo . Upon this closing “SPAC Merger,” all RFAC public shares were converted one-for-one into ordinary shares of PubCo , and RFAC’s warrants and rights were assumed by PubCo (each RFAC warrant became a PubCo warrant exercisable for one PubCo share, and every ten RFAC rights were exchanged for one PubCo share at closing) . As a result, GCL Global Holdings Ltd became the publicly traded parent company owning both the GCL operating business and the former SPAC. The company’s ordinary shares and warrants commenced trading on Nasdaq under the new ticker symbols “GCL” and “GCLWW” (previously RFAC had traded as “RFAC” and “RFACW”) as of February 14, 2025 . The combined company did not change its jurisdiction or create any additional holding companies beyond this structure – PubCo (GCL Global Holdings) remains domiciled in Cayman and is the sole listed entity. All former Class A public shares and Class B sponsor shares of RFAC now rank as a single class of ordinary shares of GCL Global Holdings Ltd, simplifying the capital structure to “one share, one vote” going forward.

- Governance and Founder Shares: After the merger, GCL’s original owners emerged with a controlling stake – they collectively hold a majority of the outstanding shares and have designated a majority of the board of directors of the combined company . The SPAC’s sponsor, RF Dynamic LLC, rolled over its entire stake without additional incentives or penalties: its 2,875,000 Class B founder shares converted into PubCo ordinary shares (the sponsor had originally purchased these for a nominal ~$0.009 per share) , and its 4,450,500 private placement warrants (each exercisable at $11.50 for one share) were assumed by PubCo unchanged . All of the sponsor’s shares (and GCL insiders’ shares) are subject to a lock-up of 12 months post-closing, per the Sponsor Support and Lock-Up Agreements, meaning they cannot be sold until one year after the merger closed . Unlike some SPAC mergers that impose additional earn-outs or forfeitures, in this deal the sponsor did not forfeit any founder shares or warrants at closing – the sponsor retained its full equity position, aligning its incentives with the long-term performance of GCL’s stock . Overall, GCL’s management and pre-merger owners retained effective control of the company (owning ~66% of shares immediately after closing) , while public shareholders and the SPAC sponsor together hold the remainder. This governance outcome – with GCL’s team at the helm and the sponsor’s economic stake intact (but locked-up) – is intended to ensure stability and commitment as GCL transitions to life as a U.S.-listed public company.

GMHS

Company Info

- Gamehaus Holdings Inc., a technology-driven mobile game publishing company, distributes mobile games created by its developer partners across gaming markets worldwide.

- It engages in sale of virtual items associated with mobile games, as well as advertisements within mobile games.

- The company is based in Shanghai, China.

Price Chart

Shareholders

- Total Shares: 53.57M

- SPAC Public Holders: 95.98K

- Sponsors: 1.72M

- GMHS Shareholders: 51.4M

- Private Shares: 307K

- Shares issuable upon the conversion of the Public and Private Rights held by Golden Star Shareholders: 1.41M

- Common Shares: 50M

Merge Details

- Pre-Merge

- Promissory note: 500K, Sponsor

- Target Valuation: 500M

- Two-Step Merger via Cayman Holding Company: The transaction was executed using a newly formed holding company (“Gamehaus Holdings Inc.”), incorporated in the Cayman Islands, which became the publicly traded Pubco . The merger agreement provided for a double–merger structure:

- First Merger: Gamehaus Holdings created a wholly-owned subsidiary (“Gamehaus 1 Inc.”) in Cayman. In the first step, Gamehaus 1 Inc. merged with and into Gamehaus Inc. (the private target), with Gamehaus Inc. surviving as a wholly-owned subsidiary of Pubco . In this merger, each outstanding share of Gamehaus Inc. (both ordinary and preferred) was canceled and converted into the right to receive shares of Pubco (Gamehaus Holdings) . Essentially, Gamehaus’s shareholders exchanged all their shares for Class A ordinary shares of Gamehaus Holdings at a fixed exchange ratio, making them shareholders of the new holding company.

- Second Merger: Immediately after, a second subsidiary (“Gamehaus 2 Inc.”) merged with and into Golden Star Acquisition Corp., with Golden Star (the SPAC) surviving as a wholly-owned subsidiary of Pubco . In this step, Golden Star’s public shareholders exchanged their SPAC shares for shares of Pubco on a one-for-one basis (plus the conversion of SPAC rights into Pubco shares, since Golden Star’s units included rights entitling holders to 0.2 of a share) . Golden Star’s existence was then effectively absorbed into Pubco – the SPAC became a subsidiary of Gamehaus Holdings, and soon after the closing the surviving SPAC entity was likely dissolved as is customary.

FST Corp.

Company Info

- FST Corp. develops, produces, and sells golf shafts and other sports equipment under the KBS brand name.

- It provides Shafts for Irons that include KBS TOUR Series that can be fitted into iron golf clubs, pitching wedge, and sand wedge; KBS TOUR LITE Series designed to provide tight dispersion, trajectory, additional spin, and longer distance in a lightweight package; KBS TOUR-V Series, a steel shaft that features larger outer diameters that results in a stable tip section and tight shot dispersion; KBS 560 and 580 Series developed for junior developing players; KBS MAX 80 Series, a lightweight shaft designed for mid-high handicap players; KBS Tour $-Taper Series provides shot workability and tight dispersion; and KBS Tour $-Taper Light Series, a lightweight tour performance golf club shaft that provides shot workability and tight dispersion for players.

- The company also offers the Shafts for Wedges includes KBS Wedge Series for players seeking a similar feel to the KBS TOUR; KBS Tour 610 Wedge Series shaft that delivers penetrating ball flight with controlled spin; KBS TOUR-V Wedge shaft for wedges to produce shots with a lower-mid trajectory and mid ball spin; and KBS HI-REV 2.0 wedge shaft series for higher ball launch and Shafts for Putters, which include KBS Tour One Step Putter shaft for amplified feel along with reduction in vibrations; KBS CT Tour Putter shaft series designed for based off of the company’s “Constant Taper” Technology; and KBS GPS Graphite putter shaft designed as a balance performance shafts.

- In addition, it sells food and alcoholic beverages. The company sells its products through retailers and distributors.

- FST Corp. was incorporated in 1976 and is headquartered in Chiayi, Taiwan.

Price Chart

Shareholders

- Total Shares: 44.47M

- SPAC Public Holders: 1.78M

- Sponsors: 2.19M

- FST: 40M,

- Shareholders: 38M

- Advisor: 2M

- Other Dilutions

Merge Details

- Pre-Merge

- PIPE Alternative: Up to 30M, Pre-Closing Forward Purchase: Instead of a traditional PIPE equity sale, Chenghe and FST arranged a Prepaid Forward Purchase Agreement with Harraden CircIle Investors, LP and an affiliate,

- Target Valuation: 400M, the merger pricing was a straight equity exchange valuing FST at $400 million with no contingent earn-out payments, which likely reflected confidence in FST’s growth (27% revenue growth in 2024) and the strategic value of its KBS golf shaft brand without needing additional performance incentives.

- The Chenghe–FST business combination was executed through a multi-step structure involving a new Cayman holding company and an intermediate restructuring of FST’s shareholder base:

- FST Restructuring in Taiwan: Because FST was a publicly traded company in Taiwan (listed on the Taipei Exchange’s Emerging Stock Market), the deal was structured so that FST’s shareholders would swap their shares into a new offshore entity. The parties agreed to a two-phase restructuring: in Phase I, within ~72 days of signing the merger agreement, a new Cayman entity (“FST Corp.”, also called CayCo) would acquire at least 55% of FST’s outstanding shares from existing shareholders . In Phase II, once Taiwanese regulators approved FST to terminate its public-company status, CayCo would acquire additional shares to reach at least 90% ownership of FST . (This 90% allows a squeeze-out of any remaining minority shareholders.) FST’s stock would then be de-registered in Taiwan and FST would become a private subsidiary of the Cayman holding company . Throughout this process, FST’s shareholders who agreed to roll over received ordinary shares of CayCo (FST Corp) in exchange, at the agreed valuation ratio, effectively consolidating FST’s ownership under the Cayman entity.

- New Cayman Holding Company and Merger Sub: Chenghe formed FST Corp. (CayCo) as the new holding company for the combined business, along with a wholly-owned merger subsidiary (“FST Merger Ltd.”) . Once the FST share exchange (Phase I) was largely in place, the legal merger of the SPAC into CayCo was executed. Specifically, Merger Sub was merged with and into Chenghe Acquisition I Co., with Chenghe surviving the merger as a wholly-owned subsidiary of FST Corp . In this step, often called a “Up-C” merger, the SPAC’s public listing was essentially transferred to the new Cayman holding company. Chenghe (the SPAC entity) survived the merger but was renamed “FST Ltd.” and became a direct subsidiary of FST Corp., while FST Corp. took over as the publicly traded parent company . This structure allowed FST Corp. to become the Nasdaq-listed company at closing without FST (the operating company in Taiwan) directly merging into a foreign firm (which helped navigate Taiwanese regulatory requirements via the staged restructuring).

- Share Conversions and Exchange: At the merger effective time, all of Chenghe’s outstanding securities were converted into equivalent securities of the new company. Chenghe’s Class B founder shares automatically converted into Class A shares on a one-for-one basis immediately before the merger . Then, each Chenghe Class A ordinary share (including those resulting from the founder share conversion and any separated SPAC unit shares) was exchanged for one ordinary share of FST Corp. . This means former SPAC shareholders (public investors and the sponsor) received FST Corp. ordinary shares of equal quantity. Public warrants of Chenghe were also assumed by FST Corp., becoming FST Corp warrants with the same terms (same exercise price of $11.50 and expiration, merely now exercisable for FST Corp. shares instead of SPAC shares) . By these conversions, the post-merger company had a single class of ordinary shares outstanding (all pari passu) and the SPAC’s dual-class structure and units were unwound for simplicity .

- NASDAQ Listing and Ticker Change: Upon closing, FST Corp. became a NASDAQ-listed public company. Chenghe’s securities – which had traded under ticker symbols “LATG” (Class A common shares) and “LATGU” (units) – were suspended from trading as of January 16, 2025 . The following day, FST Corp.’s ordinary shares began trading on the Nasdaq Global Market under the new ticker symbol “KBSX.” (The ticker reflects FST’s well-known brand “KBS” golf shafts.) Any remaining SPAC units were separated into their components, and going forward only FST Corp. common stock (KBSX) and warrants traded. The merger was approved by Chenghe’s shareholders on Dec 23, 2024, and consummated on Jan 15, 2025, marking the official transition of FST to a U.S.-listed company . FST Corp. is domiciled in the Cayman Islands (like the SPAC was) and continues to hold FST (Taiwan) as its operating subsidiary.

- Post-Closing Structure: After these steps, FST Corp. (NASDAQ: KBSX) is the public holding company. FST Ltd. (formerly Chenghe SPAC) remains as a wholly-owned sub holding the legacy trust and SPAC assets, and Femco Steel Technology Co. Ltd. (the original Taiwanese company) is now another wholly-owned subsidiary under FST Corp. (pending full Phase II completion to bring ownership to 100%). This structure effectively internationalized FST’s corporate structure into a Cayman/Nasdaq vehicle, while simplifying the capital structure to one class of stock and aligning all shareholders as holders of FST Corp. ordinary shares.

Blaize Holdings, Inc.

Company Info

- Blaize Holdings, Inc. provides artificial intelligence (AI)-enabled edge computing solutions.

- Its portfolio includes programmable AI processors for deployment across multiple verticals, including enterprise, industrial, commercial, defense, and automotive markets; and AI computing platforms that power applications, such as computer vision, advanced video analytics, and AI inference, as well as software tools for non-expert practitioners to deploy AI models without the need for extensive coding expertise.

- The company also offers the GSP, an AI computing accelerator for computer vision and machine learning applications; and Blaize AI Studio, an intuitive and visual non-code environment intended to simplify the creation and deployment of AI models.

- In addition, it provides hardware products consisting compute cards, silicon chips, boards, and systems.

- The company was founded in 2010 and is headquartered in El Dorado Hills, California.

Price Chart

Shareholders

- Total Shares: 102M

- SPAC Public Holders: 3.17M

- Sponsors: 17.1M

- Blaize Stockholders:54.99M

- Final Closing Lenders: 25.54M shares

Merge Details

- Pre-Merge

- Convertible Note PIPE Alternative: 110.7M

- Sponsor: 11.5M

- RT Parties: 96.8M

- PIPE Capital Raise: 15.4M, In the final weeks before closing, BurTech also raised a small direct equity PIPE to bolster funding. Between December 31, 2024 and January 13, 2025, BurTech entered into subscription agreements for 1,540,300 Class A shares at $10.00 per share . This $15.4 million PIPE investment closed immediately prior to the merger, injecting additional cash to meet closing needs . The PIPE shares were issued at the same $10 price as the SPAC trust shares, and BurTech agreed to file a resale registration statement within 45 days post-close so that PIPE investors could freely trade their stock . Together, the PIPE funds, the remaining trust cash (after redemptions), and the sponsor’s note financing all contributed toward satisfying the minimum cash condition for the deal (set at $125 million) .

- Convertible Note PIPE Alternative: 110.7M

- Target Valuation: Equity value revised from $700M ➝ $767M after April amendment

- Reverse Merger: BurTech Merger Sub merged into Legacy Blaize (operating company); Legacy Blaize survived as subsidiary; BurTech renamed Blaize Holdings, Inc.

- Ticker Change: Shares and warrants began trading January 14, 2025 under BZAI and BZAIW, respectively

- Capital Structure:

- Blaize common and preferred converted into new common at ~0.78 ratio

- BurTech Class B founder shares converted 1:1 into Class A (anti-dilution waived)

- Final structure: single class of common equity + public warrants

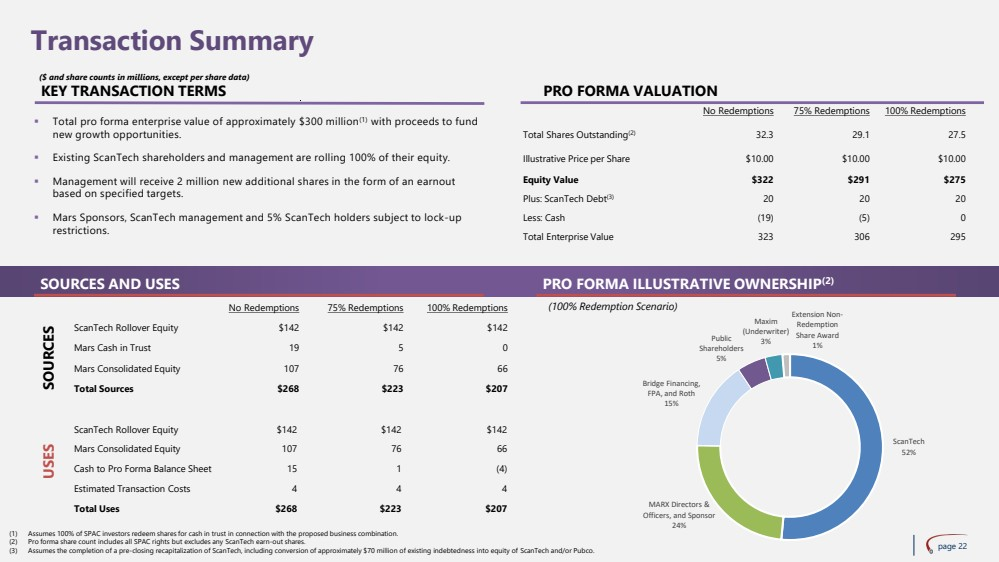

ScanTech AI Systems Inc.

Company Info

- ScanTech AI Systems Inc. develops systems, software, and artificial intelligence solutions for security checkpoints.

- The company offers SENTINEL Computed Tomography (CT), a checkpoint baggage inspection system for airports and other security applications; and ALL SECURE, a multi-energy cargo inspection system.

- It serves defense and security, aviation, nuclear and energy, ports and borders, cargo and freight, and other critical infrastructure sectors.

- The company was founded in 2011 and is based in Buford, Georgia.

Price Chart

Shareholders

- Total Shares: 48.26M

- SPAC Public Holders: 646K

- Sponsors: 2.23M

- ScanTech: 14.2M

- Maxim(Underwriter): 276K

- RiverNorth FPA: 1.5M

- Debt-to-Equity Conversions: 15M

- Approximately $30 million of the company’s debt was converted into equity, resulting in about 15 million new shares issued to key institutional creditors . For example, Polar’s $1.25 M bridge note (see above) was settled for 1.5 M shares, and York Capital, which held a contingent interest in the target, agreed to terminate its rights in exchange for 1,700,000 Pubco shares (with 700k of those registered for resale)

- Other Dilutions

Merge Details

- Pre-Merge

- Forward Purchase Agreement (FPA): Mars entered a prepaid forward purchase deal with RiverNorth SPAC Arbitrage Fund. RiverNorth agreed to buy up to 1,500,000 SPAC shares on the open market (capped at 9.9% ownership) at prices not exceeding the redemption price

-

- Bridge Funding (Subscription Agreements): Polar Multi-Strategy Master Fund committed a total of $1.25 million in bridge financing to Mars/ScanTech via definitive subscription agreements on April 2, 2024 and May 29, 2024 . This funding provided crucial working capital to ScanTech while the deal was pending. In exchange, Polar was entitled to receive common shares of the post-merger company (one share per $1 contributed) – Polar’s $1.25 M note was ultimately converted into 1,500,000 Pubco shares under a settlement agreement . In addition, similar non-redemption agreements were made with other investors: for example, Seaport Group SIBS LLC and Aegus Corp provided financing or support in return for shares of Pubco at closing . (Notably, a bridge loan from Aegus was later partially settled by issuing 360,000 shares post-close) . These arrangements were aimed at both covering expenses and incentivizing certain investors to refrain from redeeming.

- Post-Merge

- New Loan Financing: In March 2025, ScanTech AI secured a new $2.85 million unsecured loan from St. James Bank & Trust at a 12% annual interest rate . The note included provisions to extend the maturity and potentially repay the balance in either common stock or cash, providing flexibility . (The company simultaneously settled a prior smaller note with St. James and, as noted, issued equity to Aegus Corp to reduce that bridge debt .) This infusion provided working capital as the newly public company ramped up its operations.

- Subsequent Equity Funding: In mid-2025, the company arranged additional financing from institutional investors. In July 2025, ScanTech entered a securities purchase agreement with an investor (340 Broadway Holdings LLC) for a $1.5 million promissory note, funded in tranches . As an origination fee, the company issued approximately 2.1 million shares of common stock to the investor (valued at $1.36 M based on market price)

- Target Valuation: 142M

- Step 1 – SPAC Merger: Mars formed a Cayman subsidiary (“Mars Merger Sub I”). At closing, Merger Sub I merged into Mars (the SPAC), with Mars surviving the merger . In that step, each outstanding Mars ordinary share (that hadn’t been redeemed) was canceled and exchanged 1-for-1 for a share of Pubco common stock . This had the effect of swapping the public shareholders into the new Delaware Pubco (ScanTech AI Systems Inc.) and making Mars a wholly-owned subsidiary of Pubco. Mars’s units were split into shares and rights prior to this exchange, and the rights (which entitled holders to 0.2 shares each) were also converted into Pubco shares .

- Step 2 – Target Merger: Pubco had a Delaware subsidiary (“Mars Merger Sub II LLC”) that merged with and into ScanTech Identification Beam Systems, LLC (the target operating company) at closing . ScanTech (the LLC) survived that merger as a wholly-owned subsidiary of Pubco . In this step, all outstanding units of ScanTech were canceled and converted into shares of Pubco common stock per the exchange ratio in the BCA, delivering the equity consideration to ScanTech’s pre-merger owners . Any outstanding convertible securities of ScanTech (e.g. SAFE notes or other rights) were terminated or converted as agreed .

- Post-Closing Structure: Upon completion, ScanTech AI Systems Inc. (Delaware) became the publicly traded company on Nasdaq (ticker: STAI), owning 100% of both the former Mars SPAC and the ScanTech operating business. No new holding company was formed beyond Pubco (Pubco effectively served as the new parent). The public entity was renamed to ScanTech AI Systems Inc. and all shares outstanding are a single class of common stock (one share, one vote) – there are no multiple classes of stock post-merger. Additionally, as noted, public shareholders from the SPAC received bonus shares for non-redemption (two extra shares per share after 90 days) as a unique feature of this deal . This merger structure and incentive plan were detailed in the S-4/proxy and confirmed in the closing 8-K filings.

NASDAQ & NYSE SPAC IPO 2025 H1

Basic Info

| Symbol | Company Name | Exchange | IPO Date | Country | Market Cap | Stock Price | ATH | ATL | Founded | Return IPO |

|---|---|---|---|---|---|---|---|---|---|---|

| GTER | Globa Terra Acquisition Corporation | NASDAQ | Jul 9, 2025 | Mexico | 208.39M | 10.08 | 11.04 | 10.03 | 2024 | 0.35% |

| GSHR | Gesher Acquisition Corp. II | NASDAQ | Mar 21, 2025 | United States | 207.61M | 10.38 | 10.50 | 9.97 | 2024 | 3.52% |

| EGHA | EGH Acquisition Corp. | NASDAQ | May 9, 2025 | United States | 204.80M | 10.20 | 10.21 | 10.02 | 2025 | 1.80% |

| IPOD | Dune Acquisition Corporation II | NASDAQ | May 7, 2025 | United States | 195.86M | 10.21 | 10.25 | 10.00 | 2024 | 2.00% |